- Gold’s record highs in Q1 suggested that risk-off sentiment has dominated.

- BTC has already shown resilience, consolidating near highs while gold surged.

Analysts speculate that with Gold [XAU] hitting new highs in Q1 and outperforming Bitcoin [BTC] during trade tensions, a potential top could shift capital into risk assets.

If this rotation occurs, could BTC gain momentum to reclaim $100k in Q2?

Potential rotation from Gold to BTC

Gold’s 70% surge over 16 months has pushed its market cap to $20.75 trillion, now $1.25 trillion above the combined top 10 assets. Consequently, analysts anticipate a capital shift if a local top forms.

The Bank of America survey reinforces the idea – 58% of fund managers overweight gold, while only 3% back BTC. This has limited Bitcoin’s appeal as a hedge, yet a shift in positioning could provide upside momentum.

However, macro-driven volatility remains a key variable. BTC is trading 10% below its New Year rally, while gold has extended gains by 17%.

Notably, XAU’s vertical expansion aligned with BTC’s corrective phase, suggesting liquidity displacement.

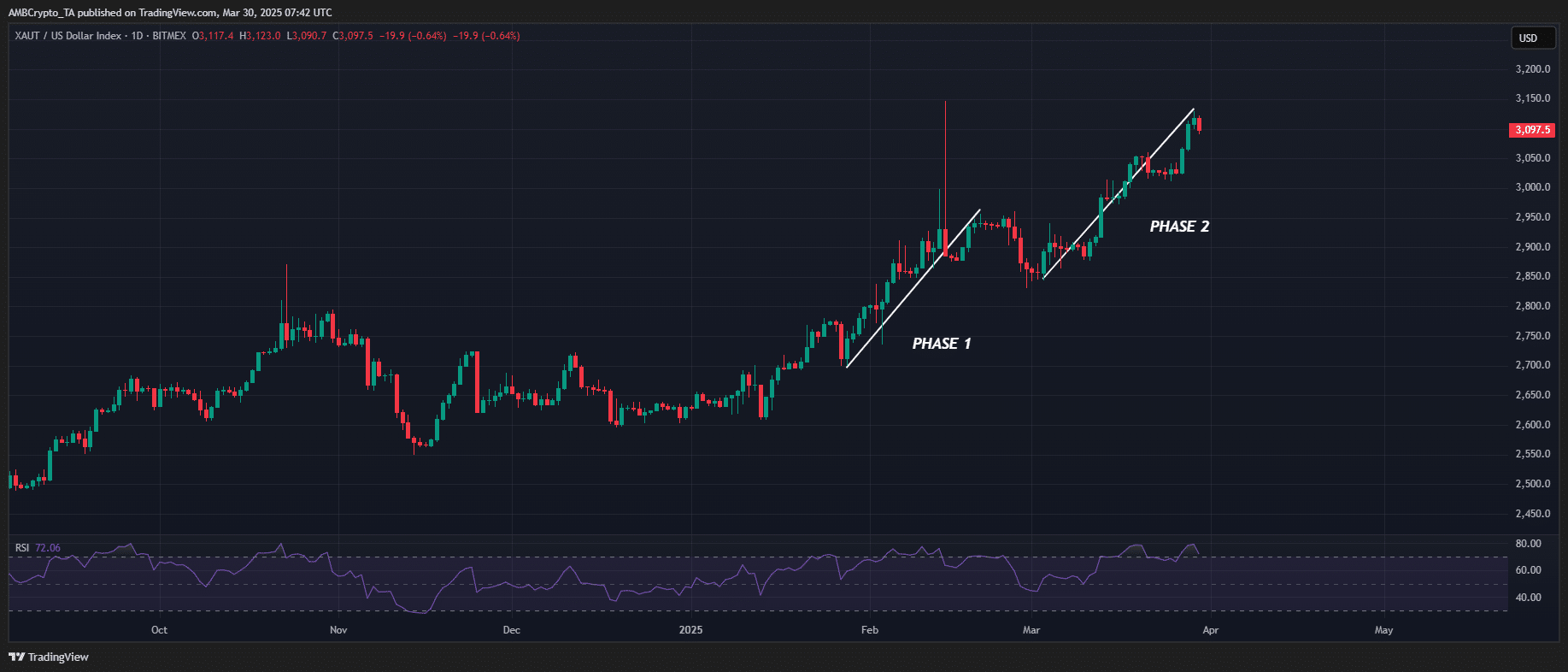

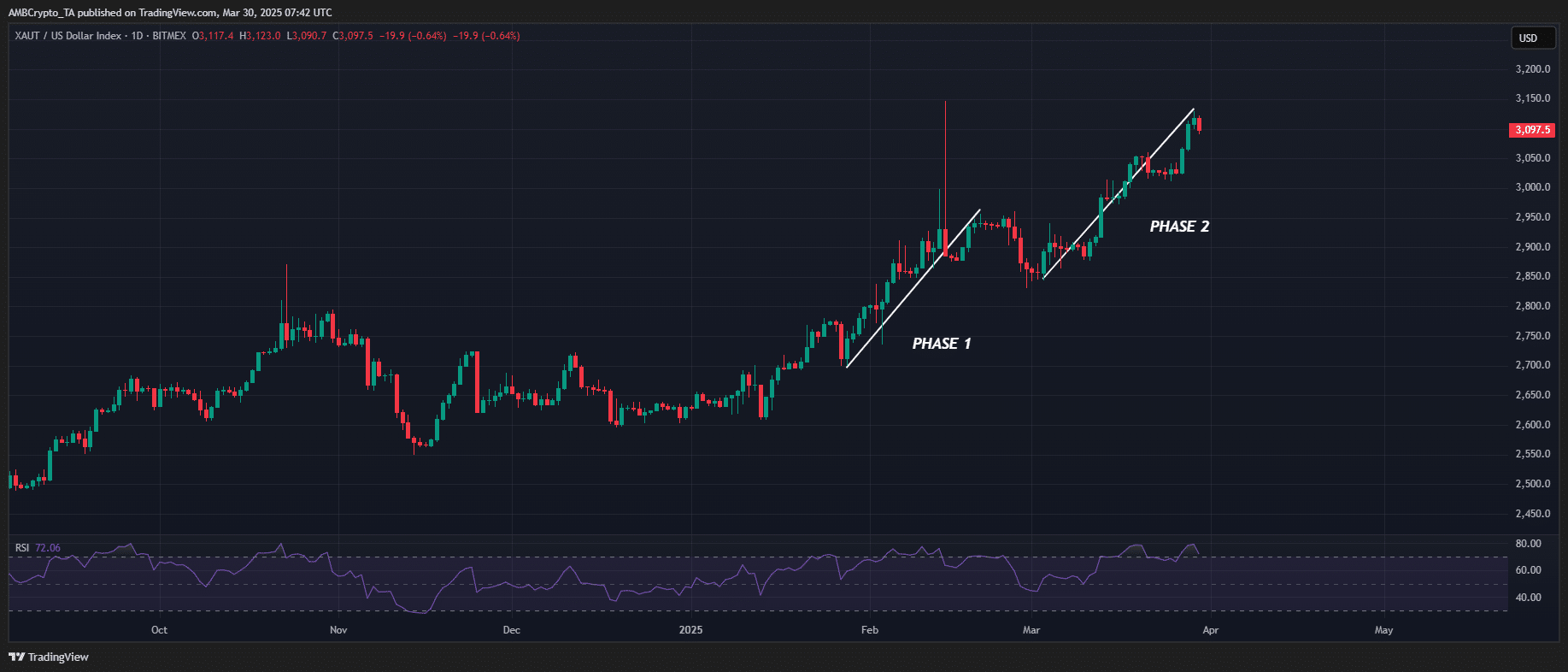

Source: TradingView (XAU/USD)

Put simply, on two distinct market-wide retracements, gold printed new all-time highs while BTC lost key structural support, signaling inverse liquidity rotation.

However, Gold’s recent pullback saw its Relative Strength Index (RSI) retrace into the bullish demand zone before surging to a fresh ATH of $3,097.

With RSI now in the ‘extreme’ overbought zone, the risk of a corrective move increases.

A decline in gold demand could trigger capital rotation into risk assets. Could this potential shift serve as a catalyst for Bitcoin to reclaim its safe-haven narrative in Q2?

The real test for Bitcoin lies ahead

Gold’s rally from $1,820 in October 2023 to $3,100 this week is nothing short of historic. Up +16% YTD, it’s outperforming stocks, currencies, and even the U.S. dollar – despite rising interest rates.

Traditionally, a stronger USD should push gold lower. The simple reason? A strong dollar makes Treasury yields more attractive. But instead, demand for gold has surged, breaking market norms.

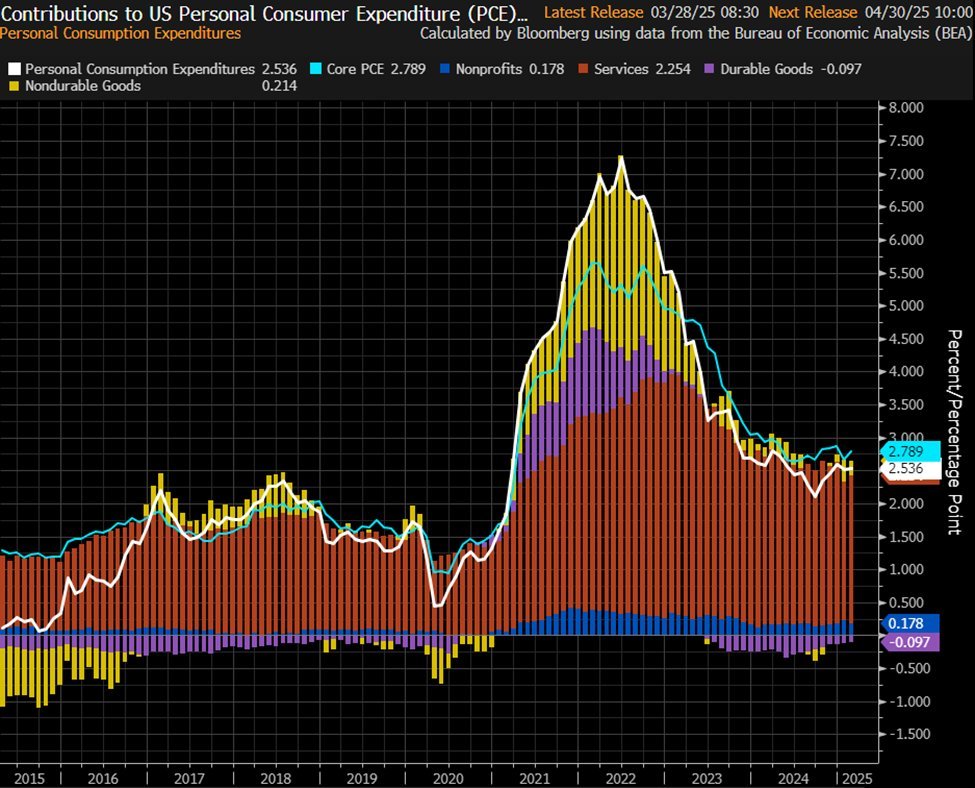

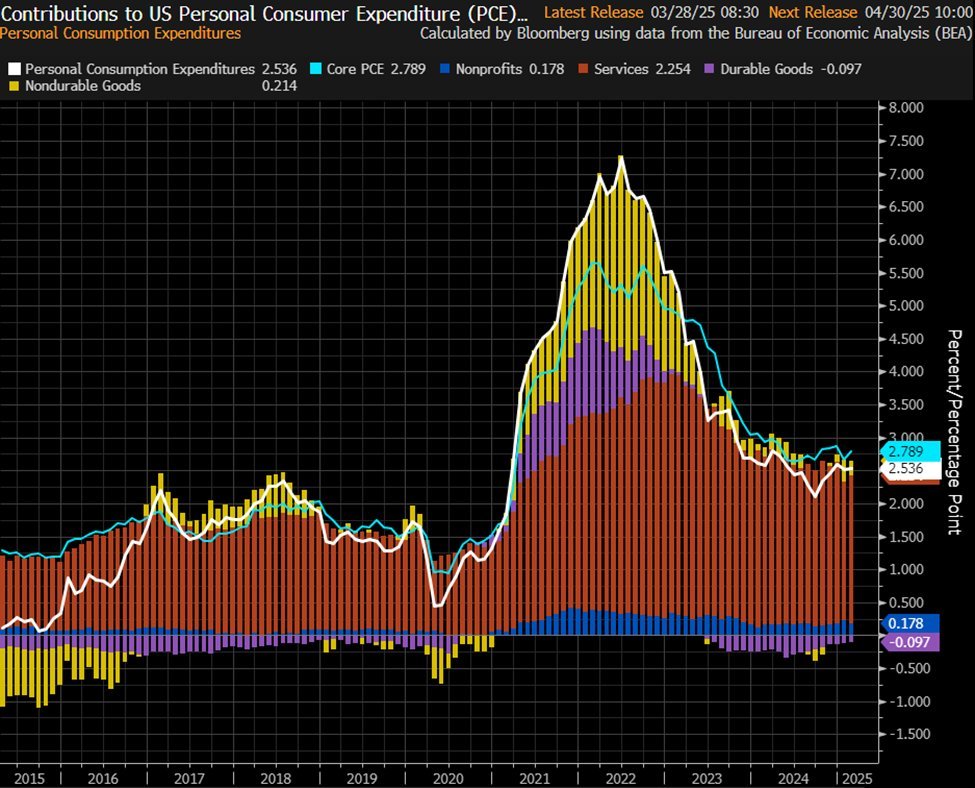

At the same time, inflation is heating up. 1-month annualized PCE inflation just jumped above 4.0%, while 6-month figures are now at 3.1%. As inflation erodes buying power, gold’s appeal as a safe haven is only growing.

Source: Bloomberg

As inflation rebounds, XAU has hit 50 all-time highs in the past 12 months. In fact, ZeroHedge reported that physical gold demand has surged alongside escalating trade tensions, reinforcing its role as a macro hedge.

In January, U.S. gold imports hit a record $30.4 billion. This represents a 2x increase from 2020 pandemic levels.

For BTC to challenge XAU’s dominance, a Bitcoin Strategic Reserve would need to be established.

Without such a mechanism, expectations for BTC to reclaim $100k remain speculative, with risk assets still facing liquidity constraints.

Despite RSI overextension, XAU’s price action continues to exhibit strong demand absorption. This makes a pullback unlikely — particularly with the impending ‘reciprocal’ tariff announcement, a key macro risk event.

In such a climate, Bitcoin’s structural test lies ahead, as Gold remains positioned to extend price discovery into new all-time highs.