- Bitcoin’s short-lived breakout unraveled fast, as a geopolitical fakeout triggered forced liquidations.

- Will escalating macro risks continue to suppress follow-through?

On the 16th of June, Bitcoin [BTC] wicked up to $108,944, invalidating the local bearish setup with a decisive short squeeze that liquidated $45.7 million in short positions.

More critically, this breakout followed three days of compression just around the $105k resistance zone, where traders anticipated a repeat of early June’s rejection that sent BTC tumbling to $100,424.

This time, however, instead of retracing, BTC surged. So was this breakout the first confirmation of a local bottom, or will geopolitical overhangs unwind this move before follow-through materializes?

Emergency escalation sends Bitcoin tumbling

Bitcoin nearly triggered another major liquidity grab around $109,700, where traders had stacked close to $50 million in leveraged shorts. But the move fell short. Price stalled just before the sweep.

Instead, BTC reversed decisively, dropping 3.2% to an intraday low of $105,412 at press time. In the process, three long-heavy liquidity clusters got wiped out, each stacked with around $25 million in leverage.

So, what killed the setup? A macro fakeout.

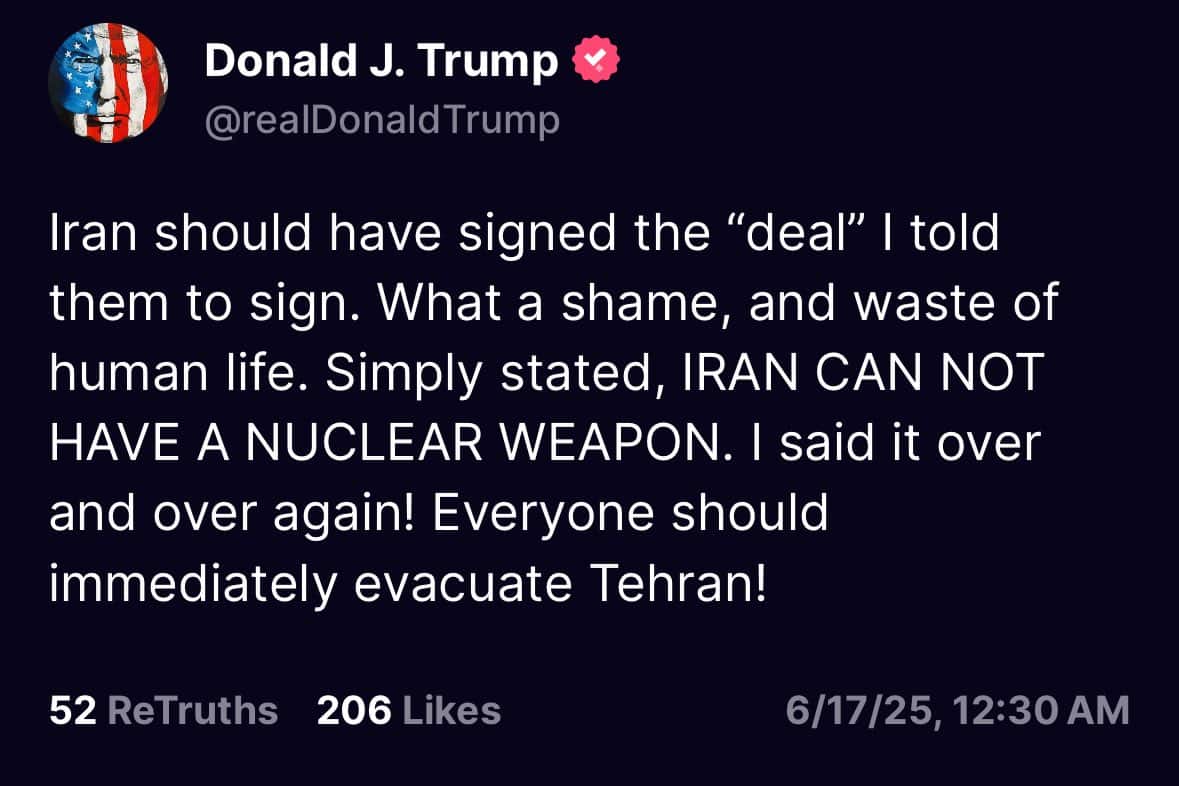

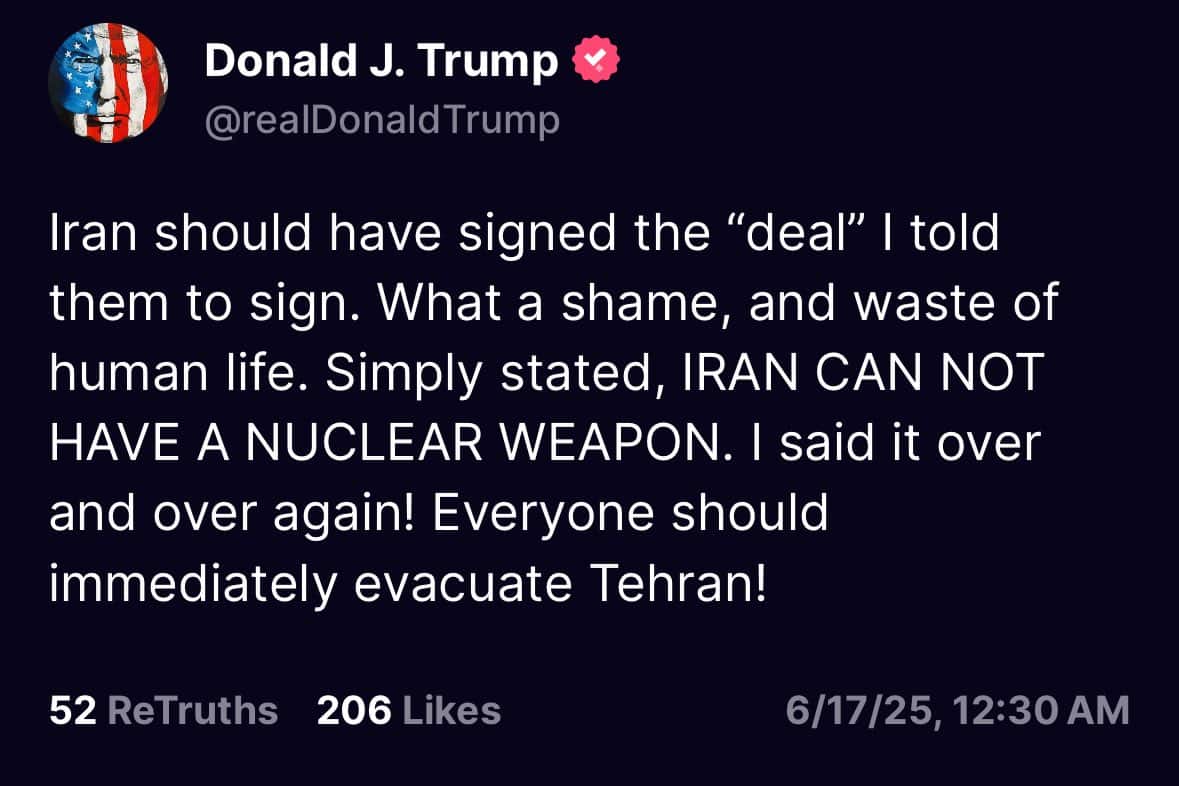

You see, the rally had been fueled by buzz that Trump had brokered a peace deal between Israel and Iran. But that narrative collapsed quickly, as he dismissed the reports and triggered an emergency alert instead.

Source: Truth Social

What came next was a classic bull trap.

Late longs jumped in chasing the move, only to get wiped as things reversed hard. Open Interest dropped 1.47%, signaling liquidations across futures, while 23,900 BTC flooded back onto exchanges, marking a 231% spike from the day before.

And yet, this feels more like the early signs of broader macro fragility. With directional conviction still missing, Bitcoin slips back into “wait-and-see” mode, caught between headlines and hesitation.

G7 interruption adds weight to the narrative

Markets moved swiftly into risk-off mode. It began with President Trump ordering an emergency evacuation in Tehran, already a high-stakes signal. But the real kicker came when he abruptly cut short his G7 visit.

But things escalated further. Fox News’ Lawrence Jones reported that Trump told the National Security Council to be on standby in the emergency situation room.

All of this piled on to growing speculation of a potential U.S. military intervention, something risk assets were quick to price in. Bitcoin, once again pinned below the $105k resistance, struggling to flip the level into confirmed bottom.

Source: TradingView (BTC/USDT)

Meanwhile, Bitcoin’s Funding Rates are still leaning heavily long, setting the stage for another potential cascade.

At this rate, a move back to $100k is looking more and more likely if the macro FUD doesn’t ease up.