- Bitcoin ETF outflows and miner activity signal caution despite a bullish breakout attempt.

- Bitcoin Apparent Demand shows early rebound, but sentiment remains below the neutral threshold.

After weeks of suppressed interest, Bitcoin’s [BTC] 30-day apparent demand metric has finally rebounded from its March-April lows, hinting at a potential market shift.

The 30-day metric, which had plunged to -200,000 BTC—its lowest level since early 2023—has begun edging upward.

Naturally, this subtle rebound hinted at renewed buyer curiosity. However, demand still lingered in the red, showing the recovery remained fragile.

Without a clean push into positive territory, investor confidence was unlikely to return with full force.

Source: CryptoQuant

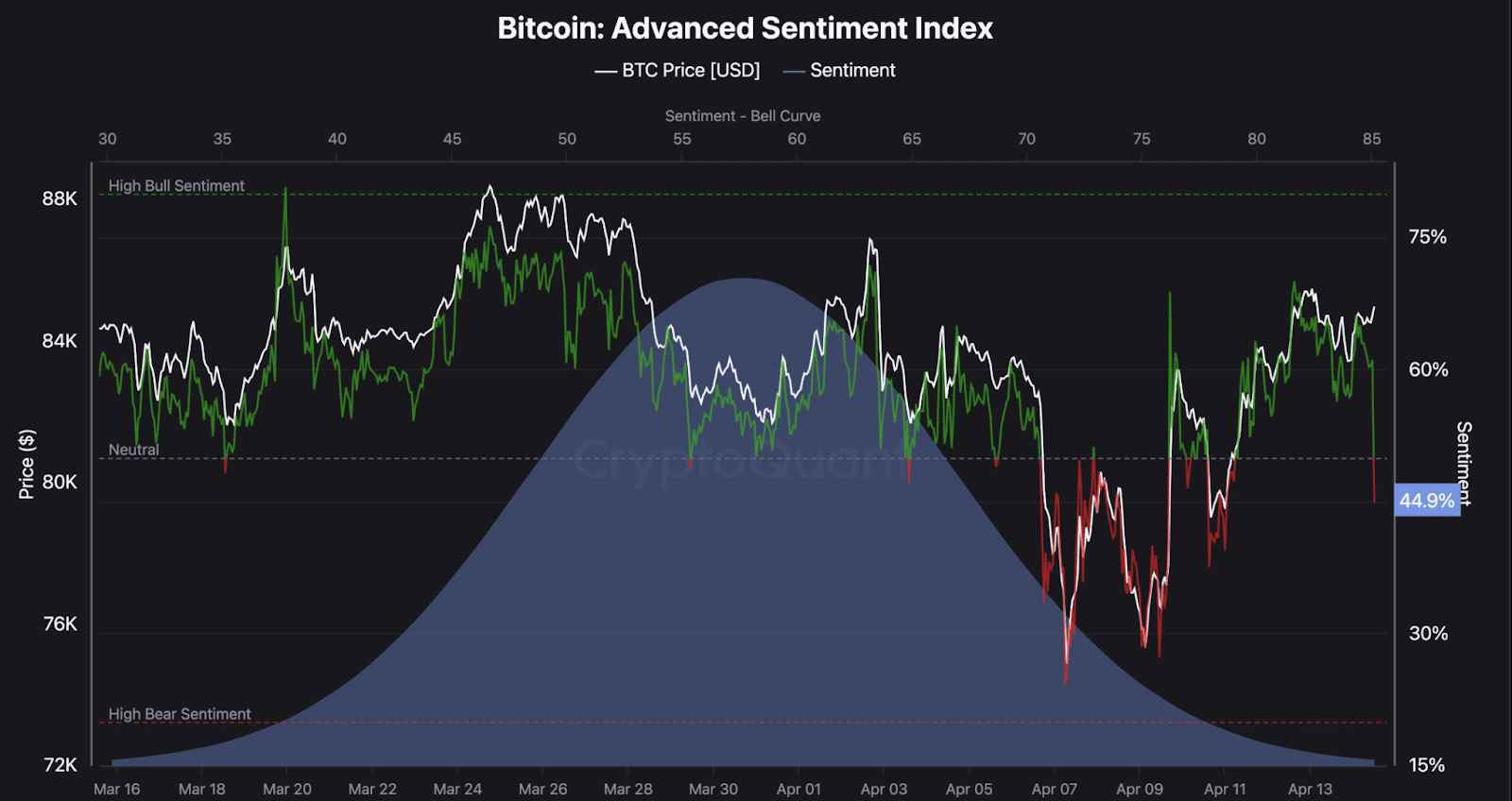

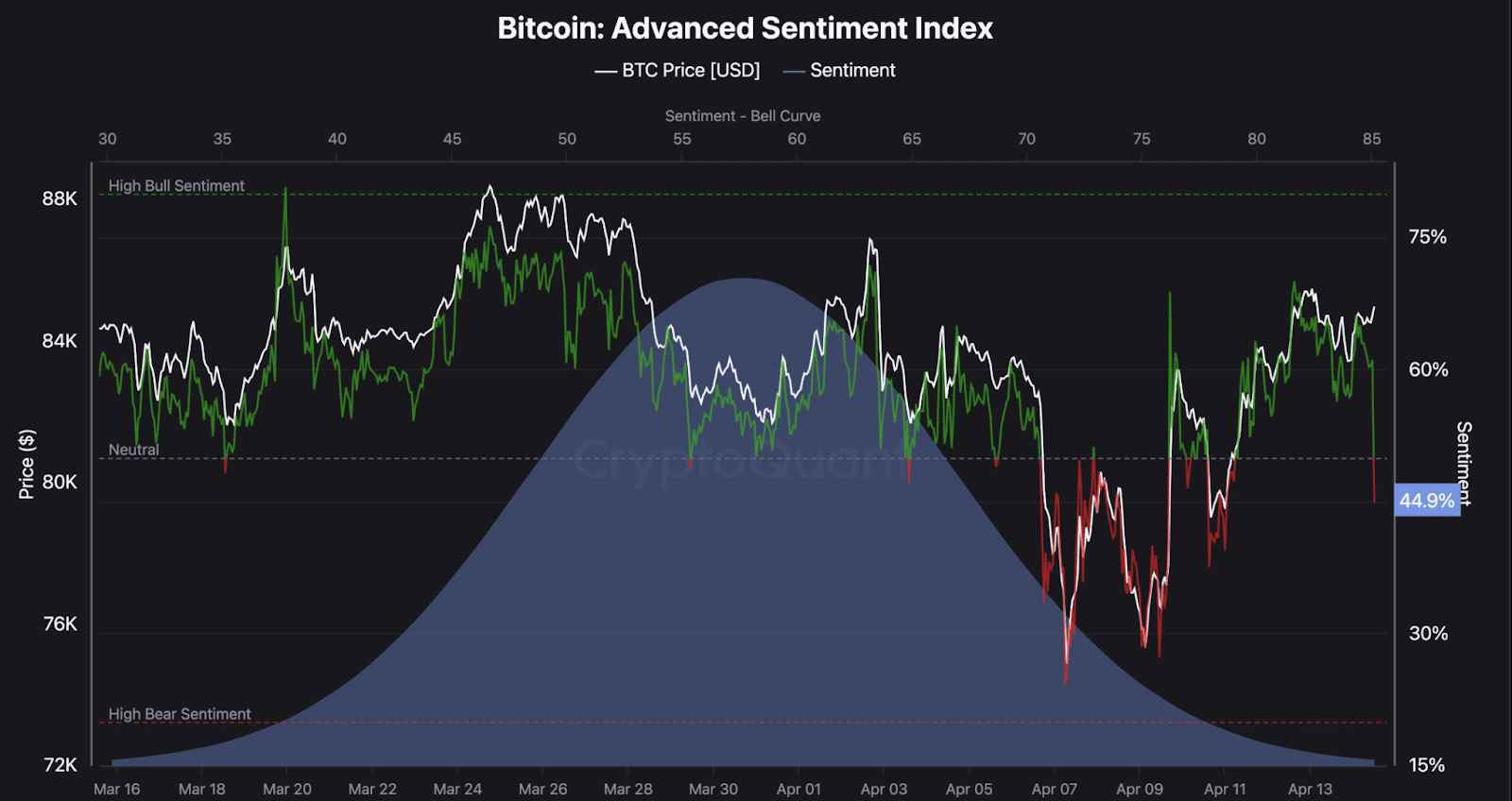

Market sentiment dips below neutral as volatility returns

Of course, demand wasn’t the only shaky pillar. Sentiment had also turned cautious.

By the time of writing, the Bitcoin Advanced Sentiment Index had fallen to 44.9%, dropping below the neutral zone and nearing bearish conditions.

Sentiment had hovered around 70% in mid-March but deteriorated alongside increased market volatility.

Bitcoin briefly touched $88,000 on the 2nd of April, before falling sharply to as low as $75,000 during the first half of April.

Although price action has since stabilized, the drop in sentiment has mirrored the uneven recovery, further reinforcing the market’s hesitance to commit to a strong bullish narrative.

Source: CryptoQuant

Institutions retreat as Bitcoin ETF inflows decline

Institutional flows, once a key pillar of Bitcoin’s strength, have begun to weaken.

Spot ETF holdings dropped from 1.19 million BTC in March to just 1.115 million BTC in early April. This figure broke below the alert threshold of 1,116,067 BTC, triggering warnings of a significant institutional pullback.

More importantly, this marked a break from the steady ETF accumulation trend that had dominated most of 2024.

With institutions now pulling back, long-term confidence appeared to be eroding, despite some signs of retail interest returning.

At the same time, miner activity has shifted toward a potentially bearish stance. The Miners’ Position Index (MPI) surged nearly 40% in 24 hours, reflecting an increased outflow of BTC relative to its one-year average.

Historically, such a rise indicates that miners are preparing to sell a portion of their reserves—either to secure profits or in anticipation of further downside.

When combined with ETF outflows and weakening sentiment, this miner behavior adds another layer of pressure to Bitcoin’s recovery path.

Source: CryptoQuant

BTC breakout offers hope, but…

On the technical front, Bitcoin has broken out of a descending trendline, sparking optimism for a bullish reversal. At last check, BTC hovered around $83,946—up 0.29% in the past 24 hours.

Moreover, a visible double-bottom pattern emerged in recent sessions, reinforcing bullish potential. BTC now trades between $76,572 support and $87,889 resistance—both key short-term levels.

Source: TradingView

For bulls to regain control, a clean break above $87,889 is necessary, which would open the path toward the $98,825 level.

Until this resistance is decisively flipped, the broader market recovery remains tentative and highly reactive to macro and on-chain developments.