- Biggest gainers: Cronos [CRO], Four [FORM], Zcash [ZEC].

- Biggest losers: Pi Network [PI], PancakeSwap [CAKE], Hyperliquid [HYPE].

The cryptocurrency market showcased significant polarization this week, with select tokens posting remarkable gains while others experienced substantial declines.

This divergence highlights the importance of selective positioning in the current trading environment, as individual token momentum drives price action rather than broad market trends.

Market winners

Cronos [CRO]: Exchange token leads the market

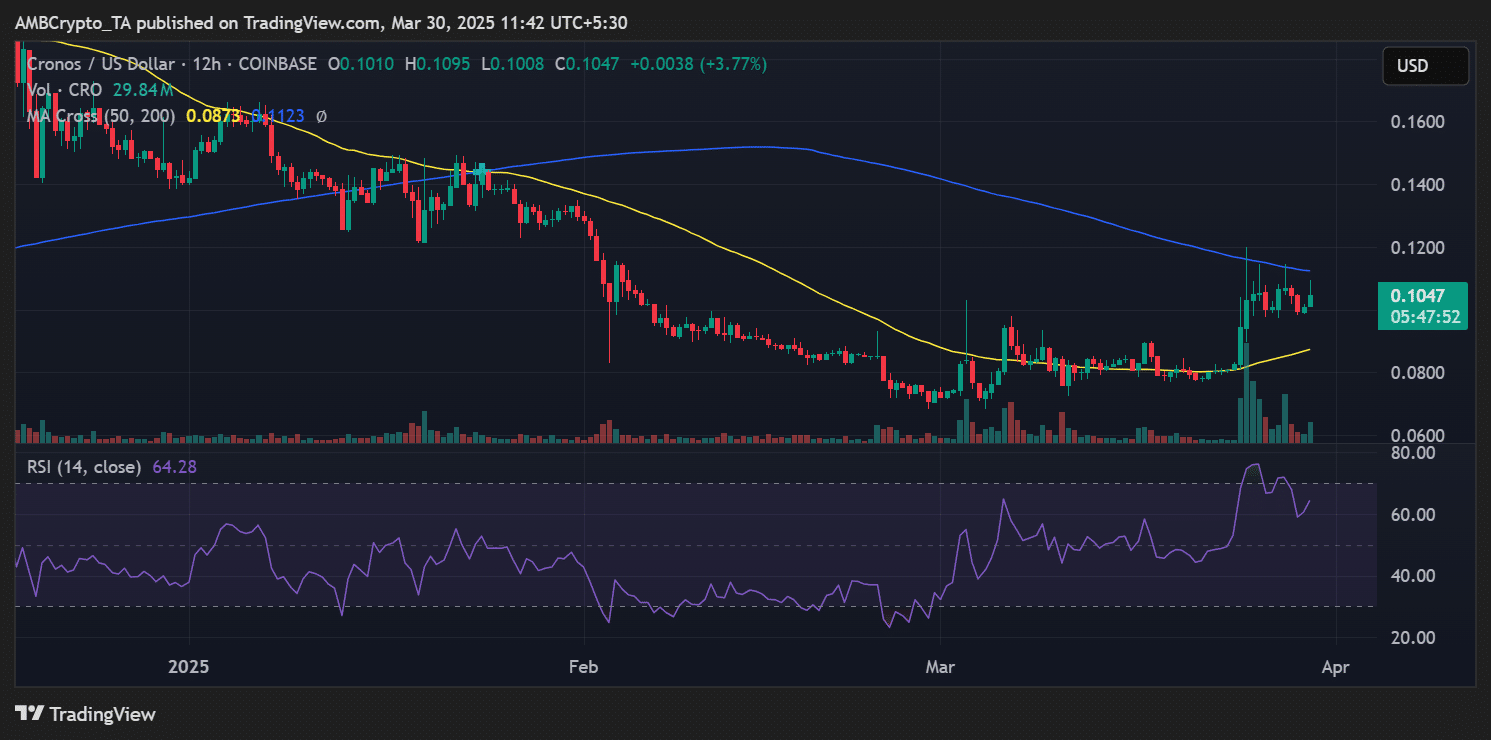

Cronos [CRO] dominated the crypto markets this week, surging an impressive 31% from $0.080 to $0.105.

The exchange token’s remarkable performance defied broader market trends, establishing CRO as one of Q1 2025’s strongest performers among major cryptocurrencies.

The rally ignited dramatically on the 25th of March, when CRO exploded from $0.082 to $0.094 in a single session, breaking through its 50-day moving average at $0.087 for the first time since January.

This technical breakout triggered substantial buying interest, with trading volume spiking to nearly 30 million USDT, more than triple the weekly average.

After consolidating around the $0.105 level mid-week, CRO faced minor profit-taking that temporarily pushed prices back to $0.099.

However, buyers quickly returned on the 28th of March, driving the token to test weekly highs above $0.112 before settling at the current $0.105 level.

Source: TradingView

Technical indicators have turned decidedly bullish, with the RSI climbing above 64 without entering overbought territory.

More significantly, the 50-day moving average has begun to curve upward, with early signs of potentially forming a golden cross with the 200-day MA in the coming weeks, a powerful bullish signal watched closely by institutional traders.

The impressive price action coincides with several positive developments for the Cronos ecosystem, including enhanced staking rewards, new exchange listings, and expansion of the platform’s DeFi capabilities.

These fundamental improvements have likely contributed to the sustained buying pressure.

For traders looking ahead, CRO faces immediate resistance at $0.115, with a breakthrough potentially targeting the $0.125 level last seen in December.

On the downside, the newly established support at $0.100 should be closely monitored for any signs of weakness.

Four [FORM]: Layer-2 protocol maintains momentum

Four [FORM] continued its impressive winning streak, surging 28% from $1.90 to $2.20 this week.

The layer-2 smart contract platform has now posted significant gains for two consecutive weeks, cementing its position as one of Q1’s standout performers.

The rally kicked off decisively on the 25th of March when FORM skyrocketed from $1.95 to $2.50 in a single session following the announcement of major protocol upgrades.

Trading volume exploded to record levels during this initial surge, indicating substantial institutional interest rather than retail-driven speculation.

While profit-taking emerged above the $2.50 mark, triggering a partial retracement, buyers have defended the $2.20 support level with conviction.

Each attempt to push prices lower has been met with fresh buying interest, particularly evident in the final trading sessions.

Technical indicators remain firmly bullish despite the consolidation phase, with the RSI holding above 60 without entering overbought territory.

FORM’s successful defense of previous resistance-turned-support around $2.20 suggests this level may now serve as the foundation for the next leg higher.

Zcash [ZEC]: Privacy coin shows strength

Zcash [ZEC] delivered a stellar performance this week, climbing 16% from $31.20 to $36.30. After several weeks of consolidation below key resistance levels, the privacy-focused cryptocurrency staged an impressive recovery.

The rally ignited on the 25th of March when ZEC surged from $32.10 to $34.50, breaking above its 50-day moving average for the first time since February.

This technical breakout accelerated on the 26th of March, with ZEC pushing toward $37.00 before encountering resistance.

The most significant price action occurred on the 27th of March, when ZEC touched a weekly high of $39.60, reaching levels not seen since January.

While profit-taking emerged above $39.00, triggering a pullback to $35.50, buyers defended this support zone with conviction.

Trading volume peaked substantially during the initial surge, indicating strong institutional interest behind the move.

The successful defense of the $35.00 level during late-week consolidation suggests this previous resistance may now function as support.

For traders eyeing next moves, ZEC faces immediate resistance at $38.00, with a break above potentially targeting the $40.00 psychological level.

Other notable gainers

Beyond the top performers, the broader market saw several jaw-dropping moves.

FUNToken [FUN] led the top 1,000 tokens with a remarkable 176% gain, while Tutorial [TUT] and BabyBoomToken [BBT] followed with impressive gains of 97% and 83%, respectively.

Market losers

Pi Network [PI]: Mobile mining token extends decline

Pi Network [PI] suffered another devastating week, plummeting 22% from $1.02 to $0.79.

The mobile mining token has now claimed the unwanted distinction of being the market’s biggest loser for two consecutive weeks, extending its total decline to over 47% since mid-March.

The selloff began immediately on the 24th of March, with PI crashing through the psychological $1.00 support that had previously held as the final defense line.

This breakdown triggered cascading liquidations, driving prices to new yearly lows by the 26th of March when the token briefly touched $0.77.

A modest relief bounce materialized on the 27th of March, with PI recovering to $0.88 amid oversold conditions.

However, this technical bounce proved short-lived as sellers quickly regained control, pushing the token back below $0.80 by week’s end.

Trading volume remained elevated throughout the decline, indicating persistent distribution rather than panic selling.

Despite reaching deeply oversold conditions, dip buyers have shown little interest, suggesting further downside may lie ahead.

For any meaningful recovery, PI must first reclaim $0.85, though the severe technical damage suggests sustained weakness remains the most likely scenario.

PancakeSwap [CAKE]: From winner to loser

PancakeSwap [CAKE] experienced a dramatic reversal this week, plunging 21% from $2.60 to $2.05.

The Binance Smart Chain’s leading DEX token, which ranked among last week’s top performers with a 40% gain, failed to maintain its upward momentum as profit-taking turned into widespread selling.

The decline began subtly, with CAKE consolidating around $2.60 before facing rejection at $2.70 on the 25th of March.

This failed breakout triggered the initial wave of selling, which accelerated dramatically on the 26th of March when CAKE crashed through multiple support levels in a single session.

The most significant breakdown occurred on the 28th-29th of March, when CAKE plummeted from $2.35 to $1.95, briefly touching levels not seen since early March.

While a modest bounce emerged around the $2.00 psychological support, recovery attempts have remained weak and short-lived.

Trading volume spiked substantially during the decline, particularly on the 29th of March, indicating genuine distribution rather than temporary repositioning.

For any meaningful recovery, CAKE must first reclaim the critical $2.20 support-turned-resistance level, though current market structure suggests further consolidation is likely.

Hyperliquid [HYPE]: Perpetual DEX token collapses

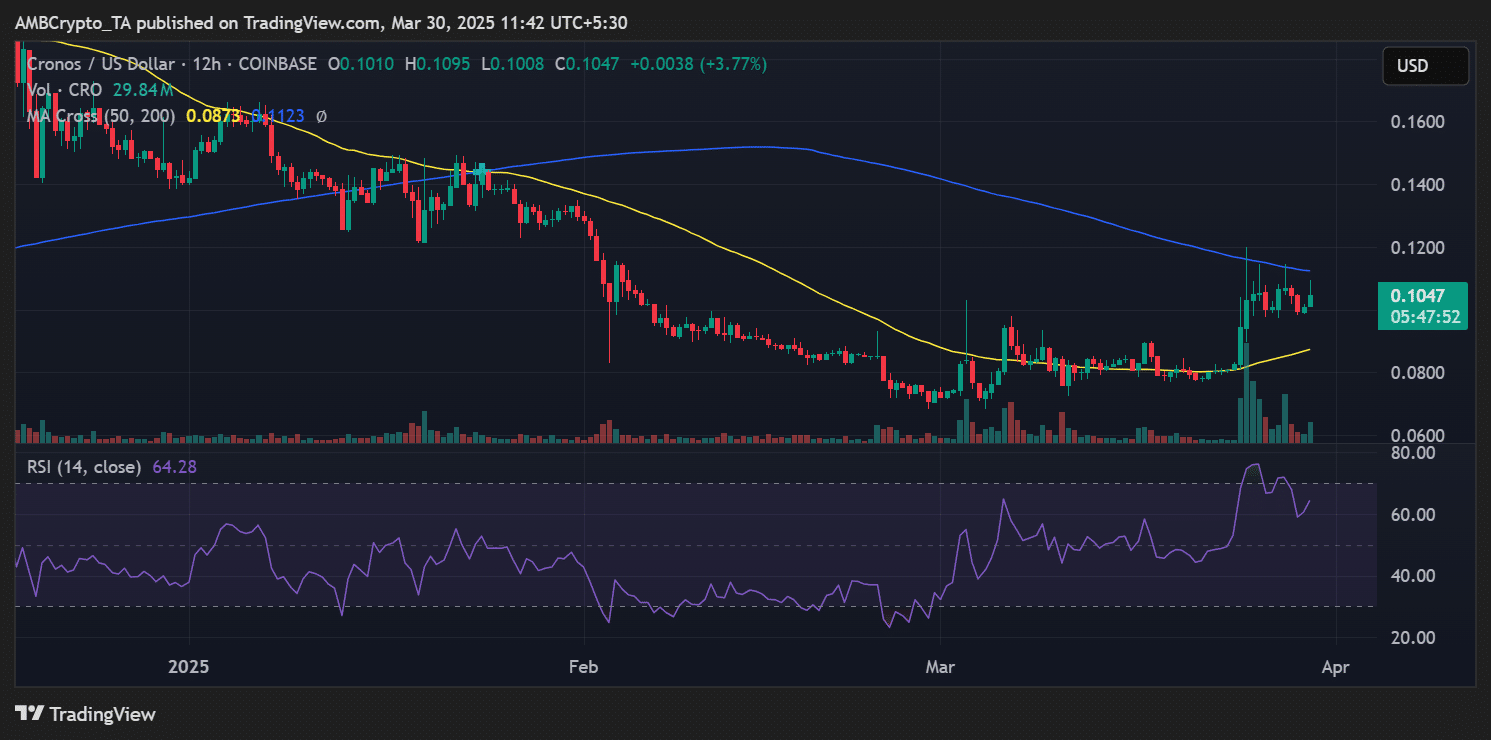

Hyperliquid [HYPE] suffered a brutal reversal this week, plummeting 18% from $16.30 to $12.70.

The perpetual DEX token, which had posted impressive gains just a week earlier, faced relentless selling pressure, erasing nearly all its March advances.

The decline began subtly, with HYPE consolidating around $16.50 after reaching a monthly high of $17.20 on the 25th of March.

This failure to break above resistance triggered the initial wave of profit-taking, which accelerated dramatically on the 27th of March when HYPE crashed through multiple support levels in a single catastrophic session.

This pivotal breakdown saw HYPE plunge from $16.20 to $13.70, representing a staggering 15% single-day loss. The severity of this move triggered a brief consolidation around the $14.50 level as oversold conditions emerged.

However, this technical bounce proved short-lived, with sellers quickly regaining control and pushing HYPE lower throughout the week.

Technical indicators paint a concerning picture for HYPE holders. The MACD histogram remains deeply negative, with the signal and MACD lines trending lower.

More concerning is the death cross formation that occurred in early March, with the 50-day moving average at $14.63 positioned well below the 200-day MA at $21.59, exerting substantial downward pressure.

Source: TradingView

The current price structure shows HYPE struggling to find stability around $12.70, with multiple attempts to bounce from this level meeting immediate selling.

HYPE must first reclaim and hold above $14.00 for any meaningful recovery, though the extensive technical damage suggests this may prove challenging in the near term.

Fundamental developments have contributed to this decline, with reports of decreased activity on the protocol and growing competition in the perpetual DEX space weighing on investor sentiment.

HYPE may continue to face headwinds without a significant catalyst in the coming weeks.

Other significant decliners

In the broader market, several tokens experienced dramatic losses.

MUBARAK [MUBARAK] led the declines with a devastating 53% drop, followed by Siren [SIREN] and Tornado Cash [TORN], which plummeted 42% and 41%, respectively, during the week.

Conclusion

Here’s the weekly recap of the biggest gainers and losers. It’s crucial to bear in mind the volatile nature of the market, where prices can shift rapidly.

Thus, doing your own research [DYOR] before making investment decisions is best.