In brief

Twenty One Capital is set to become the third-largest Bitcoin treasury company after merging with Cantor Equity Partners and receiving major Bitcoin contributions from Tether and Bitfinex.

CME Group will launch XRP futures on May 19, entering a $3.9 billion market where Coinbase and Kraken are already active.

Upexi shares soared 335% after announcing a $100 million raise to build a Solana treasury, adopting a long-only strategy focused on SOL.

Public Keys is a weekly roundup from Decrypt that tracks the key publicly traded crypto companies. This week: Twenty One Capital makes a huge Bitcoin operating company splash, CME is entering the XRP futures chat, and investors show love for a little-known company that’s started buying Solana.

Nineteen, Twenty, …

There’s a lot of fuss being made over Twenty One Capital, a new Bitcoin treasury company involving $146 billion stablecoin issuer Tether, crypto exchange Bitfinex, and Wall Street giants Cantor Fitzgerald and SoftBank.

It’s slated to go public via SPAC by merging with Cantor Equity Partners, which already trades on the Nasdaq under the CEP ticker. Once the ink dries, Twenty One will change its ticker to XXI.

Tether and Bitfinex will contribute a total of 31,500 Bitcoin to the new company, according to an SEC filing from Cantor. After the merger closes, SoftBank plans to buy enough shares to maintain “significant minority ownership,” leaving Tether and Bitfinex as the majority owners.

Before the company has even raised any additional cash to fund its BTC treasury, it plans to “own at least 42,000 Bitcoin.” That’s enough for Bitcoin Treasuries to have already penciled it in as the third-largest Bitcoin treasury company behind MSTR and Bitcoin miner MARA Holdings.

So if you’ve already got Strategy, the OG Bitcoin treasury company, and iShares Bitcoin Trust, or IBIT, in your portfolio—why is XXI interesting?

Twenty One Capital CEO Jack Mallers, founder of the Strike parent company Zap, told Bloomberg he’ll be laser focused on improving the company’s Bitcoin per share, or BPS, and Bitcoin return rate, or BRR.

“[With] a vehicle like an ETF, your exposure is static. So Twenty One is an operating business. And we will be building Bitcoin products, Bitcoin operative cash flow. And then using the capital markets to grow the Bitcoin on our balance sheet,” he said. “So we want our shareholders to get wealthier, get richer in Bitcoin terms.”

But onlookers have been quick to point out, redeeming shares in-kind for Bitcoin won’t be possible. Mallers has since sent a letter to Strike investors, assuring them that he’s not leaving the company.

CME’s XRP futures play

CME Group, the world’s leading derivatives marketplace, is launching XRP futures contracts on May 19. The new product will allow clients to trade both a micro-sized contract of 2,500 XRP, and a larger-sized contract of 50,000 XRP.

CME isn’t first in this regard.

Coinbase launched its own XRP futures contracts on April 21. And Kraken, although it wasn’t first to launch XRP futures, acquired the company that did. In 2019, Kraken acquired London-based Crypto Facilities, which has offered XRP futures contracts in October 2016. The company has since been rebranded as Kraken Futures.

But CME, which is wading into a pool with $3.9 billion worth of XRP open interest, has a history of erasing first-to-market leads.

Cboe launched its Bitcoin futures contracts on December 10, 2017 under the XBT ticker. A week later, CME Group launched its own Bitcoin futures under the BTC ticker.

Two years later, Cboe threw in the towel saying there just wasn’t enough interest in crypto. CME now commands $13.6 billion worth of the $68 billion Bitcoin futures market.

But hey, guess who’s back?

Solana Treasury Company

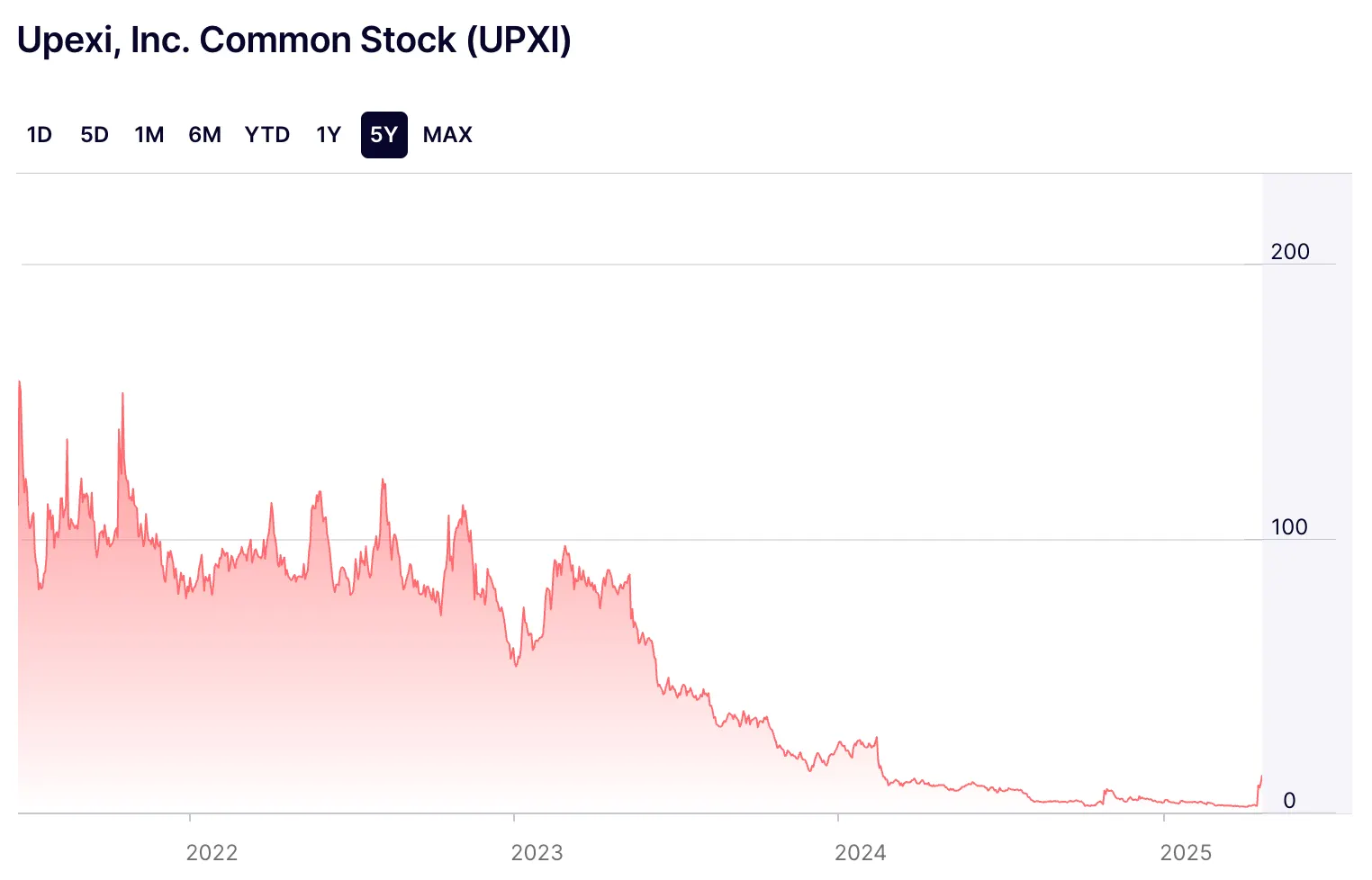

Upexi, which trades on the Nasdaq under the UPXI ticker, saw its shares gain a staggering 335% after it announced a Solana treasury plan meant to mirror what Strategy has been doing with Bitcoin since 2020.

The company said it had successfully secured a $100 million private placement.

“The Company intends to use approximately $5.3 million from the offering for working capital and debt reduction, with the remaining funds to be used for the establishment of the Company’s Solana treasury operations and accumulation of Solana,” the company said in a Friday SEC filling.

The company is incredibly bullish on SOL. It’s adopted a “long-only strategy” primarily focused on Solana and plans to participate in “restaking Solana to improve returns.”

The news has revived a company that was otherwise sliding into obscurity.

As a business, Upexi wears many hats. It owns and operates several brands, like LuckyTail, Cure Mushrooms, and PRAX, which sells paraxanthine-based energy supplements.

Other Keys

- Waiting on deets from Riot: Bitcoin miner Riot Platforms just secured a $100 million line of credit from Coinbase. “This credit facility is a key part of our efforts to diversify sources of financing to support our operations and strategic growth initiatives,” CEO Jason Les said in a statement. Decrypt reached out to Riot for details about what those key strategic initiatives may be, but did not immediately receive a response.

- Coinbase gets buy from Benchmark: Investment bank Benchmark set a $252 price target for Coinbase, which trades on the Nasdaq under the COIN ticker, and gave it a buy rating earlier this week. “We believe most investors have yet to recognize or focus on the extent to which stablecoin and market structure legislation could cause significant expansions in COIN’s valuations,” they wrote, noting that the bills could broadly “reignite crypto market activity.”

- Door’s open for Semler doubters: Eric Semler, chairman of Bitcoin treasury company Semler Scientific, is as bullish as ever after the company announced it has upped its BTC stash to $314 million. “You can sell or stop if you don’t like what we’ve done with Bitcoin,” Semler said during an interview Thursday at Bitwise’s Bitcoin Standard Corporation Investor Day event in New York. Not many investors took him up on that. Just before the closing bell, SMLR had gained 7% over yesterday’s close and was trading for $36.80.

Edited by Guillermo Jimenez.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.