- BTC remained above the short-term realized price ($86.5K) despite a $359M long squeeze.

- Price recovery suggested spot market strength, but momentum needs to build for further upside.

Bitcoin [BTC] is proving resilient despite a sharp liquidation event that wiped out $359.7 million in long positions.

As volatility continues to grip the market, short-term levels are now more important than ever to gauge what lies ahead for the king coin.

Massive long liquidation but no breakdown

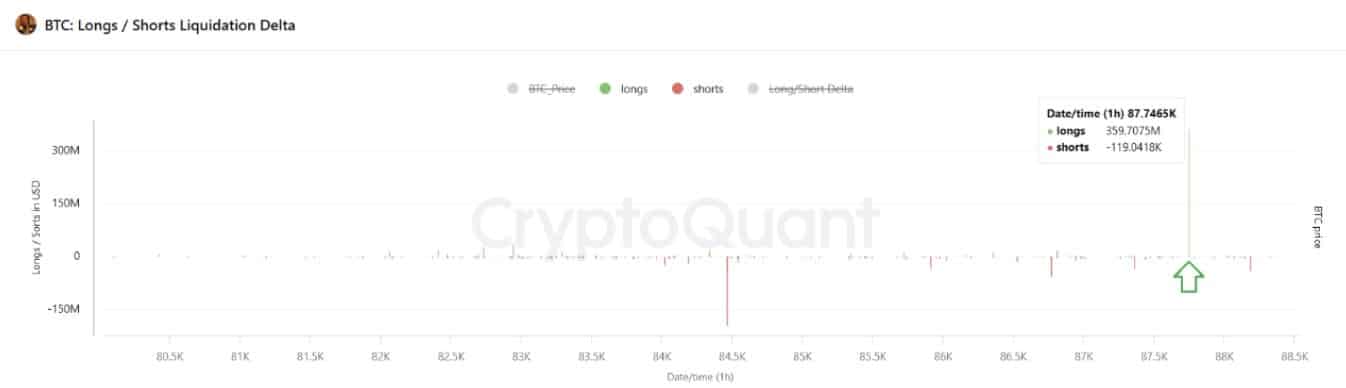

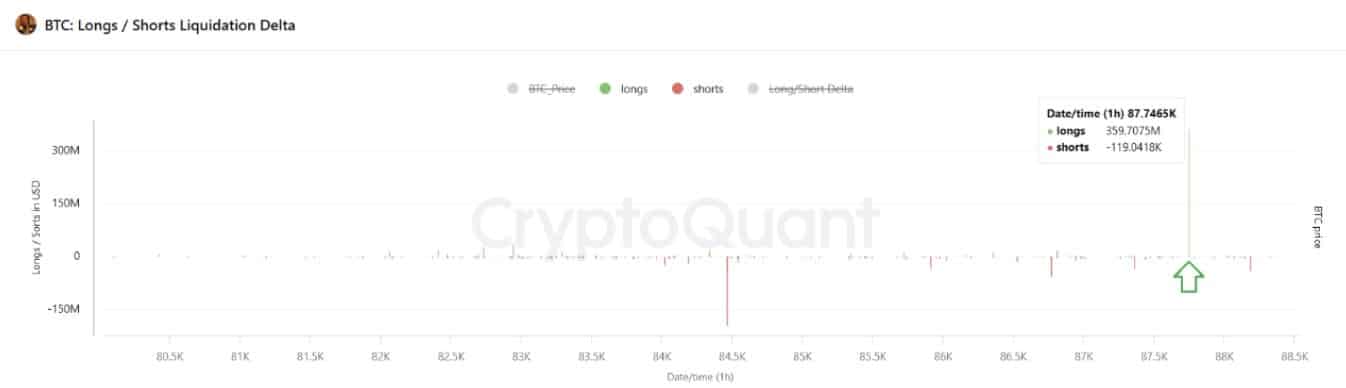

According to CryptoQuant data, the market recently witnessed a large-scale long squeeze, with nearly $360 million in long positions flushed out in a single hour.

Interestingly, this was not accompanied by a sharp downward price spiral. Instead, BTC bounced back quickly and traded at around $86,000, indicating strong buyer support and a lack of panic selling.

Source: CryptoQuant

This recovery indicates that, despite over-leveraged traders facing losses, spot market participants remain steadfast.

The liquidation event appears to have corrected overheated derivatives positions, potentially paving the way for more sustainable upward movements.

Bitcoin price holds above short-term realized price

Another encouraging signal comes from the Realized Price – UTXO Age Bands chart.

At the time of writing, BTC was above the short-term realized price for the 1-day to 1-week cohort at $86,000 and the 1-week to 1-month cohort at $84,000. These levels often act as support zones for short-term holders.

Source: CryptoQuant

As long as BTC maintains its position above these price bands, it implies that strong hands are stepping in, validating buyer conviction.

However, a breakdown below these levels could signal a shift in sentiment and trigger a wave of short-term profit-taking.

Bitcoin momentum remains intact despite slight cooling

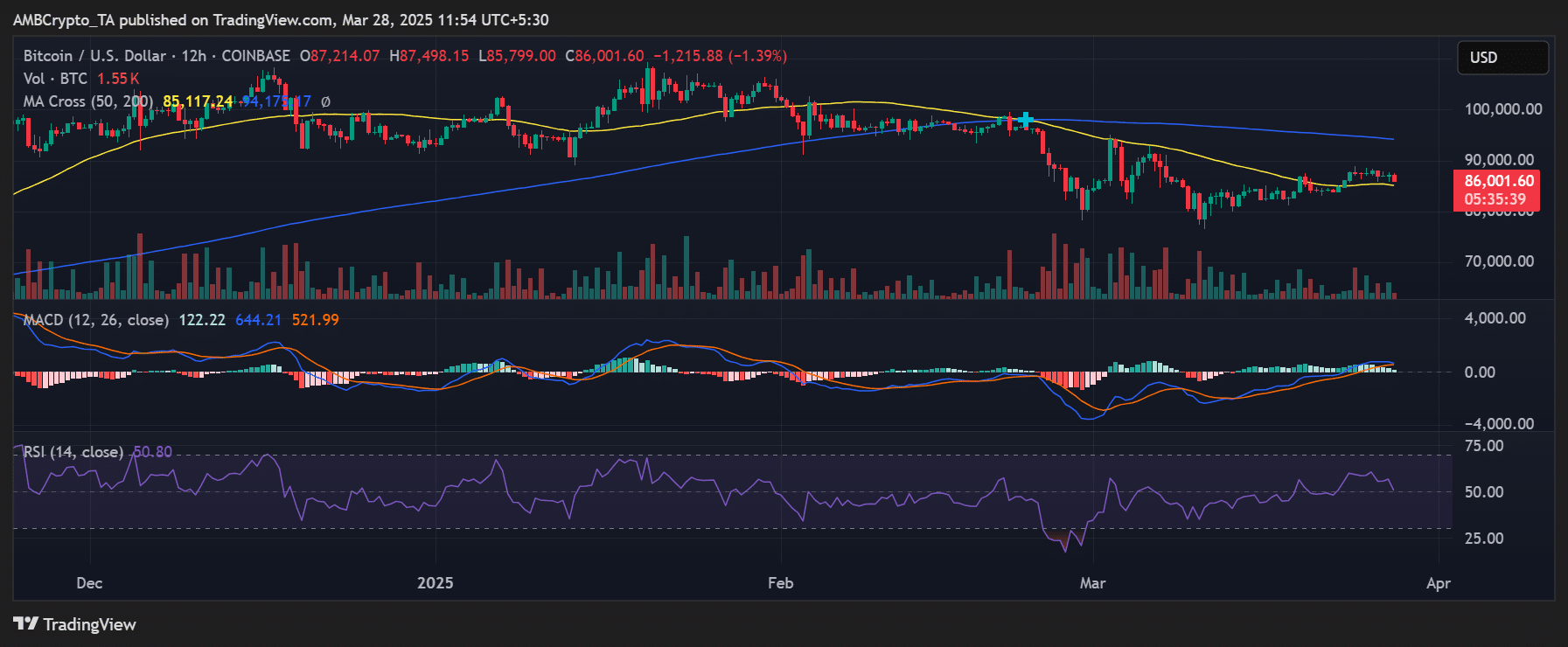

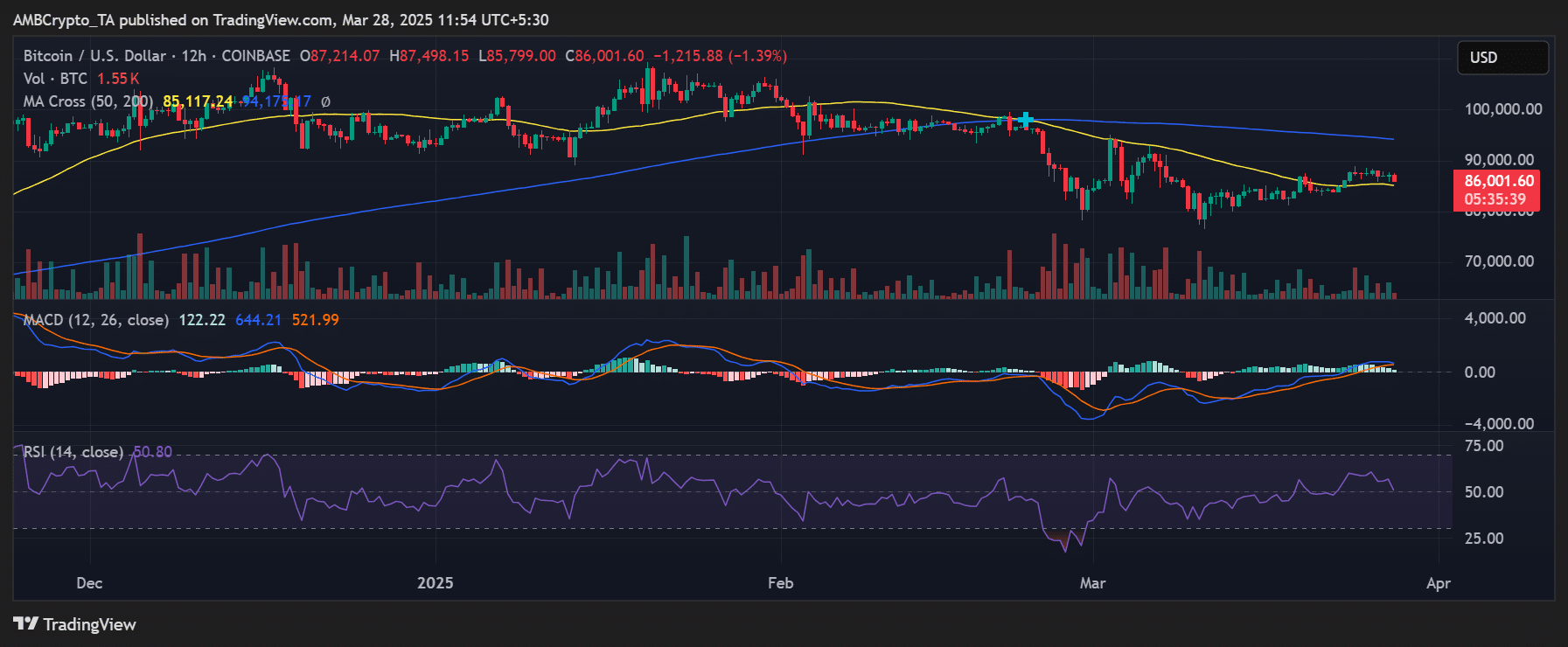

From a technical analysis perspective, Bitcoin’s 50-day Moving Average ($85,250) remains an important pivot.

The price has recently bounced off this level and is trending above it, with the Relative Strength Index (RSI) sitting at around 50, indicating a closeness to oversold conditions.

Source: TradingView

Moreover, the MACD line remained above the signal line, albeit with narrowing divergence, a possible sign of consolidation before the next leg up.

A retest of the $90,000 psychological level appears likely if momentum picks up again.

What next?

Bitcoin’s resilience after liquidation and its ability to remain above key realized price levels highlight strong demand.

However, cautious optimism is necessary, as BTC requires sustained momentum and higher volume to break out of its range. If buyers successfully protect short-term support zones, the next bullish movement could already be unfolding.