- RNDR has spiked by 14.5% over the past 24 hours.

- Render was breaking out from the consolidation, positioning for a move toward $6.

Over the past day, Render [RNDR] has made a strong upswing on its price charts. Over this period, the altcoin has surged from a low of $3.2 to a local high of $3.8.

At the time of writing, Render was trading at $3.79, reflecting a 14.51% daily increase. On the weekly charts, the altcoin has gained 18.96%. Additionally, Render’s trading volume has surged by 73.42%, reaching $67.34 million.

Given the recent price action, Render appears poised for a breakout from its current consolidation phase.

Is Render finally ready to rally?

According to AMBCrypto’s analysis, Render was experiencing a strong upward momentum as buyers dominated the market.

Source: TradingView

For starters, this buying activity can be observed through the rising Chaikin Money Flow (CMF). As such, CMF has turned positive, hitting 0.04 over the past 48 hours.

When CMF turns positive, it suggests that buyers are dominating the market. This was further validated by a rising and positive MACD line.

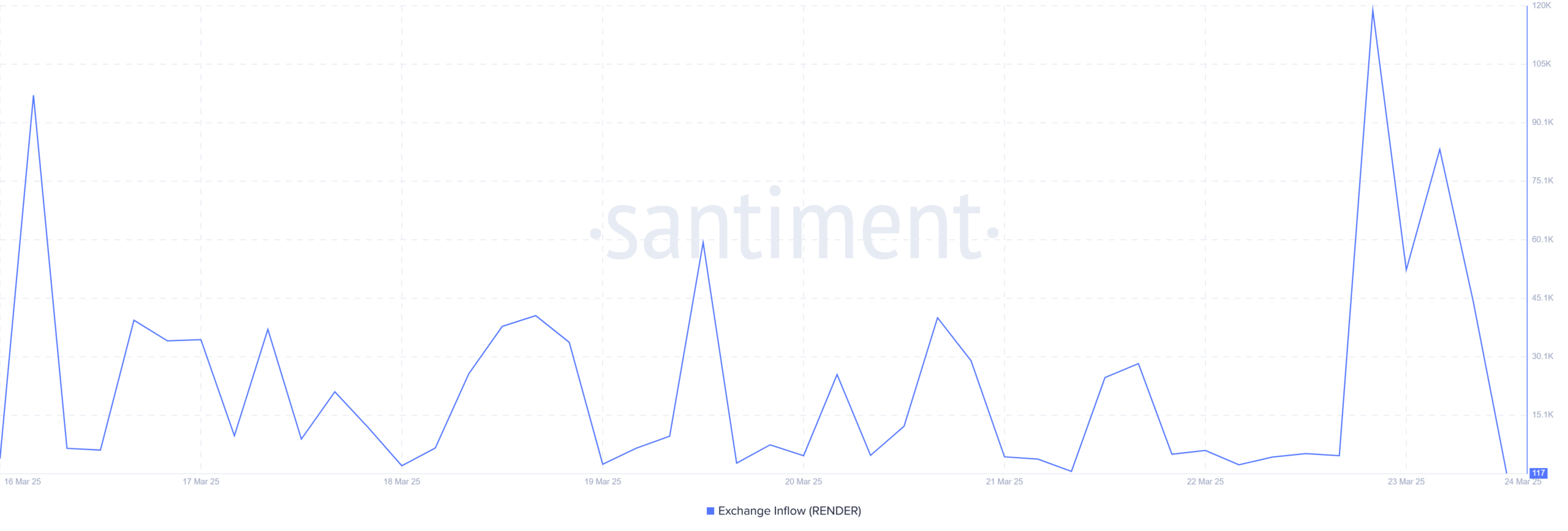

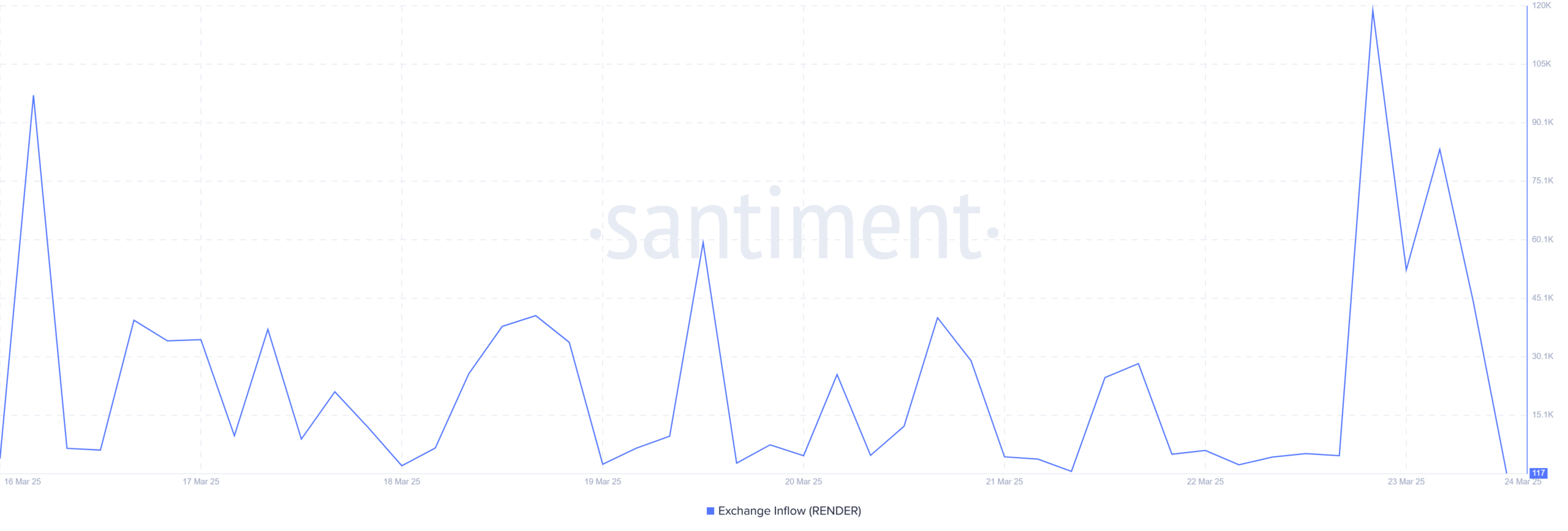

Source: Santiment

Render has experienced a significant drop in exchange inflow, with Santiment data indicating a sharp decline to a low of 117.7 tokens over the past day.

This reduced inflow suggests that holders are choosing to retain their tokens rather than sell them. In contrast, higher inflow levels often signal selling intent, which could lead to increased selling pressure.

Additionally, a positive order imbalance further supports this trend. The dominance of buy orders over sell orders indicates that buyers are currently in control of the market, reflecting strong purchasing activity.

As a result, more buy orders are being executed compared to sell orders.

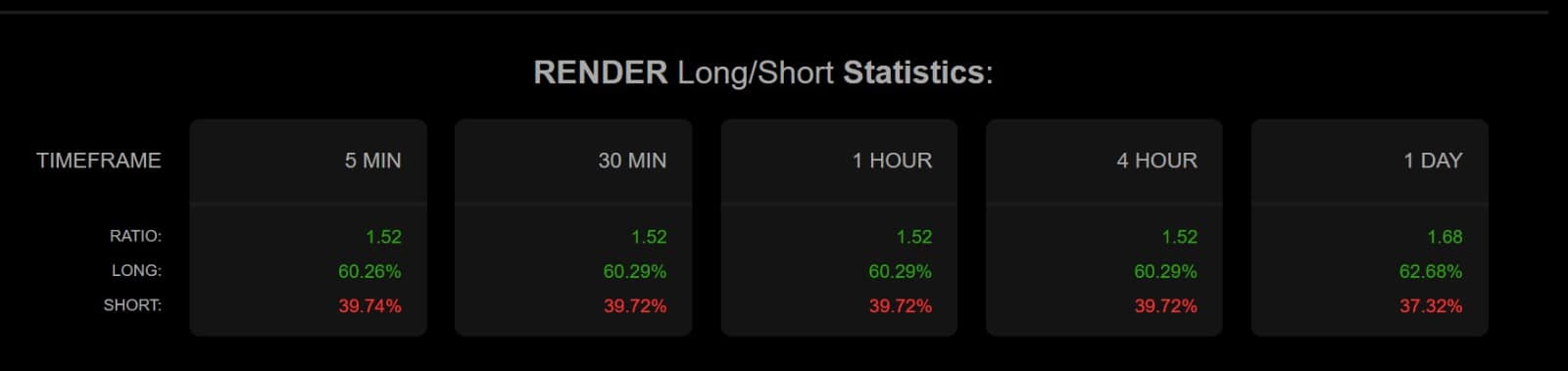

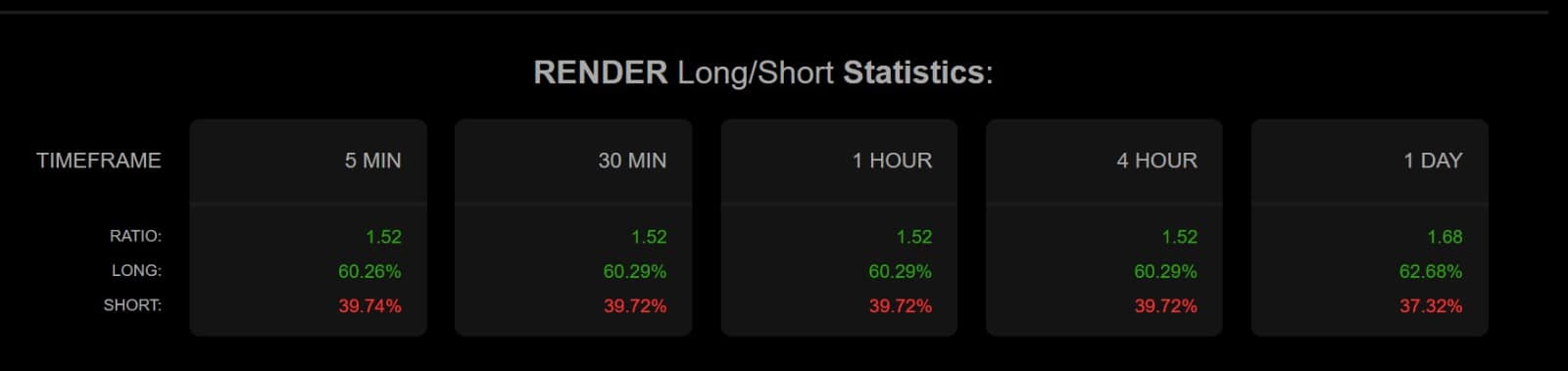

Source: MobChart

Finally, these buyers are entering the market primarily to open long positions. The Long/Short Ratio reveals that long positions dominate, with 62.68% of accounts being long, compared to 37.32% holding short positions.

Such a ratio indicates that the majority of investors are optimistic, anticipating a near-term price recovery.

Source: Coinalyze

What next for RNDR

In conclusion, current market conditions suggest that Render (RNDR) is well-positioned for further gains. With buyers dominating and strong bullish sentiment prevailing, RNDR appears poised for significant upward movement.

If a daily breakout from consolidation is followed by a successful retest and a close above $3.8, this will validate the bullish move. Render could then target $4.5, potentially building momentum to challenge the $6 resistance level.

However, if the attempt fails and the price closes below $3.5, RNDR may undergo a correction, retracing to $3.2.