Although $12 billion worth of Bitcoin options contracts expire tomorrow—one of the largest quarterly expiries that derivatives exchange Deribit has seen—CEO Luuk Strijers says he expects volatility to be subdued.

On Deribit alone, the March 28 expiry affects 45% of the open options contracts on the platform. The exchange currently has $27 billion worth of open interest in Bitcoin contracts, with the put/call ratio skewing slightly pessimistic at 0.52.

A call option gives buyers the right, but does not oblige them to buy an asset at a set price before the option expires. Typically, traders open these contracts when they’re expecting a price increase. A put option allows a trader to sell an asset at a set price before expiration. Traders tend to use them when they’re expecting an asset’s price to decrease.

Analysts at Singapore-based crypto trading desk, QCP Capital, flagged $85,000 as the max pain point. Bitcoin was recently trading at $87,016, up 0.4% over the past 24 hours, according to data provider CoinGecko.

But so far, indicators make it seem unlikely derivatives traders will be in for max pain.

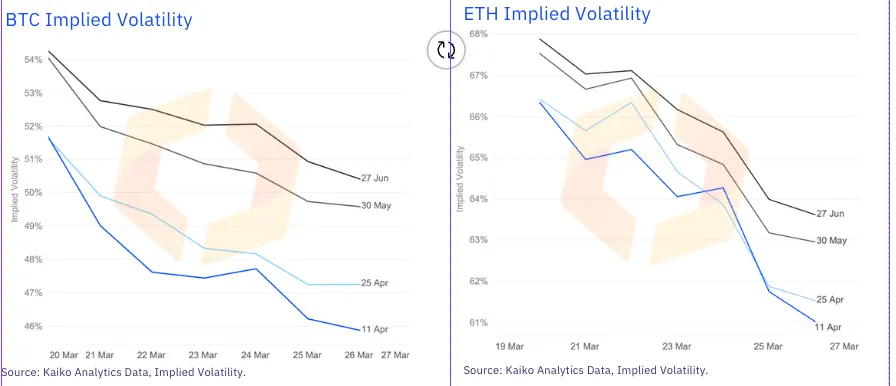

“Deribit DVOL is currently at 47, which is relatively low—comparable to levels seen at the end of February and August 2024—signaling low implied volatility and limited expectations for sharp price action,” Deribit’s Strijers told Decrypt in an email.

The Deribit Implied Volatility Index, or DVOL, uses current activity in options markets to predict price volatility in the next 30 days.

It’s a Bitcoin and Ethereum equivalent of the Cboe Volatility Index, or VIX, which measures the stock market’s expectation of volatility based on S&P 500 index options.

Strijers sent his comment to Decrypt earlier this week, before U.S. President Donald Trump announced a 25% tariff on vehicles. But even after the unexpected macroeconomic news, the DVOL slid toward 46.

“In broader markets, uncertainty around U.S. tariffs remains high, and the lack of clarity is causing nervousness in the equity market,” Strijers added, “while U.S. dollar and gold prices remain high.”

He also flagged that Mt. Gox has already thrice shifted “sizeable amounts” of Bitcoin this month, with some of it going to Kraken. Although Glassnode analysts told Decrypt there’s little on-chain evidence to show that creditor repayments will restart, there’s still a chance.

Adam McCarthy, a research analyst at Kaiko, agreed that despite the size of tomorrow’s Bitcoin options expiry, that he’s not expecting anything extreme in terms of pricing or volatility.

“For the first time in over a year we’re entering a quarter with very few well defined risk events,” he told Decrypt.

McCarthy said 2024 was flush with implied volatility term structure inversions, like the launch of Bitcoin and Ethereum spot ETFs, the fourth Bitcoin Halving, and the November U.S. presidential election.

Typically, options with longer term expirations have higher implied volatility because they leave more room for uncertainty. But in an inversion, short-term options exhibit higher implied volatility than long-term options.

“As we enter the second quarter, the structure for both of the leading assets is normal, with no major risk events being priced in at present,” McCarthy added.

Editor’s note: This post was updated to add comments from Kaiko.

Edited by James Rubin

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.