- Ethereum’s MVRV ratio nears the “red box” zone, signaling potential selling pressure.

- Historical patterns suggest a correction could follow as ETH’s overvaluation risks increase.

Ethereum’s [ETH] MVRV ratio is inching closer to the dreaded “red box” zone — a level historically linked to market pullbacks.

As the metric teeters on the brink, traders are on high alert, weighing the risk of overvaluation against the possibility of sustained momentum.

With past patterns hinting at looming selling pressure, could Ethereum’s recent gains be running on borrowed time?

Ethereum’s MVRV nears critical levels

Ethereum’s MVRV ratio is inching closer to the critical “red box” zone — the metric is hovering at around 0.88 at press time.

This has drawn attention from traders wary of a potential correction. As the ratio edges closer to this danger zone, concerns arise over whether Ethereum’s current price level accurately reflects its intrinsic value.

Source: IntoTheBlock

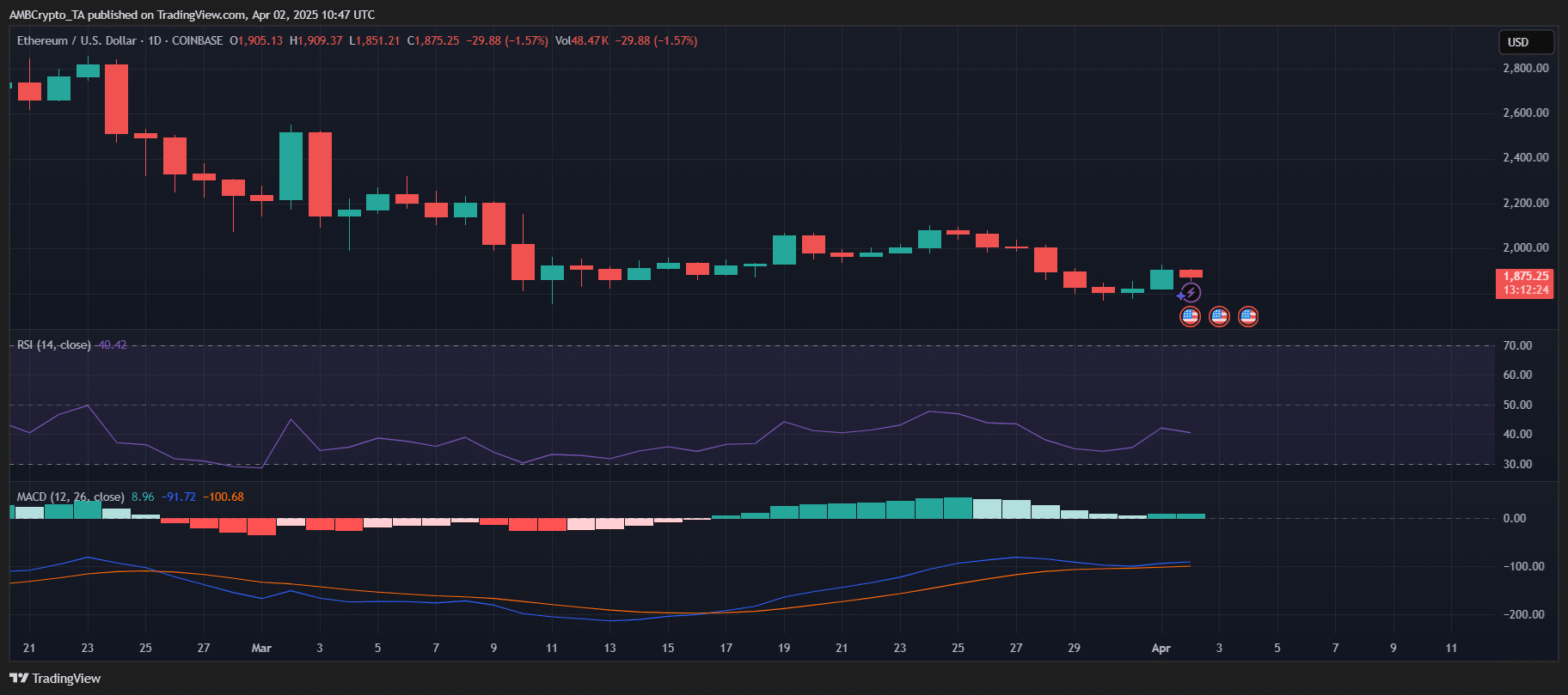

The chart shows a recent dip after a period of gradual recovery, suggesting the market might be approaching a tipping point.

While bullish sentiment persists, this MVRV movement hints that profit-taking could soon outweigh buying pressure.