- Positive Funding Rates and Taker Buy Dominance support ETH’s climb above $2.4K.

- On-chain weakness and exchange inflows raise concerns of a potential short-term slowdown.

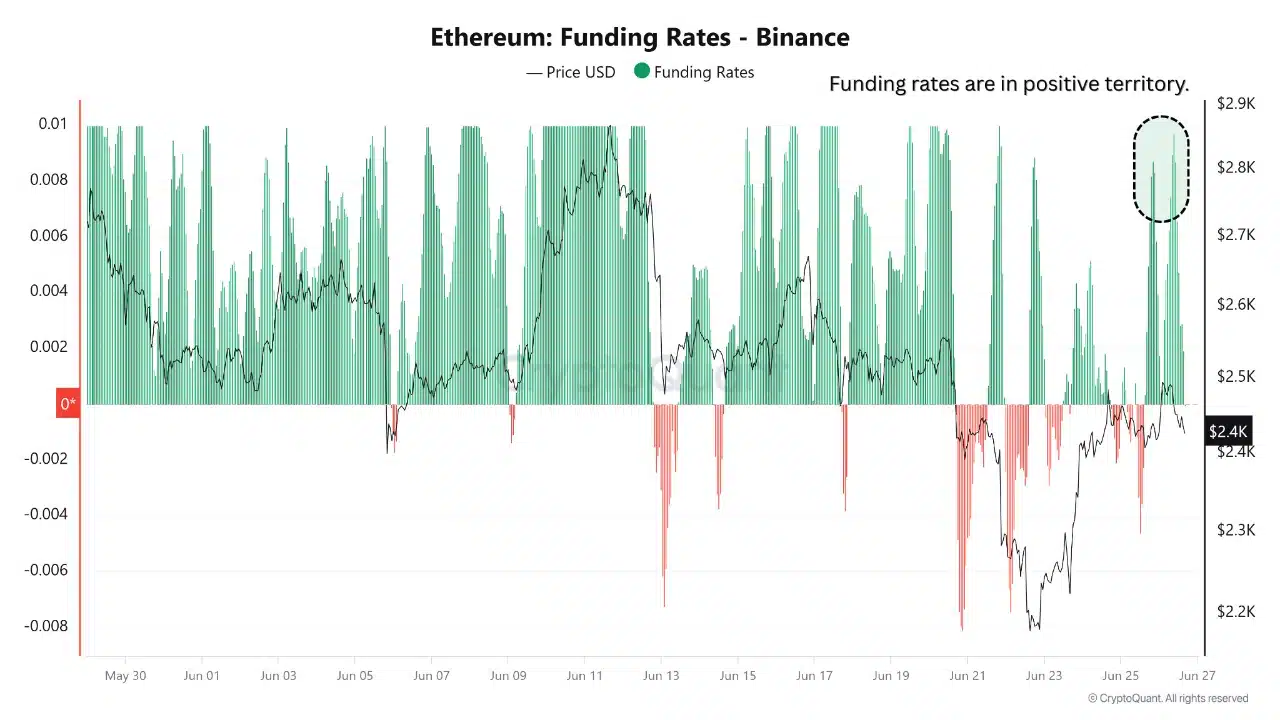

Ethereum [ETH] has posted a strong rebound in recent sessions, reclaiming the $2,400 level as derivatives Funding Rates on Binance turned positive.

This shift revealed an influx of leveraged long positions as traders bet on further upside.

However, over 177,000 ETH flowed into Binance over the past three days, hinting at possible profit-taking by large holders. This raised short-term risk despite a structurally bullish bias.

Therefore, while sentiment has flipped in favor of buyers, rising exchange inflows suggest caution as market participants reassess near-term upside potential.

Another leg higher

ETH continued to trade within a rising channel pattern, having bounced from its lower trendline near $2,195 and consolidating above $2,400 at press time.

The RSI remained neutral at 47, indicating that the asset had room to move in either direction without being overbought or oversold.

This channel structure has historically supported bullish continuation patterns. However, buyers must defend this zone to avoid slipping back below $2,200.

Therefore, the ongoing price stability within this range could serve as a springboard if broader sentiment remains intact.

Source: TradingView

Is Ethereum losing on-chain strength?

Ethereum’s on-chain activity showed a weakening divergence between price and daily active addresses. At press time, the DAA divergence, which previously spiked positively, had begun to retreat.

This implied that address growth was not keeping pace with the price action, weakening the underlying support for the ongoing recovery.

While ETH has maintained levels above $2,400, the fading divergence may limit sustained bullish momentum.

Therefore, Ethereum needs renewed network participation to avoid stagnation and reinforce the recent price rebound.

ETH’s transaction activity collapses

Despite bullish technical structure, Ethereum’s daily transaction count has sharply declined to 337K — a steep drop compared to recent averages.

This fall in activity suggests a potential disconnection between price action and actual network usage.

Therefore, even as traders engage in leveraged buying, on-chain user activity appears to be weakening. If this continues, the lack of transactional demand could undermine the price rally.

Consequently, Ethereum’s next move may depend heavily on whether user engagement rebounds swiftly.

Are aggressive buyers keeping Ethereum afloat?

Spot taker CVD signals showed that Ethereum was experiencing dominant buy-side pressure at press time. This reflected continued confidence among market participants, who executed more market buys than sells.

Such behavior typically aligns with short-term bullish trends and reinforces current price levels.

However, given the conflicting drop in derivatives volume and on-chain metrics, this taker buy dominance must sustain to prevent a reversal.

Bulls remain in control for now, but momentum requires broad-based support to last.

Can ETH hold its ground amid mixed signals?

Ethereum’s recovery above $2,400 shows technical and derivative market strength, but fading on-chain metrics and rising exchange inflows create caution.

If taker demand persists and network activity recovers, ETH may continue its upward trajectory. However, unless address growth and transaction volume bounce back, price momentum could stall below $2,500.