- Bitcoin’s biggest breakout weapon might also double as its sharpest macro trigger.

- A clean view of U.S. crypto sentiment is more important than ever.

As Bitcoin [BTC] grinds into fresh highs, the conversation shifts from momentum to magnitude. How high can this leg go, and where does the next liquidity ceiling sit?

But beyond price action, there’s a deeper structural narrative playing out: Bitcoin is becoming geopolitically tethered. With U.S. spot ETF inflows ramping up and the Coinbase Premium Index (CPI) flashing green, Wall Street is clearly in the mix.

Short-term bullish? Absolutely. But now the chart’s got a macro beat, that makes every pump way more layered – and volatile.

Inside the U.S. Bitcoin vault

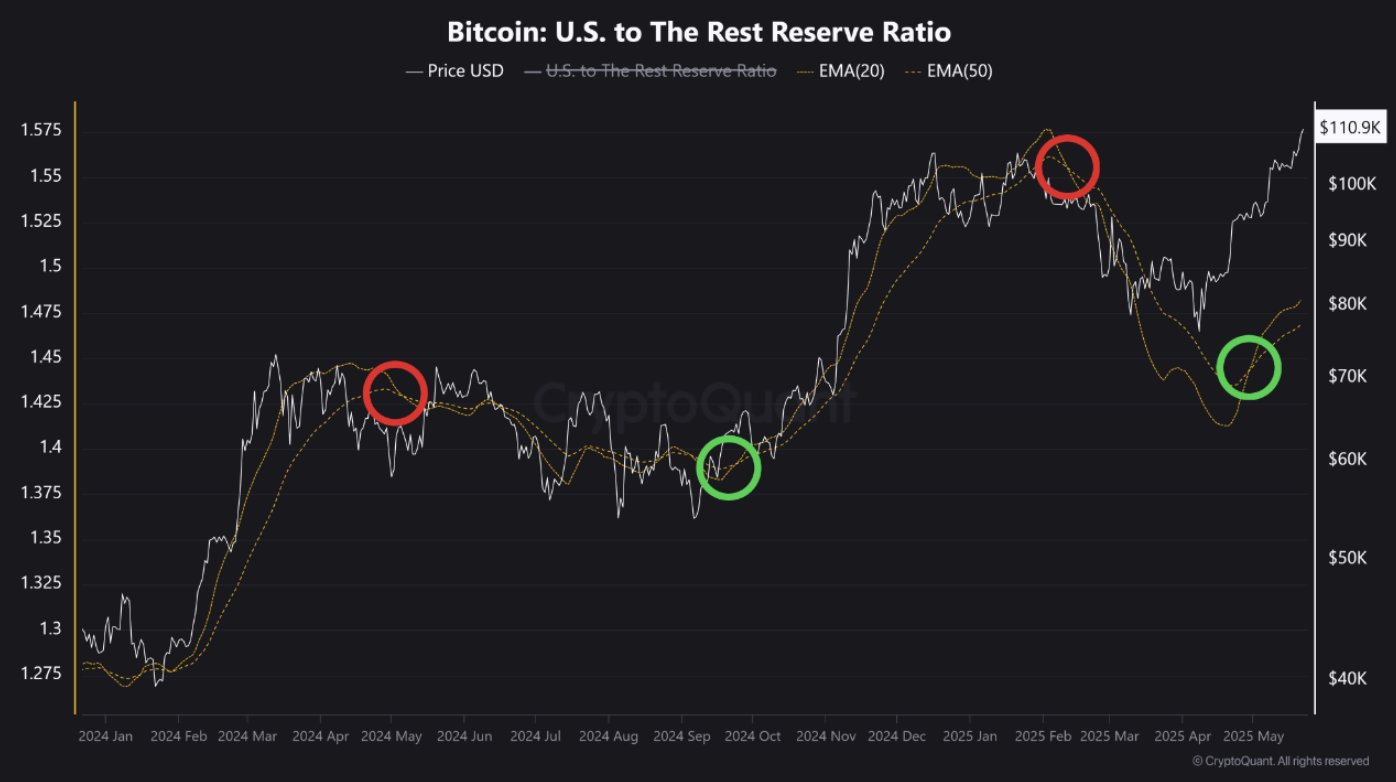

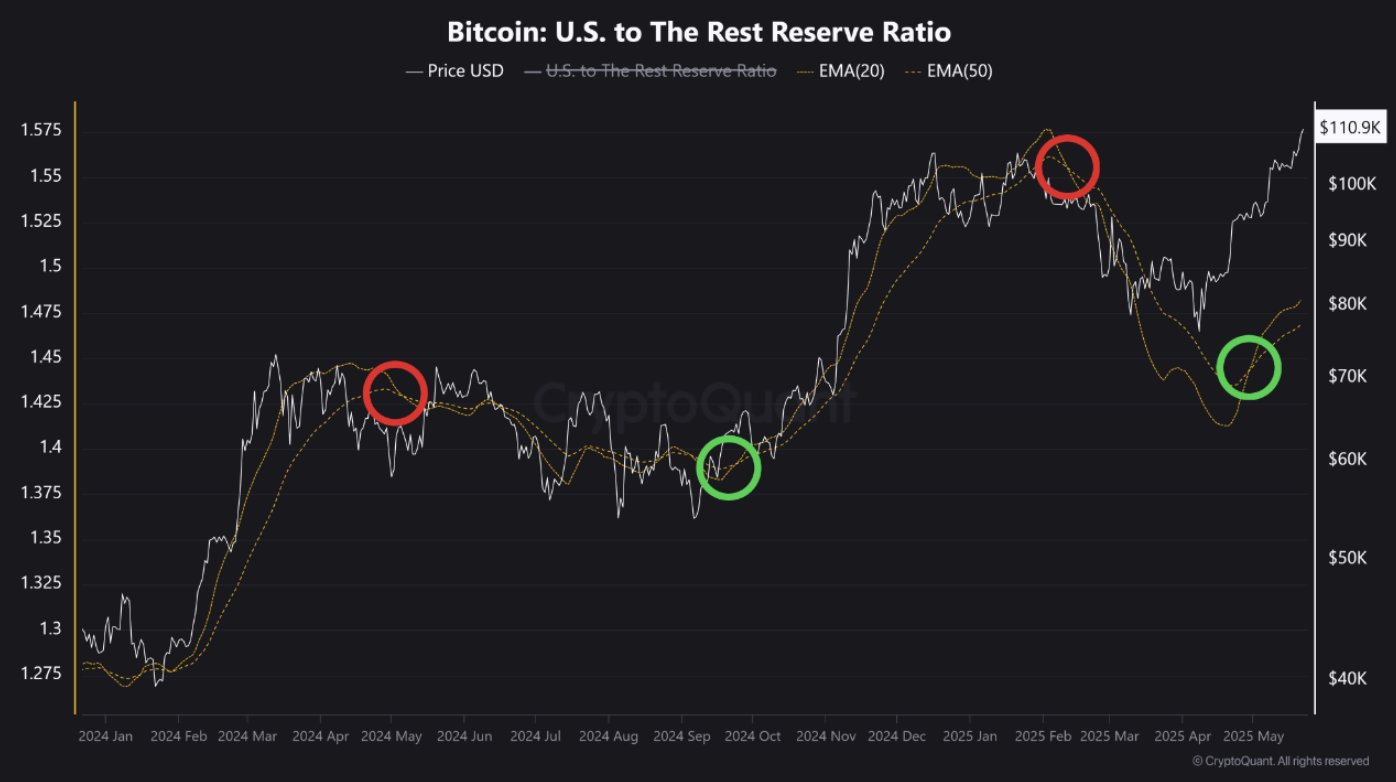

CryptoQuant data is flashing a key signal: When the BTC U.S. to Rest Reserve Ratio spikes, it often marks heavy accumulation by U.S. players that sets up golden crosses – prime setups for bull runs.

Right now, that familiar pattern is lighting up again. The recent green circle pinpoint critical “dip zone” identical to Q4 2024, which kicked off a monster 75% rally.

Source: CryptoQuant

Fueling this golden cross, U.S. Bitcoin spot ETFs are on a tear, logging seven straight days of net inflows.

The latest on the 22nd of May pulled in a staggering $935 million, with BlackRock’s IBIT ETF alone hauling $877 million, perfectly syncing with BTC’s 1.81% daily close at $111,917.

Overlay that with a green Coinbase Premium Index (CPI) and you’ve got a setup that echoes previous accumulation-to-expansion cycles. If this rhythm holds, BTC’s next price discovery zone could stretch all the way up to the $192.5k handle.

Will Wall Street’s appetite turn momentum into mania?

Nobody can forget the post-“Trump pump” crash. Bitcoin smashed through two consecutive all-time highs in under 30 days, only to get caught in a volatility vortex that sent it spiraling.

The 20th of January marked the inflection point. As Trump re-entered the Oval Office, risk markets recoiled. Headlines were stacked with tariff revival chatter, sticky inflation prints, and a Fed signaling tighter for longer.

Wall Street rotated defensive — and so did crypto.

That’s when the BTC: U.S. to Rest Reserve Ratio flipped red, showing U.S. investors were pulling back fast. Big outflows from U.S. exchanges lined up perfectly with Bitcoin’s fall to $76k, all in less than 100 days.

Source: TradingView (BTC/USDT)

Looking forward, if tariffs chill and inflation cools, risk-on flows could continue surging, pumping fresh U.S. capital into Bitcoin’s veins.

But beware — macro FUD is a lurking beast. When it rears, Wall Street’s defensive mode kicks back in.

That golden cross? It’s bullish, but chasing a November-style 75%+ blast off rally? Too optimistic for now.