- XRP and SOL are ‘crypto securities’ according to a recent Oregon AG complaint against Coinbase.

- Paul Grewal dismissed the complaint for omitting Judge Torres’ decision on XRP.

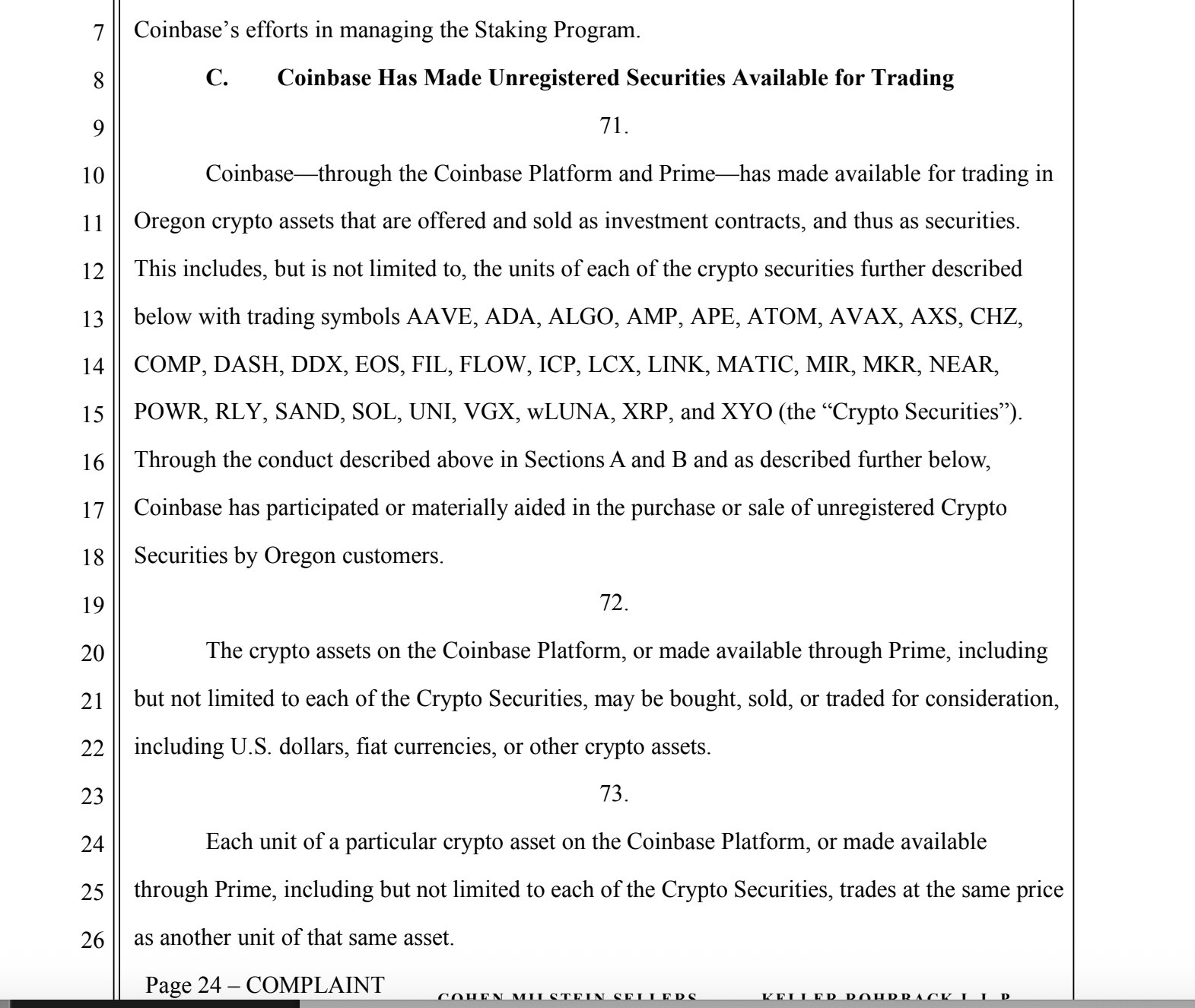

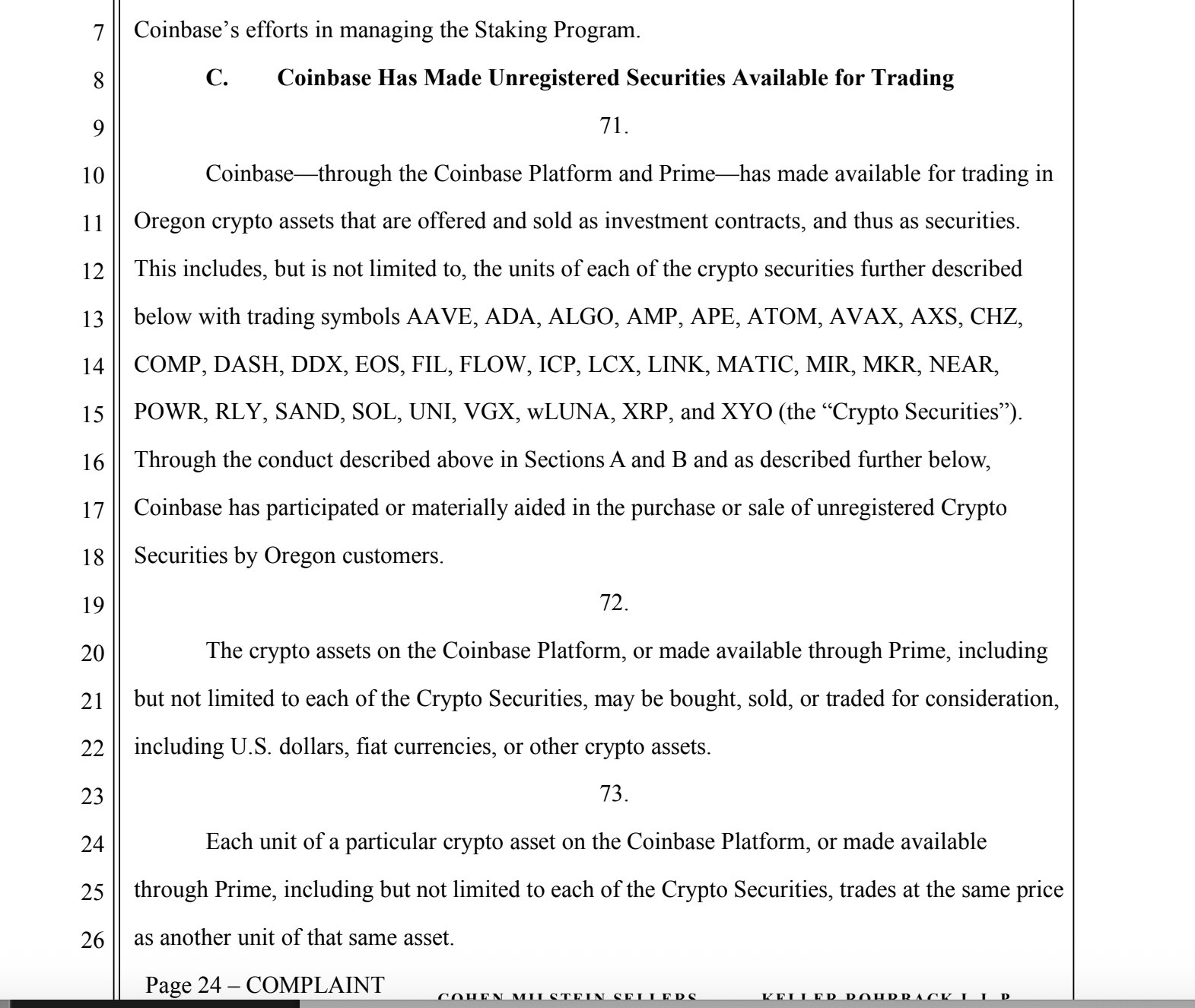

The Oregon Attorney General (AG), through the recent Coinbase lawsuit, claimed that Ripple [XRP], Solana [SOL], and 29 other tokens traded through the platform are unregistered ‘crypto securities.’

In fact, Justin Slaughter, vice president of regulatory affairs at Paradigm, stated that the Oregon AG marked more tokens as securities compared to the dismissed SEC case against Coinbase.

“The Oregon AG suit covers many more tokens than the SEC complaint did, with 31 tokens claimed to be unregistered securities, including UNI, AAVE, FLOW, LINK, MKR, and even XRP.”

Source: X (excerpt of the Oregon AG complaint)

Coinbase dismisses Oregon suit

The lawsuit was first revealed on the 19 of April by Coinbase’s legal chief, Paul Grewal.

However, he dismissed the complaint, stating that the Oregon AG failed to acknowledge Judge Analisa Torres’ decision on XRP, among other omissions.

For the unfamiliar, Judge Torres ruled that only the sale of XRP to institutional investors fell within the ‘security’ definition.

This could be another regulatory bump on XRP after a recent 60-day Ripple-SEC pause for potential settlement on the case.

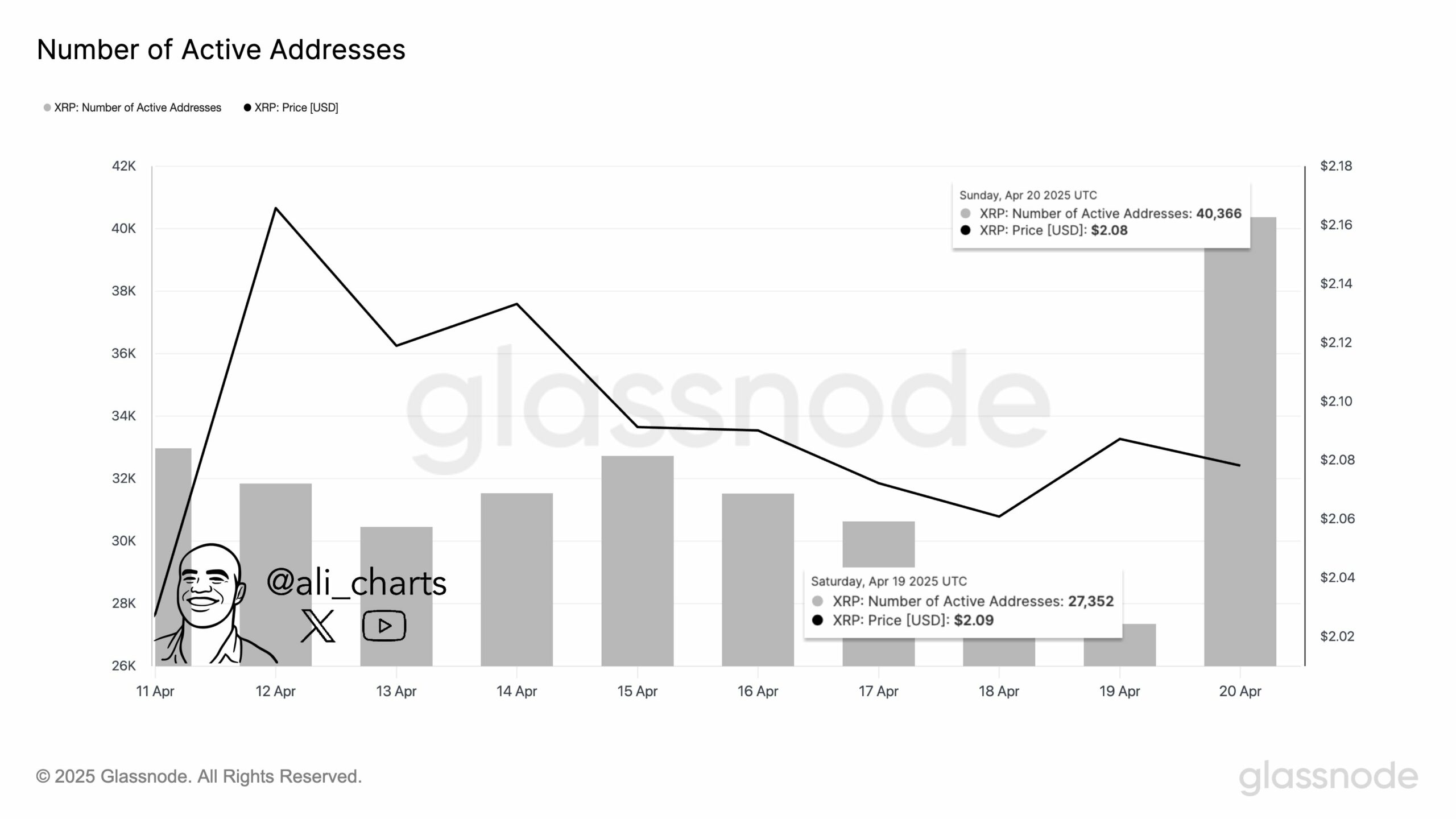

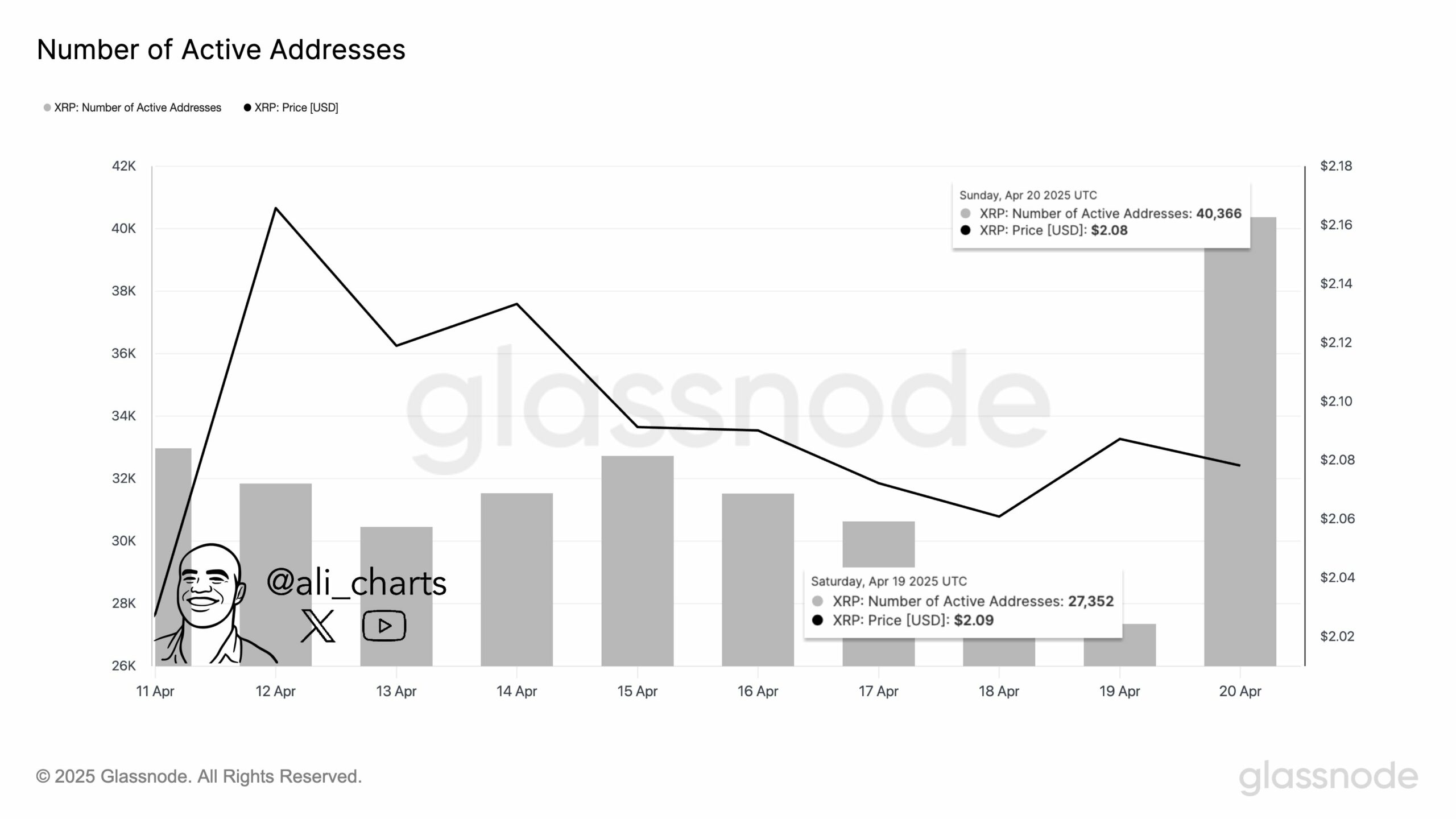

On XRP markets, address activity spiked 65%, from 27K to 40K users, but network traction didn’t boost price action.

Source: Glassnode

Despite the possibility of fronting a bullish breakout to $2.48, XRP’s short-term price action was sluggish.

In fact, per Coinglass data, its Open Interest (OI) rates fluctuated between $3B and $4B since February. This meant that speculative interest in the derivatives market cooled off.

On the price chart, however, XRP was still within its downtrend. Bullish strength could only be confirmed if the altcoin zooms past $2.4 and breaks the downtrend.

Source: XRP/USDT, TradingView