- Ethereum’s network activity and whale accumulation highlighted bullish alignment despite range-bound price

- Rising scarcity and cooling speculative demand could support a long-term breakout above $2,833

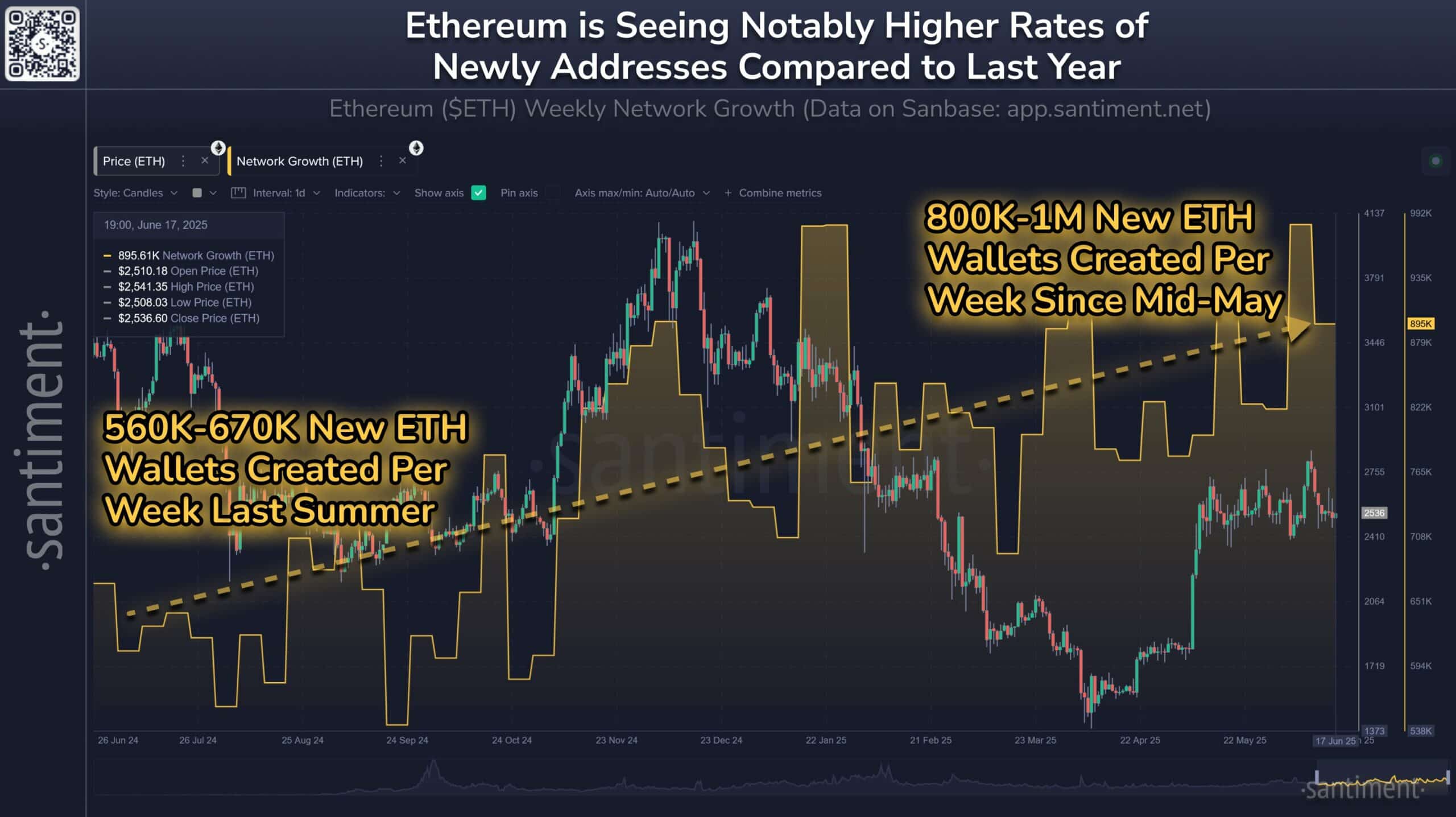

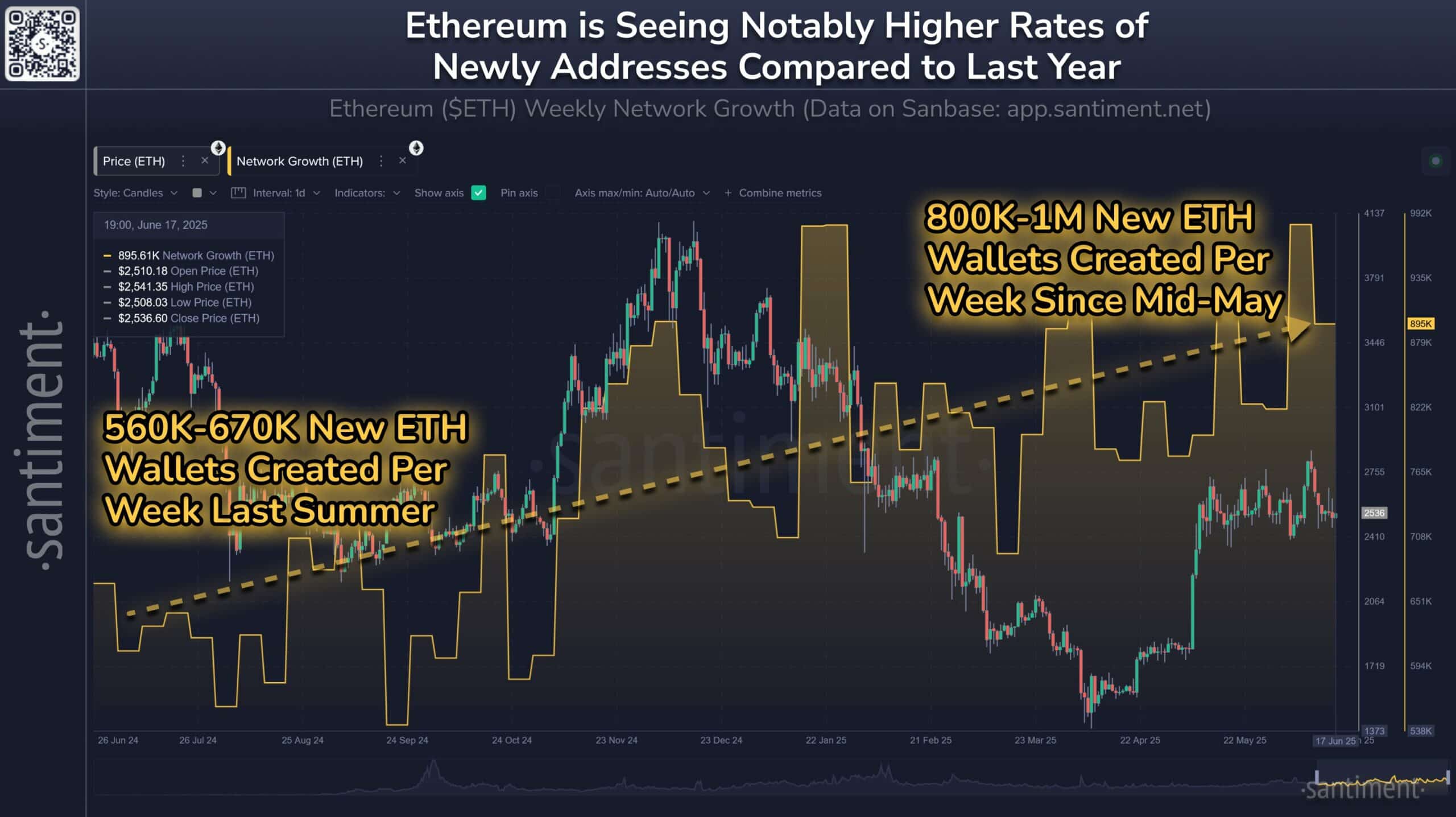

Ethereum [ETH] has seen a consistent uptick in weekly address creation lately, ranging between 800k and 1M since mid-May – Up from 560k–670k this time last year.

With ETH trading within a narrow band near $2,500, the surge in new wallets could mean that the network’s fundamentals are strengthening rapidly.

A hike in user participation often signals deeper utility adoption, particularly when wallet creation grows alongside stable price action.

Therefore, Ethereum’s expanding network base may serve as a foundation for stronger demand and long-term valuation support.

Source: Santiment/X

Are whales quietly returning to accumulate ETH?

Large holder netflows have reversed sharply over the past week, rising by over 7,400% after weeks of muted activity. This spike followed a prolonged period of negative flows, which may have signaled distribution or repositioning.

Now, the renewed inflows could mean growing confidence among whales. This trend also seemed to coincide with steady price support, possibly reflecting strategic accumulation.

Additionally, this whale behavior could precede a supply crunch if the trend continues. Therefore, the latest accumulation trend by large holders may signal the start of a more bullish phase.

Source: IntoTheBlock

Will Ethereum’s price break free from its consolidation pattern?

ETH has remained locked in a range between $2,396 and $2,833, respecting an ascending channel structure.

Despite multiple attempts, bulls have struggled to breach the $2,833 resistance, while bears have failed to break below the $2,396 support. This price compression reflects indecision, but something like this often precedes explosive movement.

At the time of writing, the Stochastic RSI was low – Implying an incoming reversal if buying pressure increases. Until a breakout occurs, the price will likely oscillate in this tight zone. However, growing fundamentals may soon tip the balance.

Source: TradingView

Is ETH shifting from short-term hype to long-term value?

Finally, ETH’s short-term holder activity, measured by the 0–1 day Realized Cap HODL Waves, saw a decline after weeks of sharp spikes. This suggested that recent buyers may be exiting or taking profits, reducing short-term volatility and easing sell pressure.

At the same time, ETH’s Stock-to-Flow ratio surged to 43.2—its highest in months—indicating growing scarcity as new issuance slowed down.

This combination of fading speculative behavior and rising long-term value metrics could set the stage for a more sustainable upward move.

If long-term demand persists, ETH may soon break its current price ceiling and shift firmly into accumulation territory.

Source: Santiment

Is Ethereum gearing up for a breakout beyond $2,800?

Ethereum’s on-chain strength is becoming increasingly difficult to ignore. With new wallet creation accelerating, whales returning, and scarcity metrics like Stock-to-Flow spiking, the fundamentals may be aligning for a potential rally.

While the price remains trapped within a defined range, the rising network activity and declining short-term holder momentum could soon shift the balance. If bullish pressure holds, ETH may break past $2,800.