- Bitcoin fell 7.21% from its ATH, now hovering near $102K amid stalled retail activity.

- BTC now faces dual resistance at $103.5K (Fib) and $107.4K (SAR) with fading bullish momentum.

Bitcoin [BTC] retreated from its recent all-time high of $111K and traded at $102,994 at press time. This nearly 7.21% decline has triggered visible hesitation among retail traders.

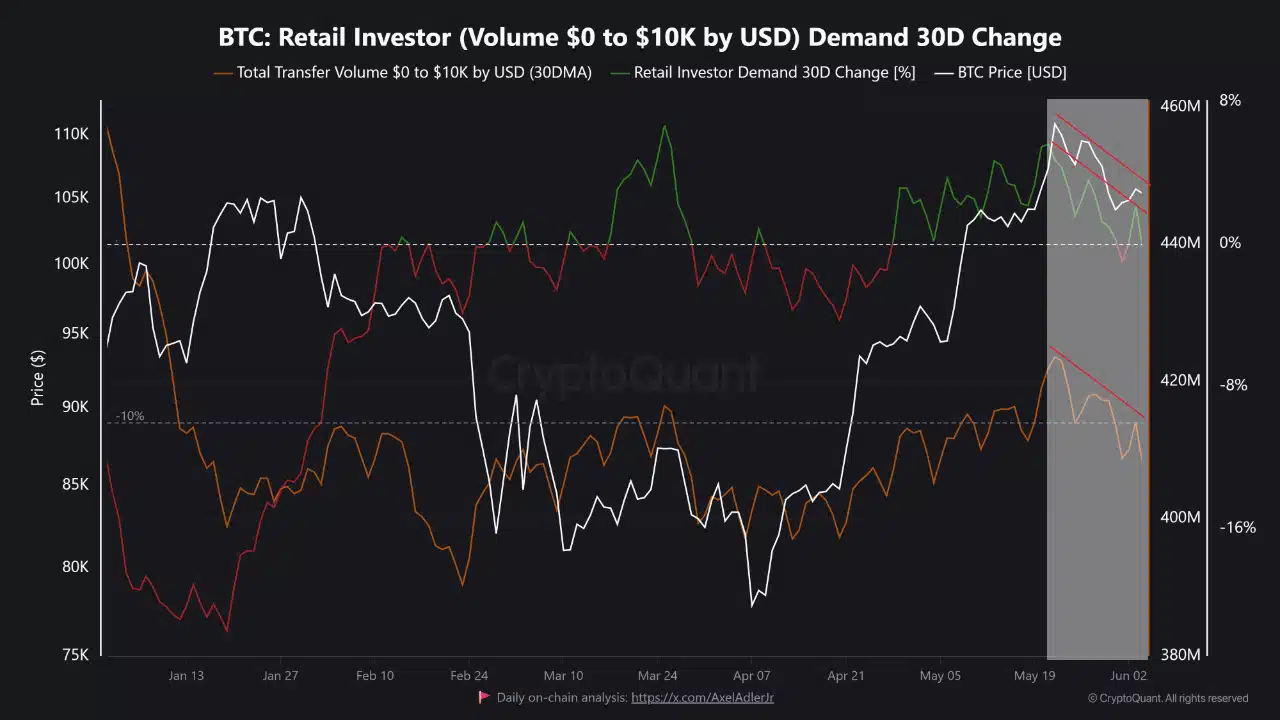

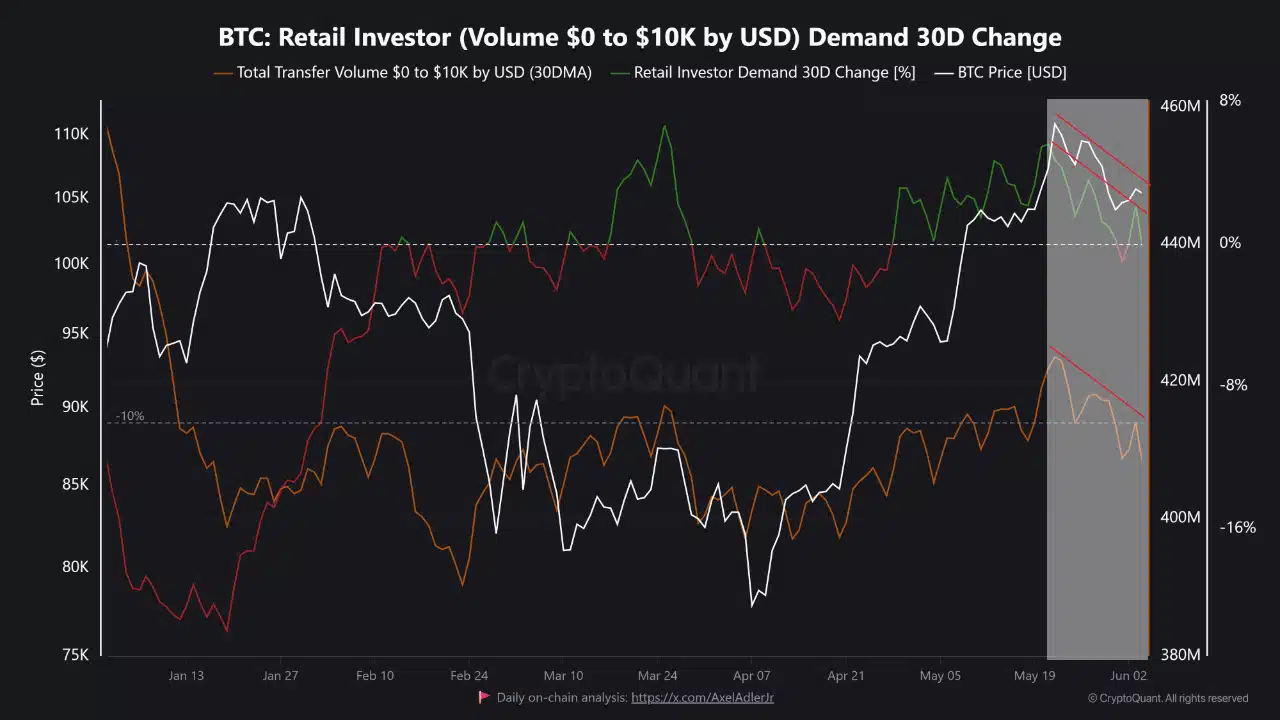

The Total Transfer Volume ($0–$10K) fell from $423 million to $408 million. At the same time, the Retail Investor Demand 30D Change dropped from +5% to -0.11%.

This fading enthusiasm from smaller participants underscores weakening momentum.

Therefore, Bitcoin may struggle to reclaim its recent highs without renewed engagement from this segment or sustain a stable rebound.

Source: CryptoQuant

Buyers remain inactive

Interestingly, Exchange Reserve dropped 2.16% to $244.01B, suggesting fewer coins are being held on trading platforms.

This typically signals reduced selling pressure, as assets are moved off exchanges into custody wallets.

However, the concurrent price drop shows buyers have not absorbed this shift. In effect, sellers may be stepping aside, but demand remains muted.

Therefore, the declining reserve alone fails to deliver a bullish impact. Bitcoin requires strong spot inflows and active accumulation to respond positively — neither of which appears visible in the current environment.

Source: CryptoQuant

BTC dormant wallets stay quiet as volatility returns

Supply-Adjusted Coin Days Destroyed (CDD) rose only 0.29%, signaling minimal activity from long-term holders. This low movement reflects strategic inaction rather than panic or distribution.

Their decision to stay sidelined suggests confidence in Bitcoin’s long-term narrative, but hesitation in the short term.

Of course, this reduces the risk of a panic-driven selloff—but it also limits any chance of momentum returning without their support.

Source: CryptoQuant

SAR confirms Bitcoin’s weakness

Bitcoin failed to hold above the 0.236 Fibonacci retracement at $103,592, trading around $102,994 at press time. Meanwhile, Parabolic SAR resistance has formed overhead at $107,439.

These two levels mark significant barriers that have rejected recent attempts to regain momentum. The overall structure shows a weakening trend, with bulls unable to maintain control above key technical thresholds.

Therefore, as long as the price remains below the Fib and SAR resistance zones, sellers will continue to dominate the short-term narrative. A reclaim above $104K is now essential to shift sentiment back to bullish.

Source: TradingView

Will weak liquidity cap the rebound?

With Retail Demand dipping, Exchange Reserves falling without follow-through, and Supply-Adjusted CDD showing little action, Bitcoin seems poised for a range-bound phase.

Until meaningful demand returns through retail inflows or long-term accumulation, Bitcoin could remain capped below major resistance.

Therefore, recovery depends not just on fewer sellers but on fresh conviction, strong volume, and reclaiming key levels.