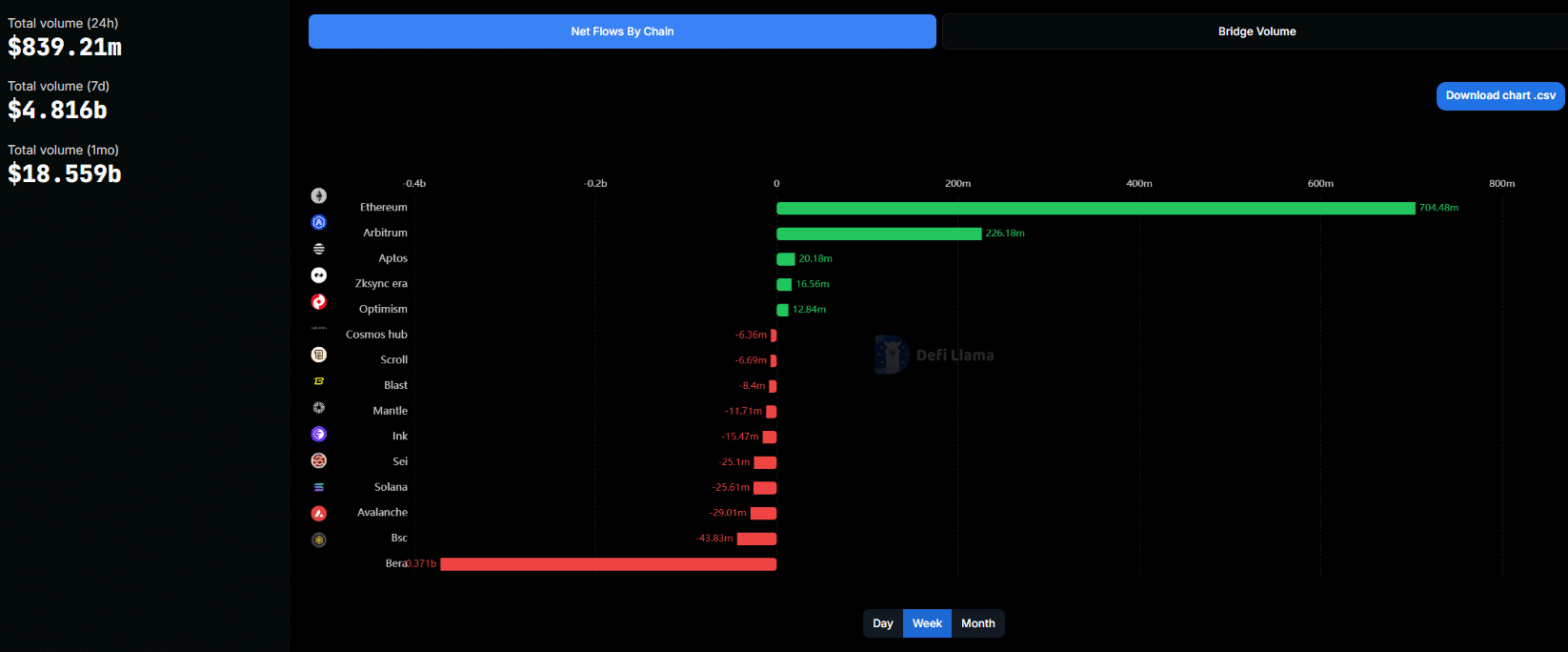

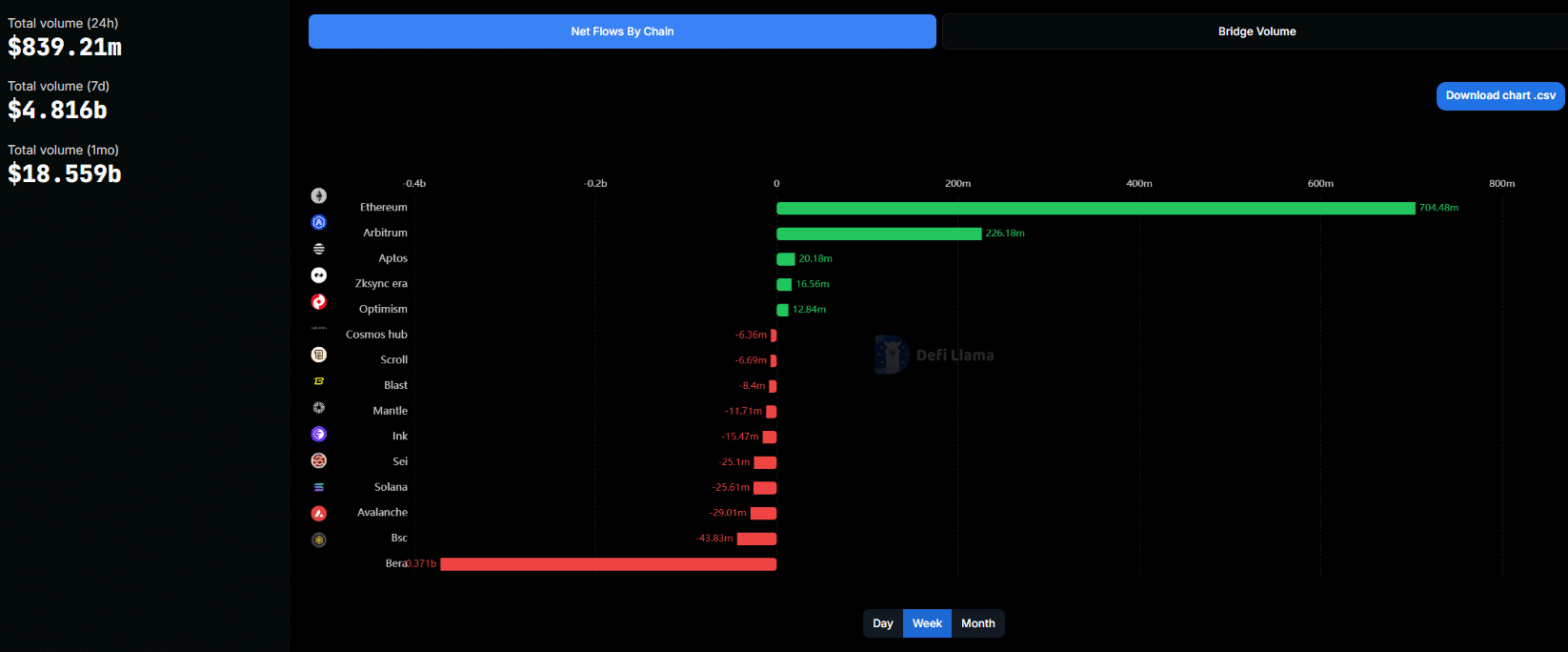

- Ethereum captured 85% of total weekly inflows, reinforcing its dominance in DeFi liquidity.

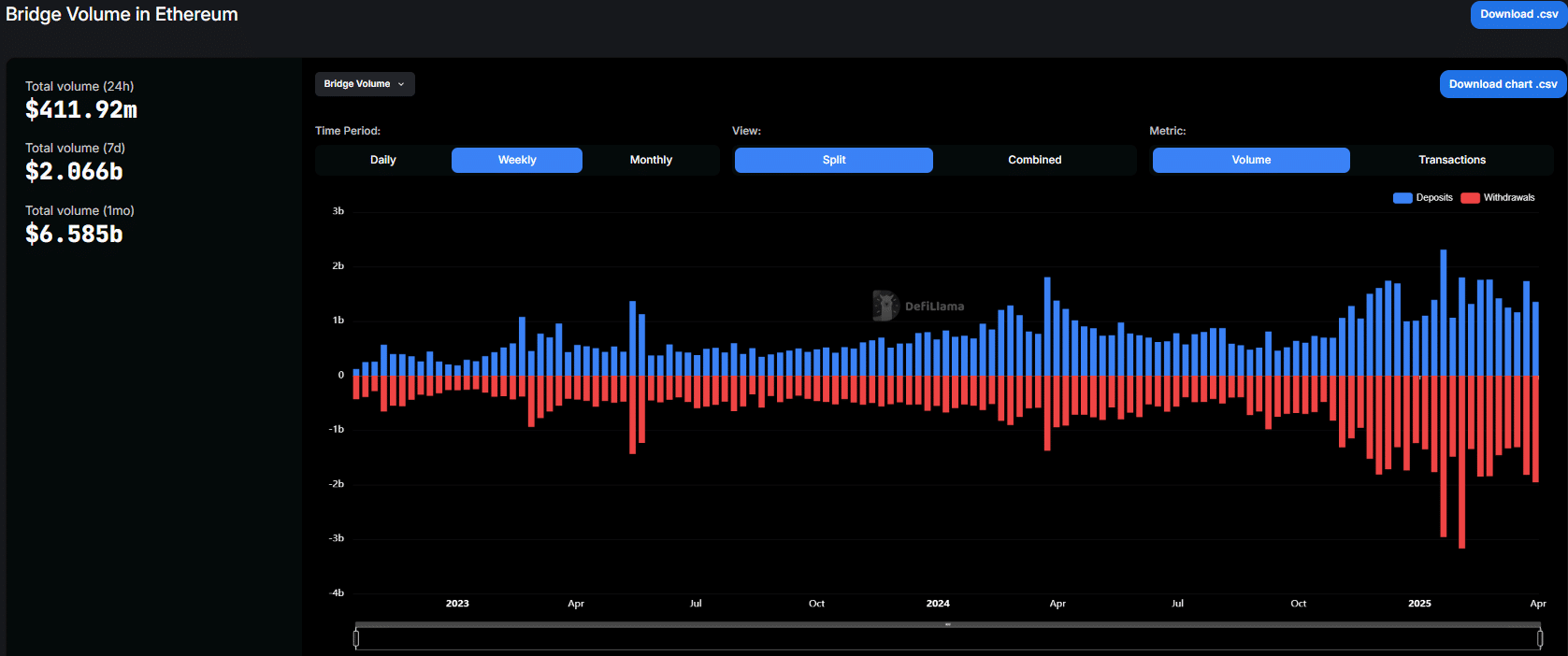

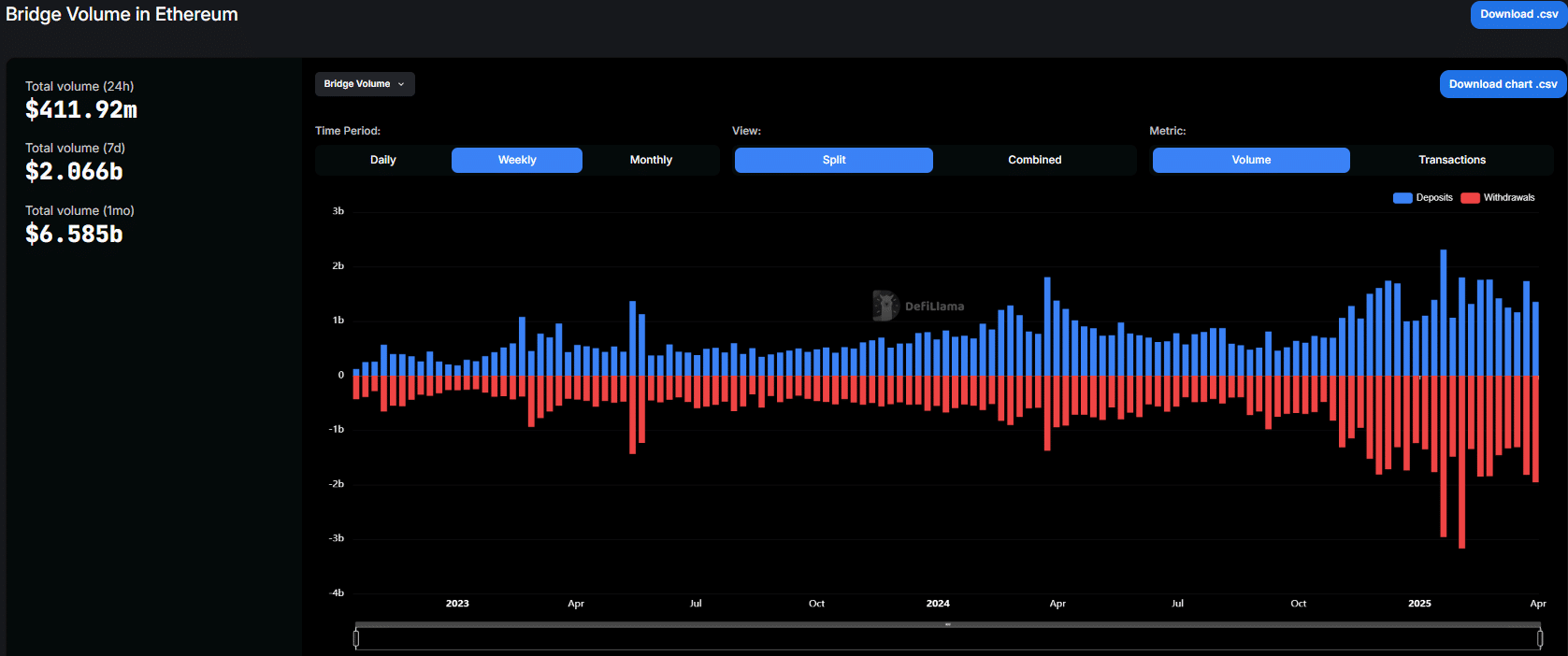

- Bridge volume data shows consistent weekly outflows exceeding deposits across Ethereum.

Ethereum [ETH] has once again asserted itself as the undisputed leader in blockchain capital inflows—and by a wide margin.

At the time of writing, DeFiLlama’s latest data makes the picture unmistakably clear.

Ethereum attracted a staggering $704.48 million in net inflows this week, dwarfing all other networks and signaling a deepening preference among capital allocators.

Source: DeFiLlama

Naturally, the divergence doesn’t stop there. Arbitrum [ARB] trailed with $226.18 million, a distant second and just 27% of Ethereum’s intake.

Meanwhile, smaller inflows trickled into Aptos [APT] ($20.18M), zkSync Era [ZK] ($16.56M), and Optimism [OP] ($12.84M)—all combined barely grazing 8% of Ethereum’s total.

When the tide turns, it leaves others behind

On the flip side, losses were just as pronounced.

Binance Smart Chain (BSC) led the outflow chart with -$43.83 million, followed by Avalanche [AVAX] (-$29M) and Solana [SOL] (-$25M).

Taken together, these exits reveal mounting pressure on alternative Layer-1 ecosystems, particularly as capital consolidates around high-activity, high-trust platforms.

Of course, this capital migration isn’t occurring in a vacuum.

Ethereum alone accounted for over 85% of all positive net inflows this week, showcasing its gravitational pull in a market increasingly risk-aware.

Having said that, it’s not just inflows doing the talking. Outflows, too, paint a revealing portrait.

Bridge data adds another layer of context. For the week ending on the 30th of March, Ethereum recorded $1.957 billion in withdrawals against $1.353 billion in deposits, netting a $603 million outflow.

Source: DeFiLlama

For example, back on the 19th of January, Ethereum logged nearly $2.96 billion in weekly withdrawals, the highest in the current dataset.

However, even amid this exodus, Ethereum’s magnetism for fresh capital remains unrivaled. This seeming contradiction may reflect capital rotation within the ecosystem.

The flow knows before the price does

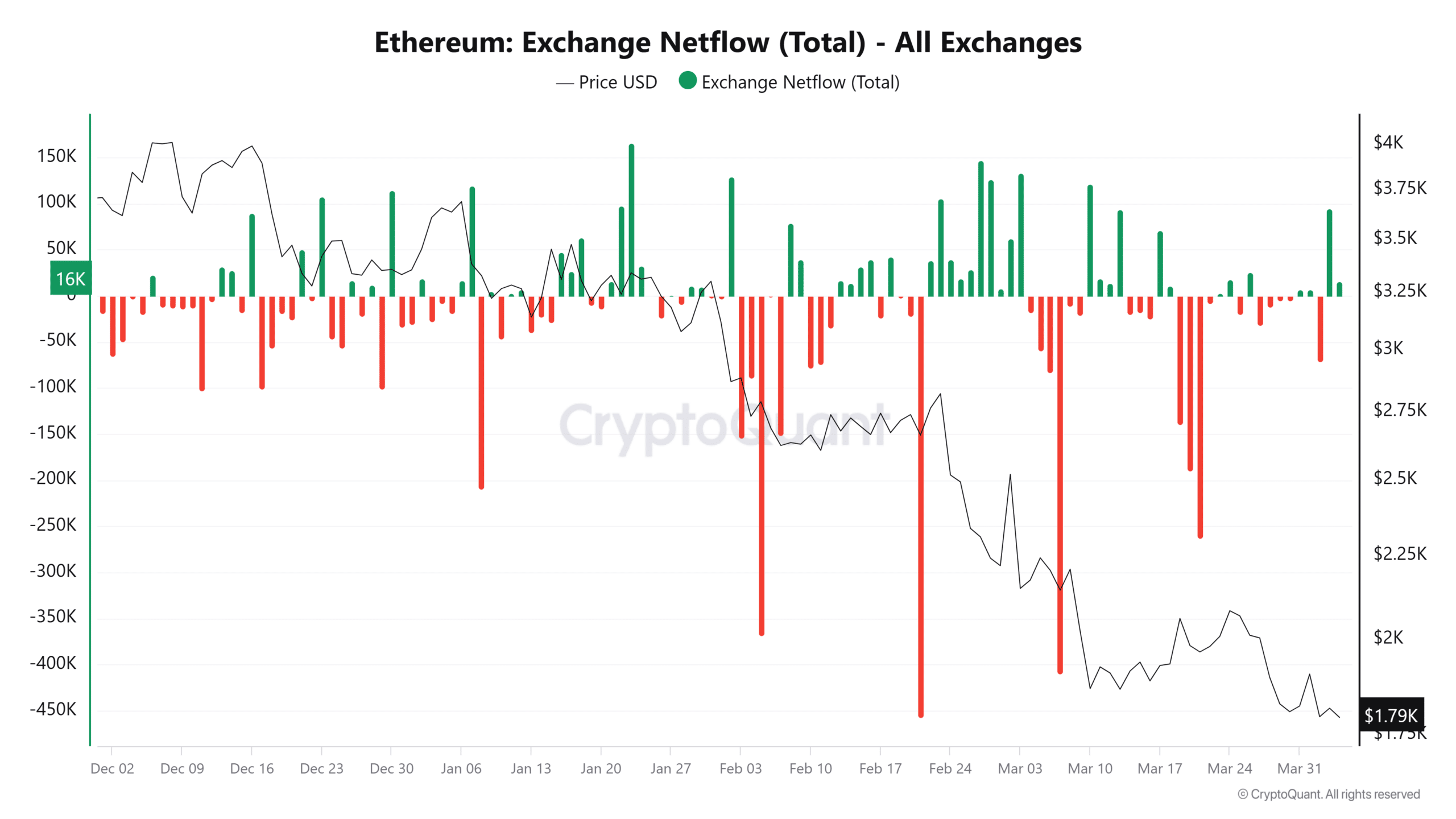

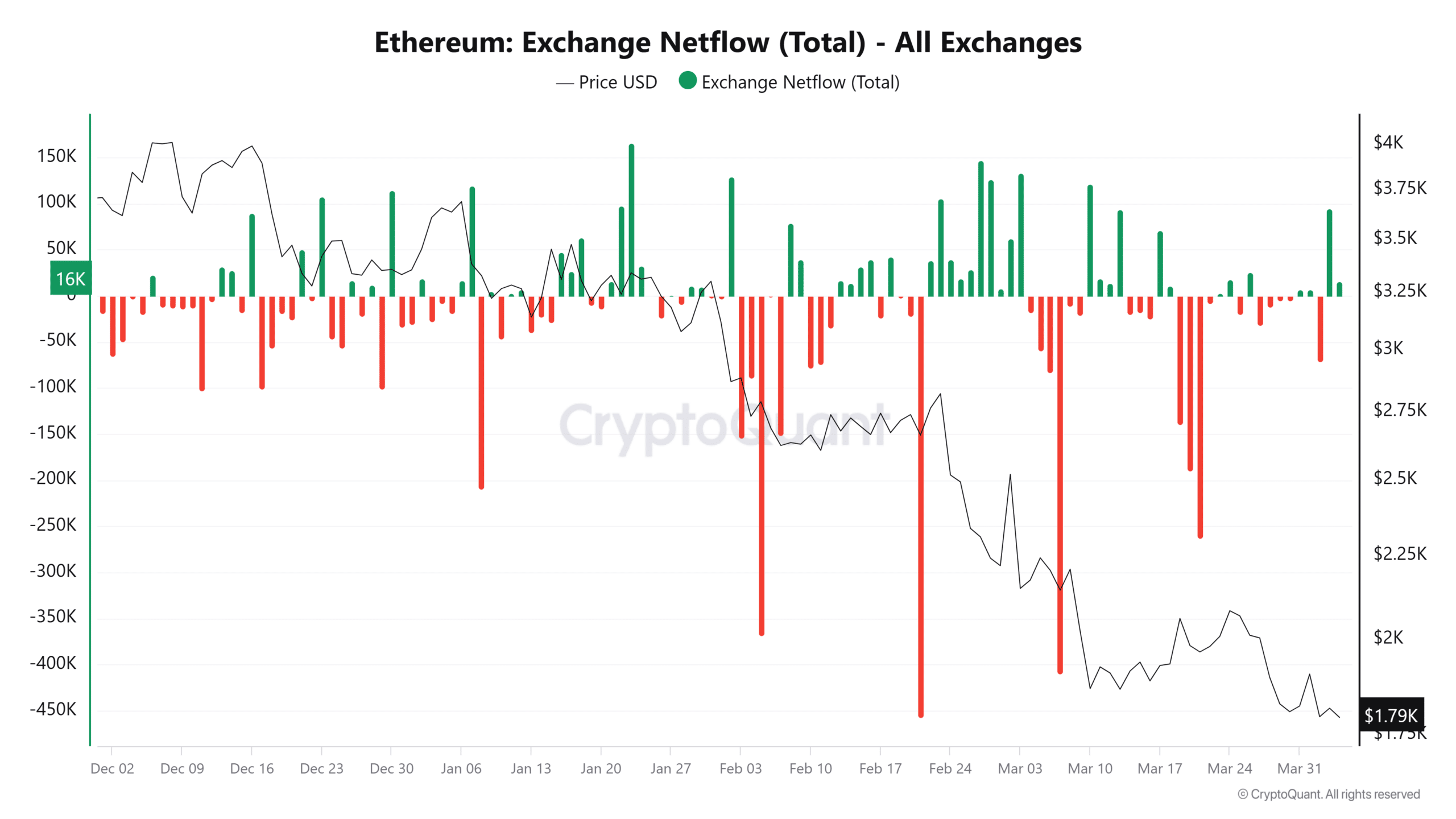

In fact, daily netflow behavior provides deeper context.

Source: CryptoQuant

Between December 2024 and April 2025, Ethereum’s price slid by 50.6%, tumbling from $3,630 to $1,794.

On the 8th of January, ETH plunged to $3,326 as 208K ETH exited exchanges—signaling panic. By contrast, the 23rd of February saw a $2,819 rebound alongside a 105K ETH inflow, hinting at strategic accumulation.

Seemingly, it reinforces a familiar rhythm that inflows and outflows don’t just follow price; they often precede it.

On top of that, in late March, Vitalik Buterin unveiled a forward-looking “multi-proof” Layer-2 model that fuses optimistic, zero-knowledge, and TEE-based verification.

Whether this evolution can offset current outflow trends remains to be seen. Nonetheless, such architectural upgrades often take time to influence sentiment. Markets tend to reward proven stability over speculative improvements.

Ethereum remains DeFi’s liquidity backbone—commanding net flows, transaction volume, and developer activity with widening dominance.

While BSC, Solana, and Avalanche bleed capital, Ethereum and Arbitrum now absorb over 90% of positive inflows, signaling a flight to trusted chains.

Outflows or not, ETH isn’t going anywhere

Despite ongoing outflows, Ethereum’s simultaneous inflow surge reflects a complex but resilient ecosystem.

In a market where trust drives capital, Ethereum still holds the crown—and with Layer-2s maturing fast, that grip looks firmer than ever. For now.