- HYPE overcame a major resistance level in the past 24 hours, but has more obstacles ahead.

- Hyperliquid dominated several on-chain metrics, including growing TVL, fees, and perpetual volume.

Hyperliquid [HYPE] has seen a significant climb in the past 24 hours, gaining over 16%. This continues its weekly gain of 14.29%.

According to AMBCrypto analysis, despite the current obstacles in place, HYPE has a high probability of hitting a new market high as sentiment begins turning in favor of the bulls.

Obstacles ahead for HYPE: Where next?

HYPE’s significant rally in the past 24 hours came after breaching a major resistance level marked by a Fibonacci level on the chart at $25.08, with the price now heading for its January high at $27.05.

If the current market momentum is sustainable, then HYPE would likely cross its monthly high while heading to reach higher levels.

However, it would face certain resistance on the chart, specifically at $27.115, $29.148, and $32.043, as it rallies higher.

Assuming the trend remains bullish, these levels would be minor retraction points before a continued upward movement.

Source: TradingView

To determine if the current market sentiment would sustain HYPE establishing new market highs, AMBCrypto looked into other metrics, suggesting a high probability.

Liquidity inflow and usage grows

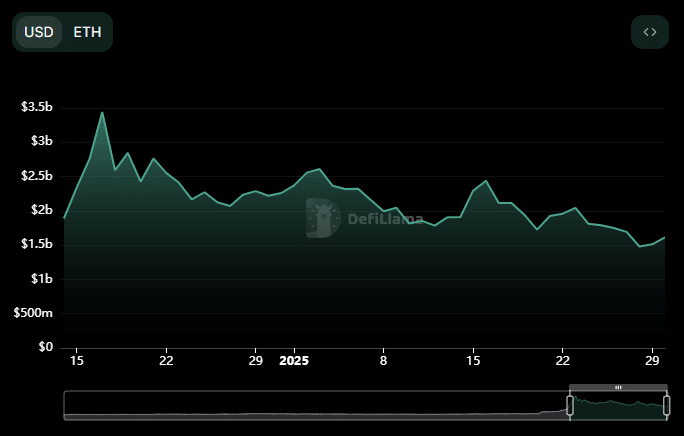

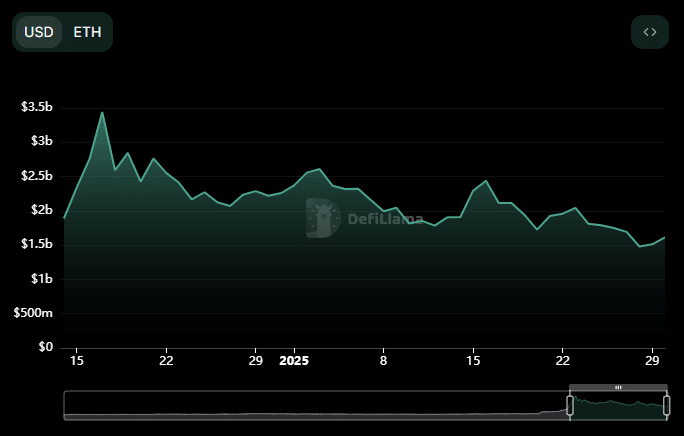

Insight on DeFiLlama shows there’s been a consistent decline in the growth of HYPE’s total value locked (TVL) over the days, establishing new lows and maintaining that level.

TVL measures the liquidity flow into protocols. It typically reflects market sentiment toward an asset. A surge in TVL signals market confidence, while a decline indicates a potential fall.

In the last 48 hours, however, a directional shift has occurred, and HYPE’s TVL is looking to establish a new high, now reaching $1.651 billion from a low of $1.48 billion on the 28th of January.

Source: DeFiLlama

Similarly, there’s been a surge in fees generated over the past 24 hours, growing from $1.5 million to $2.0 million. When fees grow, it indicates high usage of protocols within the ecosystem, which HYPE now benefits from.

More usage tends to impact an asset’s price positively and indicates the potential for it to consistently surge even higher.

HYPE remains dominant

According to Artemis’ ranking of the top 10 perpetual protocols in the market, HYPE takes the lead, pacing ahead of others.

Read Hyperliquid’s [HYPE] Price Prediction 2025–2026

In the past seven days, the total trading volume across these top perpetual protocols hit $43.6 billion, with Hyperliquid contributing 56.0%, recording a trading volume of $24.2 billion during this period.

Should this trading volume keep surging, alongside transaction fees and TVL, HYPE is well-positioned for a continued upward move in the market and could potentially surpass the major obstacle marked on the chart.