- The stablecoin market cap hits $231B, but slowing inflows hint at cautious investor sentiment.

- Liquidity patterns resemble mid-2021; a breakout rally depends on renewed stablecoin growth momentum.

Despite reaching an all-time high market cap of $231 billion, the stablecoin market is flashing caution signals as its 90-day growth rate begins to stall.

This slowdown comes at a critical juncture for the broader crypto landscape, where stablecoins often act as a leading indicator of market sentiment and liquidity.

Historically, a rebound in stablecoin growth has preceded major rallies — most notably in July 2021, when a sharp uptick in stablecoin inflows helped fuel a powerful bullish run.

Liquidity climbs along with uncertainty

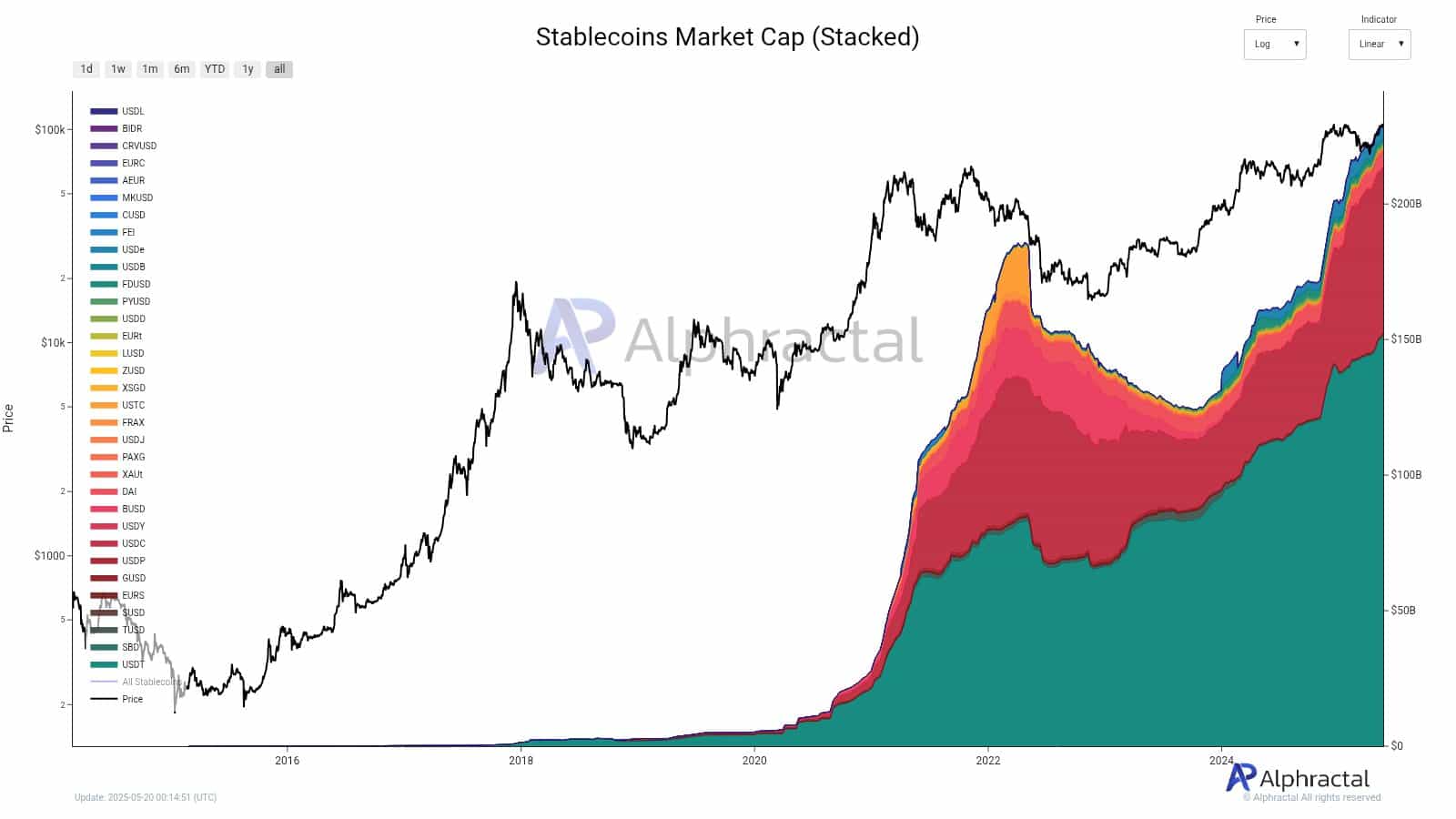

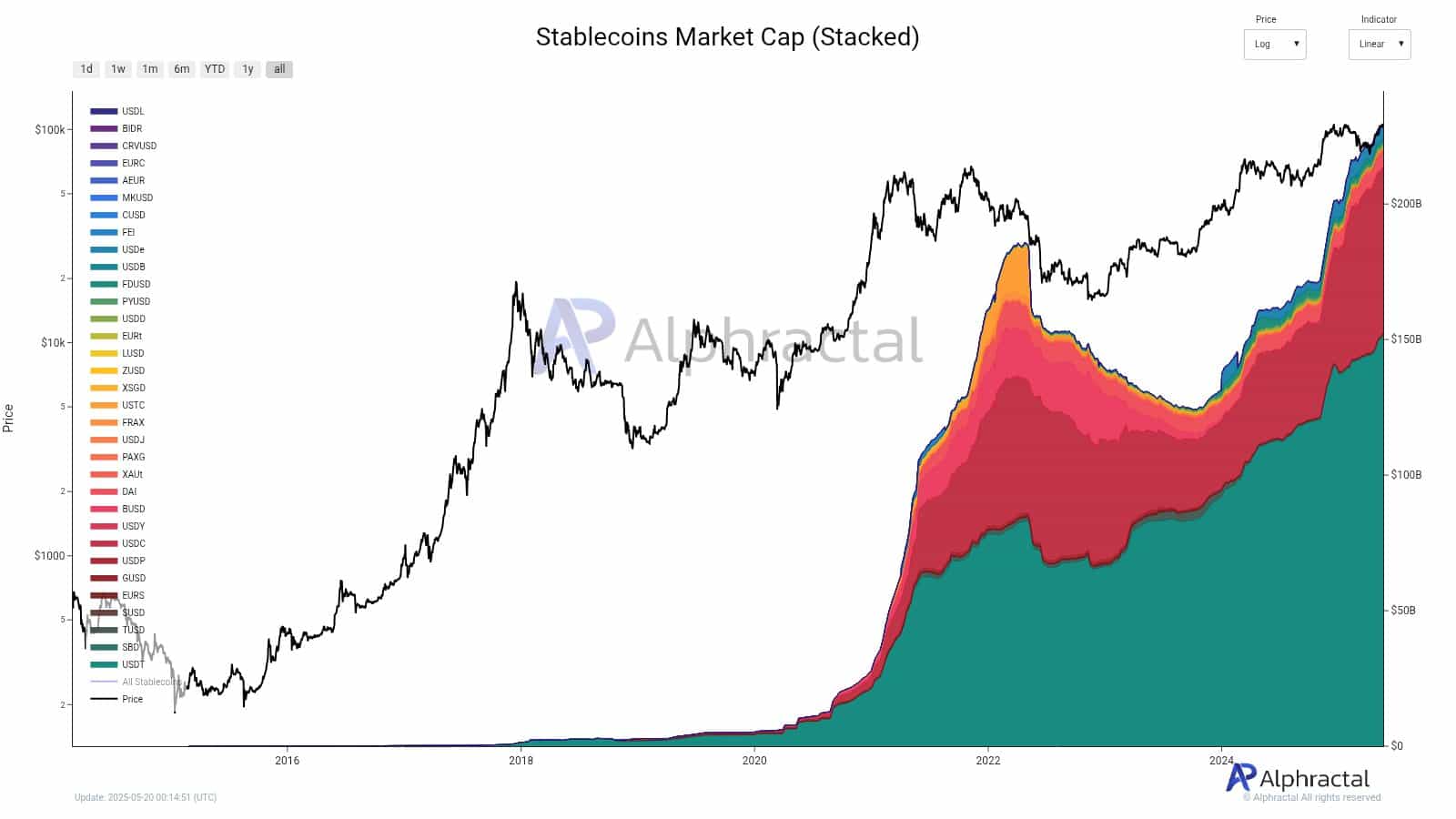

Despite the surge in stablecoin supply to an all-time high of $231 billion, the composition of growth shows a fragmented picture.

USDT continues to dominate, while newer entrants like FDUSD and PYUSD remain relatively thin in market share.

Source: Alphractal

While there’s broad liquidity in the system, it’s not flowing evenly — potentially a sign of selective market confidence rather than a full-blown bullish wave.

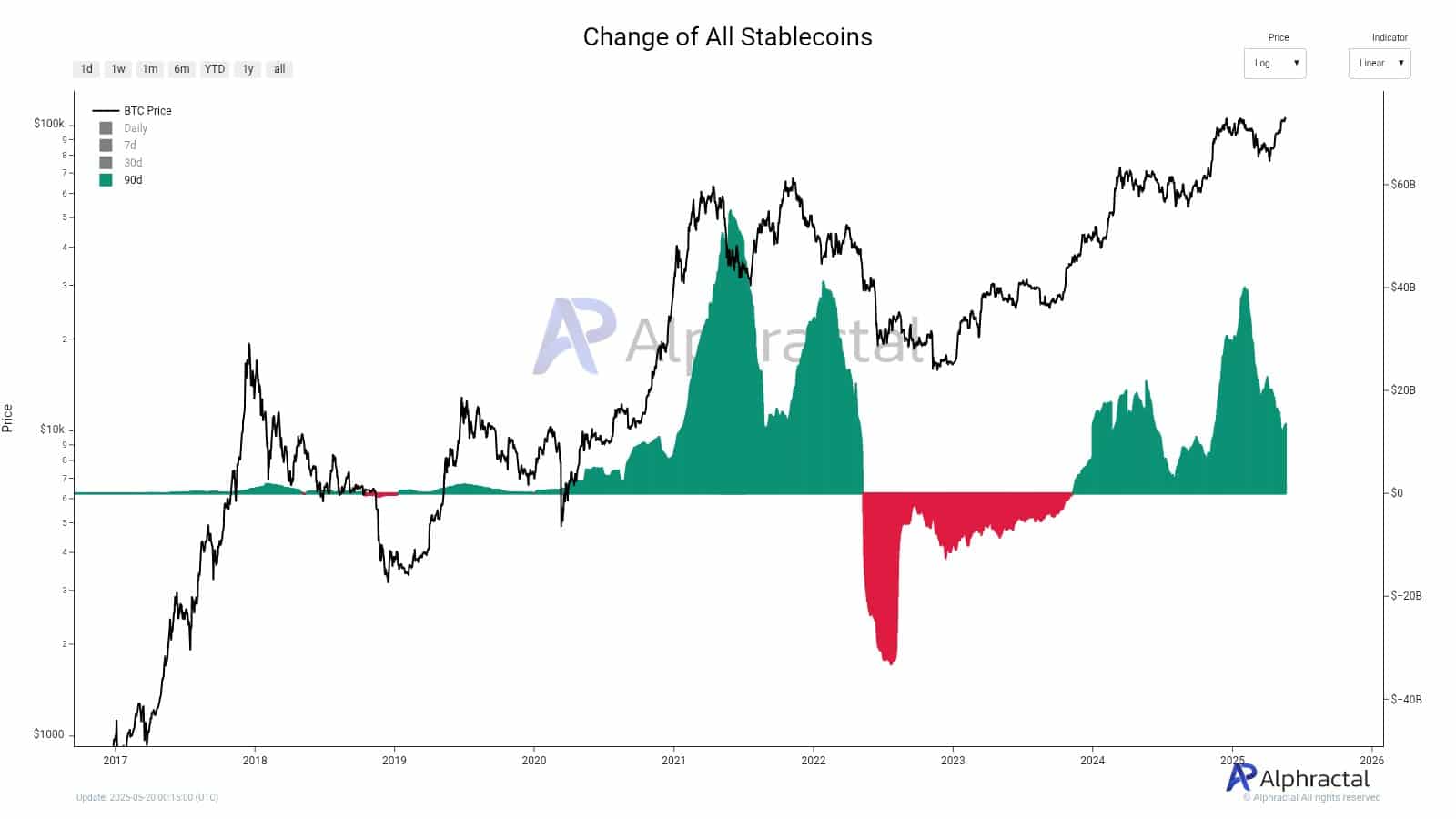

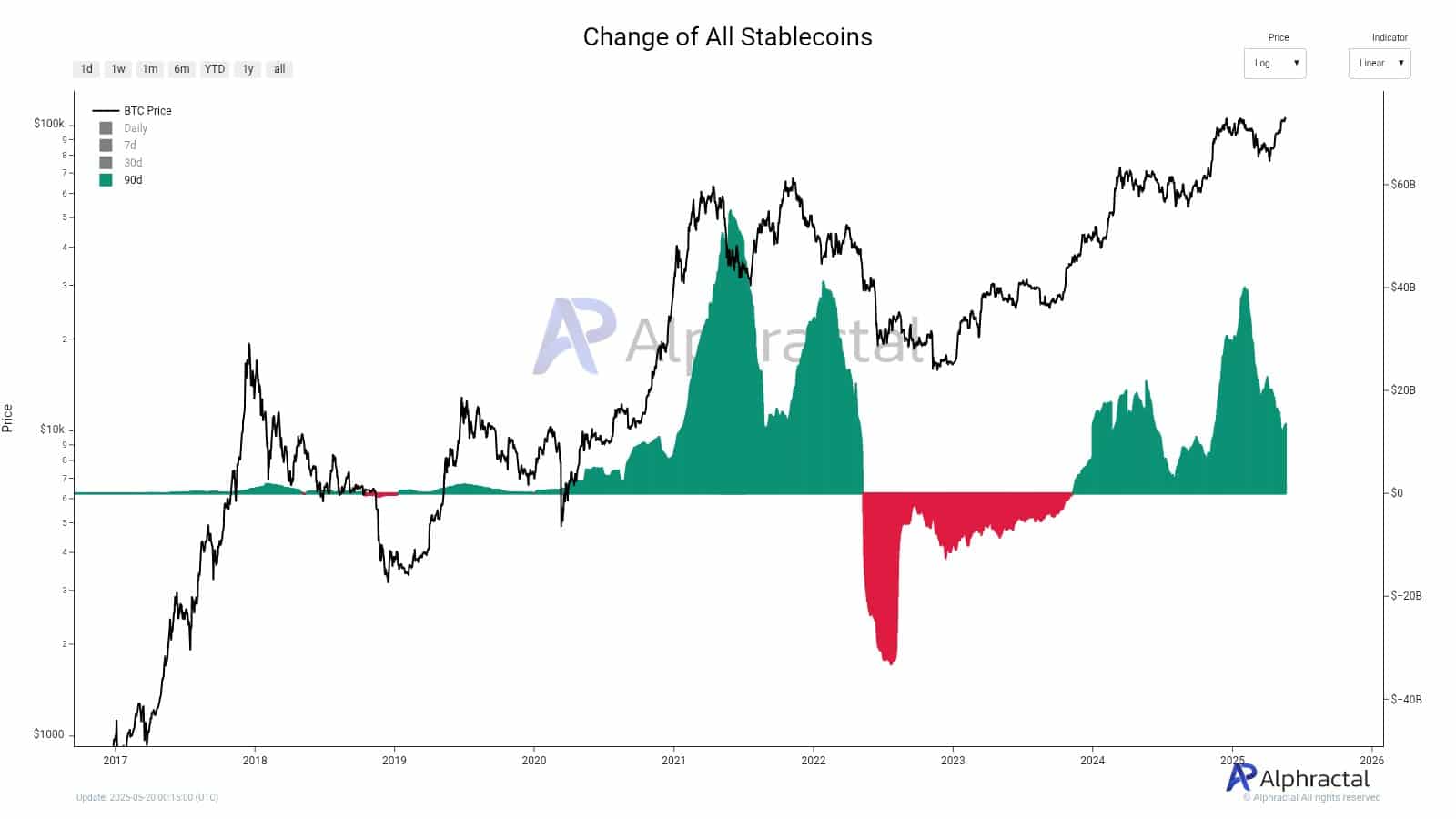

Stalling momentum on the 90-day change

While the aggregate stablecoin market is expanding, the 90-day change shows a recent decline, hinting at hesitation from capital allocators. This dip in inflows aligns with periods of consolidation in altcoin markets, showing a lack of aggressive risk appetite.

Source: Alphractal

It’s not a full reversal — but it could mark the top of a cycle unless inflows pick up soon. Historically, such pauses precede either an acceleration or a plateau in market prices.

Patterns mirror 2021

The current structure of stablecoin inflows, particularly the stall in the 90-day momentum, resembles the early plateau seen in mid-2021, just before stablecoin expansion surged again and drove Bitcoin to new highs.

If history repeats, a renewed uptick in stablecoin growth could act as the fuse for a broader market rally. But until then, caution prevails.