- Long-term Bitcoin holders are taking some profits, which is a sign of “recalibrated expectations.”

- BTC Open Interest spikes and a rising Stock-to-Flow ratio hint at volatility and scarcity.

Bitcoin [BTC] climbed 1.33% in 24 hours to trade at $107,842 on the 26th of June, shaking off short-term panic. However, deeper metrics painted a more cautious picture.

BTC fear fades, but confidence doesn’t follow

BTC’s 25 Delta Skew—a measure of trader sentiment—saw its 1-week reading fall from over 10% to just 2.96%. This reflected reduced panic among traders. Still, not all is calm.

The 3-month and 6-month Skews stayed negative at -2.6% and -4.3%, respectively. That implies medium-term uncertainty hasn’t gone away.

Notably, Options volumes still favor puts, pointing to defensive positioning among larger players.

Therefore, although immediate downside fear has receded, underlying sentiment revealed that investors have yet to regain full bullish confidence.

Are traders fueling the fire with THIS?

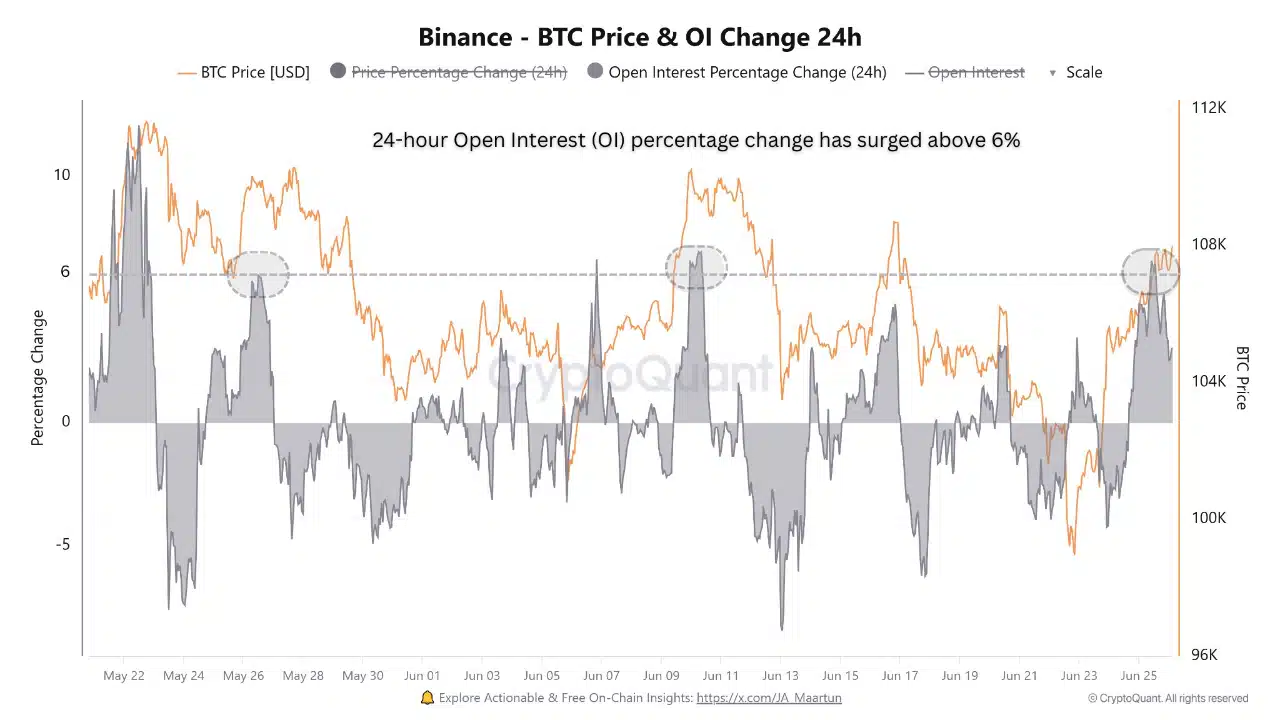

Binance’s Open Interest surged above 6% for the third time in two months, marking a notable uptick in speculative positioning. Each of the last spikes in May and June preceded sell-offs and temporary slowdowns.

Naturally, this hints at an uptick in speculative trades and an overheated short-term environment, even as BTC’s price looks stable. In short, leverage is back on the rise.

Is long-term confidence slipping?

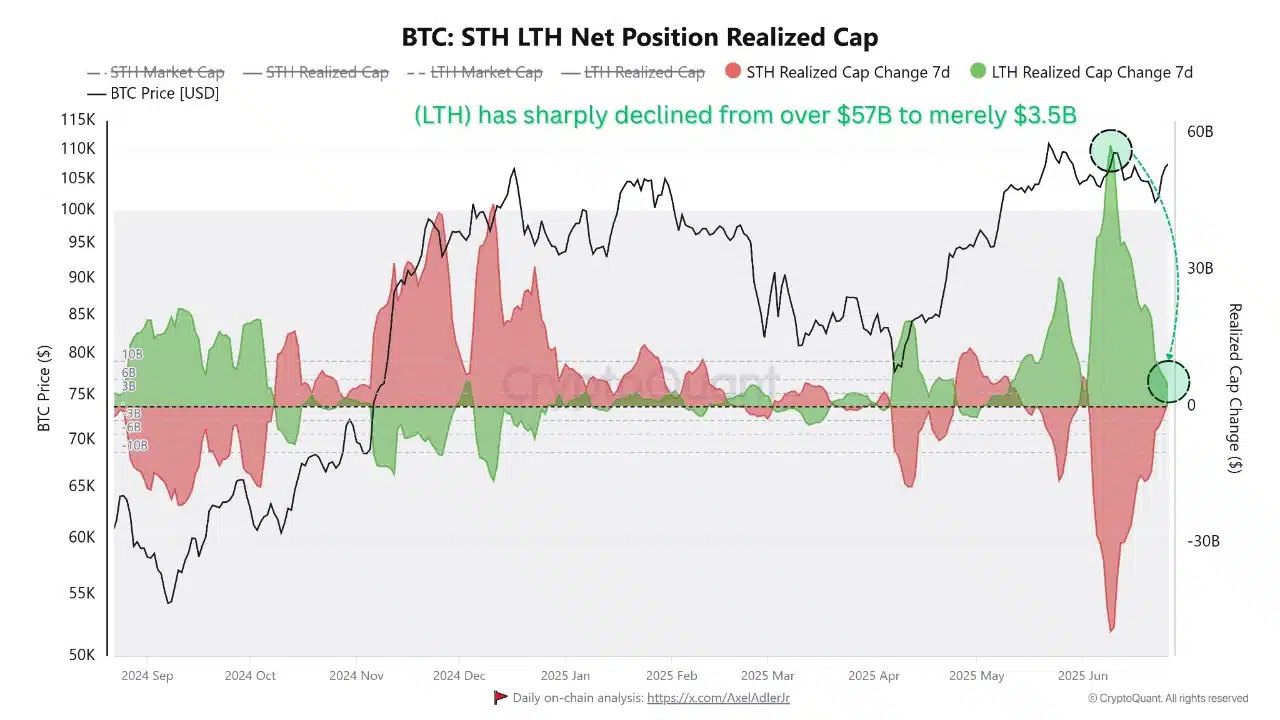

The Long-Term Holder Net Position Realized Cap dropped from over $57 billion to just $3.5 billion, revealing major profit-taking.

This plunge showed that LTHs, typically the market’s most patient cohort, have started trimming exposure after significant gains.

Of course, this doesn’t scream panic. It’s more likely calculated de-risking, with no major bearish catalysts in sight.

But such a steep drop still signals recalibrated expectations, possibly linked to macro uncertainty or halving fatigue.

Can BTC stay grounded without overheating?

Exchange-wide trading volumes have tapered, according to CryptoQuant’s bubble chart. Despite BTC hovering near ATH, no signs of frenzy emerged.

Most volume bubbles remain neutral to blue, reinforcing a healthy environment where price moves aren’t driven by fear or greed.

That stability gives Bitcoin room to consolidate, rather than whip around. Instead of overheating, the market might just be taking a breath before its next leg up.

Finally, will THIS push BTC into a new cycle?

Bitcoin’s Stock-to-Flow ratio surged to 387, not to mention its highest in recent months. This metric tracks how many years it would take to mine BTC at current rates.

While it’s not an all-time high, the sharp rise reflects growing demand versus diminishing supply, potentially creating upward pressure.

However, the timing of such effects often lags. Therefore, while this spike strengthens BTC’s fundamental value narrative, it does not yet guarantee short-term upside without supportive price action.

Although fear has declined and the market avoids overheating, caution from LTHs and rising speculation introduce complexity.

BTC must navigate this tightrope carefully—balancing healthy consolidation with increasing leverage—to build the foundation for its next major move.