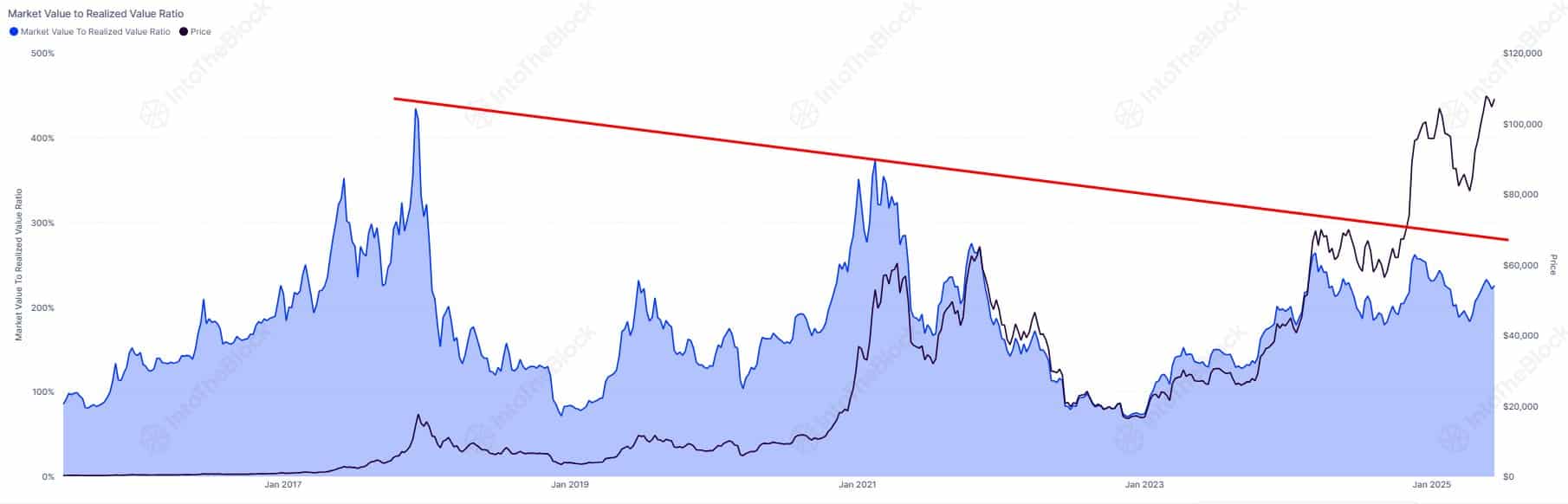

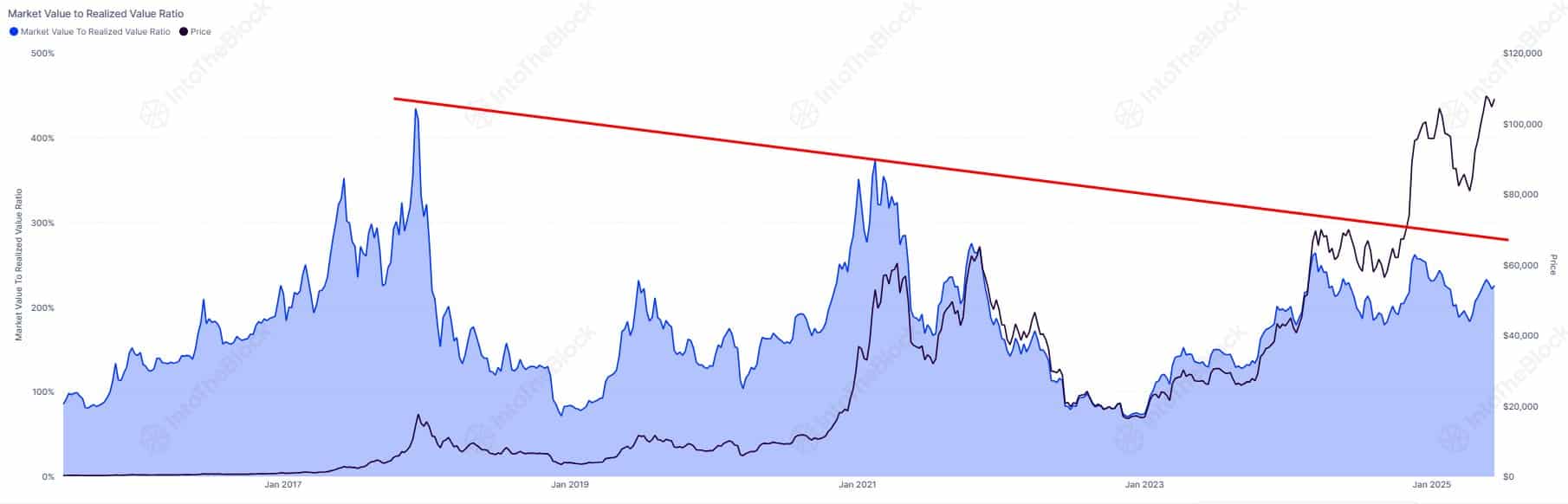

- MVRV at 2.25 suggested that Bitcoin remains far from bull market peak conditions.

- Exchange outflows rose while short-term holders stay inactive, limiting immediate selling pressure.

Bitcoin’s [BTC] continued to hover above $104K, yet several on-chain signals suggest the market hasn’t hit euphoric extremes.

In fact, a combination of undervaluation metrics, negative sentiment, and quiet short-term activity hints that the bull run may still be intact.

MVRV says: This isn’t the top—Yet

At press time, the MVRV ratio, at 2.25, remained well below prior bull market peaks despite the asset trading above $104K.

Historically, higher MVRV values have aligned with tops, but the ongoing long-term decline in this metric implies that Bitcoin might still have room to run.

Therefore, current price action reflects sustainable momentum rather than extreme speculative behavior often seen in euphoric conditions.

Source: IntoTheBlock/X

Why is sentiment negative despite Bitcoin’s rally above $100K?

Interestingly, Bitcoin’s Weighted Sentiment dropped to -0.723, revealing widespread skepticism among traders and investors.

Typically, negative sentiment during an uptrend suggests disbelief in the rally’s sustainability.

However, contrarian analysis often views this as a bullish signal, implying that the market still holds potential for upside. As crowd doubt persists, fewer participants are likely to take profits prematurely.

Consequently, sentiment-driven resistance remains weak, supporting the possibility of continued price expansion in the near term.

Source: Santiment

Could BTC NVT and Puell Multiple be hinting at undervaluation?

Both the NVT Golden Cross and Puell Multiple declined by over 23% and 25%, respectively.

Together, these suggest that Bitcoin’s price is still catching up with on-chain fundamentals. Miners aren’t showing stress, and network activity isn’t in overdrive.

In other words—no froth. This points to value-driven growth rather than a speculative surge.

Source: CryptoQuant

Are BTC investors shifting towards long-term holding?

On-chain exchange metrics show a 10.72% increase in outflows and a 10.27% decline in inflows.

This behavior signals that more Bitcoin is being withdrawn from exchanges than deposited. Such a pattern usually reflects investor intent to hold rather than sell, thereby decreasing short-term selling pressure.

Additionally, strong outflows often precede supply squeezes, amplifying upward momentum when demand increases. Hence, this reinforces the narrative of confidence among holders during the rally.

Source: CryptoQuant

Why are short-term holders unusually quiet during this surge?

Realized Cap HODL Waves data shows short-term (0d–1d) activity at just 0.278, a significantly low level during a bullish run.

Typically, this metric spikes when new investors take profits during rapid price increases. However, the subdued behavior here indicates that short-term holders are not actively cashing out.

As a result, the lack of fresh selling reduces overhead pressure and strengthens the case for sustained upward momentum, with seasoned holders remaining in control.

Source: Santiment

Will long liquidations trigger the next major correction?

According to Binance’s Liquidation Map, a large cluster of long liquidations sits just below the $104K level.

If prices fall below this threshold, it could trigger cascading forced sell-offs, intensifying downward volatility.

However, significant short positions lie just above, suggesting potential for a short squeeze if the price breaks higher instead.

Therefore, the market remains at a critical crossroads where leverage dynamics could dictate the next decisive move.

Source: Coinglass

Bitcoin’s rally above $100K has not triggered traditional signs of market overheating, as on-chain indicators remain neutral or even bullish.

Negative sentiment, declining valuation metrics, and holding behavior suggest the uptrend may still have fuel.

However, elevated long-term liquidation levels highlight short-term risk if support breaks.

Overall, the data paints a picture of cautious optimism, where fundamental strength remains intact, yet leverage and sentiment could shape near-term volatility.