- As of June, Hyperliquid was the third-largest player in the Bitcoin perpetual market.

- HYPE outperformed BNB by 230% and got its first corporate treasury company.

The Hyperliquid [HYPE] DEX (decentralized exchange) has become a real competitor to Binance [BNB] exchange, according to high-frequency trading firm Jump Trading.

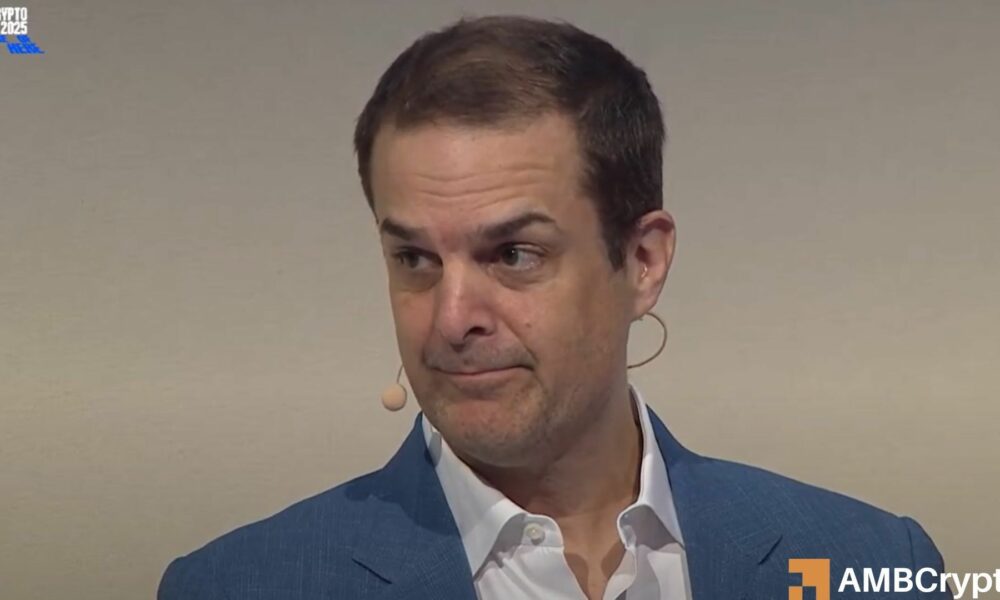

In a discussion session during the 2025 Coinbase State of Crypto Summit, Dave Olsen, CIO at Jump Trading, said,

“Hyperliquid is turning a lot of heads. They are the first meaningful competitor to Binance. They’re exposing some of the regulatory gaps in the regulatory framework to have U.S participation.”

He was highlighting some of the crucial observations he had seen in 2025, and Hyperliquid’s on-chain execution was a major one to him.

HYPE eating BNB lunch?

For perspective on Hyperliquid’s traction, its growing dominance in the Bitcoin perpetual market is a tell-tale sign.

In mid-May, it ranked fourth after OKX and Bybit, while Binance dominated in terms of BTC Open Interest (OI).

Fast-forward to June, Hyperliquid’s BTC OI surged to nearly $3B, making it the third-largest BTC perps market after flipping OKX. It’s the only top DEX in the CEX-dominated segment.

Bybit ranked second at $5.5B, while Binance topped at $8B. Bybit could be the next in line to be flipped by Hyperliquid.

In fact, Syncracy Capital’s Ryan Watkins stated that the perps market could become a $100B opportunity in the near future, likely boosting Hyperliquid even more.

“(Perps) could easily become a $100B+ revenue opportunity within 5 years. Hyperliquid.”

TheDEX’s traction and competitiveness were also confirmed by the surging DEX to CEX ratio. Now, DEXes handle 27% of total trading volume, up from 10% in 2024.

The growth has seen its native token, HYPE, holders lock in massive gains. The altcoin has recovered by over 300% since April and hit a new record high. But the rally may be far from over.

HYPE saw its first corporate treasury company, Tony G Co-Investment Holdings. The firm bought 10K HYPE tokens at $438.82K, making it the first Strategy-like corporate treasury company for the altcoin.

This begs the question, which altcoin between HYPE and BNB could offer better investor returns in the short term?

According to the HYPE/BNB ratio, HYPE has outperformed BNB by over 230% since April lows.

Given the growing moat, HYPE may still offer better returns despite the recent dip compared to BNB. The altcoin traded at $38 at press time.

Source: HYPE/BNB ratio, TradingView