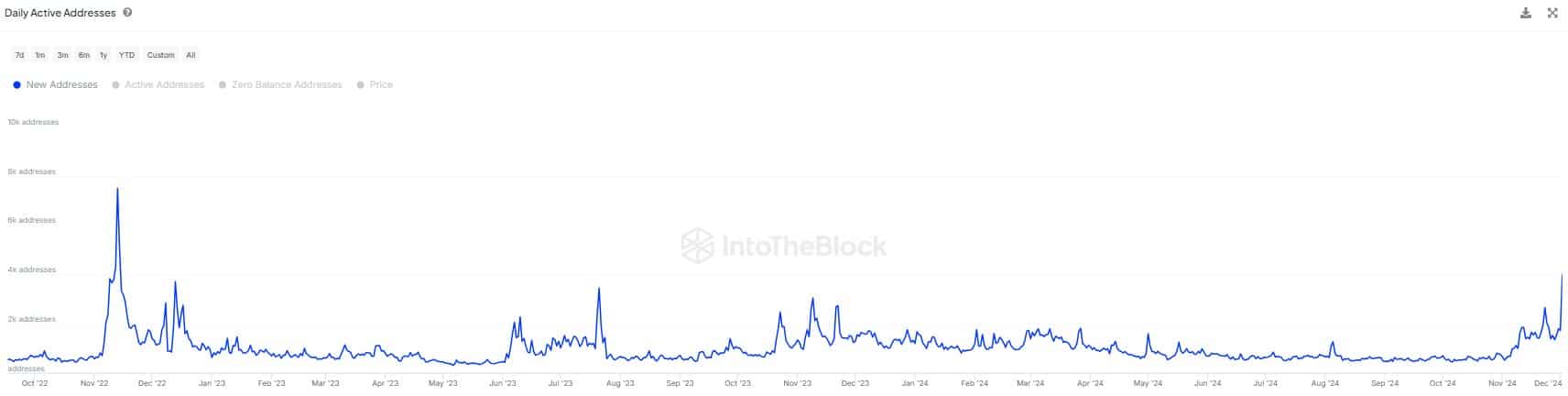

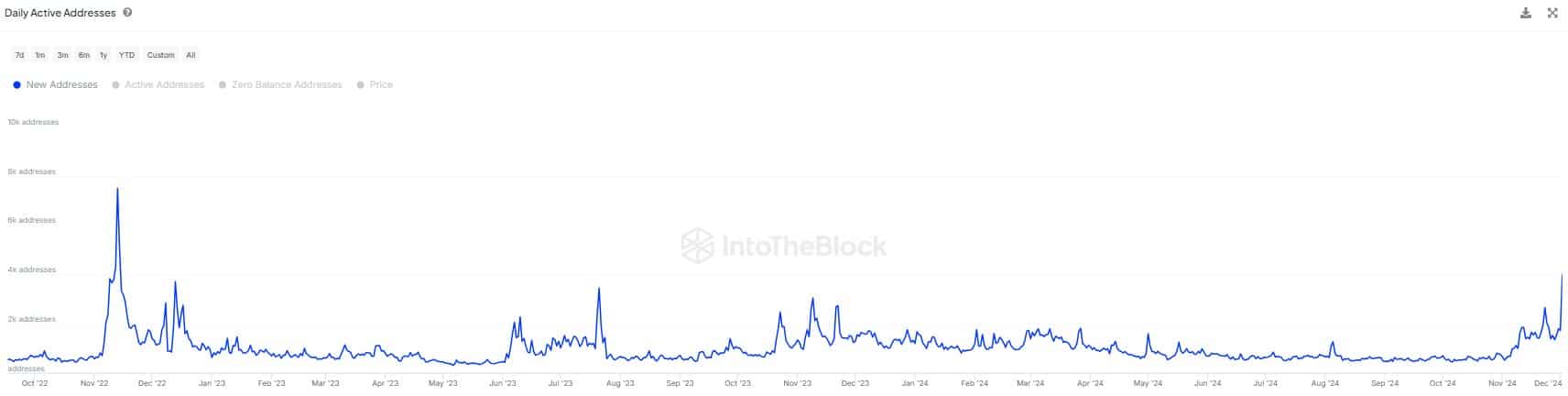

- The number of new LINK addresses has surged, returning to levels not seen since 2022.

- This increase coincides with a rise in large transactions and longer average holding periods.

After recording an impressive 126.19% monthly gain, Chainlink [LINK] appeared to be in a consolidation phase at press time, recording a minor 1.29% decline in the last 24 hours.

This appears as a healthy retracement that could pave the way for renewed upward momentum.

Insights from AMBCrypto suggested that while LINK is in a temporary recoil, the asset’s market conditions strongly favored another rally, mirroring last month’s bullish performance.

New entrants hint at potential surge

Data from IntoTheBlock revealed a significant increase in the creation of new LINK addresses.

Currently, over 4,000 new addresses linked to Chainlink have been established. This trend suggests fresh interest in the asset, likely from investors preparing to buy.

Source: X

If these new entrants drive substantial purchases, the demand could push LINK’s price higher, building on its recent momentum.

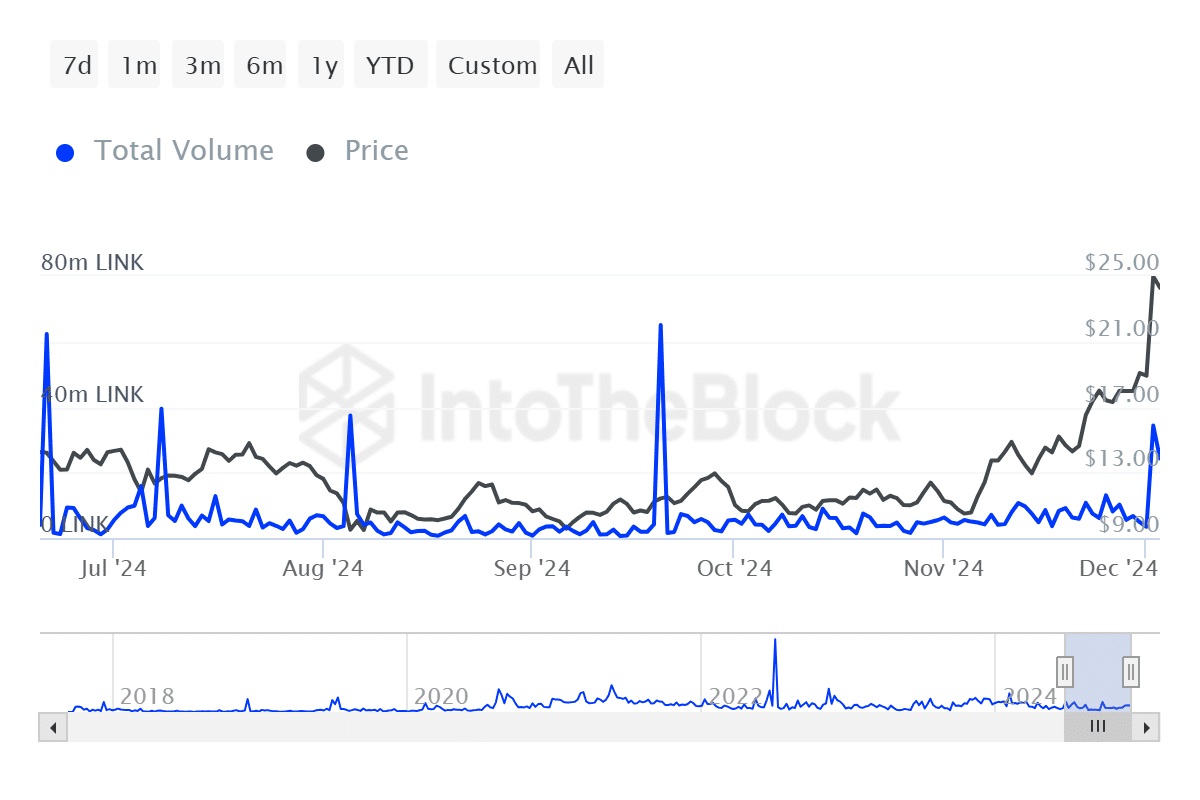

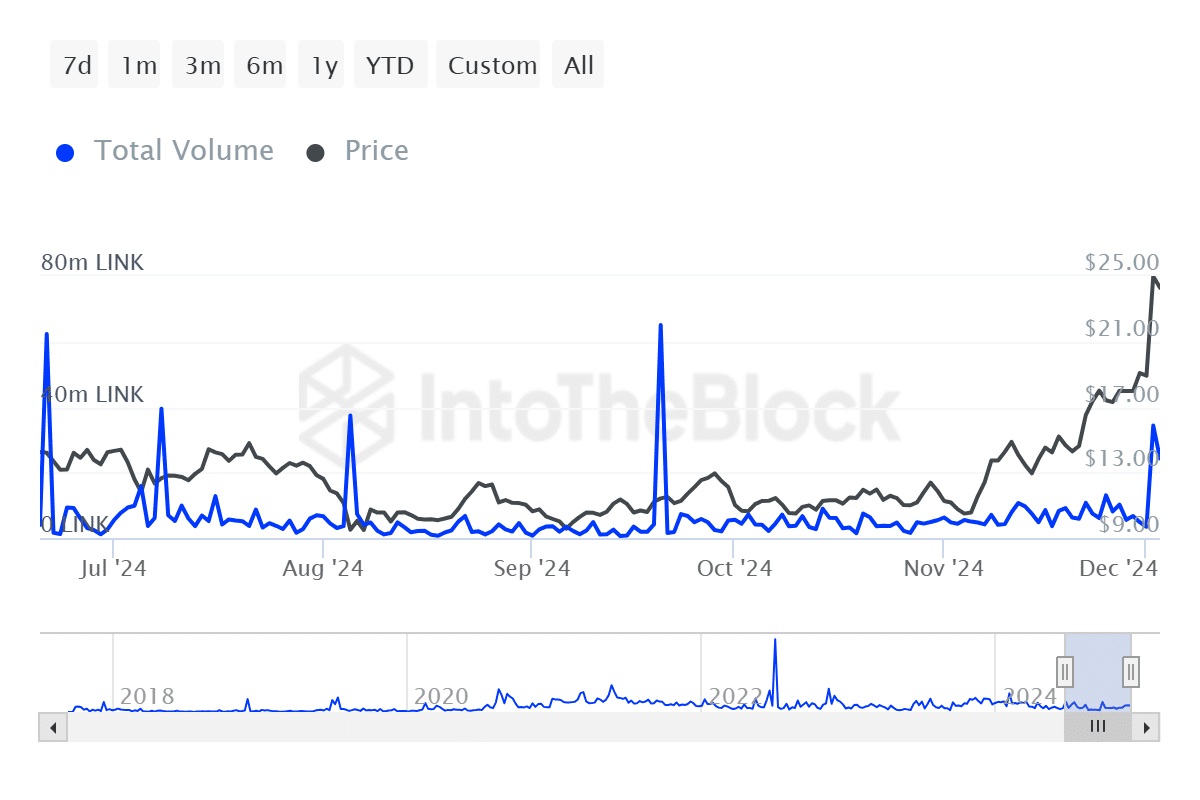

Spike in large transactions and volume

December has seen a notable rise in large transaction volumes and counts, typically associated with investors holding at least 1% of the asset’s supply.

Over the past seven days, the number of large transactions reached 1.98 K, with a total volume of 34.34 million LINK valued at $858.08 million.

Although this volume dipped over the last 24 hours to $290.99 million, it still reflected sustained upward activity.

Source: IntoTheBlock

Interestingly, the increase in large transactions coincided with stable or slightly declining prices.

This pattern often indicates accumulation, suggesting that major investors are positioning themselves for potential gains in LINK’s future performance.

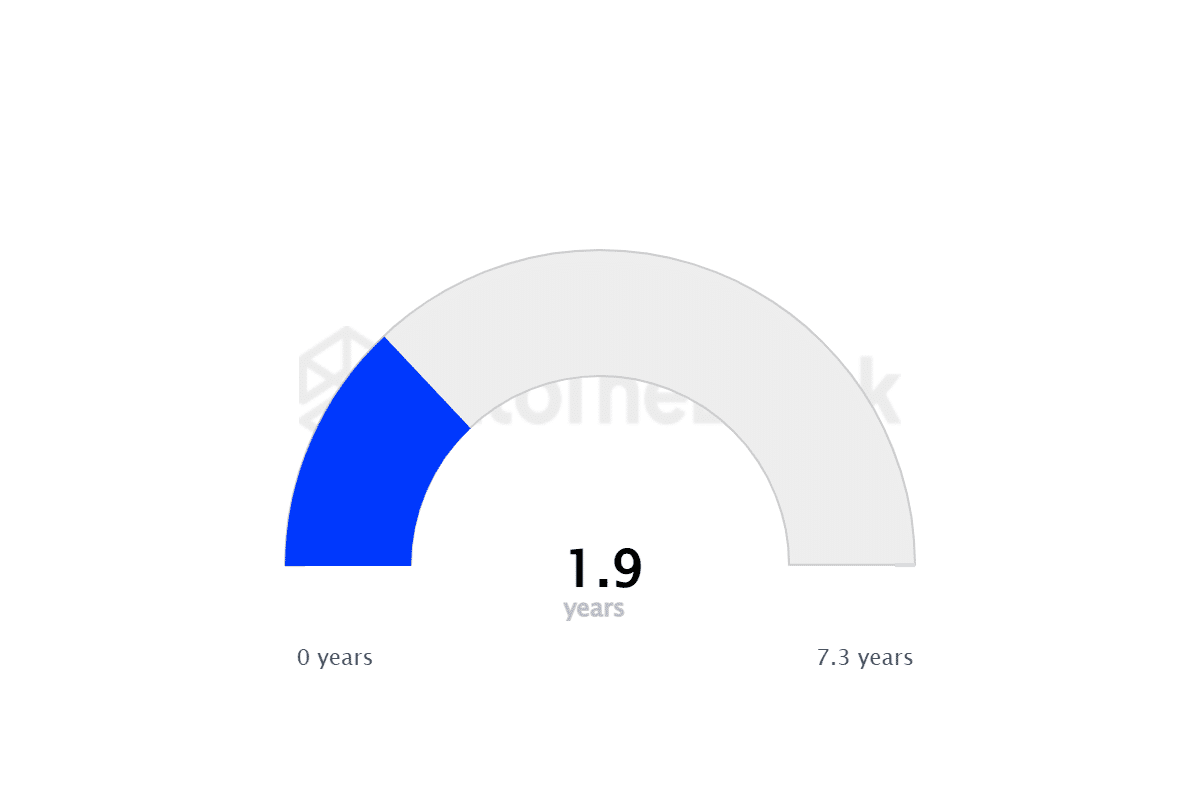

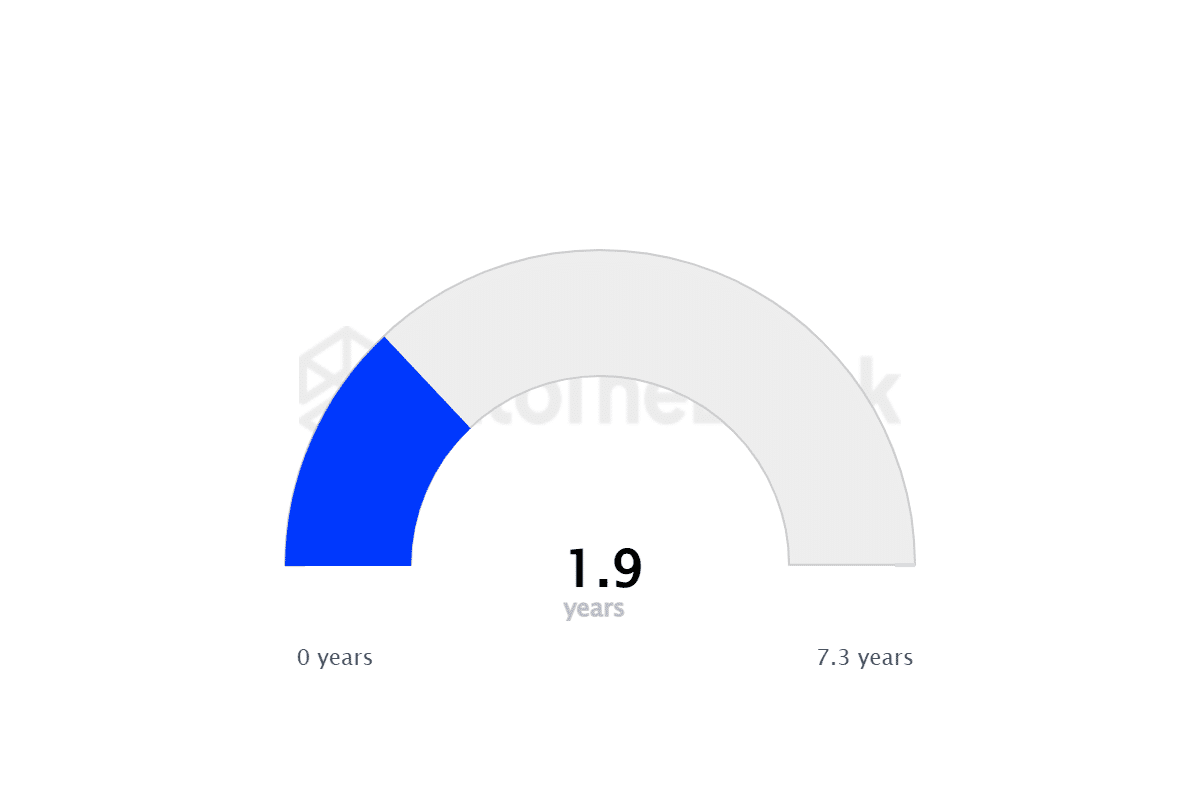

Long-term LINK holding suggests…

The average holding period for LINK has risen significantly, reaching 1.9 years, according to the Average Time Token is Held.

On average, LINK tokens remain dormant in wallets for nearly two years before being transacted.

Read Chainlink’s [LINK] Price Prediction 2024–2025

Such prolonged holding patterns suggest that large traders accumulating the asset may maintain their positions for a similar duration.

Source: IntoTheBlock

This trend serves as a strong indicator of investor confidence and a clear intent to drive LINK’s price higher over the long term. It reflects a growing preference among holders to view the asset as a long-term investment.