- Three critical support and resistance levels lie in between as crucial to Bitcoin’s next move.

- Other key market sentiment remained on the bearish end, with no clear indication of the next move.

Following its 8.03% drop in the past month, Bitcoin [BTC] has maintained a steady position in the market, oscillating between minor gains and declines. In the past 24 hours, the asset has declined by 0.81%.

Analysis highlights Bitcoin’s challenging position, with indicators increasingly suggesting a potential price drop as bearish sentiment dominates.

Key levels on the chart for Bitcoin

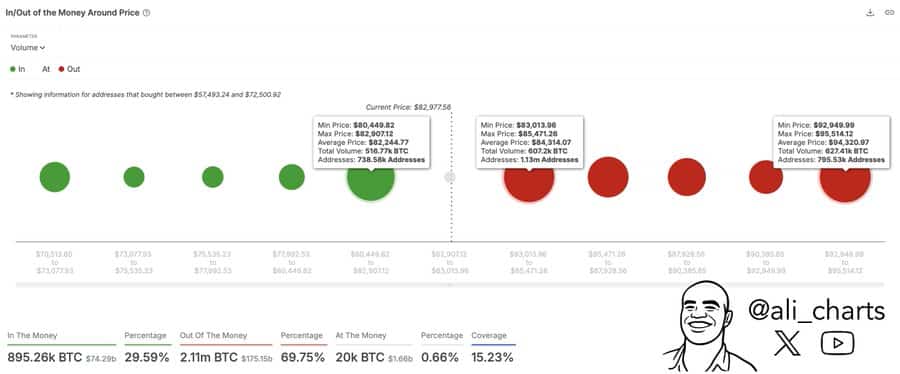

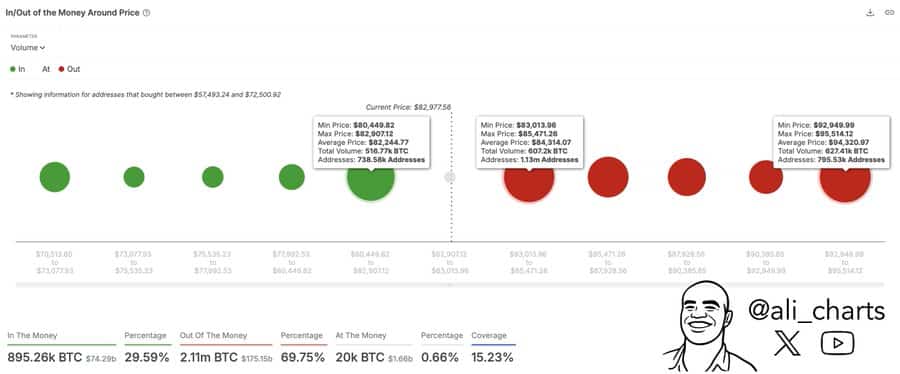

IntoTheBlock’s In/Out of the Money Around Price data identifies Bitcoin at a critical point, with 516,770 BTC buying orders placed at the $82,244.77 support level.

At the same time, two resistance levels stand at $84,314.07 and $94,320.97, with sell orders of 607,200 BTC and 627,470 BTC, respectively.

Source: IntoTheBlock

The next price movement remains uncertain. AMBCrypto observed a surge in capital inflow, increasing by 350%.

It rose from $1.82 billion to $8.2 billion. However, asset prices have not shown a significant corresponding increase. This could indicate that the capital is being held back in the market. It may be deployed later at a more favorable position.

Markets are pushing for a drop

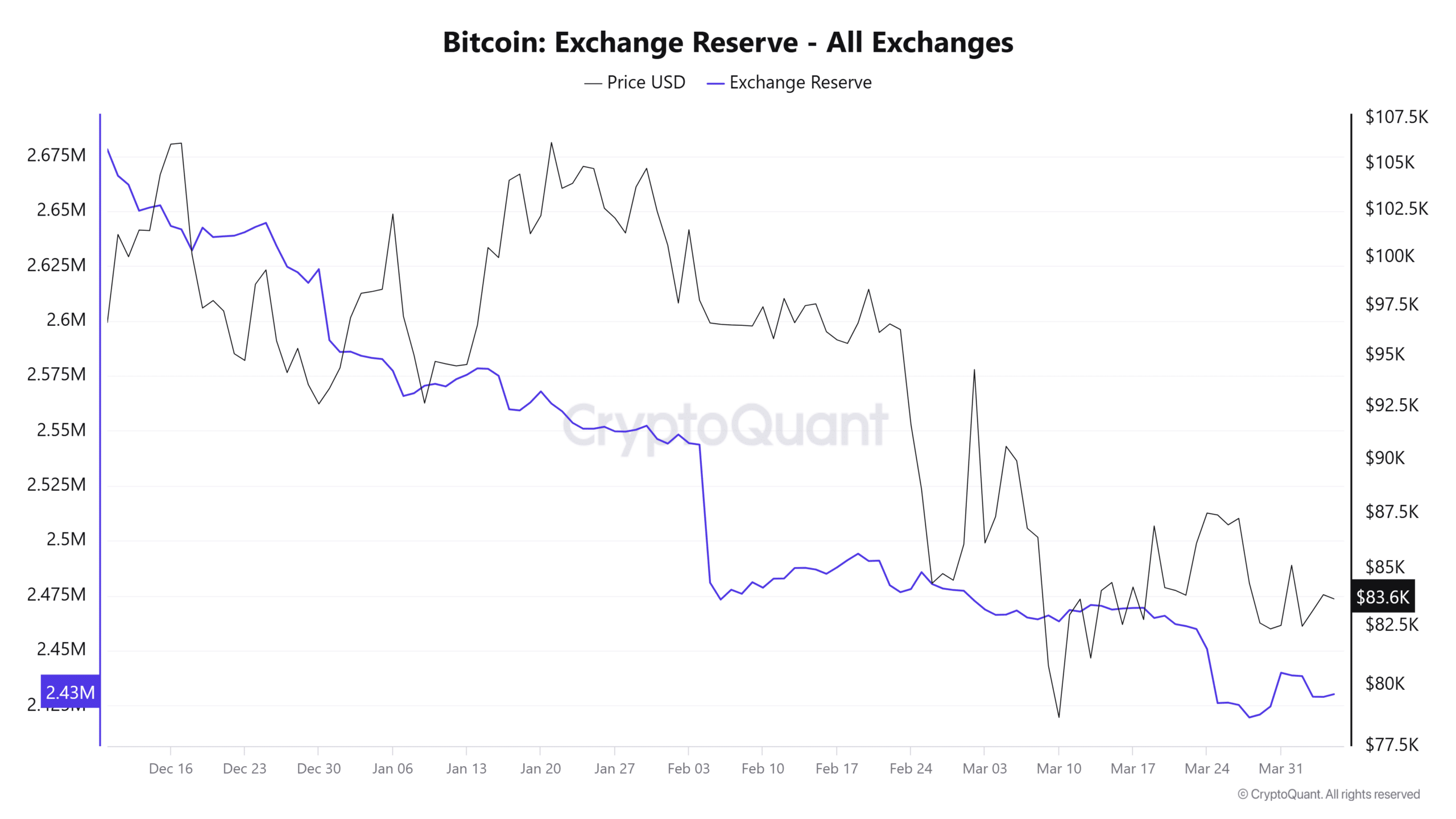

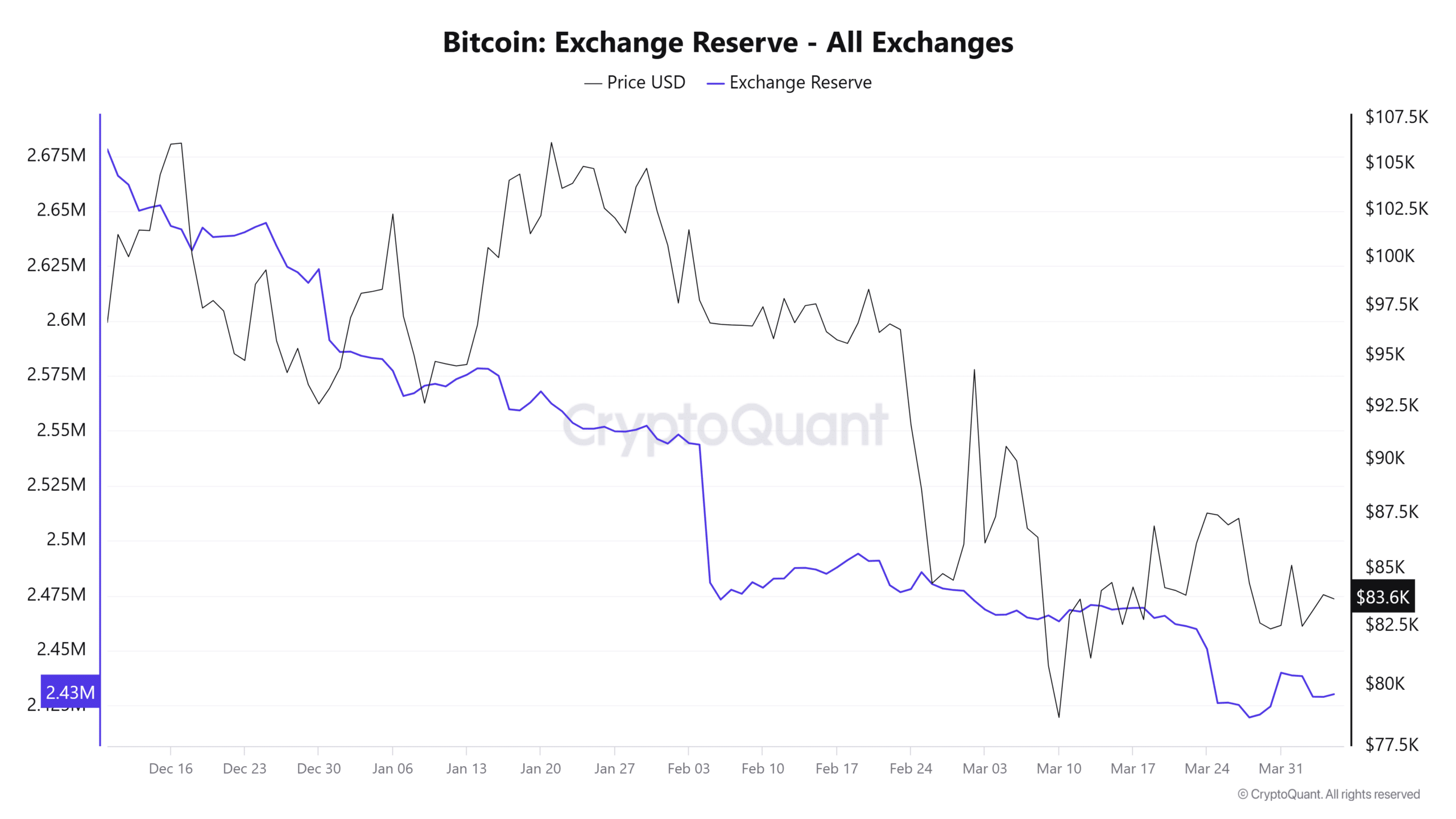

Analysis of market activity shows a push toward the downside. At the time of writing, there was a slight increase in the amount of Bitcoin on exchanges, as exchange reserves grew to 2.43 million.

An increase in exchange reserves means that market participants are moving their assets from private wallets back into exchanges in preparation to sell. If this plays out, Bitcoin may see a price decline.

Source: CryptoQuant

Exchange netflow has turned positive, intensifying bearish sentiment. A rise in netflow suggests that Bitcoin transferred to exchanges is being sold, potentially increasing selling pressure.

This indicates that the market is likely offloading Bitcoin into the $82,000 support zone.

However, capital inflows at this level could drive Bitcoin’s price higher, potentially gaining enough momentum to break through the resistance levels at $84,000 and $94,000.

More bearish alignment in place

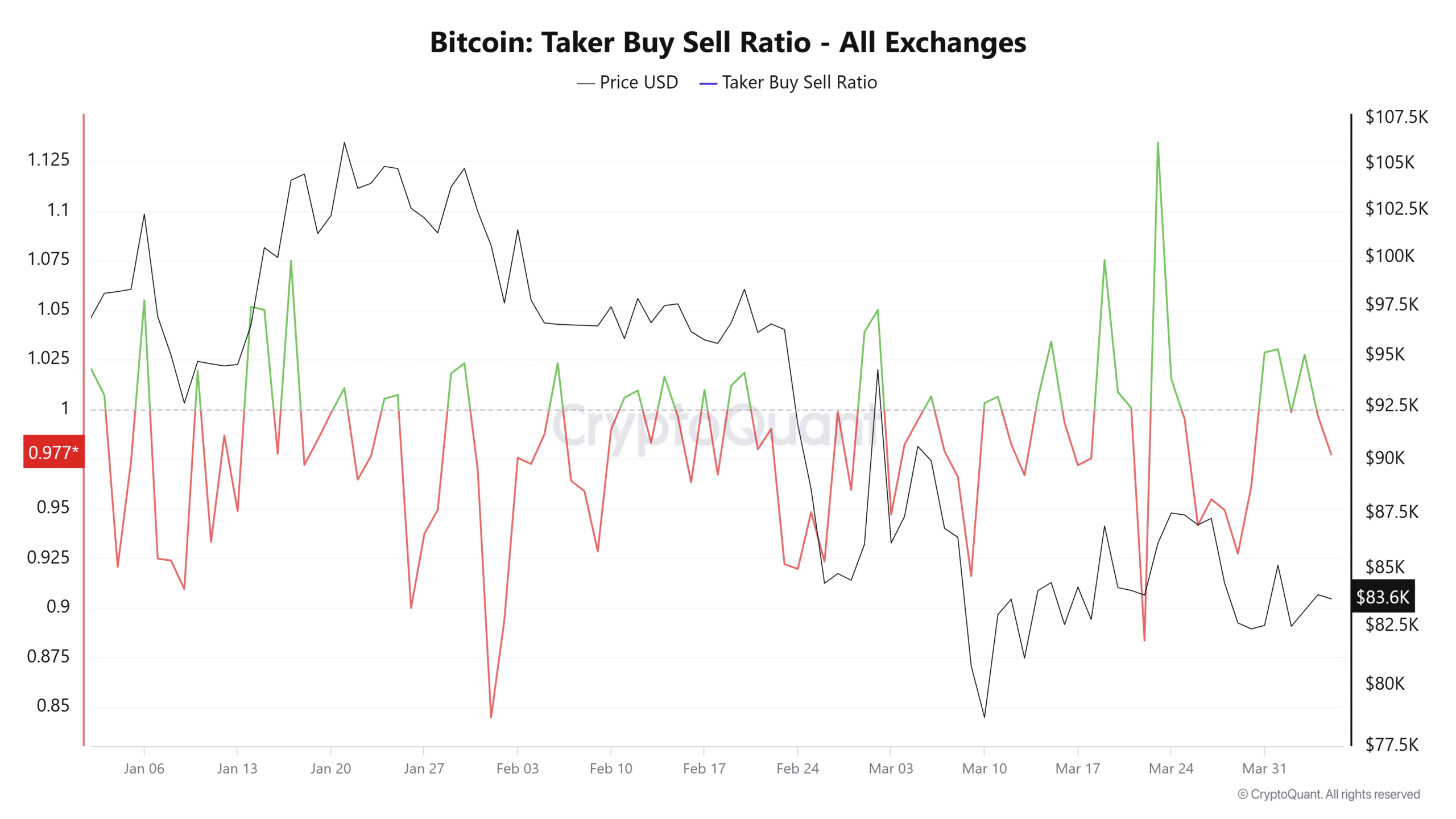

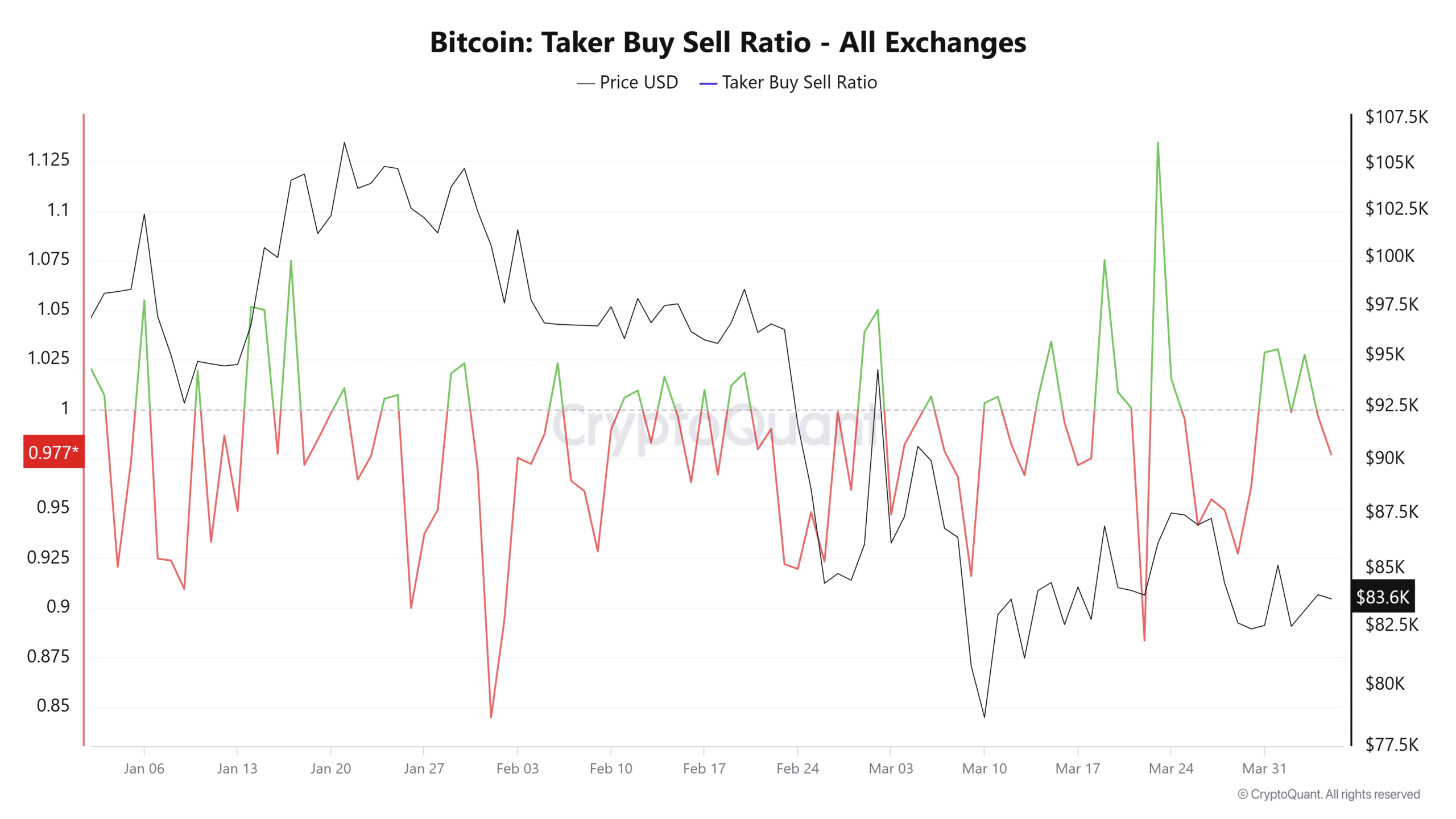

In the derivatives market, there has been continued selling pressure, with selling volume continuing to grow.

According to the Taker Buy/Sell Ratio — which uses a scale of 1 (above indicating buying, and below indicating selling) — the current reading is 0.977 and trending downward.

Source: CryptoQuant

If this ratio keeps dropping, it signals an increase in selling volume. This indicates that bears are gaining control of the market. It aligns with the previously mentioned potential market direction.