In brief

- Prediction market users on Myriad place the odds at 65% that Bitcoin will defend $100K throughout July.

- Those odds reveal strong bullish sentiment, despite technical indicators suggestion caution.

- Bitcoin trading and price data suggests it could be a closer call than the odds currently indicate.

Will Bitcoin stay above $100,000 throughout the month of July? Bitcoin holders are placing their bets on the world’s largest cryptocurrency maintaining its six-figure status, with prediction markets revealing a surge of optimism despite concerning technical signals.

Currently trading just below $108,000, Bitcoin sits roughly 8% above the psychologically crucial $100,000 level—but will this cushion be enough?

On Myriad, a prediction market developed by Decrypt‘s parent company Dastan, the market “BTC above $100K throughout July?” has attracted $12.4K in trading volume with remarkably bullish positioning. Traders have pushed the odds of Bitcoin successfully defending $100K from an even 50-50 split on July 4 to a confident 64.5% just three days later.

This optimism persists despite Bitcoin needing to avoid even a brief wick below $100K for the entire month. Unlike markets asking where Bitcoin will end July, this bet resolves to “No” if BTC even touches $99,999 or below—at any point for any length of time—making it a pure test of support strength.

Bitcoin: The $100K line in the sand

For context, Bitcoin has been trading above $100,000 since early May, establishing this level as a key psychological support, meaning that stakes are high. A breach below $100K, even momentarily, would not only resolve the Myriad market as “No” but could trigger cascading sell orders from traders who view this level as the line between bull and bear markets. Conversely, successfully defending $100K through July would reinforce it as a stable floor, potentially setting the stage for another assault on all-time highs.

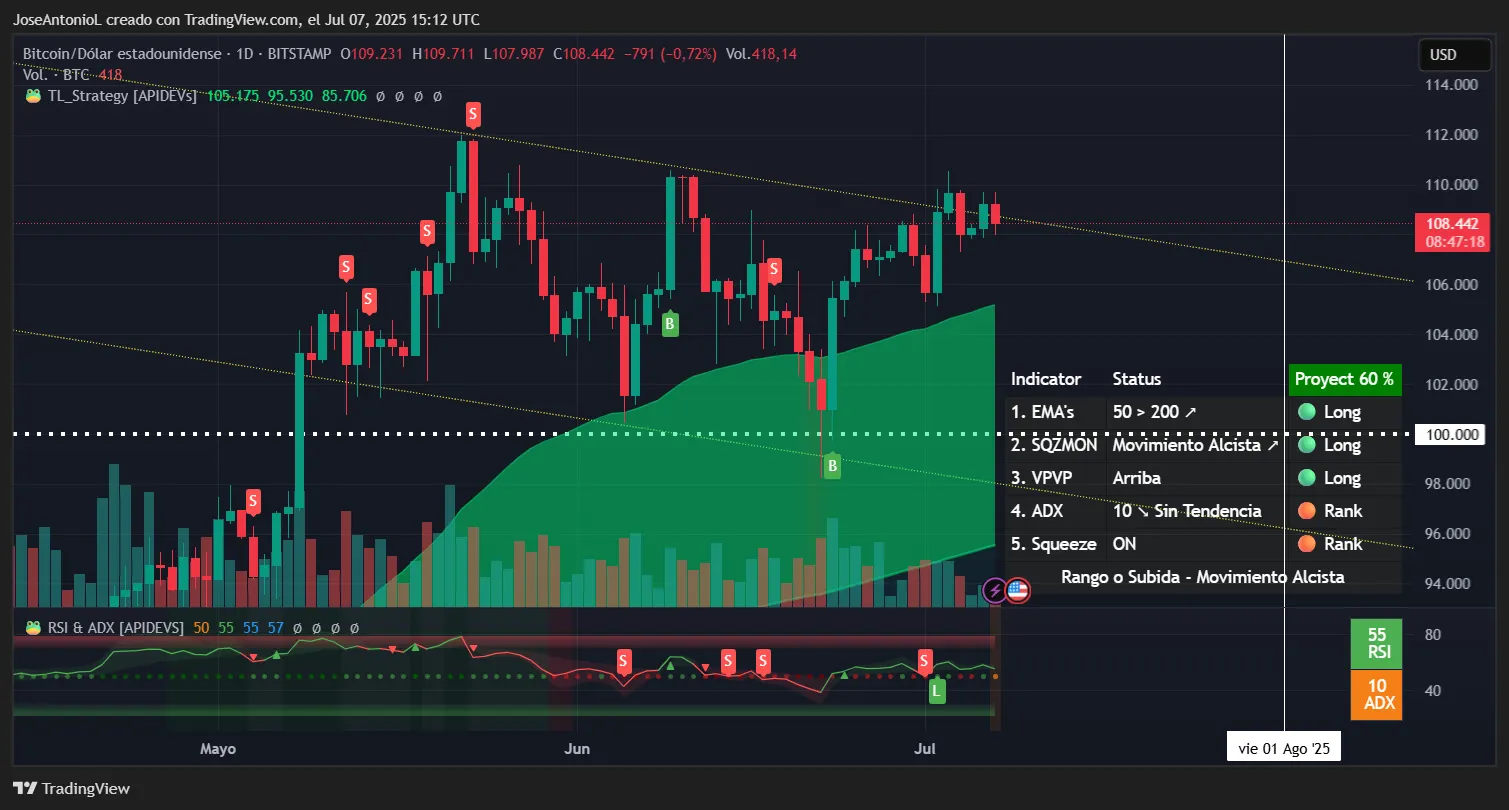

While prediction market participants lean bullish, the charts paint a more nuanced picture that should give defenders pause. Multiple technical factors converge to suggest the $100K defense faces serious challenges.

The Trend That Isn’t: Perhaps most concerning is the Average Directional Index, or ADX, reading between 10-17 across timeframes—well below the 25 threshold that confirms trend presence. This historically low reading indicates Bitcoin isn’t trending at all, merely drifting. Markets in such states become highly susceptible to sudden directional moves that can quickly erase seemingly comfortable buffers.

Volatility Coiled Like a Spring: The Squeeze Momentum Indicator shows “on” status across both daily and 4-hour charts. This compression typically precedes explosive moves of 5-10%. With only an 8.4% cushion to $100K, a downward move could easily breach the threshold.

Descending Resistance Looms: A well-defined descending trend line from April highs continues capping rallies near $109-110K. Each rejection at this level increases selling pressure, and the pattern suggests another test could trigger stops.

Volume Profile Reveals the Magnet: The Volume Profile Visible Range (VPVR) shows massive accumulation between $97-104K, with the point of control sitting at $102-103K. High-volume nodes act as price magnets during low-ADX conditions—exactly what we’re seeing now.

Path to BTC at $100K: Multiple support levels stand guard

The good news for bulls: Bitcoin would need to fall through several support zones before threatening $100K. The 4-hour chart reveals a structured defense:

The first line of defense sits at $107,200, where recent consolidation has built a base. Below that, the $104,000-$105,000 zone shows significant volume accumulation—evidence of major buying interest. The psychological $102,000 level provides one final buffer before the critical $100,000 threshold.

The bad news for bulls: Bitcoin is currently testing the upper side of the channel, instead of remaining somewhere in the middle, which means short-term traders may have more bullish enthusiasm than data suggests they should. However, by August 1, the distance between $100K and the channel’s top will be almost two-thirds the distance between $100K and the channel’s bottom. Meaning, prices would require significantly more buying pressure to break through nearby overhead resistance than selling pressure to reach distant support, which is why the risk/reward asymmetry actually favors a downside move despite current bullish positioning.

This asymmetric setup explains why despite 64.5% bullish positioning in prediction markets and current upper channel testing, the technical probability of touching $100K remains elevated. Bulls need to sustain extraordinary momentum to break higher, while bears simply need a return to normal channel behavior for things to head south.

Will $100K BTC hold? What the charts say

So can Bitcoin hold $100K throughout July? Trading data suggests it’s a closer call than Bitcoin’s current price of $108K and Myriad traders’ 64.5% confidence would imply.

The lack of momentum and compressed volatility introduce significant risk, but multiple support levels and maintained bullish market structure provide defense for the $100K line.

The next two weeks are critical—after all, the last time Bitcoin dropped from the top of the channel to roughly $100K, the move took just 11 days. If the Squeeze releases upward and Bitcoin can establish a range above $110,000, the $100K level becomes much safer. A break below $107,000 would bring the first real test, with $104,000 serving as the crucial battleground.

All that is to say that the data currently supports the view that it’s more likely than not that Bitcoin stays above $100K for the rest of the month—if all things remain equal. And, of course, if you disagree, there are ways for you to express that in the market.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.