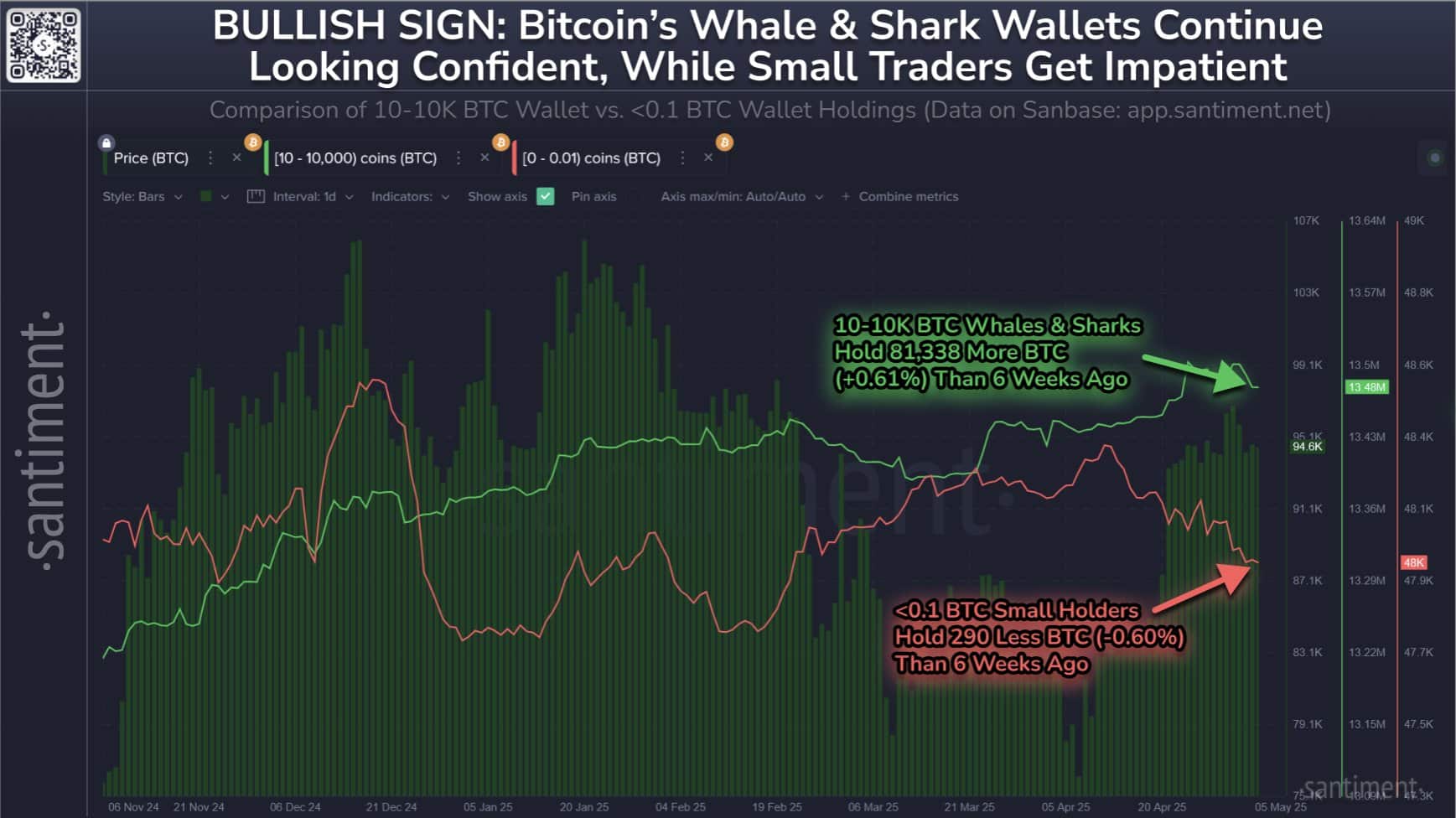

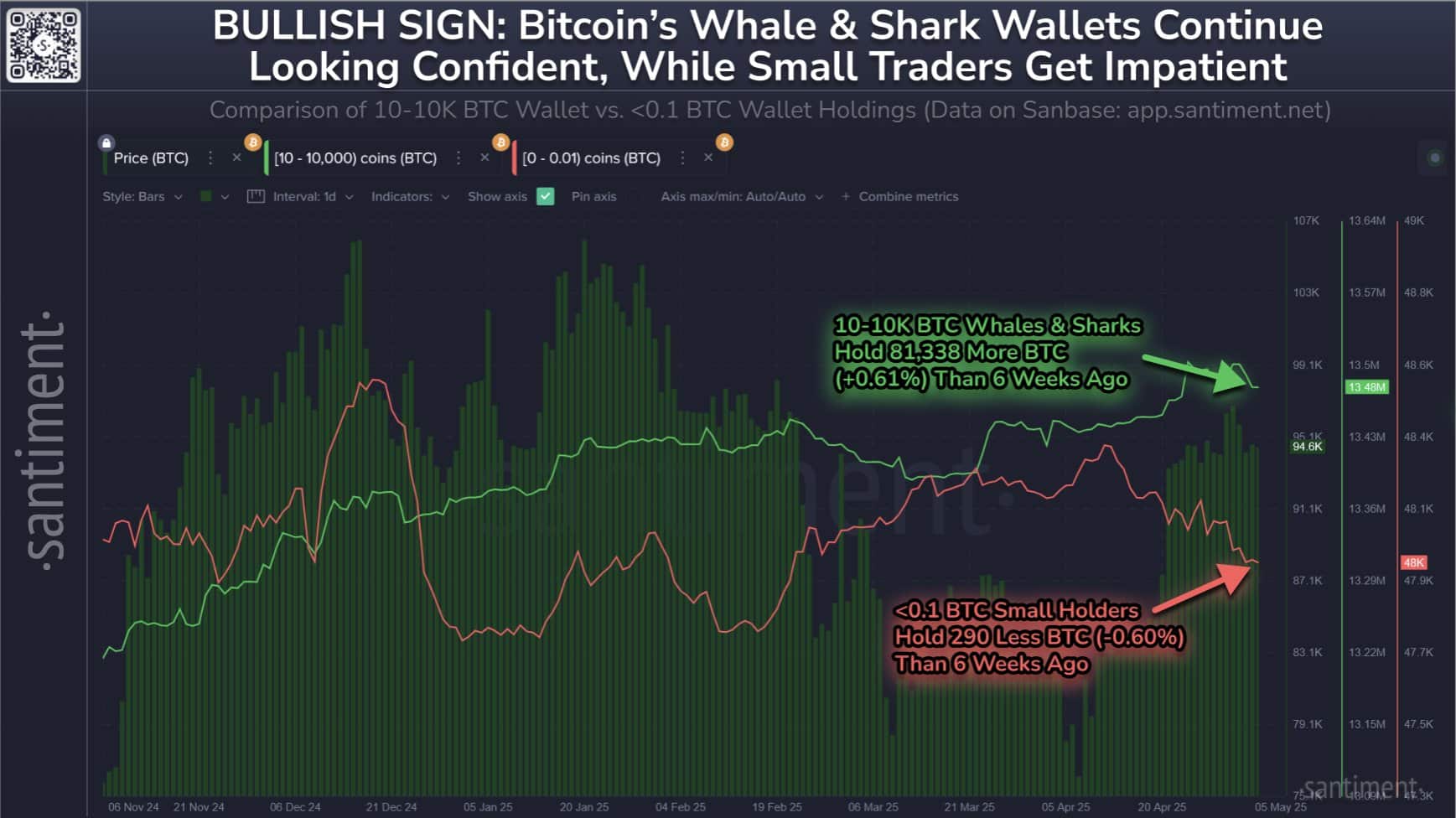

- Whale wallets scooped up 81,338 BTC as retail fled in panic.

- Stock-to-Flow ratio jumped to 669.72 post-halving, fueling a scarcity-driven bullish outlook.

Bitcoin [BTC] saw a drop of 3,400 wallets holding at least one BTC in the last two months. This decline reflects reduced confidence among long-term holders during recent volatility.

At the time of writing, Bitcoin traded at $96,678.63, up 2.28% in the past 24 hours.

Naturally, market watchers are now focused on $93,198—the most critical support. If it collapses, $83,444 becomes the next key level to watch.

Therefore, retail softness continues to cast doubt on Bitcoin’s short-term strength, even as whales quietly move in a different direction.

BTC whales are loading up while retailers hit the exit

Large holders added 81,338 BTC in the past six weeks, increasing their holdings by 0.61%. Meanwhile, smaller wallets dumped 290 BTC, trimming 0.60% of their total assets.

This divergence suggests a familiar setup: retail panic selling, while whales quietly accumulate.

Historically, this trend has preceded price rallies, especially when retail panic creates temporary selling pressure. Therefore, the current phase may mark a strategic accumulation zone.

Source: X/Santiment

Bitcoin’s exchange flows reflect strong conviction.

Outflows surged by 182.36% while inflows only grew by 26.15% in seven days. This large discrepancy shows that more investors are pulling BTC off exchanges for long-term storage.

On top of that, it implies fading near-term selling pressure, supporting a bullish case.

BTC MVRV hints at room to grow before danger zones emerge

Bitcoin’s MVRV Z-score sat at 2.42.

This level suggests investors remain in moderate profit but not at extreme risk levels.

The ratio does not yet show overheating, meaning the market can still sustain gains. Therefore, selling pressure remains controlled.

Historically, MVRV levels above 3.5 signal euphoria, but BTC remains below that threshold.

Consequently, investors may continue holding rather than taking profits. This condition favors continued upward momentum, assuming no major shocks or breakdowns occur at current support levels.

Source: Santiment

Scarcity surges as the Stock-to-Flow ratio explodes post-halving

Post-halving, Bitcoin’s Stock-to-Flow ratio has skyrocketed to 669.72—a level reflecting serious supply constraints.

High S2F readings often indicate long-term value growth, especially when demand rises alongside supply constraints. Therefore, this signal strengthens the bullish outlook.

Source: Santiment

Historically, post-halving cycles align with major rallies due to supply shocks. This recent spike mirrors similar setups seen before past breakouts.

As a result, long-term investors may view current prices as undervalued based on future supply dynamics.

Bitcoin’s NVT Ratio has climbed to 380.12—among the year’s highest readings. This reading shows that the price is rising faster than the transaction volume.

High NVT values often warn of overvaluation, especially when network activity slows. However, early-stage rallies can also show this pattern.

So, while caution is warranted, there’s no reason for immediate alarm.

Source: Santiment

What’s next for BTC

Retail traders appear to be losing interest, but whale activity and Exchange Outflows suggest the opposite. Scarcity metrics continue to rise while profit levels stay manageable.

Therefore, Bitcoin could be preparing for its next move higher. If support at $93K holds, the market may witness another breakout attempt.

Based on current data, whales remain in control of the narrative.