- Moderate losses rising, but no signs of mass panic among holders.

- Price dropped 17%, but dormancy and accumulation continue.

Bitcoin [BTC] has entered a consolidation phase, showing signs of cooling without triggering widespread selling.

On-chain data reveals a market marked by moderate losses, fading high-profit holdings, and growing mid-range positioning.

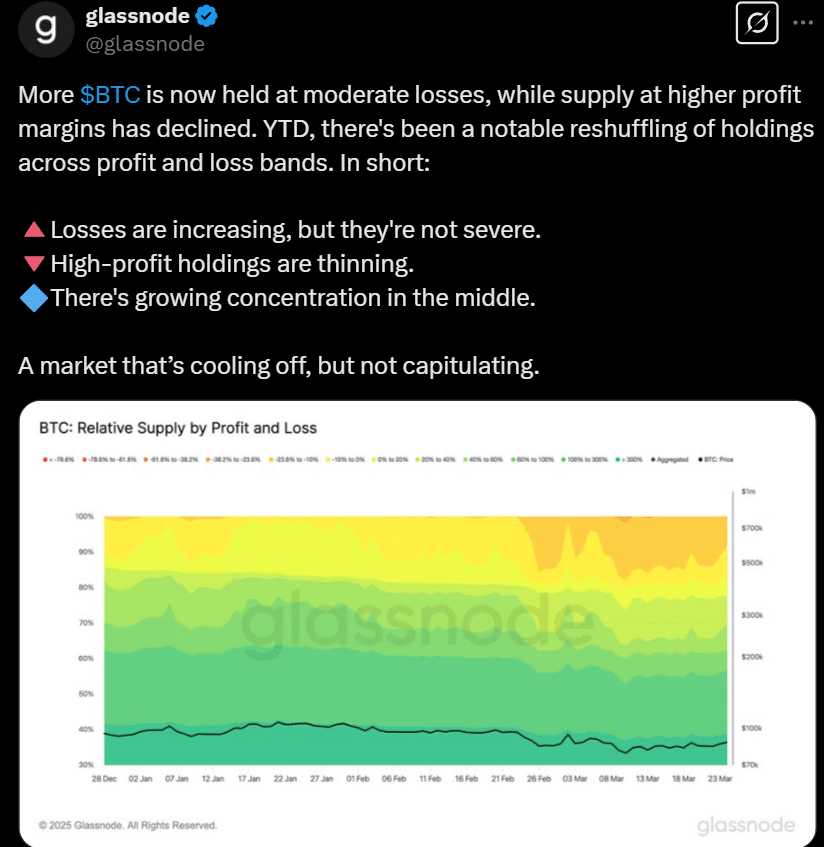

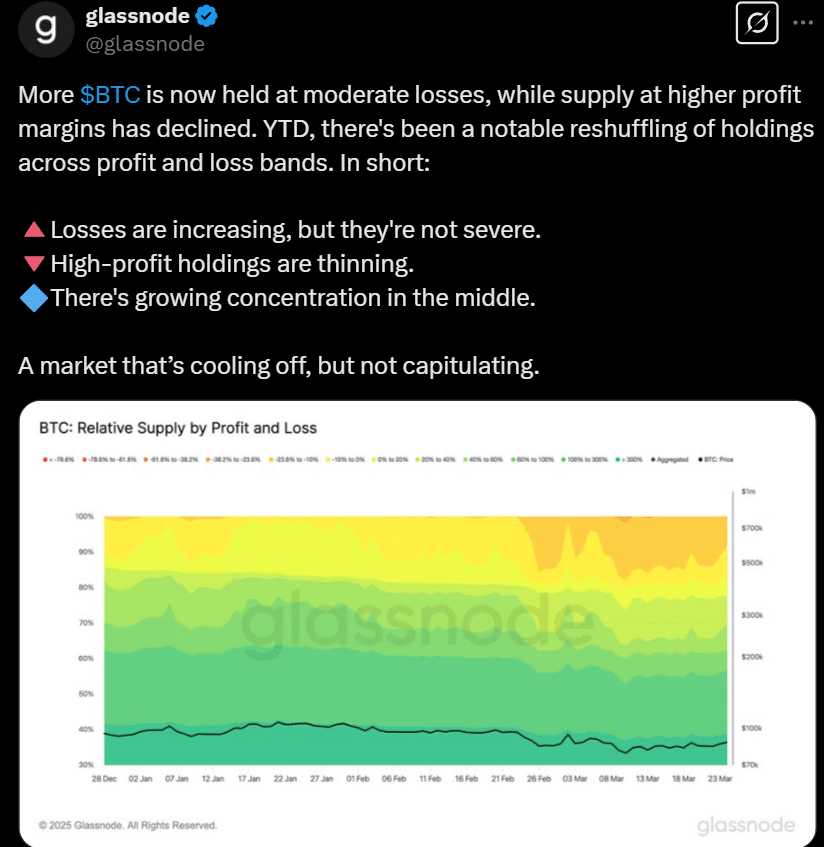

Glassnode shared that the share of Bitcoin held at moderate unrealized losses has grown significantly in 2025.

Swimming in the red—but staying afloat

Holdings in the -23.6% to -10% loss range rose 7.75% this year, pointing to more underwater holders. At the same time, high-profit holdings (40–60%) fell 3.57%, while mid-profit positions (20–40%) rose 3.45%.

This shift suggests coins are migrating from high-profit bands to mid-range levels, consistent with a market in cooldown mode but not showing panic behavior.

Source: Glassnode

But there’s more pressure building elsewhere.

The pressure mounts

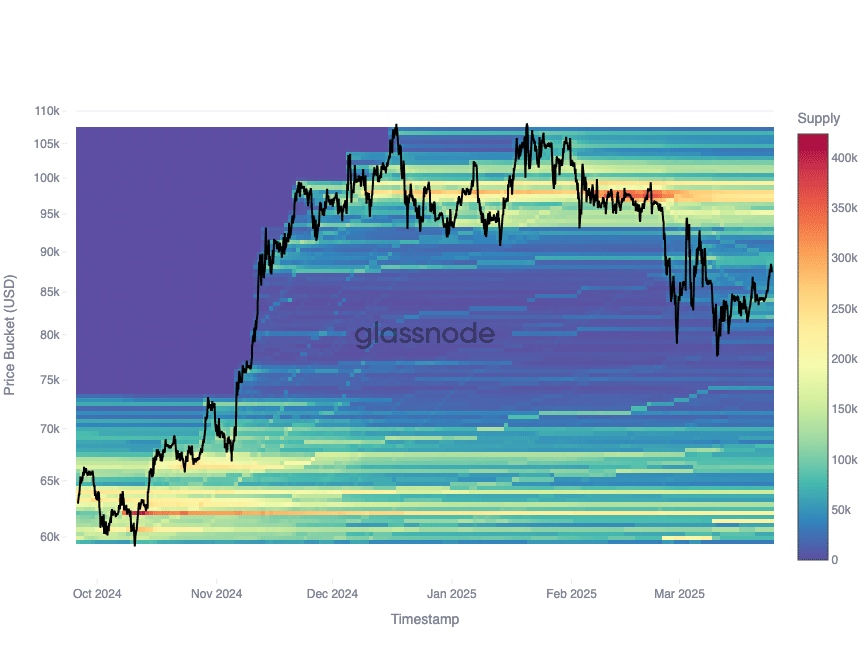

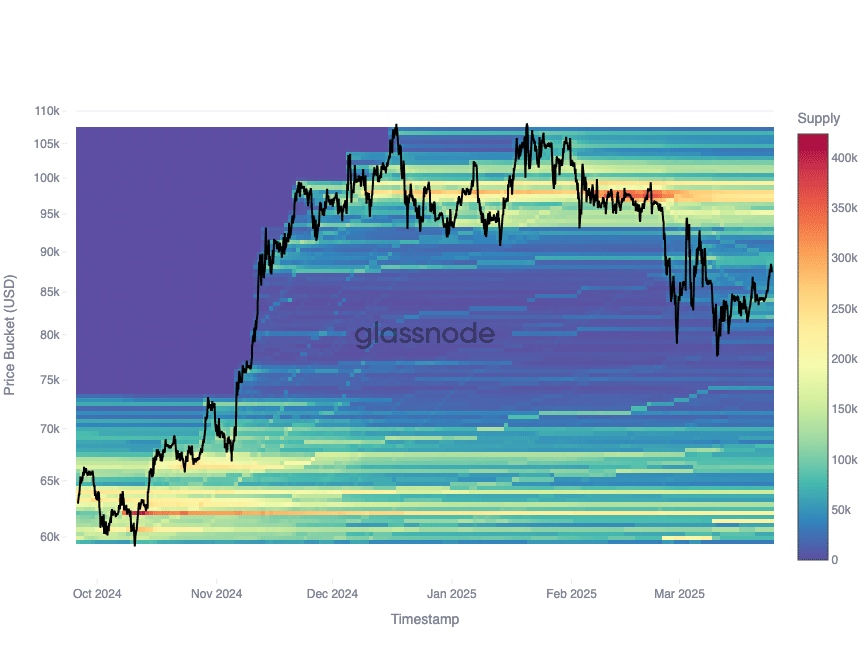

There’s mounting pressure on short-term holders, who acquired Bitcoin within the past 155 days. Over 2.8 million BTC from this group sits underwater, posing significant unrealized losses.

However, it must be noted that most investors are holding rather than selling at a loss.

The average acquisition price for short-term holders stands near $92,500. Bitcoin remains just below this level, making it a critical resistance threshold.

CryptoVizArt, a senior analyst at Glassnode, identified the $90K–$93K range as a supply zone.

Source: X

This area forms a supply zone, since investors who bought here may sell if prices reach $90K–$93K. Above that range lies the path to a new all-time high, while below it signals ongoing consolidation.

But some are simply… waiting

Still, not all holders are reacting the same way.

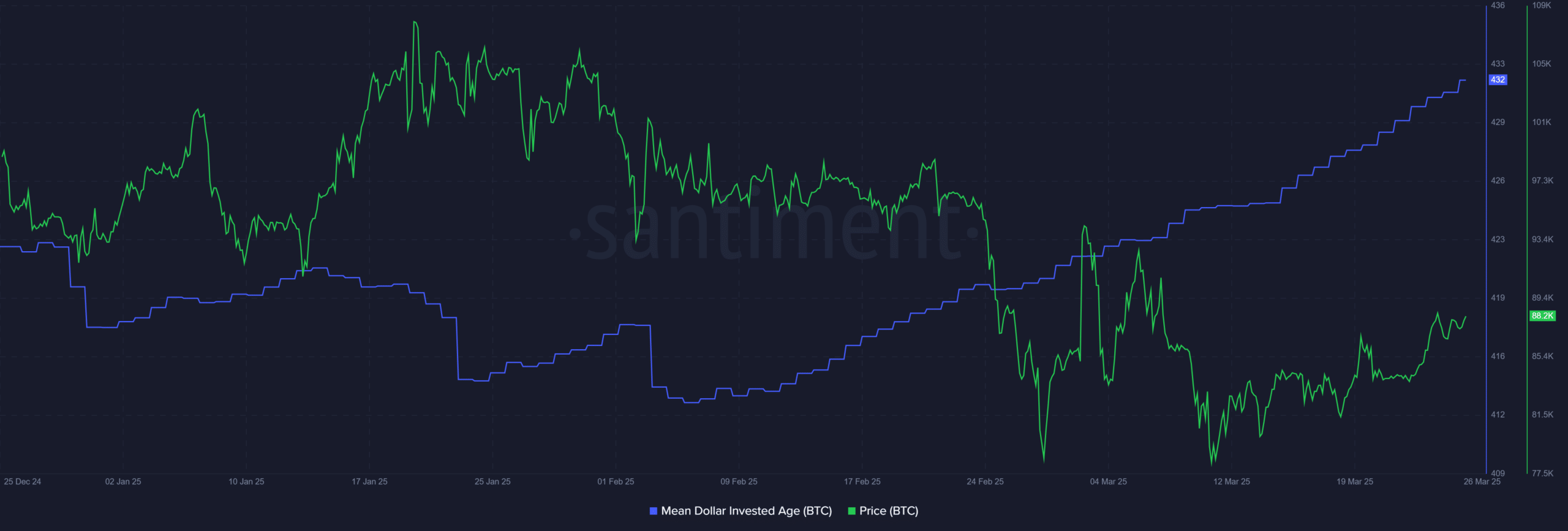

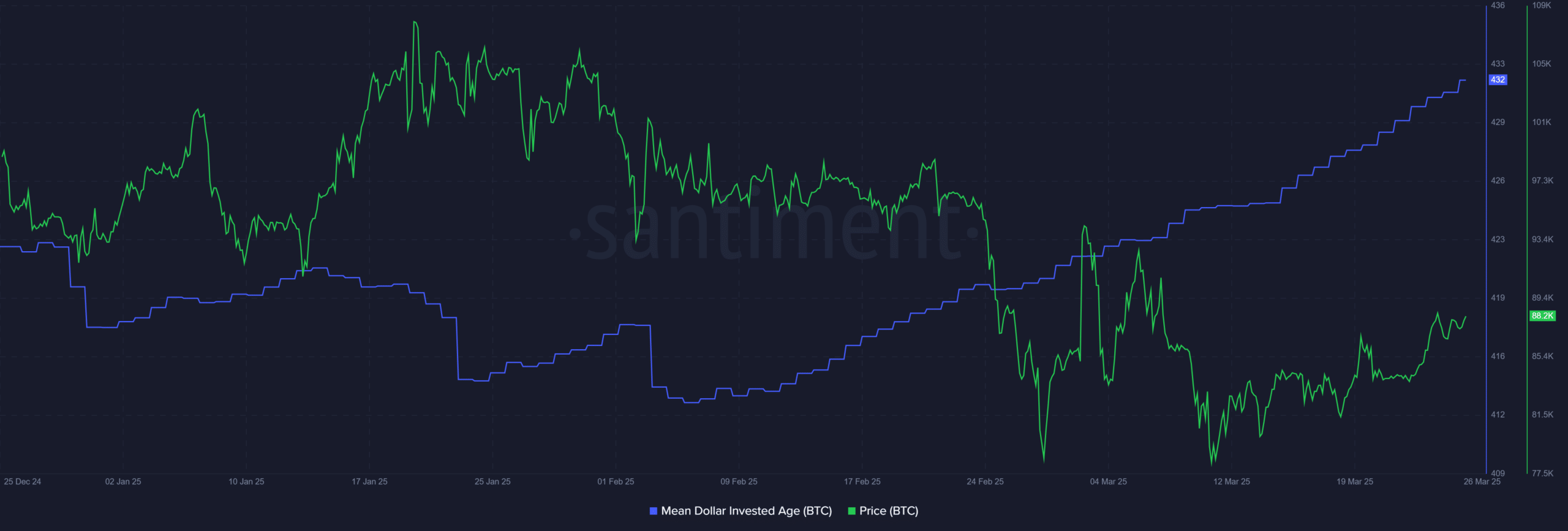

Bitcoin’s Mean Dollar Invested Age climbed from 418 to 432 days between the 4th of February and the 26th of March. This indicates old coins are dormant, suggesting accumulation over distribution.

Source: Santiment

Price falls, but Bitcoin HODLing stays strong

Bitcoin’s price slipped from $101,403 to $84,330 over that period, yet MDIA kept rising.

This divergence reflects long-term holder confidence. Investors appear willing to hold through volatility, hinting at a quiet accumulation phase.

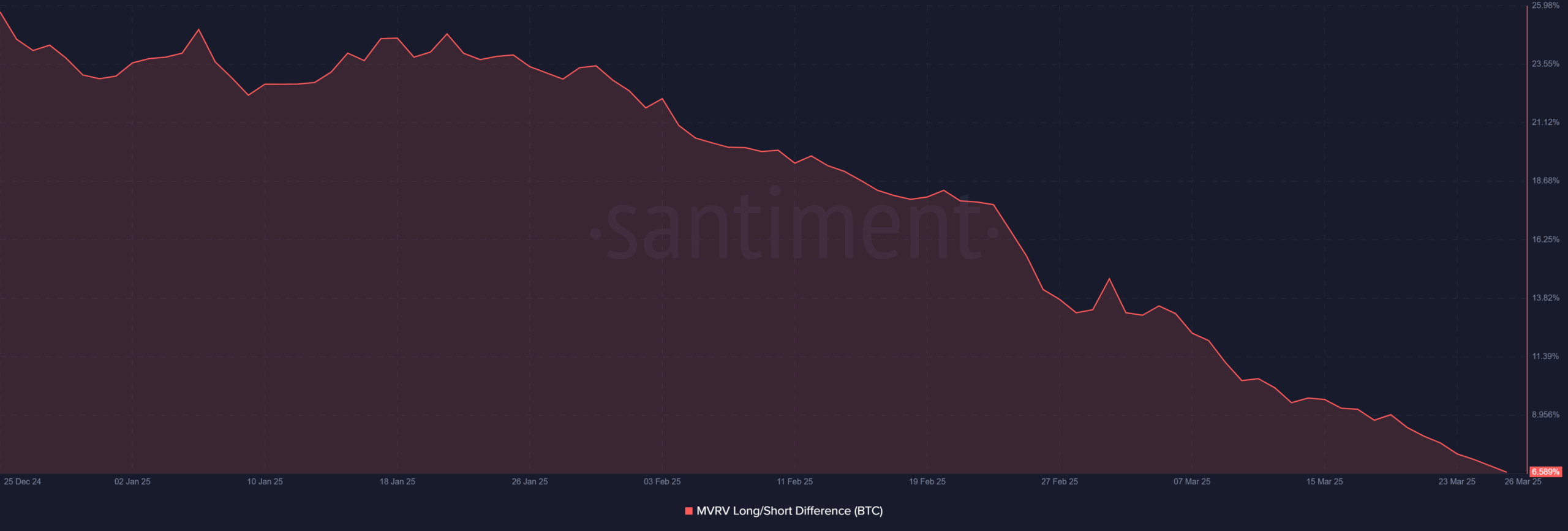

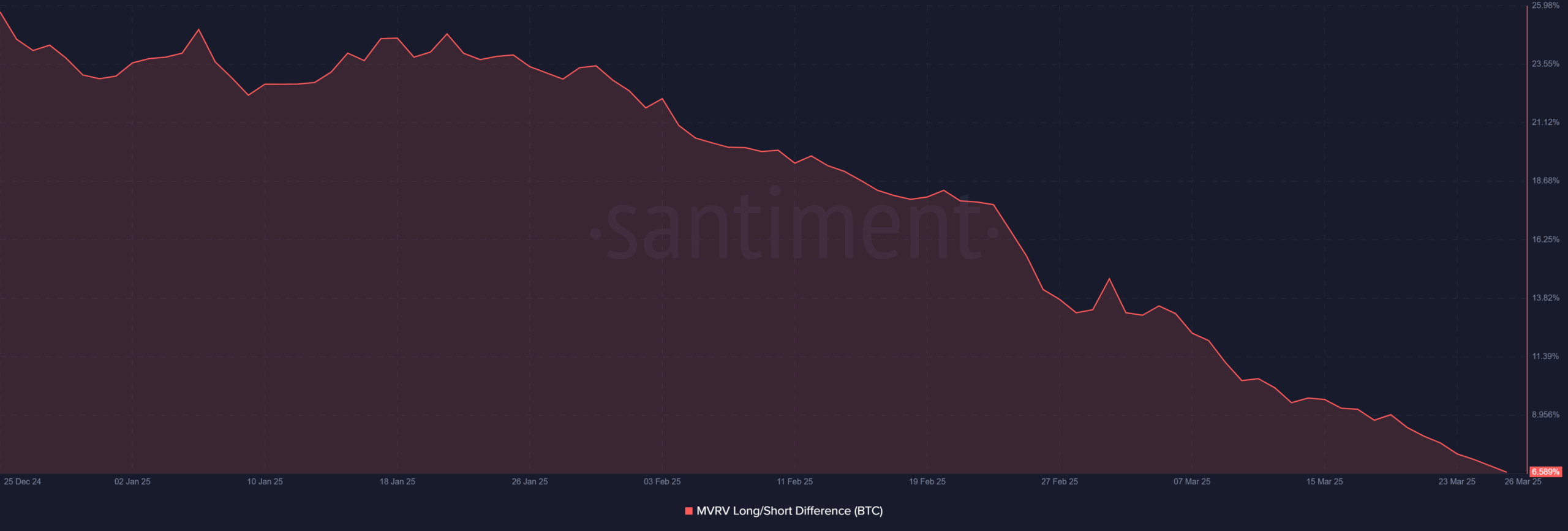

Now, let’s zoom in on another key metric. The MVRV Long/Short Difference, which tracks holder profitability, dropped from 22.12% on the 3rd of February to 6.59% on the 26th of March.

Source: Santiment

This 70% decline shows long-term holders losing their profitability edge, though sentiment remains steady. And that’s not the only signal of calm.

Whales watching, not dumping

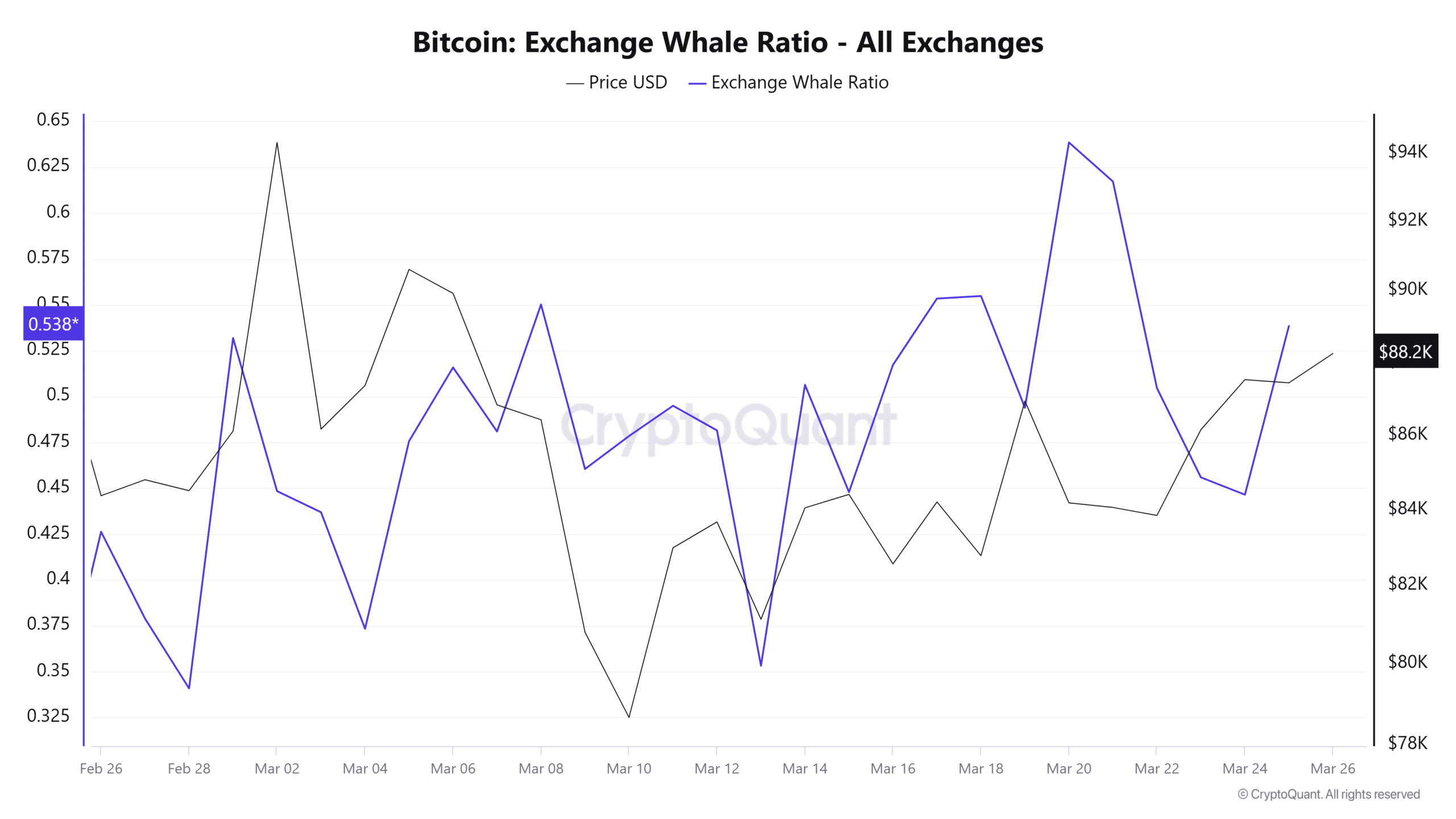

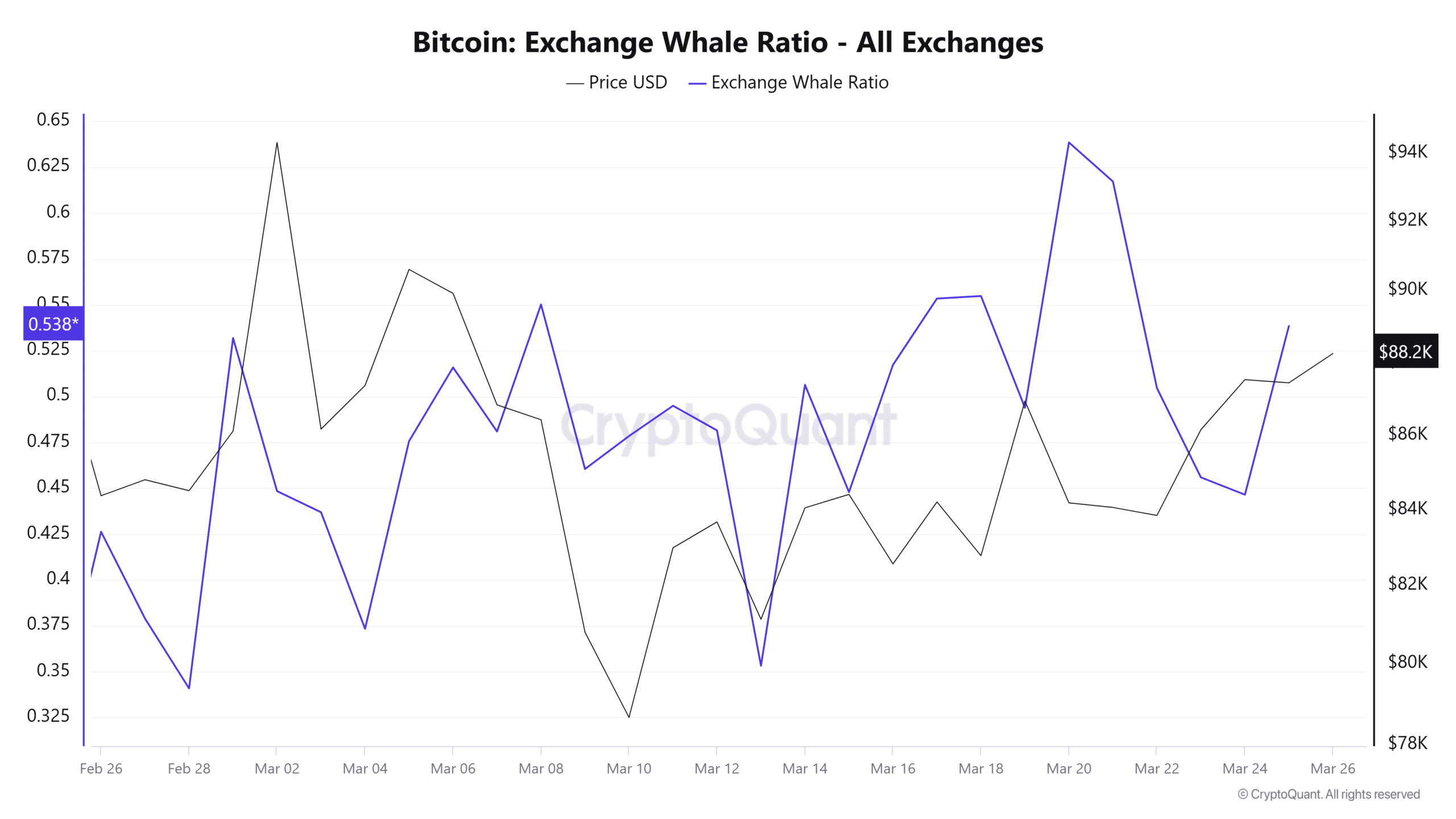

CryptoQuant data reveals a calm market, supported by the Exchange Whale Ratio staying above 0.50 in March.

Source: CryptoQuant

Peaks on the 14th of March and the 20th of March aligned with stabilization near $84,000 and a recovery to $88,200. This pattern suggests whale activity during low volatility, without triggering major sell-offs.

Bitcoin is in a cooling phase, not a breakdown.

Metrics across platforms show steady accumulation, lower short-term profitability, and dormant long-term holdings. Resistance holds near $90K-$93K; support sits at $87K-$89K.