- Altcoin-Bitcoin correlation was breaking down, hinting at fragility beneath Bitcoin’s solo rally.

- Whale-driven dominance surge showed caution, not conviction; risk of snapback looms near all-time highs.

Bitcoin’s [BTC] latest surge is turning heads, but not for the usual reasons. While the BTC slowly climbs, the broader altcoin market is stalling – a rare divergence.

With Bitcoin dominance rising and historical correlations breaking down, analysts are sounding alarms: this rally may be running on fumes, and the risk of a sudden reversal is growing.

Altcoin correlation crumbles as Bitcoin climbs

Bitcoin’s ascent is no longer lifting all boats.

Source: Alphractal

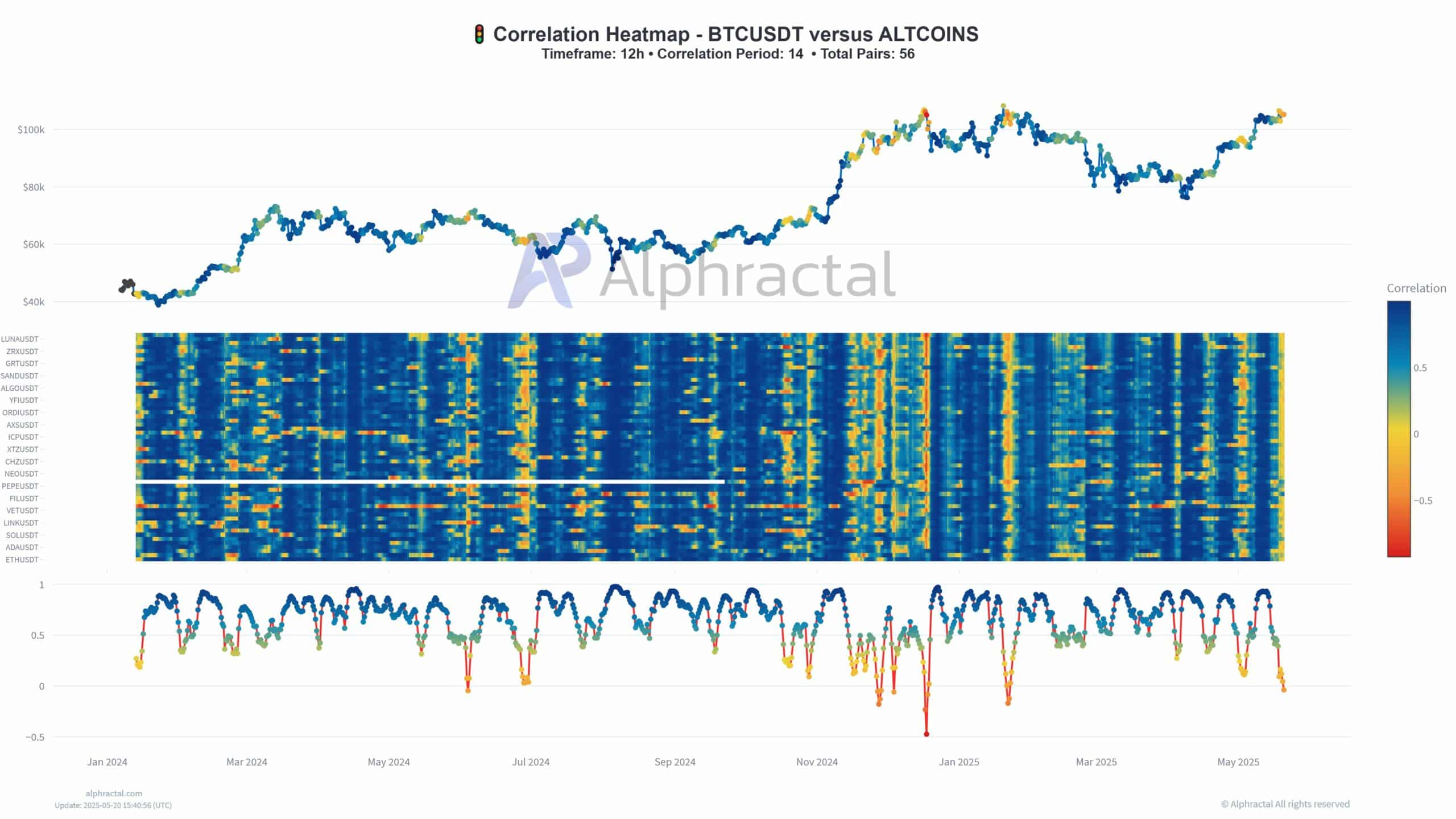

The 14-period rolling correlation between BTC and major altcoins has sharply declined since late April 2025.

Unlike previous rallies where altcoins moved in sync with Bitcoin, the current trend shows fragmentation. Most altcoins now display near-zero or negative correlation on the 12-hour timeframe.

This disconnect, highlighted by cooler blue shades in the heatmap, signals a narrowing market.

A Bitcoin-led rally often lacks long-term strength and can sometimes precede a broader risk-off shift in the market.

Dominance reclaimed

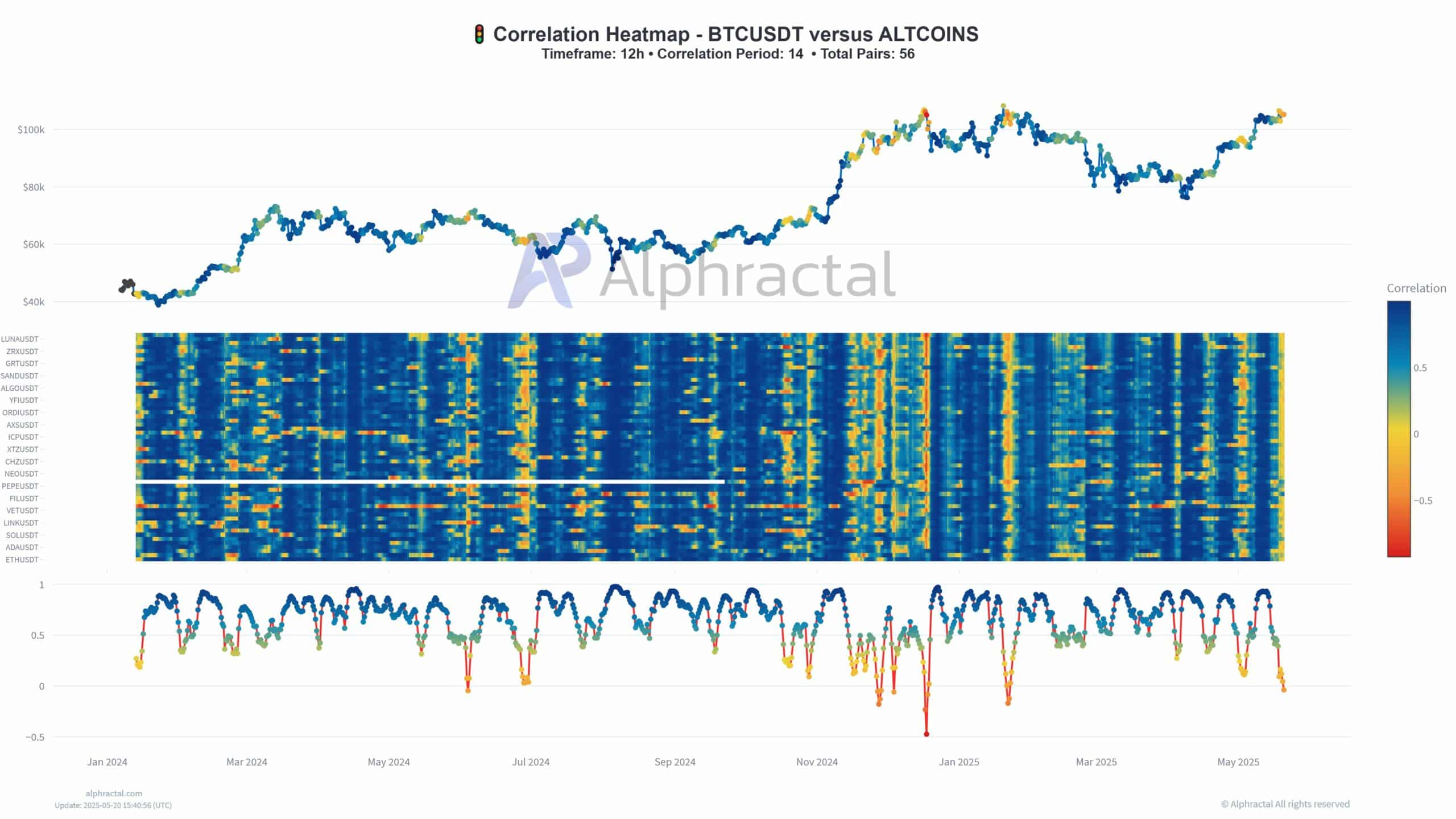

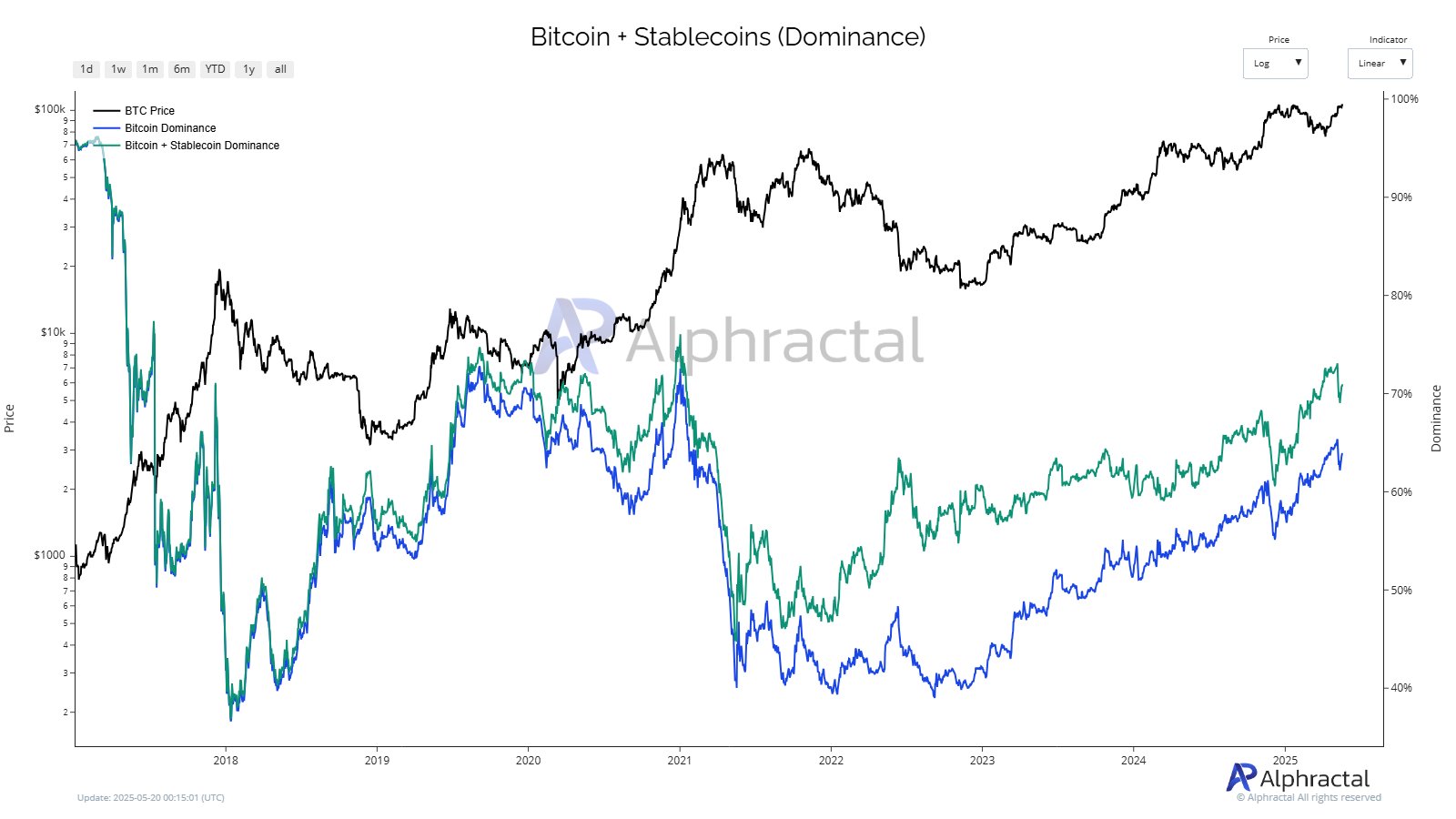

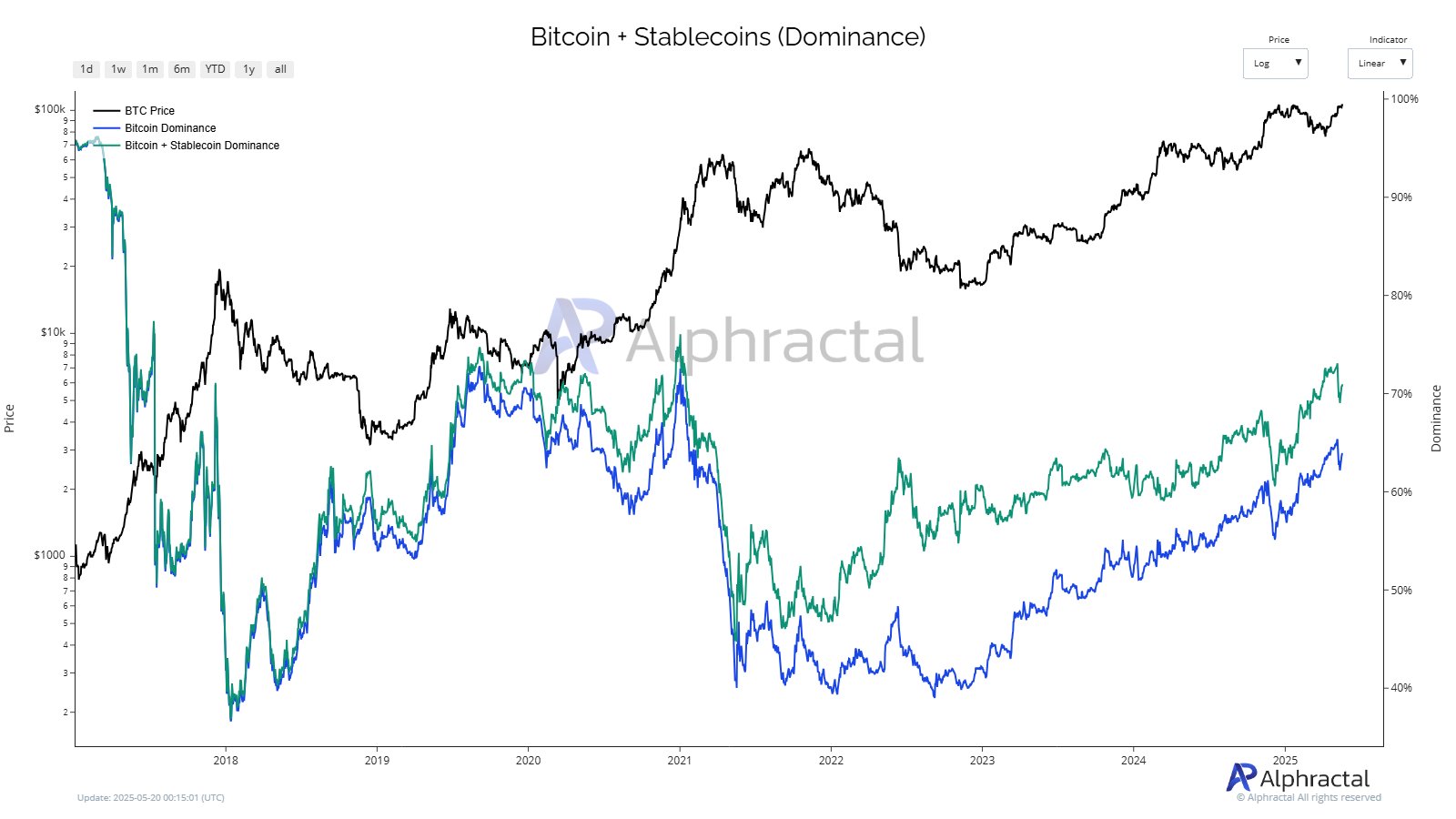

BTC’s price climb has been accompanied by a powerful resurgence in market dominance, not just for BTC alone, but when combined with stablecoins.

The joint dominance borders on 70%, showing a return to risk-off behavior and consolidation of capital in “safer” crypto assets.

Source: Alphractal

While Bitcoin dominance alone remains below its 2021 peak, the inclusion of stablecoins shows that traders are waiting on the sidelines.

Source: Alphractal

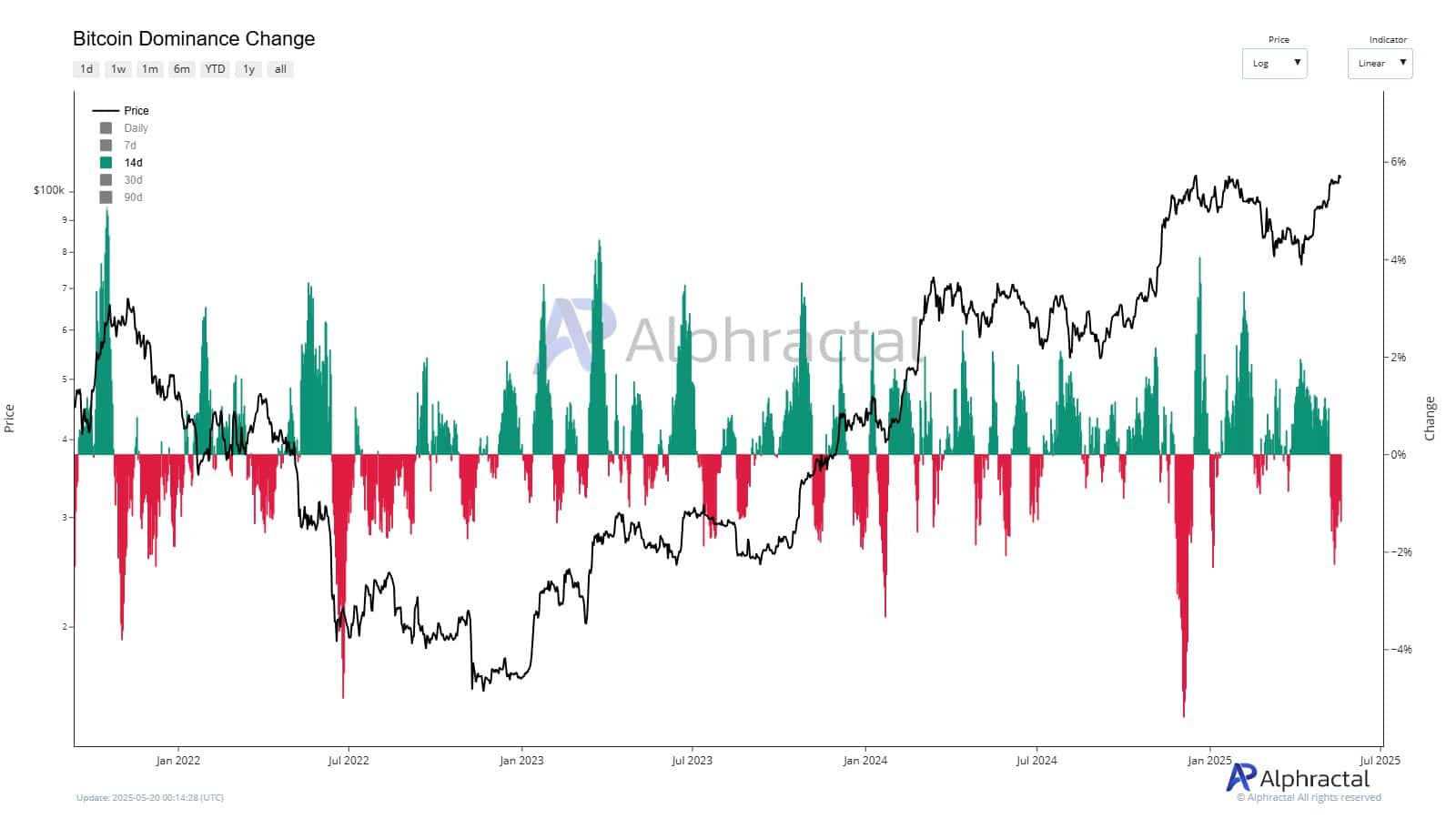

Despite price gains, BTC dominance change has frequently turned negative, highlighting continued capital rotation and market indecision beneath the surface strength.