- Over $1 billion in stablecoins left Binance as long-term holders de-risk and reduce exposure.

- Bitcoin’s retail investors are driving the rally as whales pull back, signaling a major market shift.

A silent reshuffling is afoot.

As Bitcoin [BTC] hovers near record highs, over a billion dollars in stablecoins have quietly exited Binance. Long-term holders are pulling back and de-risking, showing waning conviction at current price levels.

Meanwhile, smaller investors are stepping in aggressively, aiming to take the reins and potentially sustain the rally.

Are the power dynamics driving this rally shifting massively?

Waning liquidity or quiet rotation?

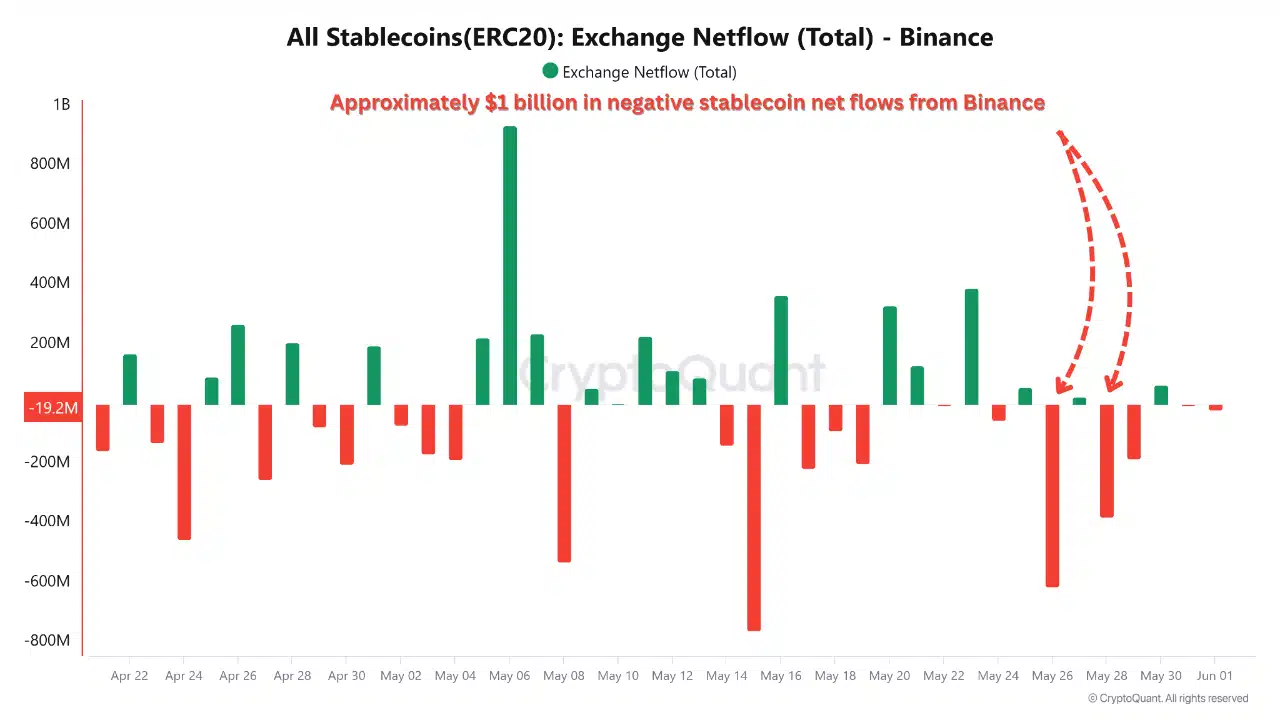

In May, Binance recorded over $1 billion in net stablecoin outflows, as seen in the chart below, one of the most significant liquidity shifts in recent months.

Source: CryptoQuant

Stablecoin netflows are an indicator of exchange-side buying power, and a drawdown of this magnitude often points to caution among larger players. While Bitcoin pushed past $110K, the capital base behind the rally may be thinning.

Precedents show similar outflows have either preceded periods of cooling or marked moments of profit rotation.

Whether this is a signal of risk aversion or a calculated pause by institutional capital, one thing is clear: the rally’s details are changing.

Long-term holders tap out

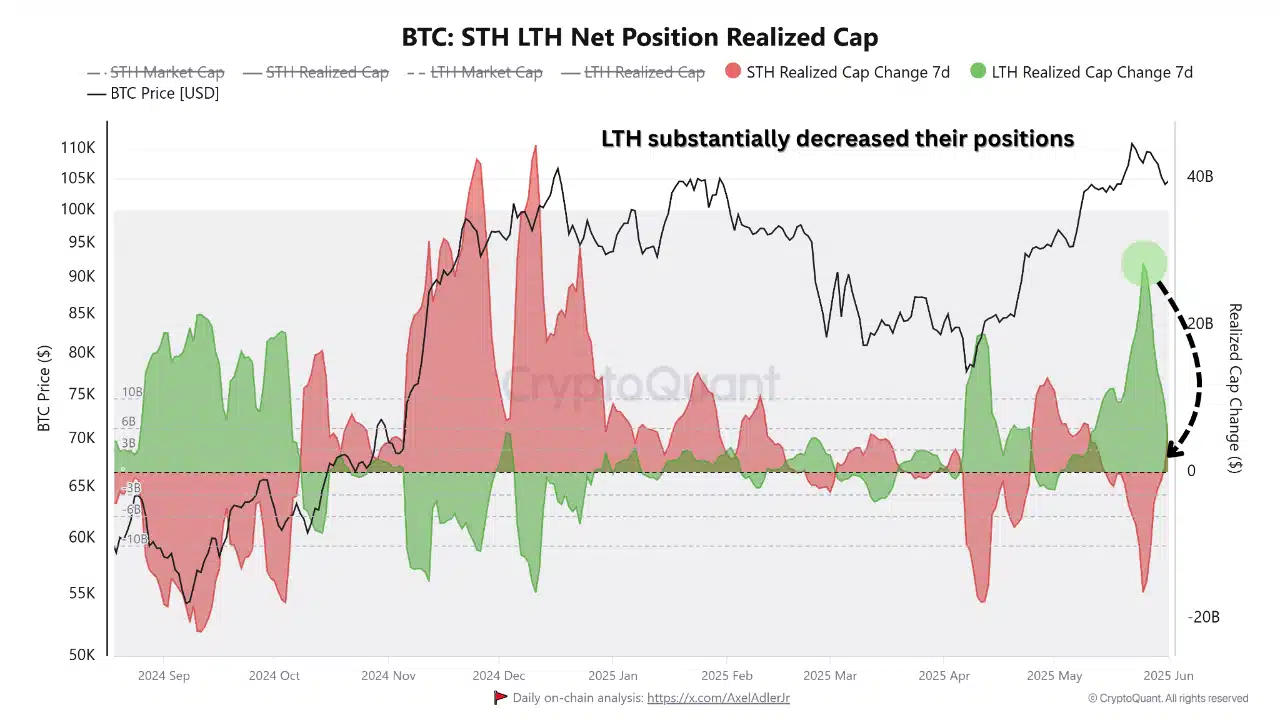

Bitcoin’s LTHs have sharply reduced their net realized cap, from $28 billion down to just $2 billion.

The green wave of accumulation has collapsed, replaced by a flat line that often precedes distribution phases.

Source: CryptoQuant

Such dramatic shifts have usually foreshadowed local tops or periods of sideways movement, especially when short-term holders fail to pick up the slack. This is smart money de-risking!

Looks like some of the strongest hands in the market are no longer holding tight.

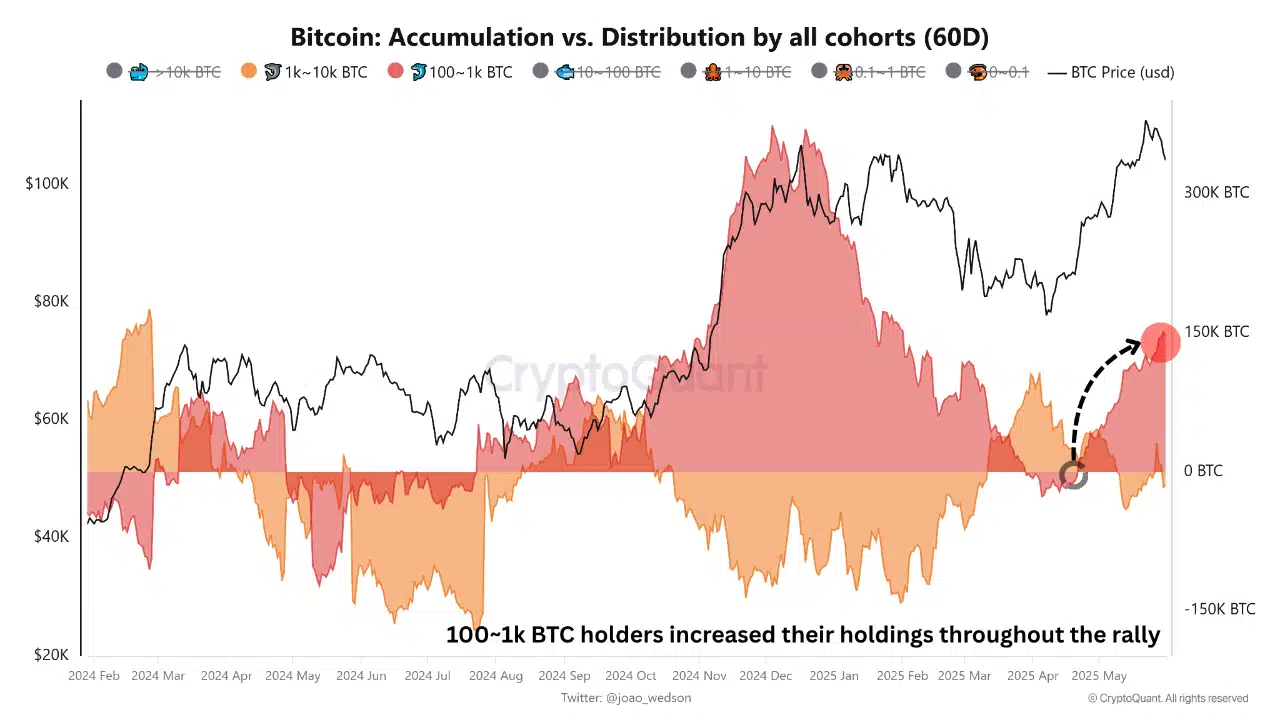

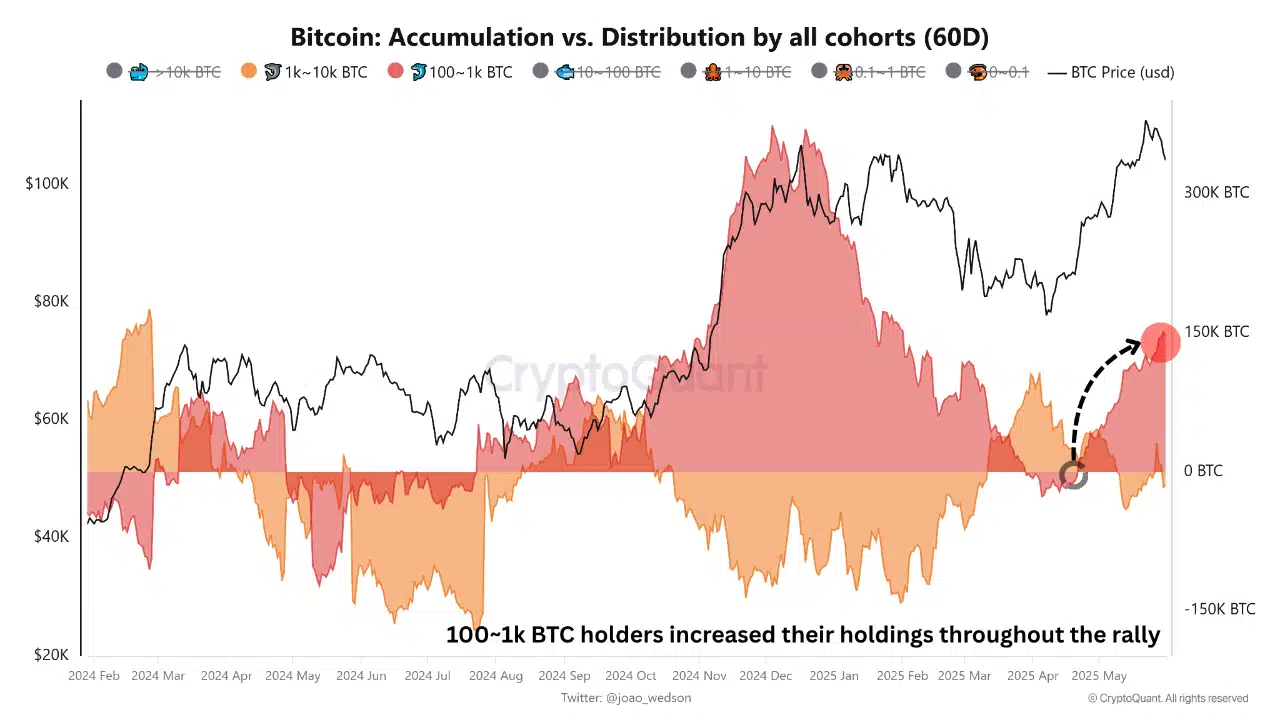

Bitcoin retail pushes while whale wallets pull back

During Bitcoin’s ascent from $81K to $110K, wallets holding 1k-10k BTC were systematically distributed, showing profit-taking at the top.

Source: CryptoQuant

In contrast, wallets holding 100-1K BTC have become net accumulators, adding strength to the rally.

Recent data reveals a shift: institutional-sized holders are selling, while smaller, retail-driven wallets continue buying. This indicates the rally is now retail-led, marking a key turning point in market dynamics.

As whale conviction weakens, retail investors now bear the responsibility of sustaining the uptrend. But with institutions pulling back, is the market entering a vulnerable phase?

The baton has passed—it’s now retail’s rally to carry or lose.