- Bitcoin hits $111K ATH, surpasses Google to become the 6th-largest global asset by market cap.

- Macroeconomic instability and rising inflation drive investors to favor Bitcoin over gold and bonds.

Bitcoin [BTC] has just notched a new chapter in financial history.

Surpassing its previous record, the king crypto hit a new ATH of $111K for the first time, and has overtaken Google in market value.

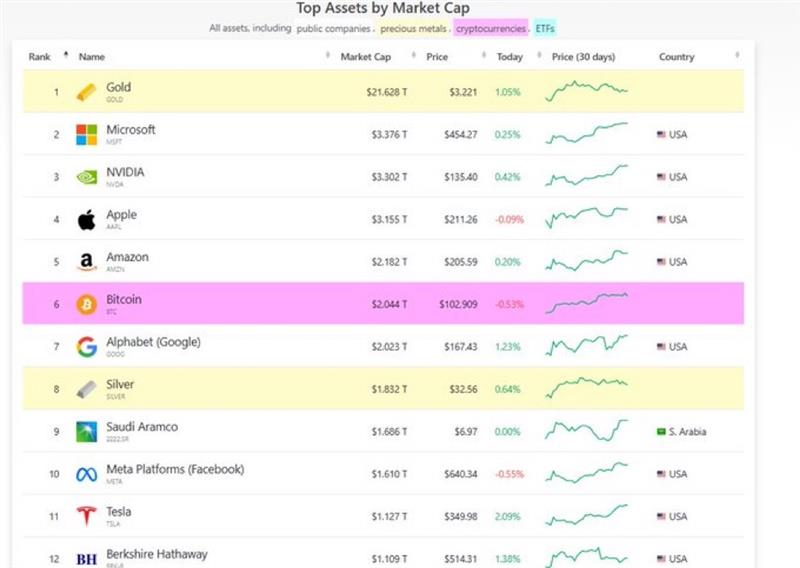

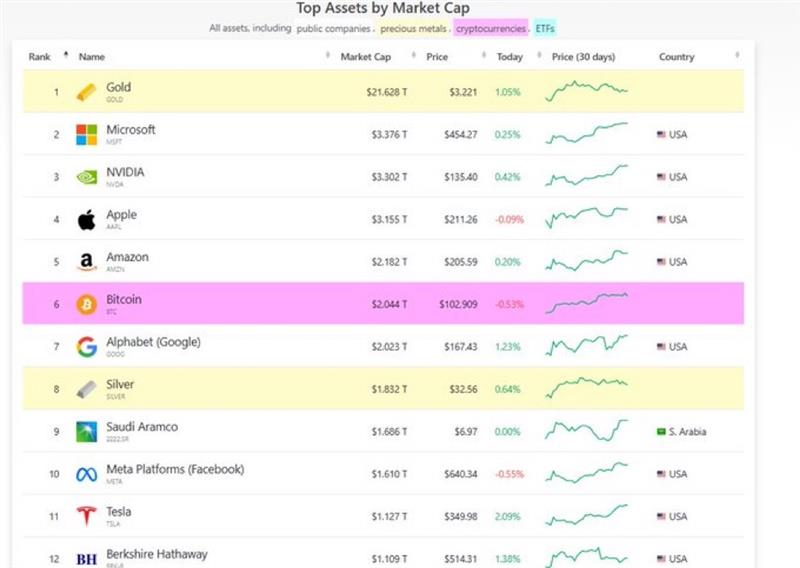

Ranked as the world’s sixth-largest asset, Bitcoin now sits just behind gold, Microsoft, NVIDIA, Apple, and Amazon, showing its growing weight in the global financial landscape.

Bitcoin breaks new ground!

Bitcoin surged past $111K on the 21st of May, setting a new all-time high and closing the daily candle at $110K on Binance.

Source: TradingView

The move caps off a week of steady gains, with BTC climbing over 10% since 17th May. Notably, the RSI was at 77.42 at press time, indicating overbought conditions as traders pushed prices into uncharted territory.

While momentum remains strong, technical signals suggest the rally could be entering a phase of heightened volatility.

Bitcoin races past Google!

With a market capitalization exceeding $2.17 trillion, Bitcoin has officially surpassed Alphabet (Google) to claim the sixth spot among the world’s largest assets.

It now ranks just behind Amazon, Apple, NVIDIA, Microsoft, and gold. The milestone places Bitcoin ahead of traditional heavyweights like silver, Saudi Aramco, and Meta.

Source: X

With mounting bullish momentum, BTC has nowhere to go but up.

What’s behind the surge?

Bitcoin’s climb past the $2 trillion market cap mark is a result of changes across the external environment.

Source: X

Having reached its first trillion faster than most assets in history, Bitcoin is increasingly seen as a hedge in a changing financial landscape.

In Japan, where inflation continues to climb, the king coin is gaining traction as a practical alternative to fiat and traditional stores of value.

In the U.S., concerns over fiscal stability have added to its appeal.

Robert Kiyosaki, author of “Rich Dad Poor Dad,” recently pointed to failed U.S. Treasury bond auctions as a red flag, suggesting that trust in government debt is waning.

“Good news. Gold will go to $25,000. Silver to $70. Bitcoin to $500 k to $ 1 million.”

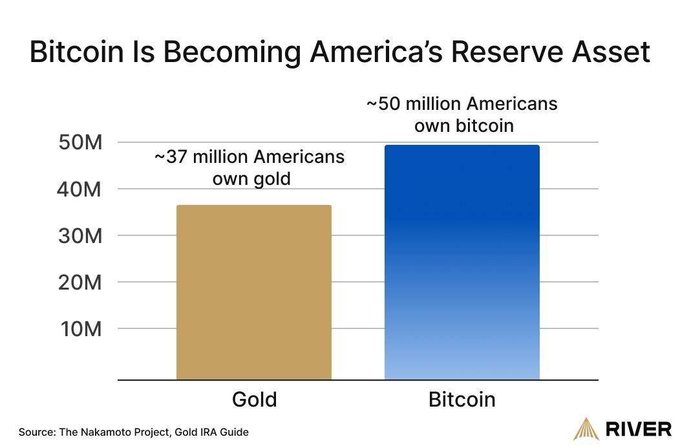

His message was clear: Americans are turning to Bitcoin.

Source: X

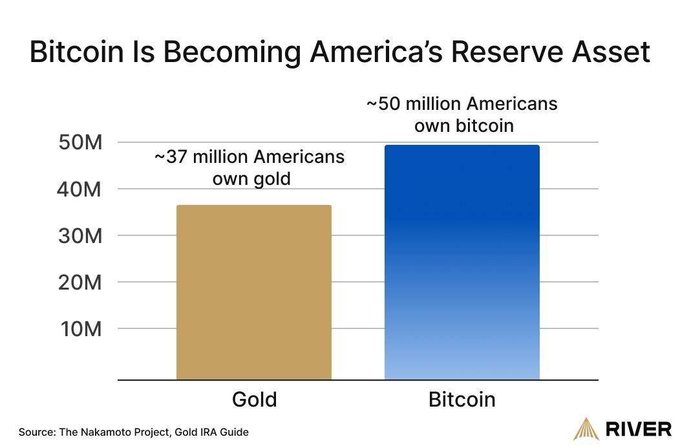

This sentiment is confirmed in data showing Bitcoin holders outpacing those accumulating gold — a notable reversal in investor behavior.