In brief

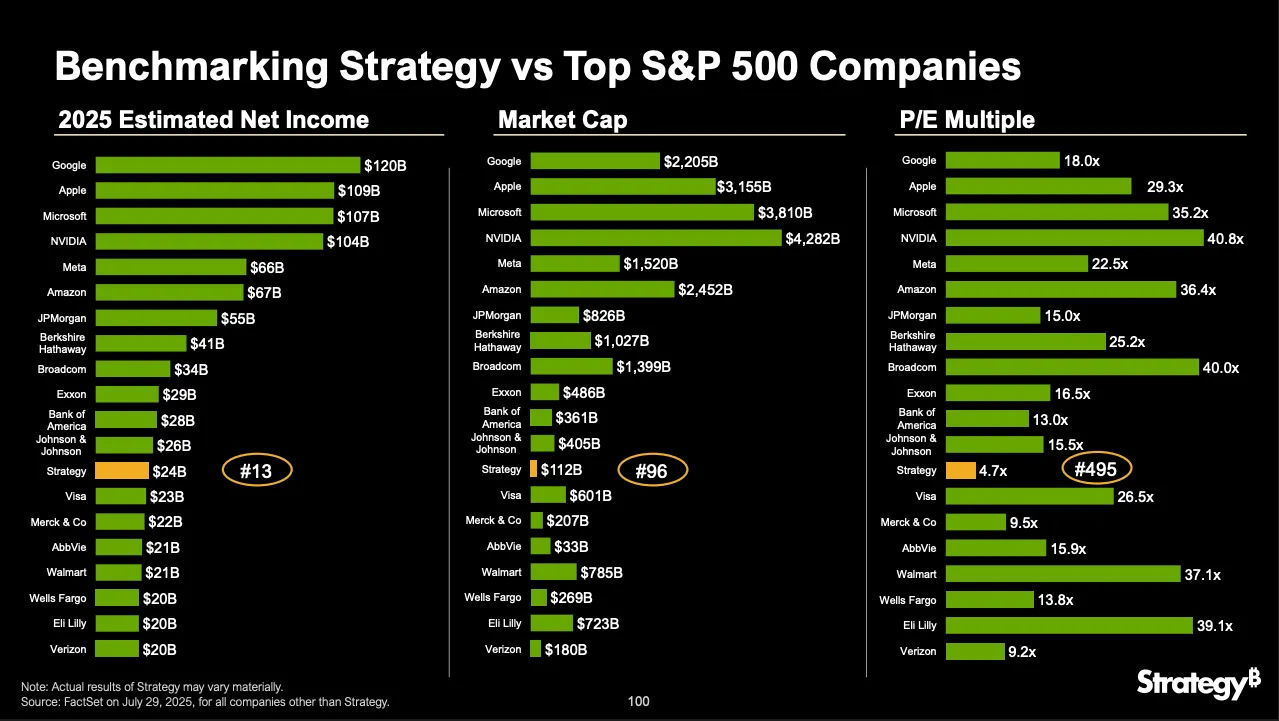

- Strategy compared its P/E ratio to S&P 500 firms last month.

- That “deceptively” implied that its revenue is recurring, Andy Constan said.

- Strategy faces class action lawsuits over allegedly false and misleading statements.

Strategy, formerly MicroStrategy, misrepresented its business to investors when measuring itself against S&P 500 firms last month, according to Damped Spring Advisors CEO and CIO Andy Constan.

It is “100% fraudulent” that the Bitcoin-buying firm compared its price-to-earnings ratio to the likes of Apple and NVIDIA on a slide during its second-quarter earnings presentation, the Wall Street veteran said during an episode of the What Bitcoin Did podcast released on Monday.

The slide implied that Strategy’s earnings are recurring, when the performance was driven by a “one-off, market-to-market” increase in the value of its Bitcoin holdings, Constan argued.

“They are marketing [that revenue] to investors as recurring earnings that deserve a multiple,” he added. “That is deceptive.”

Macro analyst Lyn Alden, who was also featured on the podcast as a guest, said, “I’m not sure I would call it fraudulent, but I don’t agree with the charts that show their P/E comparison either.”

Decrypt reached out to Strategy for comment.

Strategy shares closed down 4.35% on Thursday to trade at $372.92 after falling 2.2% the day before, according to Yahoo Finance. The stock is still up 33% year-to-date, but shares have slid 11% from $447 over the past month.

Bitcoin’s price was recently down 3.7% over the past 24 hours to trade just above $118,000, meanwhile. It hit a fresh all-time high above $124,000 on Wednesday, according to crypto data provider CoinGecko.

The price-to-earnings ratio (P/E) compares a company’s share price with the earnings that it generates, yielding a multiple that can be used to assess stocks’ relative values. As of July 29, Strategy had a 4.7x P/E multiple, while chipmaker NVIDIA’s’s stood at 40.8x.

“There are only five companies in the S&P 500 universe that have a lower PE multiple than us,” Strategy CEO and President Phong Lee said during the firm’s Q2 earnings call. “We’re possibly the most misunderstood and undervalued stock in the U.S. and potentially the world.”

Strategy disclosed a whopping $10 billion second-quarter profit last month, or earnings of $32.60 per common share. The company meanwhile posted $114.5 million in Q2 revenue, largely from software subscriptions and providing product support.

Under generally acceptable accounting principles (GAAP), Strategy started recording its Bitcoin holdings at fair value this year, reflecting quarter-to-quarter price swings. Under previous rules, firms recorded cryptocurrencies at their original cost; they could write them down as an “impairment charge” if the value dropped—but could not mark them up when prices rose.

Despite the shift in GAAP rules, Strategy should be careful with how it portrays earnings because if the Bitcoin “market falls, they will be the biggest loser in that quarter in history,” Constan argued.

Constan, who isn’t opposed to Bitcoin as an investment, argued that Strategy resembles a Ponzi scheme because the company has issued a lot of preferred shares to buy Bitcoin and “there is no hope of paying the preferred dividends without new proceeds from issuance.”

In the first quarter, Strategy disclosed a $5.9 billion loss after Bitcoin’s price fell, or a decline of $16.49 per common share. Strategy warned that a Q1 profit was doubtful around a month prior, but identical class action lawsuits, alleging securities fraud, were subsequently filed.

The lawsuit accused Strategy of making “false and misleading” public statements about the anticipated profitability of its Bitcoin treasury strategy. In SEC filings, the company has signaled that it intends to “vigorously defend itself against these claims.”

But if Strategy ever fails, Constan said that any legal battle could be overshadowed, and the slide in question could be remembered for years to come.

“Fraud will be the least of Saylor’s problems,” he said, referring to Strategy’s ever-bullish executive chairman and co-founder Michael Saylor. “That slide will live in infamy.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.