- Bitcoin’s Sharpe Ratio dips to neutral, hinting at consolidation amid waning risk-adjusted returns.

- STH SOPR below 1 indicates losses for short-term holders, adding to market uncertainty.

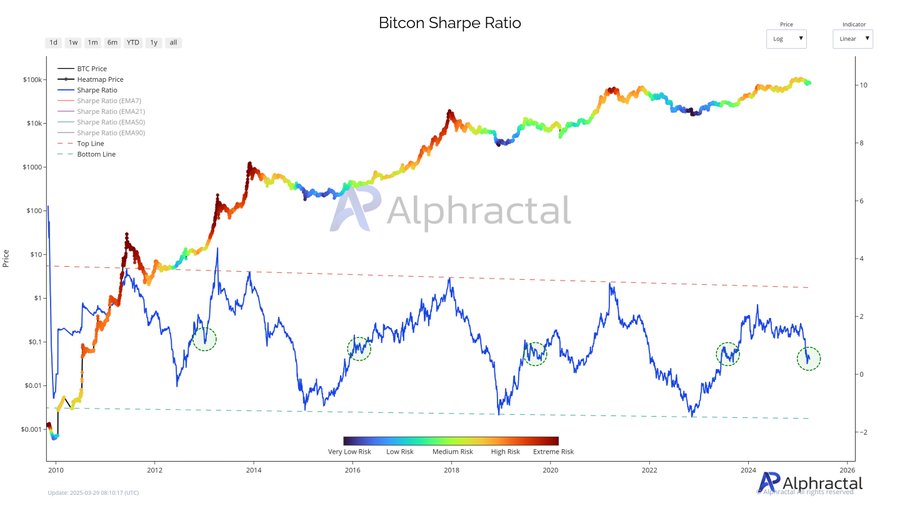

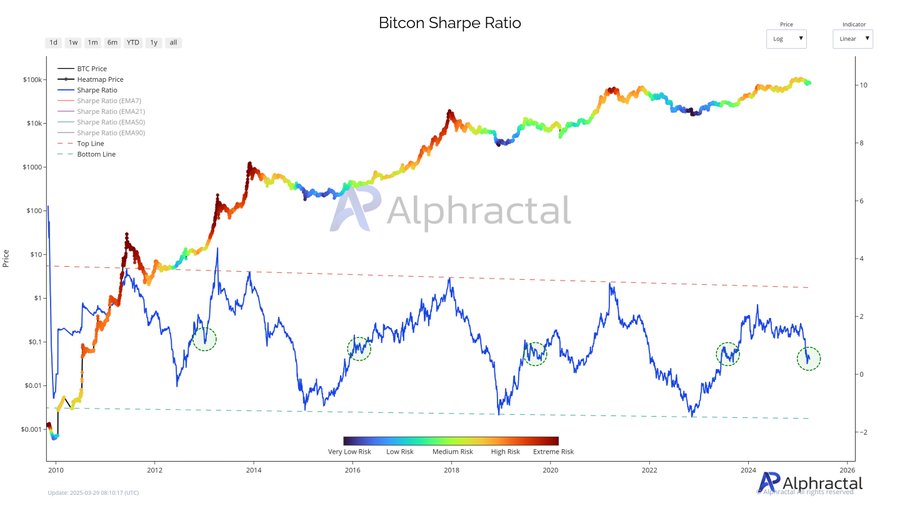

Bitcoin’s [BTC] market dynamics are showing signs of a shift, with the annualized Sharpe Ratio dipping to neutral levels — a pattern seen in previous years.

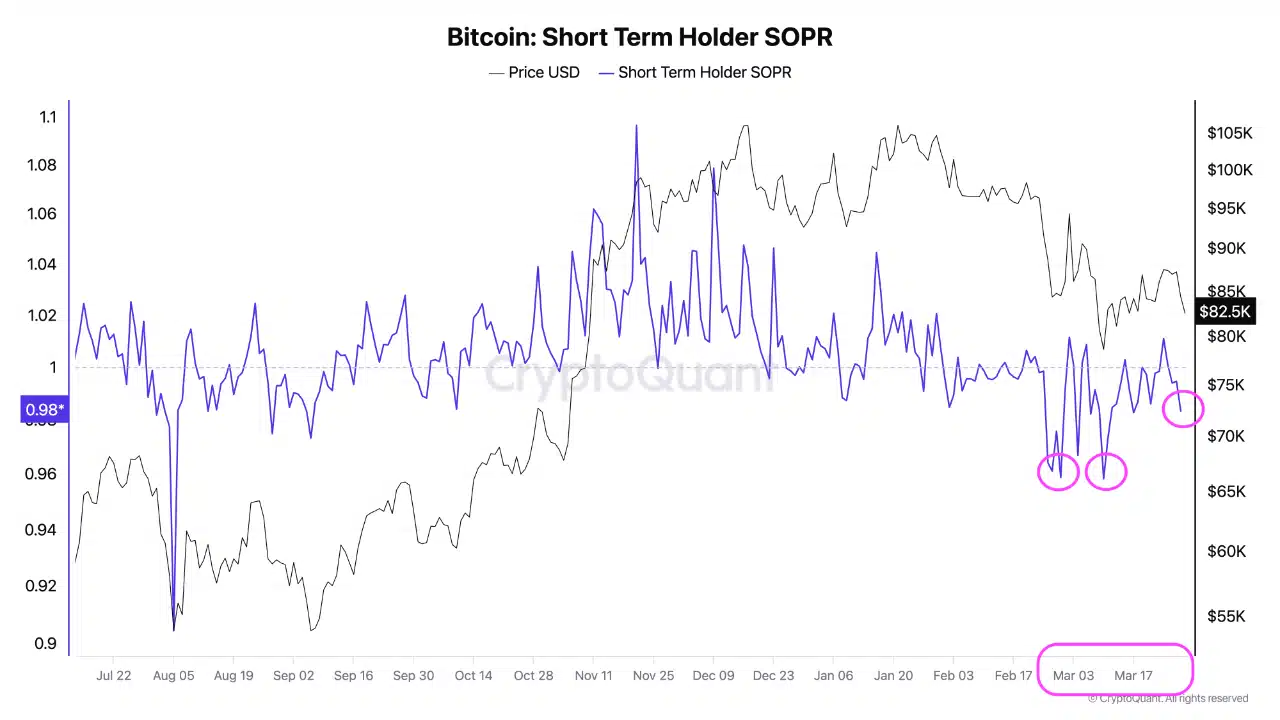

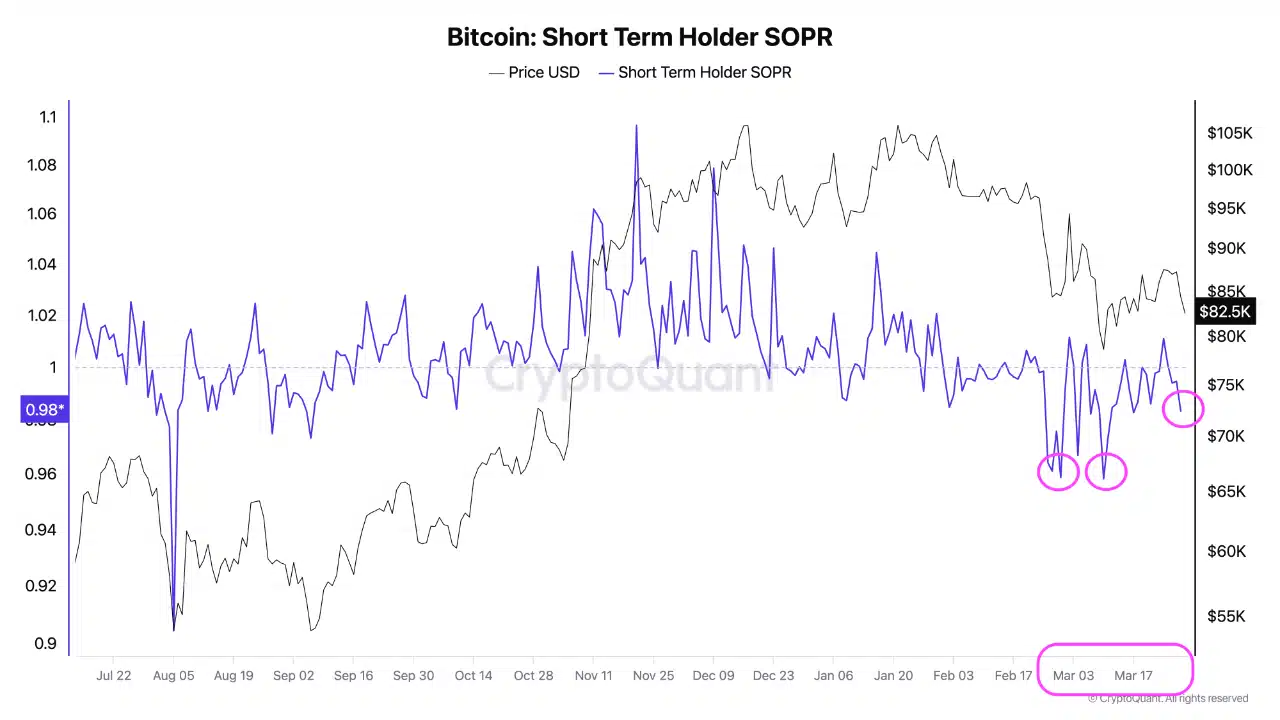

At the same time, the STH SOPR has slipped below 1, hinting at mounting losses among short-term traders and fueling a wave of panic and uncertainty across the market.

As sentiment wavers, traders are left grappling with uncertainty, weighing whether the recent signals point to consolidation or something more.

Bitcoin’s Sharpe Ratio signals market pause

Source: Alphractal

The chart shows that Bitcoin’s current Sharpe Ratio has retreated from previous highs, with the recent downturn marked by a notable dip into the neutral zone.

This decline mirrors past patterns where neutral or near-zero levels preceded periods of price stability or mild correction before resuming upward movement.

As the ratio continues to hover near neutrality, consolidation in the coming weeks seems increasingly likely.

Short-term holders under pressure

Bitcoin’s STH SOPR has remained below 1, signaling that many short-term investors are selling at a loss.

Source: CryptoQuant

As seen in the chart, notable dips in early and mid-March coincide with price declines, indicating heightened panic among traders.

Historically, such drops in STH SOPR reflect moments of capitulation, where weak hands exit the market.

However, past cycles suggest that prolonged periods below 1 often precede recovery phases as selling pressure subsides.

With Bitcoin’s price hovering between the 80k-85k range, investors are closely watching for a rebound.

A sustained move above 1 in STH SOPR would indicate renewed profitability among short-term holders, potentially strengthening market sentiment.

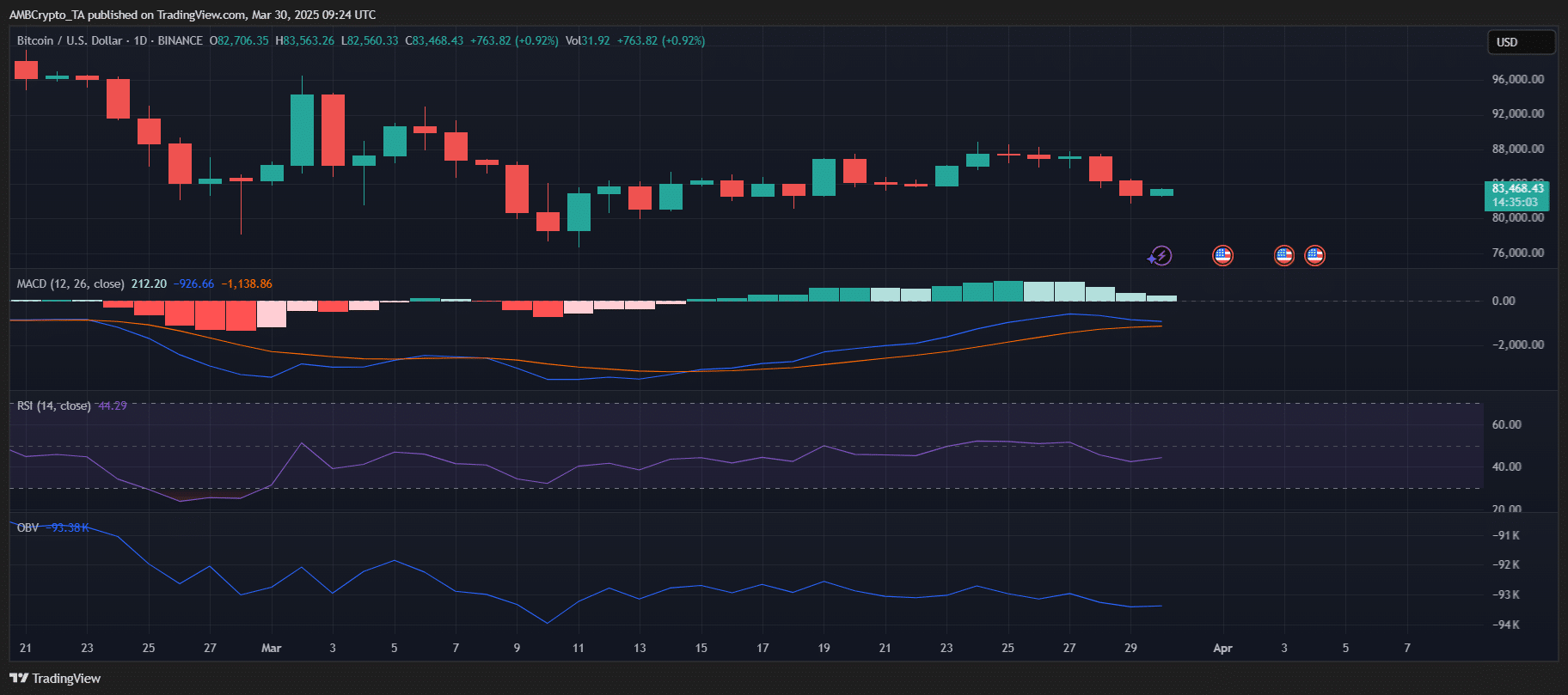

Bitcoin price outlook

Bitcoin is in a phase of cooling momentum, with recent daily candles showing signs of selling pressure. The MACD indicator remains positive but exhibits waning bullish momentum, hinting at possible consolidation.

RSI at 44.29 suggests neutral-to-slightly bearish sentiment, indicating that Bitcoin is neither oversold nor overbought.

Source: TradingView

Meanwhile, the OBV declining slightly reinforces reduced buying pressure. If the $83,000 support holds, Bitcoin may consolidate before attempting another move upward.

However, further weakness could see a test of lower support near $80,000. A potential MACD bearish crossover and RSI dipping below 40 could signal further downside.

A breakout above $85,000, however, might reignite bullish momentum.