- Toncoin retraced to $2.45, a key demand zone last tapped in March 2024, before staging an aggressive recovery.

- $4 level has proven to be a pivotal resistance, triggering multiple rejections.

Toncoin’s [TON] 19.54% monthly rally has positioned it as the top-performing high-cap asset. However, its brief deviation above the $4 level faced swift rejection, indicating potential local exhaustion.

On the flip side, market structure suggests a sentiment shift, with investors transitioning from anxiety to denial.

In market psychology, denial is a phase where participants dismiss early signs of trend exhaustion, anticipating continuation instead.

With this in mind, can Toncoin prevent a mass capitulation and trigger a supply squeeze, or is the current rally setting up for distribution?

TON’s current market standing — Battling $4 resistance

On its 1D price chart, Toncoin retraced to $2.45, a key liquidity zone last tested in March 2024. The subsequent recovery was impulsive, yet the $4 reclaim has proven to be a strong resistance.

The latest breakout attempt saw TON briefly pierce above $4, only to face swift sell-side absorption, indicative of a liquidity grab.

This rejection, despite the absence of clear overextension signals, reinforces local distribution dynamics.

Consequently, shorts capitalized, triggering forced liquidations of $340 million in open positions. The resulting deleveraging event contributed to the pullback, bringing TON back to $3.80 at the time of writing.

Source: TradingView (TON/USDT)

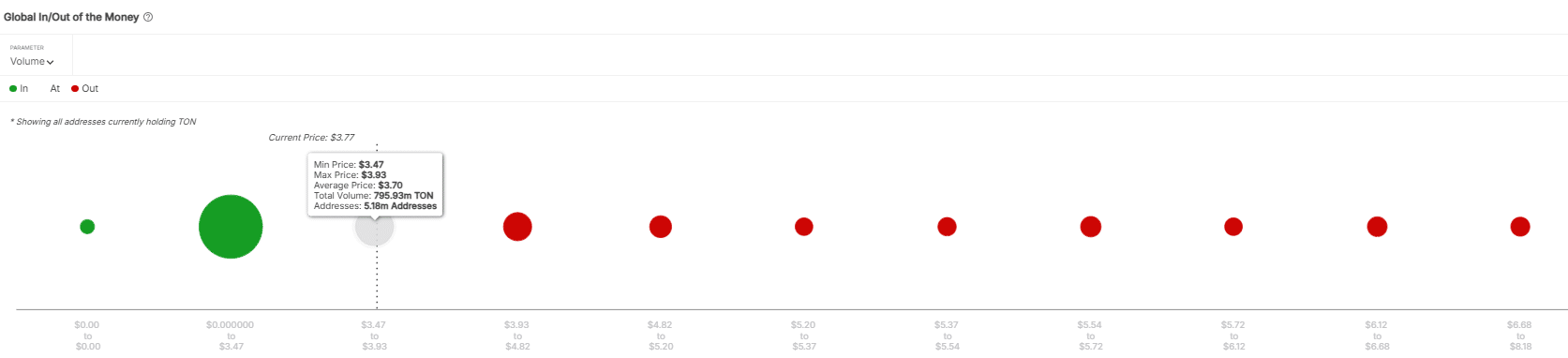

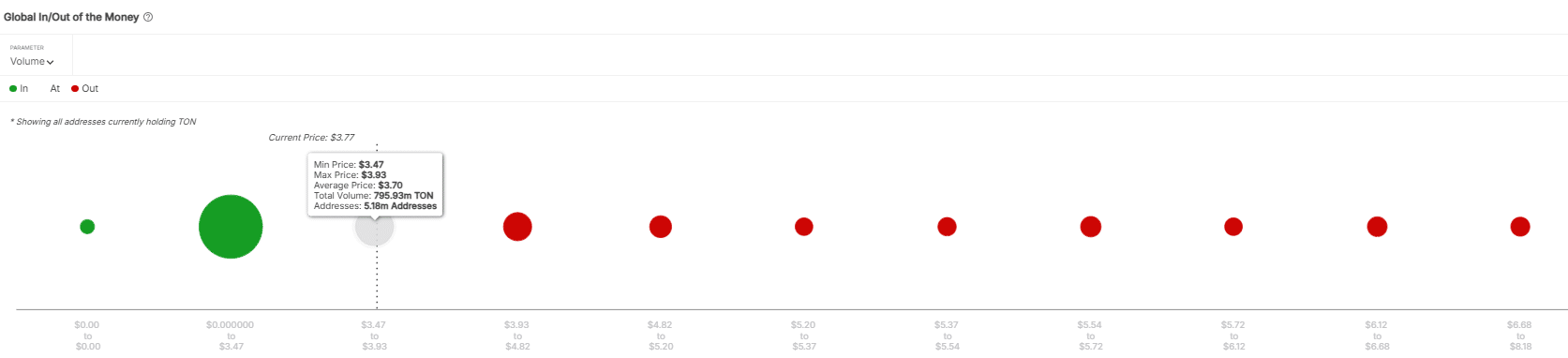

Now, TON is staging another push toward $4. However, the $3.93 supply zone remains a key inflection point, where 5.18 million addresses collectively hold 795.50 million Toncoin.

A rejection at this level could catalyze cascading sell pressure, putting 3.12 billion TON at risk of distribution.

Source: IntoTheBlock

In fact, failure to sustain bullish momentum may induce another short squeeze, extending consolidation within a liquidity trap.

Yet, there’s a silver lining. The market sentiment is shifting into the denial phase. The big question is : Will TON investors exhibit conviction in a breakout, or is a deeper re-accumulation phase inevitable?

Assessing Toncoin’s next move : HODL or capitulate?

Whales currently control 66.77% of Toncoin’s total supply, making their actions a key market signal. Over the past week, whale net inflows surged by 2159.82%, a clear indication of significant accumulation.

In fact, this accumulation aligns with Toncoin’s breakout from its $3.35 consolidation range, suggesting increased buy-side interest.

The sharp uptick in whale activity suggests that large holders are positioning for a continuation of the bullish trend, potentially disregarding any signs of trend reversal.

Source: IntoTheBlock

If this pattern holds, even after a retest of $3.93, a move past the $4 resistance zone appears increasingly probable, especially with a 7.70% increase in Open Interest (OI) in the derivatives market.

However, failure to maintain support at $3.93 could trigger cascading liquidations, putting the current open positions at risk.

To confirm a move above $4, capitulation must be absorbed. While the prevailing signals are bullish, monitoring these critical levels closely will be crucial in the near term.