- The Divergence metric between Global Liquidity and Bitcoin has flashed a rare green buy signal.

- Binance and Metaplanet buying BTC as selling pressure decreases noticeably over the past month.

Logarithmic measurement of the price of Bitcoin [BTC] and global liquidity within the same scale showed intriguing dynamics.

Historically, this combination has seen green buy signals emerge when Z-Score reached -3 below zero and red sell signals developed as Z-Score climbed above +3.

For instance, Bitcoin saw its substantial price rise from below $500 to above $1,000 during the period starting in early 2016 when a transaction signal appeared.

The red warning sign emerged in late 2017 before Bitcoin reached its maximum value at $20,000, which triggered a swift price decrease.

Source: Alpha Extract

In early 2020, the buying indicator triggered as Bitcoin surpassed the $10,000 level, which would later result in reaching its highest price point ever.

The current green signal revealed an opportunity for a Bitcoin price rise because of growing market liquidity.

Binance and Metaplanet buy BTC

Institutional investors like Binance and Metaplanet also participated in BTC purchases following a buy indicator appearing in the market suggesting potential for a rise in BTC value.

Binance keeps purchasing Bitcoin with the last 24 hours, seeing tokens worth $250 million being purchased and sent to the market maker, Wintermute, as the cryptocurrency continues to gain market presence.

Besides Binances’s strategic buy, Metaplanet also made additional purchases of 150 Bitcoin as per their post on X (formerly Twitter).

The purchase activities of institutions could drive BTC price growth through elevated market demand and thus both create more buying power and strengthen market trust.

Extended purchases showed potential to drive the BTC price higher because they might attract additional investors to join this rising market.

The buying coincides with other institutions like BlackRock and MicroStrategy also accumulating BTC during the recent dip to $80K.

What’s the impact of reducing selling pressure?

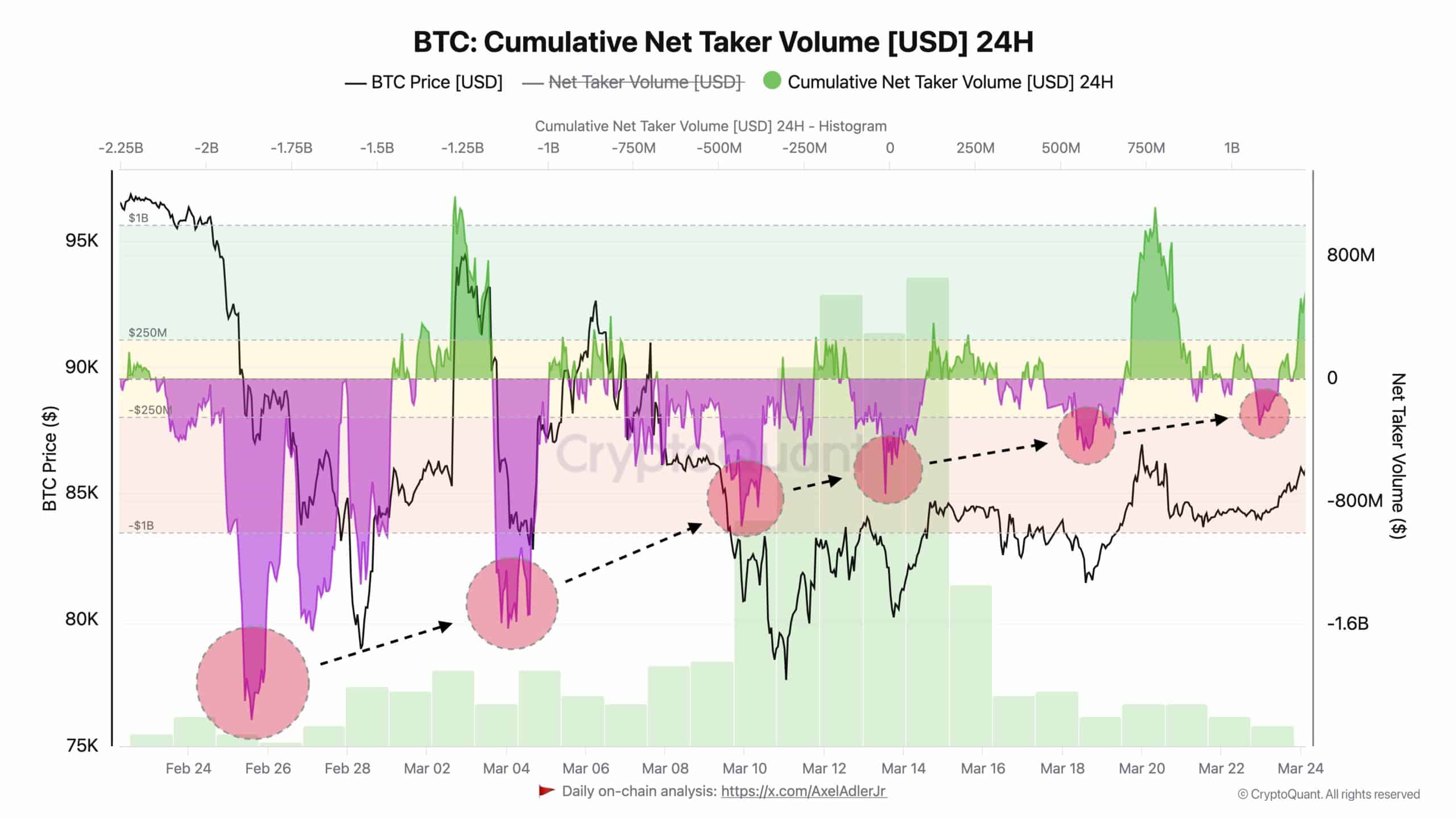

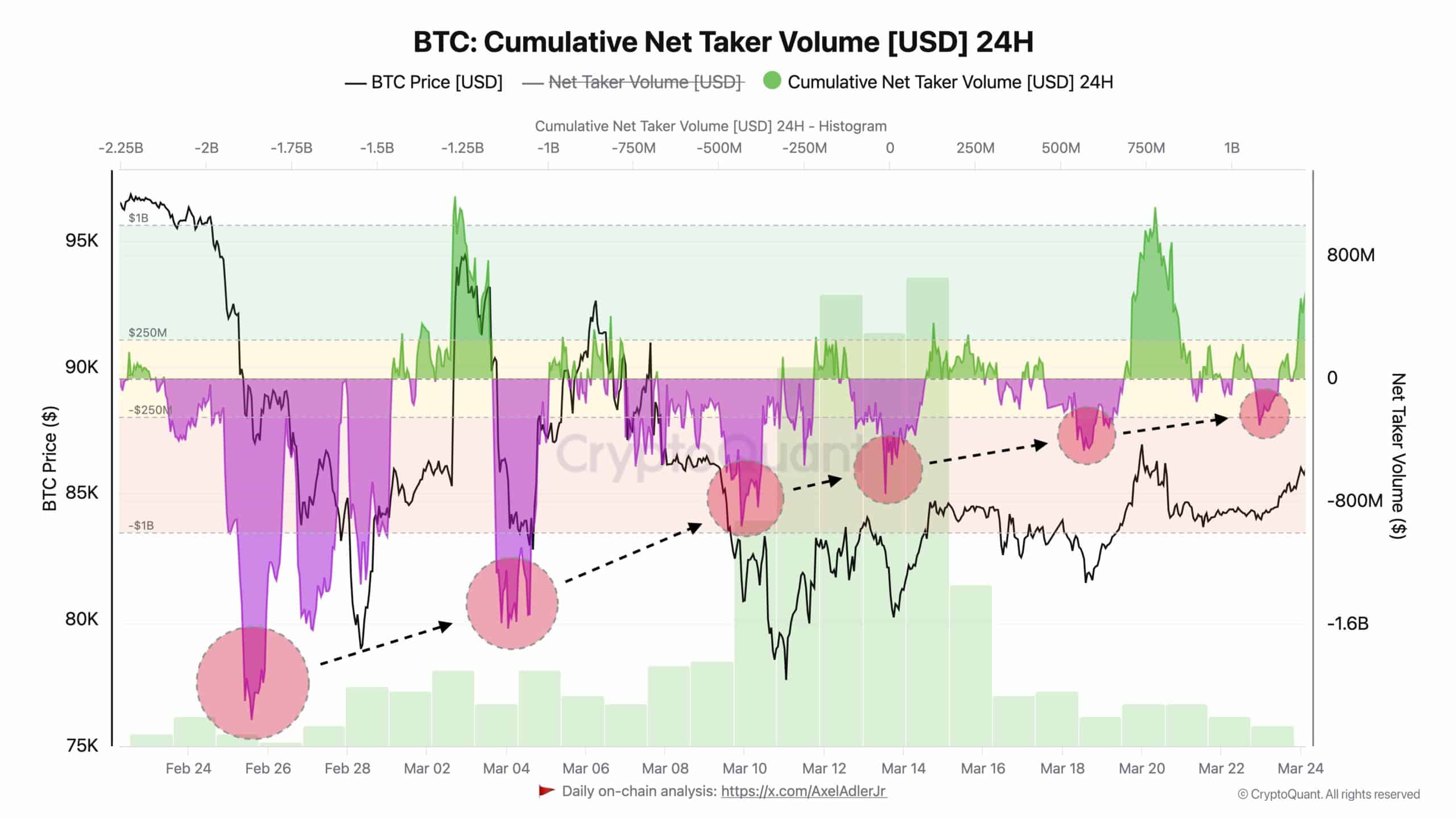

The cumulative net taker volume also indicated how aggressive BTC selling has decreased since February through lower net taker volume changes.

Since February 24 to mid-March, Bitcoin has faced massive selling pressure that reduced its price from $95K to nearly $75K.

However, BTC prices have seen stabilization upon each major sell-off event and then started to recover slowly.

The negative net taker volume reached a point of decline during mid-March, which indicated a reduction in market selling activity.

Source: CryptoQuant

Subsequently, Bitcoin experienced its price rebound above $85K as the green cumulative net taker volume surfaced in the market on the 20th of March.

The absence of major economic slowdown together with controlled asset liquidation points toward reasonable BTC price expansion according to current market patterns.