- GENIUS Act faces over 60 amendments, sparking intense bipartisan negotiations in the Senate.

- Revised bill improves rules for stablecoin issuers and sets clearer standards for foreign regulators.

Senator Bill Hagerty’s proposed GENIUS Act is quickly becoming a focal point of legislative debate in the U.S. Senate, with mounting anticipation surrounding its potential impact on stablecoin regulation.

GENIUS Act faces hurdles

The bill, which recently cleared a key procedural hurdle on the 19th of May, is now under intense scrutiny as lawmakers struggle with over 60 proposed amendments.

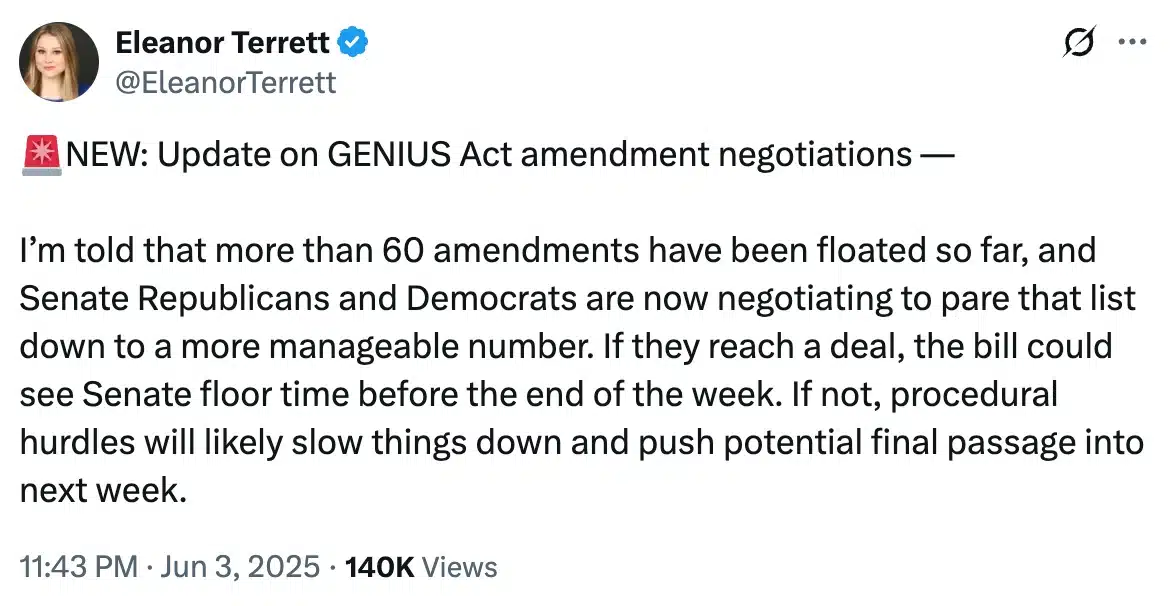

According to journalist Eleanor Terrett, these amendments have sparked active negotiations between Senate Republicans and Democrats, each aiming to streamline the legislative process before the measure hits the Senate floor.

Source: Eleanor Terrett/X

While many of the revisions were made before the closure vote, new discussions continue to emerge, particularly around provisions addressing conflicts of interest.

Although the GENIUS Act initially flew under the radar, recent negotiations have thrust it into the spotlight, revealing its growing importance across party lines.

From amendments to final legislation

That being said, a central feature of the bill empowers the Treasury Secretary to grant ‘safe harbor’ exemptions to stablecoin issuers, particularly during exceptional emergencies.

However, new amendments now require the Secretary to provide a formal explanation to key congressional committees when invoking these powers.

Additionally, while the bill permits recognition of foreign stablecoins from jurisdictions with similar regulatory standards, updated language mandates public justification and grants the Stablecoin Certification Review Committee the authority to override those decisions.

Henceforth, the latest revisions to the GENIUS Act reflect growing concerns around regulatory authority and potential conflicts of interest.

A recent amendment now requires foreign jurisdictions to meet not only comparable standards for stablecoin issuers but also demonstrate robust anti-money laundering controls and enforcement mechanisms.

While these updates enhance oversight, they stop short of resolving deeper structural concerns, particularly the Treasury’s dual role as both a debt issuer and regulator of stablecoin entities that invest heavily in U.S. Treasuries.

In conclusion, with over 60 amendments still under negotiation and bipartisan support essential for progress, the coming days will be crucial in determining whether the GENIUS Act advances or stalls amid procedural hurdles.