- BTC has moderately recovered over the past day, rising by 1.37%.

- Bitcoin’s 3-6 million long-term holders have seen their wealth sharply rise.

Over the past two months, Bitcoin [BTC] has experienced extreme volatility. Despite increased fluctuations, Bitcoin’s long-term holders remain steadfast in the market.

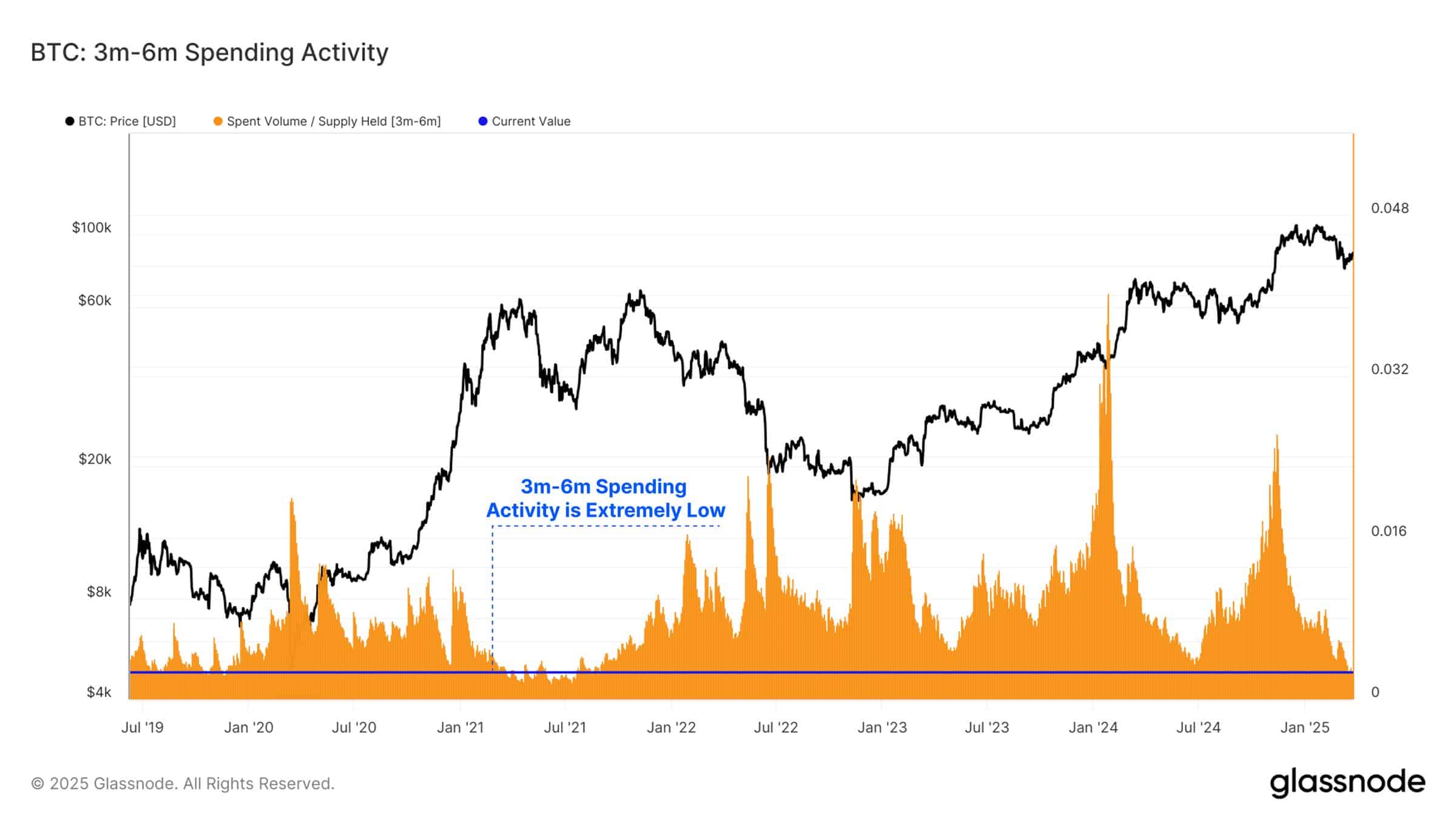

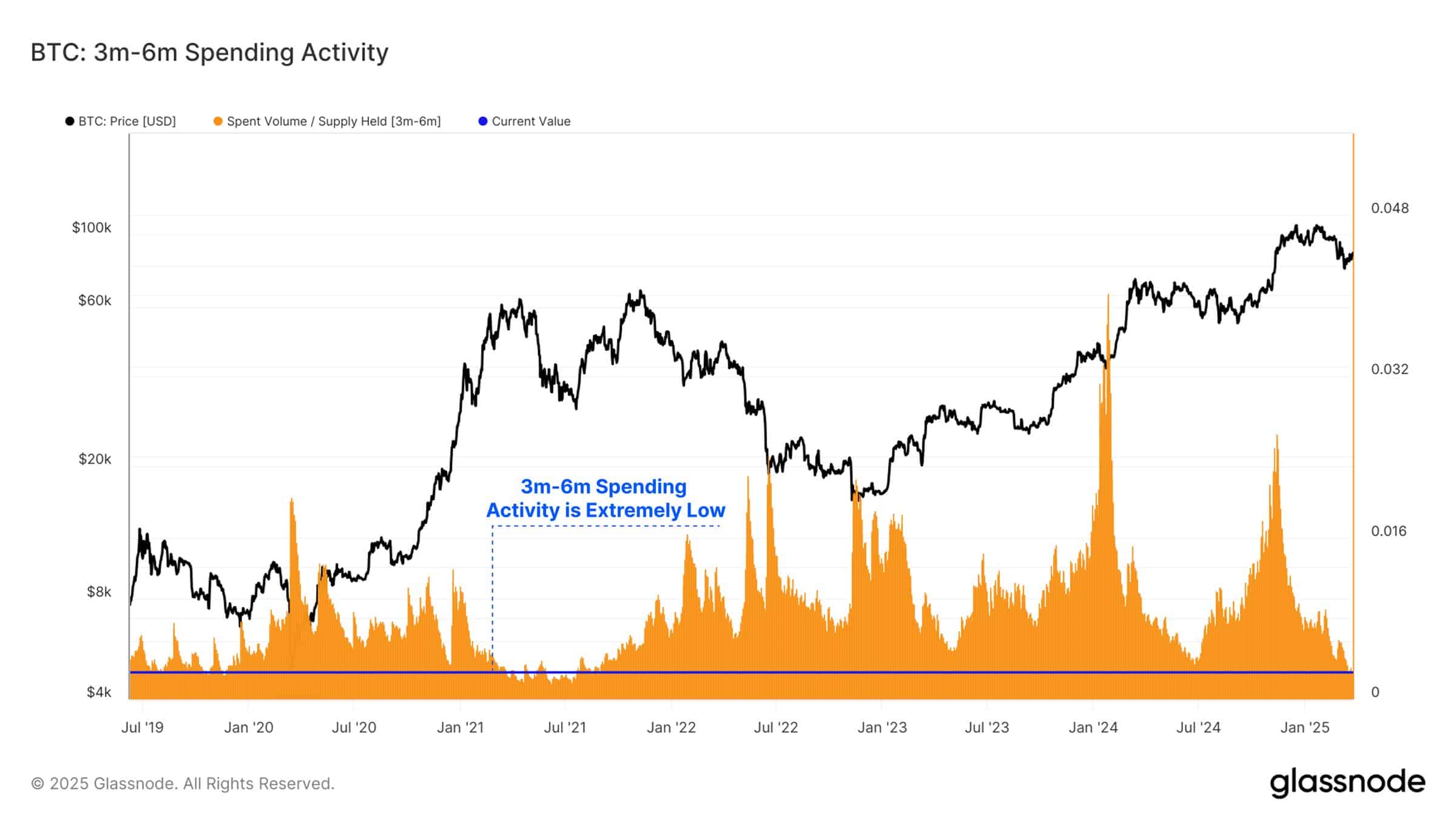

As such, long-term holders have seen their wealth rise despite the prevailing market conditions. According to Glassnode, 3-6 million Bitcoin holders, especially those transitioning into long-term holder status, have seen a sharp rise in the wealth they held.

Source: Glassnode

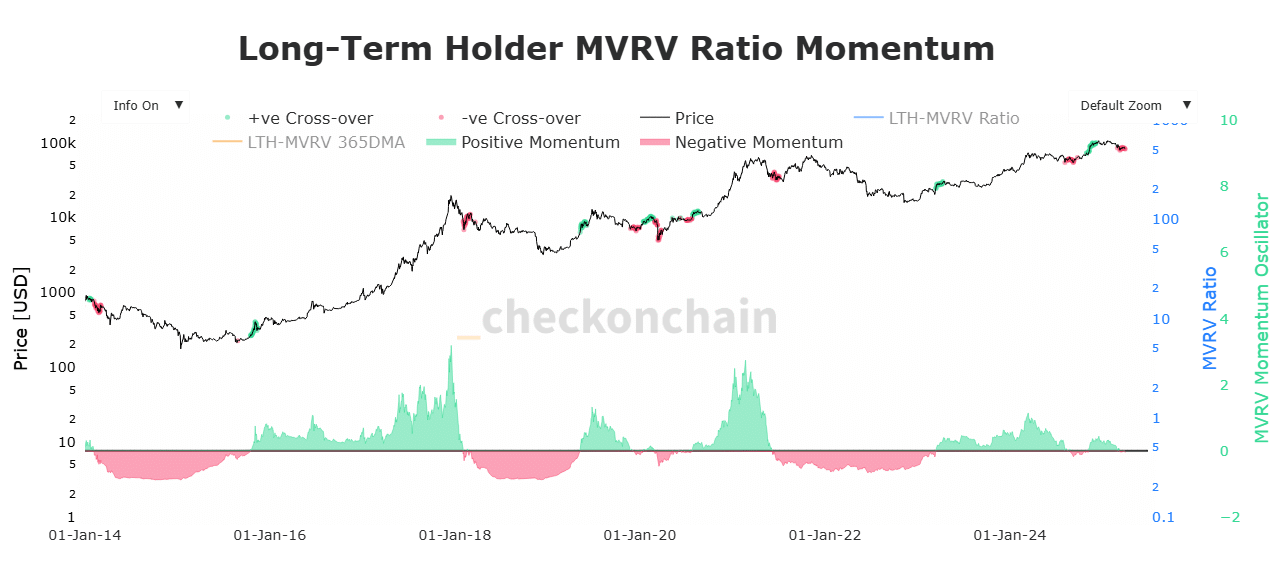

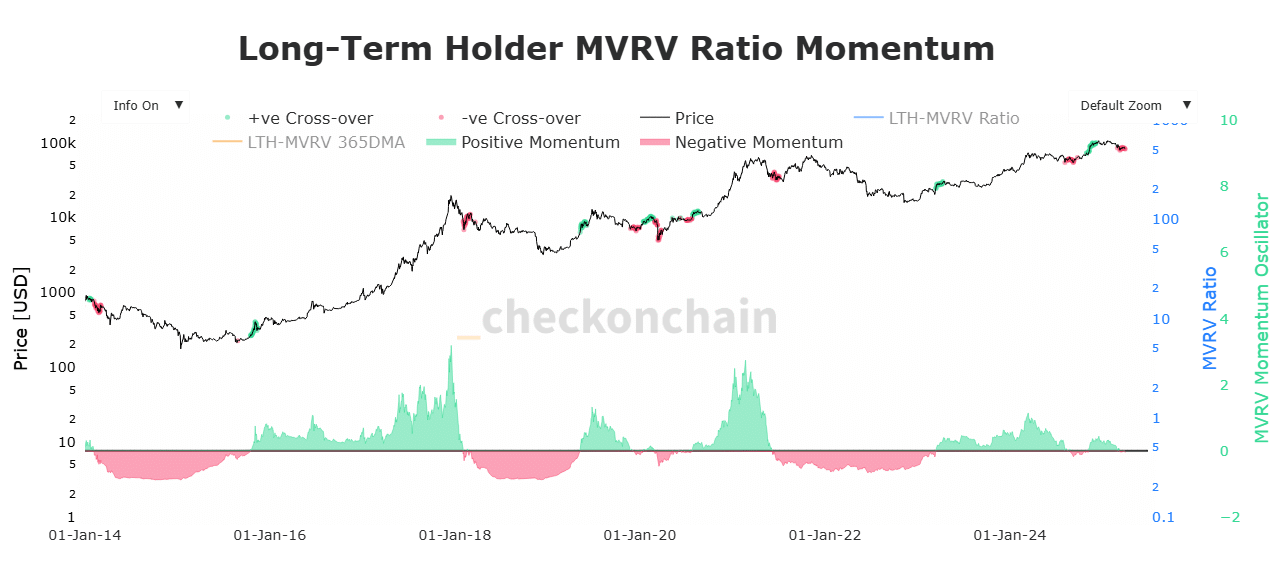

AMBCrypto has identified increasing wealth among long-term holders, with the LTH MVRV ratio maintaining positive momentum since December 2024.

This indicates that BTC’s value for long-term holders remains relatively high compared to its cost basis. Historically, positive LTH MVRV momentum reflects renewed confidence among these holders.

Although many of these coins were acquired near all-time high levels, their continued aging demonstrates conviction rather than signs of capitulation.

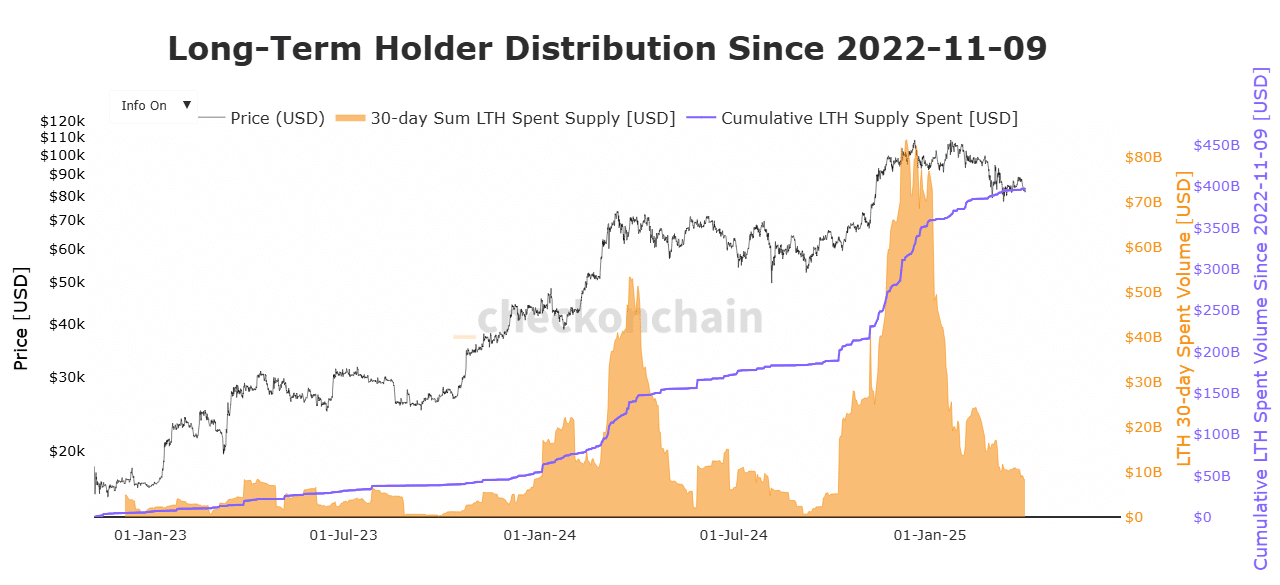

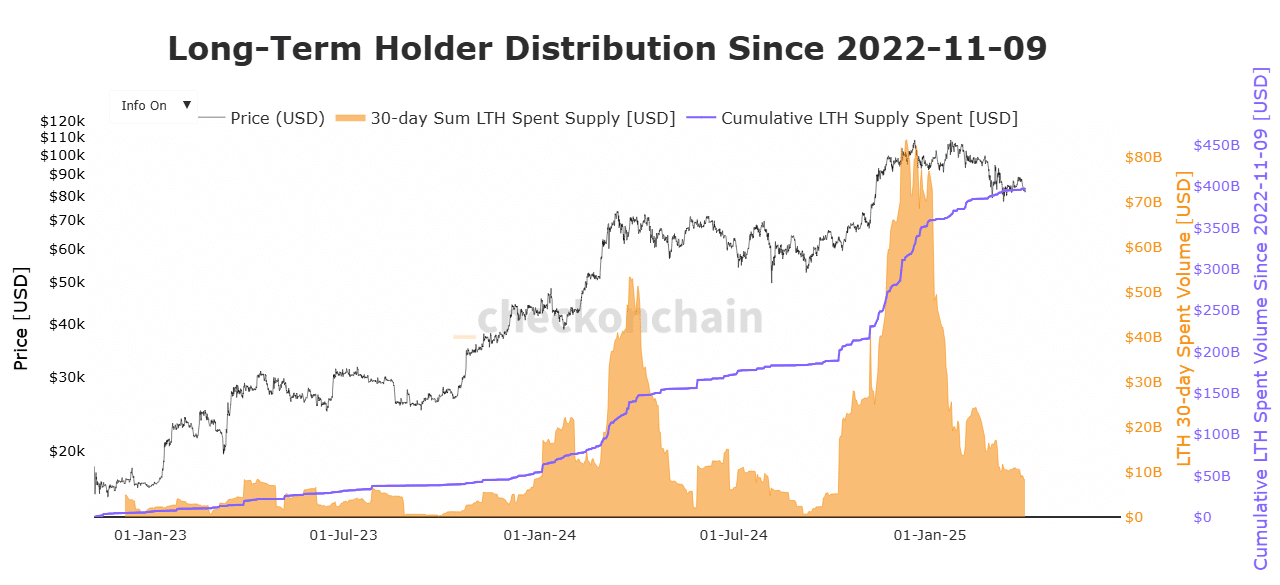

Source: Checkonchain

As long-term holders see their profits grow, they remain steadfast in holding their BTC. Spending activity from 3–6 million Bitcoin holders has dropped to its lowest level since mid-2021.

This reduced activity supports the notion that recent top buyers are maintaining their positions instead of selling, even amid ongoing market volatility.

Source: Glassnode

Therefore, Bitcoin’s LTH spent supply has seen a sustained decline since February 2025. As such, the amount spent has declined from a high of $18 billion to $8 billion as of the 31st of March 2025.

This suggests that holders are spending less and less BTC, reflecting a rising accumulation trend among LTH. With increased holding, it suggests that investors are optimistic about the long-term potential of BTC and anticipate more gains.

Source: Checkonchain

Looking further, across the 2023-2025 cycle, long-term holders have distributed over 2 million BTC. This distribution has been followed by a strong re-accumulation, helping absorb the sell side pressure.

This cyclical balance has played a key role in stabilizing Bitcoin’s price action.

What it means for BTC

With long-term holders maintaining their optimism, Bitcoin is unlikely to face significant sell pressure, as this group continues to hold rather than sell.

A reduced spending rate among long-term holders enables BTC to absorb selling pressure from short-term and speculative investors.

This balance between selling and accumulation suggests that Bitcoin will likely trade within a consolidation range. Short-term and speculative investors are entering the market to capitalize on rebounds and take profits.

The bullish sentiment among long-term holders positions Bitcoin for potential price gains. If their conviction persists, BTC is expected to hold firmly above $81k, paving the way for a possible rebound toward $87,500.

As long as long-term holders continue to hold, there is room for growth. However, if their conviction falters, Bitcoin may experience a sharp decline, dropping below $80k again.