- Despite PENGU’s 32% price surge, negative funding and weak sentiment suggested that traders remain skeptical.

- Liquidation clusters above $0.010 could drive a breakout toward the $0.012 resistance.

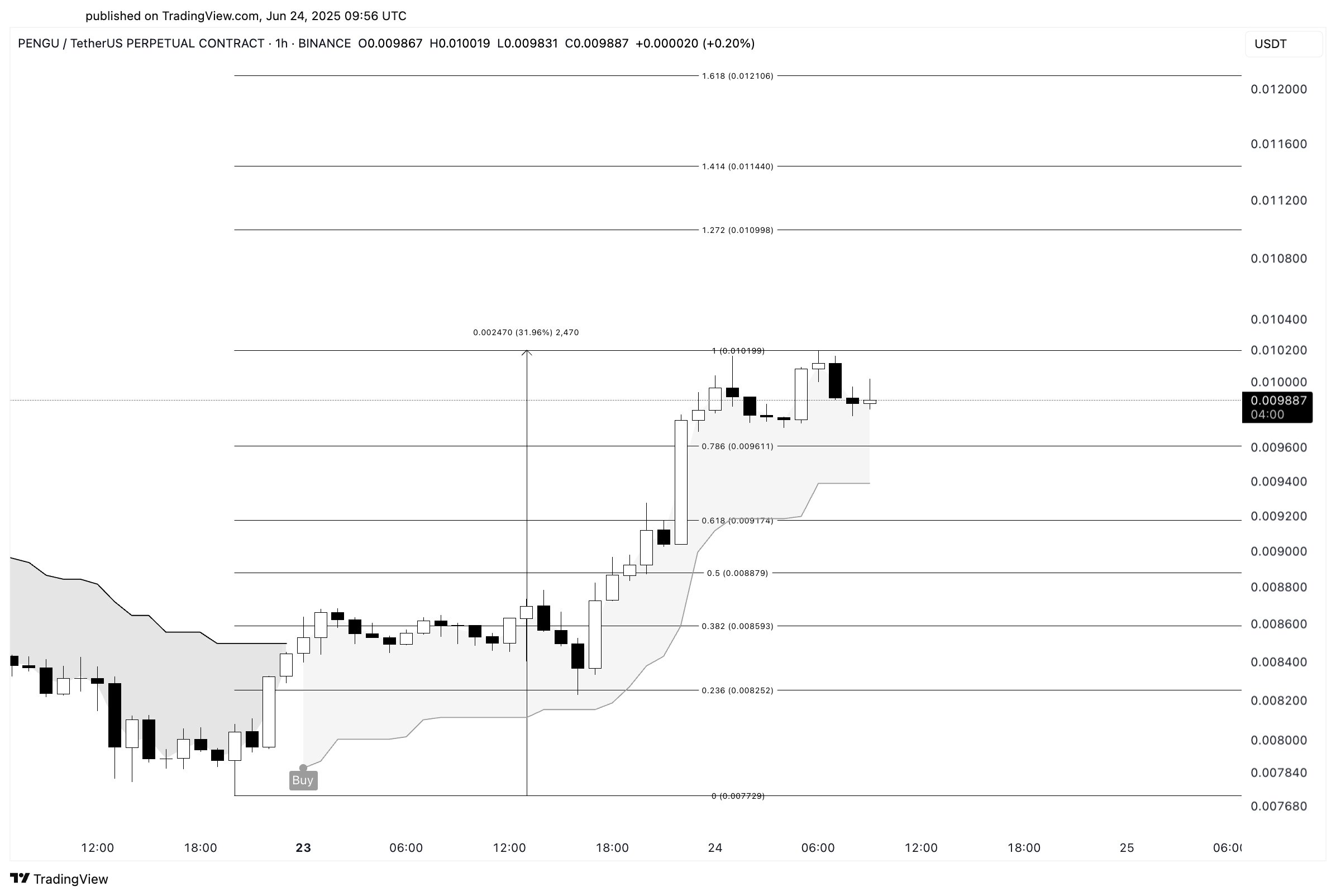

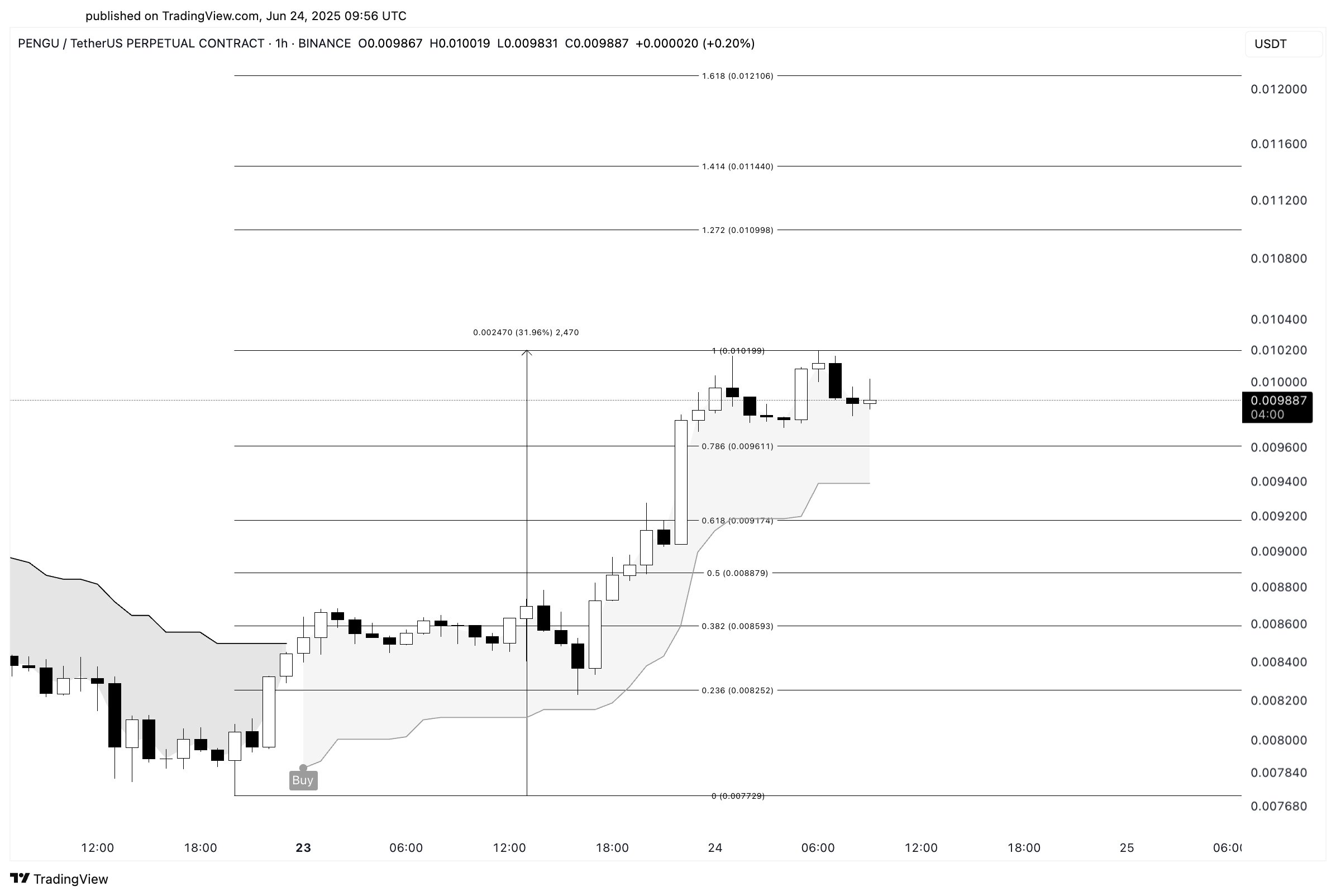

Pudgy Penguins [PENGU] soared 32% after its NYSE debut alongside VanEck on the 23rd of June, briefly challenging the key $0.010 resistance level.

Despite the initial surge, the token couldn’t hold above the key level and was trading at $0.009773 at the time of writing.

The price closely aligns with the 1.0 Fibonacci extension, a level that often acts as strong resistance. Although the recent listing fueled the spike, trader sentiment remains cautious.

To confirm a breakout, traders will look for more than just hype—solid indicators like inflows, positive sentiment, and technical confirmation are essential.

Source: X/Ali

Are PENGU Funding Rate flips hinting at trader indecision?

Funding Rates across Binance have remained erratic, swinging between positive and negative throughout June.

Although the asset’s price climbed significantly in the past 24 hours, funding rates have hovered below neutral territory, suggesting a short bias among leveraged traders.

This persistent negativity may imply that traders are either hedging against a fakeout or simply lacking confidence in a sustained rally.

Therefore, even with the NYSE buzz, Open Interest behavior shows reluctance to follow through. A decisive move above $0.010 might be needed to shift sentiment among derivative traders.

Source: Santiment

Do recent spot inflows signal real demand or just…

Recent net inflow data shows a $46.8K increase on the 25th of June, indicating some accumulation after weeks of steady outflows.

However, this inflow is modest compared to the much larger outflows seen earlier in the month, suggesting the buying may be opportunistic rather than driven by strong conviction.

If traders were positioning for a sustained breakout, we’d likely see more consistent and sizable inflows. For now, the data leans more toward caution than a confirmed bullish trend.

Source: CoinGlass

Why hasn’t sentiment caught up with the price jump?

Despite a brief 32% surge, Weighted Sentiment has barely moved, sitting at -0.17. This neutral-to-bearish reading implies that the broader crowd remains unconvinced by PENGU’s upward move.

Social discussions have yet to gain real traction, and the absence of euphoric sentiment could either be a bullish contrarian indicator or a warning sign. Historically, price rallies without community backing struggle to maintain altitude.

Therefore, unless sentiment improves, this price recovery could lose momentum just as quickly as it formed.

Source: Santiment

Is PENGU’s technical momentum enough to sustain the upside?

Technicals paint a mixed picture, with the Bollinger Bands indicating volatility compression while MACD hovered near equilibrium, at press time.

The MACD lines, although marginally bullish, do not yet reflect a strong directional shift. These signals suggest that bulls lack full control and must assert dominance soon.

Without clearer momentum confirmation, the rally risks reversal if the price continues to stall below $0.010.

Source: TradingView

Will liquidation clusters above $0.010 fuel the next breakout?

Liquidation heatmaps revealed dense clusters just above $0.010, especially between $0.0102 and $0.0106.

If the price breaks through this zone, it could trigger a wave of short liquidations and fuel a sharp upward move. Until then, these levels remain a resistance barrier.

Traders should watch closely to see if the price can break and hold above this range. Clearing it could open the path toward the $0.012 Fibonacci extension.

Source: CoinGlass

PENGU’s 32% surge reflects renewed excitement, but metrics like sentiment, inflow strength, and technical signals reveal hesitation.

If bulls can flip $0.010 into support, aided by liquidations and stronger conviction, a sustained push toward $0.012 becomes more plausible.

Until then, the move appears promising, but not yet confirmed.