- Bitcoin’s Futures Market Power dropped to 93K, signaling moderate bearish pressure.

- Despite bearish signals, bullish signals suggest the correction may be shallow and short-lived.

Bitcoin [BTC] has struggled to retest its all-time high, prompting cautious sentiment across the derivatives market.

And now, cracks are beginning to form.

Futures market starts to lean bearish

According to CryptoQuant’s analyst Axel Adler, Bitcoin’s Futures Market Power has turned bearish, dipping into negative territory. At press time, it hovered around -93k, indicating moderate skew towards bearish positions.

Source: CryptoQuant

In this context, the moderate bearish shift reflects investors’ confidence in a further move above the current ATH than a genuine threat to the overall uptrend.

Thus, although bears are rising in the Futures market, investors remain optimistic.

Compared to historical spikes like -150K in January or -450K in January 2025, this dip appears tame. In past cycles, similar drawdowns in the 50K–150K range have triggered minor 5–10% corrections.

If history repeats itself, BTC could retrace toward $93K–$98K.

That said, aggressive selling hasn’t yet shown up, suggesting this shift may be more of a hesitation than a collapse.

It’s still bullish out there

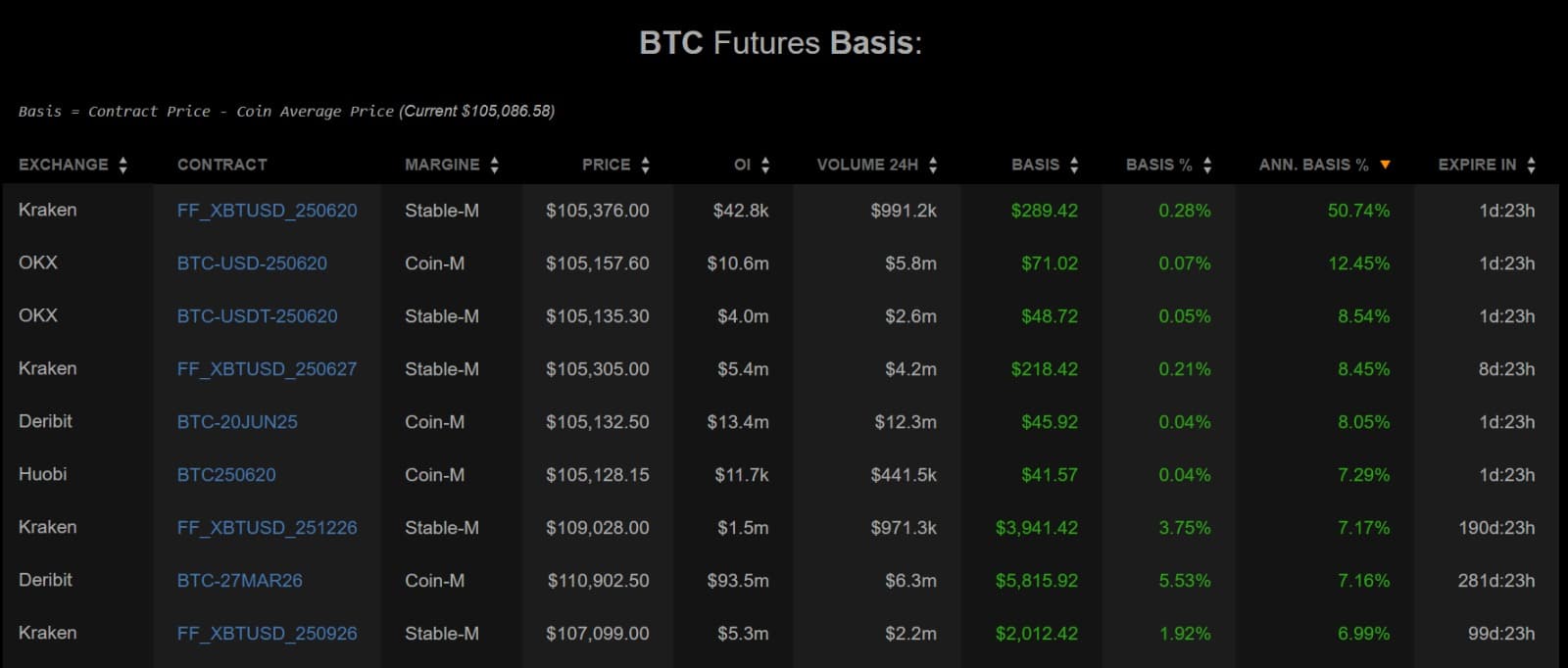

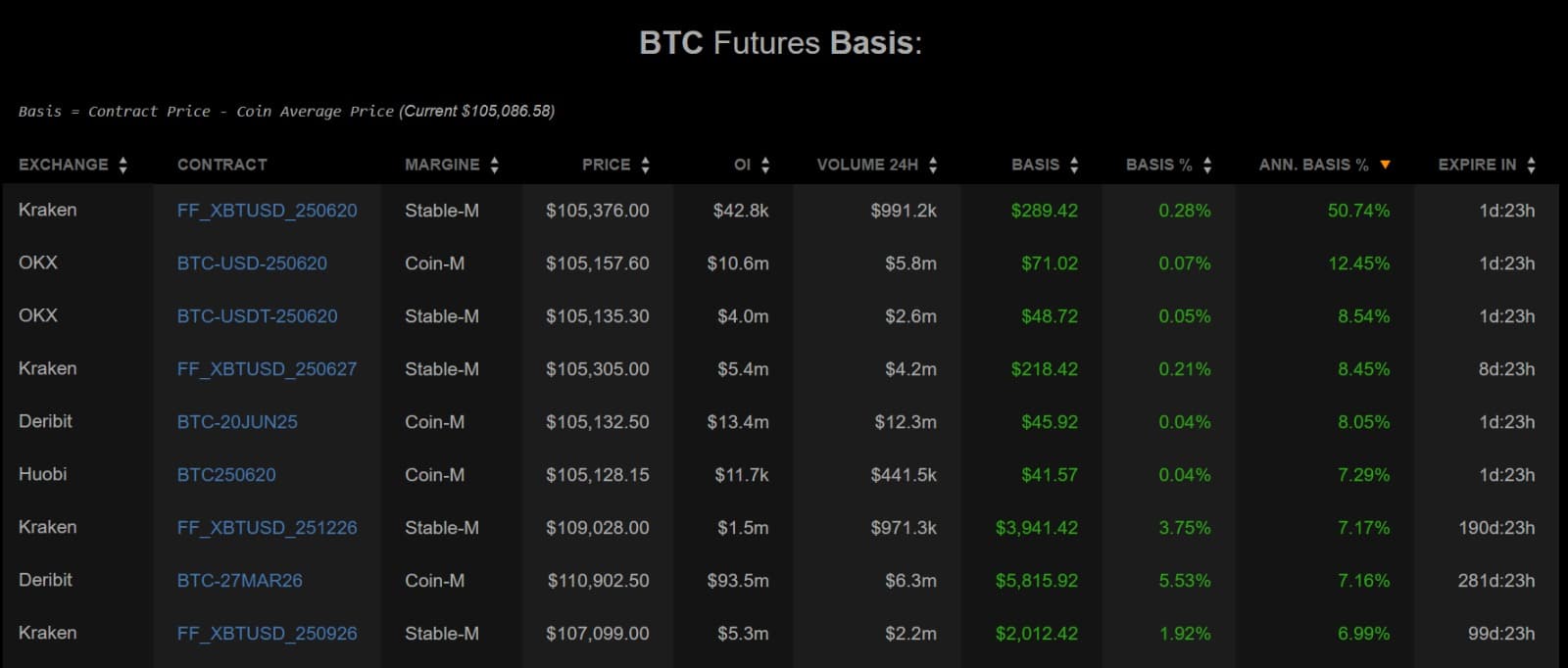

Although Bitcoin’s Futures Market Power has flipped bearish, other market fundamentals tell a different story. For starters, Bitcoin’s Futures Basis remained positive across all major exchanges, reflecting bullish bias.

Source: Coinalyze

This shows traders are willing to pay a premium to go long—a sign of continued upside expectation.

This bullishness was further evidenced by Bitcoin’s Funding Rate, which has held positive since dipping into negative territory 10 days ago.

When the Funding Rate is positive, accompanied by Futures basis, it suggests that investors are overly bullish and anticipate prices to rise even further.

Source: CryptoQuant

Additionally, Bitcoin’s Open Interest hovered near the $33B mark across the past week, indicating that traders aren’t aggressively opening new positions — neither bullish nor bearish.

Source: CryptoQuant

Had Open Interest spiked during the dip, it would have hinted at fresh shorts building. But that didn’t happen.

Final take

All said and done, this bearish flicker in Futures Market Power doesn’t seem to have the weight to derail BTC just yet. If a correction unfolds, historical support near $102,850 may act as a cushion.

On the flip side, if macro and derivative metrics hold steady, BTC could continue consolidating between $104K–$107K—remaining perched near its highs.

In short, bears may have shown up… but they haven’t taken over.