- TAO broke below the $434 and $354 support levels and could be headed lower in the coming weeks.

- The liquidation heatmap showed that a bounce to $390 was likely.

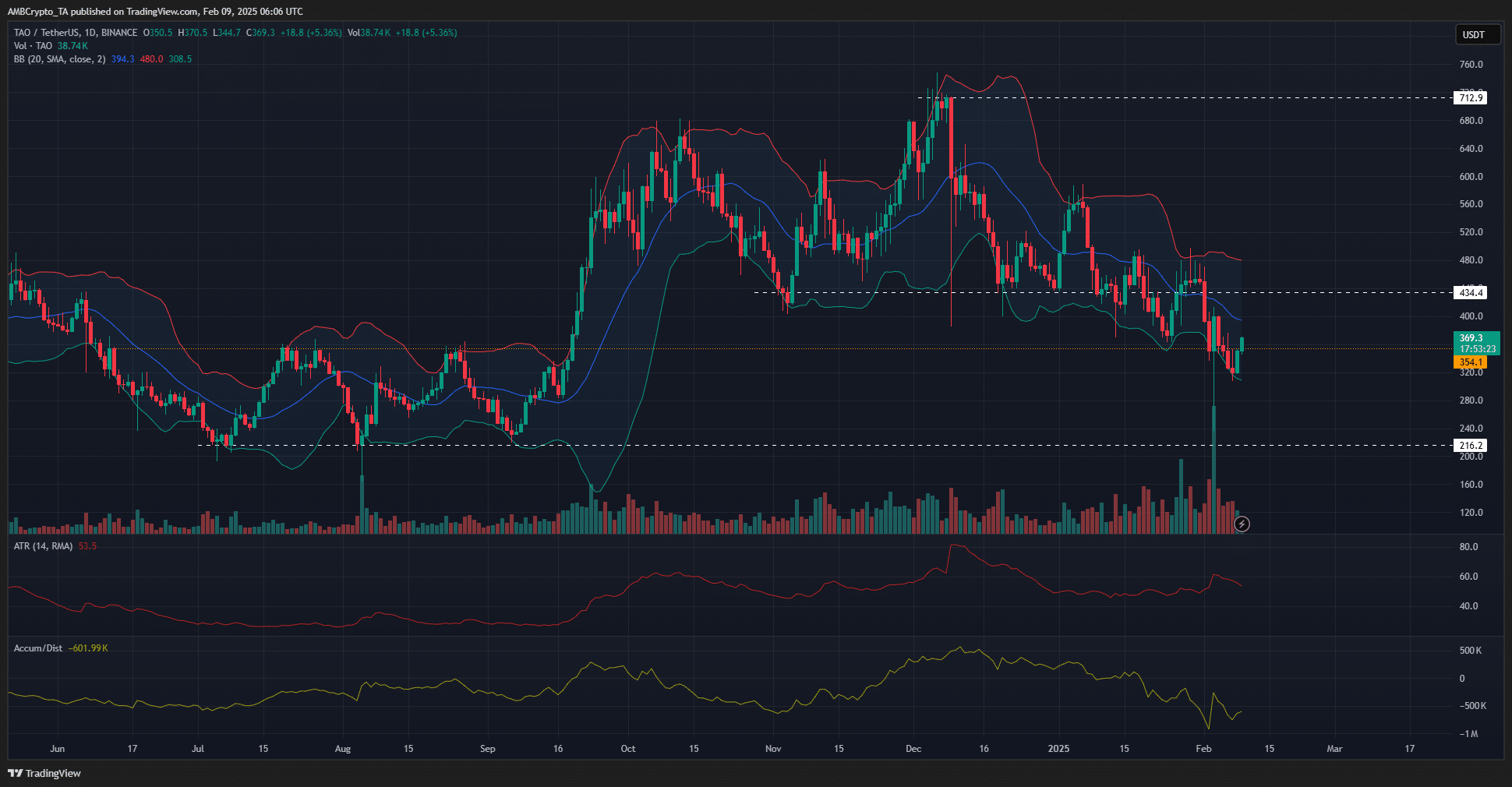

Bittensor [TAO] bulls were forced to concede the $440-$480 support zone over the past month of trading. Ten days ago, it was retested as resistance, and since those local highs, TAO has shed 26.7%.

TAO’s volatility has picked up over the past two weeks as Bitcoin [BTC] continued to trade within a range around the $100k mark.

The lack of bullish conviction across the altcoin space affected TAO, and its momentum has been bearish since December.

TAO fell below $354 but has bounced higher quickly

Source: TAO/USDT on TradingView

The Bollinger bands have been relatively wide since the second half of November.

This signified increased volatility on the daily chart, and the TAO price movements since then have been quick and sharp compared to August, for example.

The uptrend established in November was not maintained, and TAO has flipped its market structure bearishly.

In January, the bulls ceded the $434 support level as well, an important level from the weekly timeframe.

The $354 and $216 levels were the next key levels. At press time, TAO had already closed a daily session below $354, but had bounced by 14% from the local lows.

This was not indicative of recovery, but rather a shallow bounce before the next leg of the downtrend.

The ATR agreed with the BB indicator and showed heightened volatility, especially over the past week. The selling pressure and the bearish structure pointed to further lows.

Read Bittensor’s [TAO] Price Prediction 2025-26

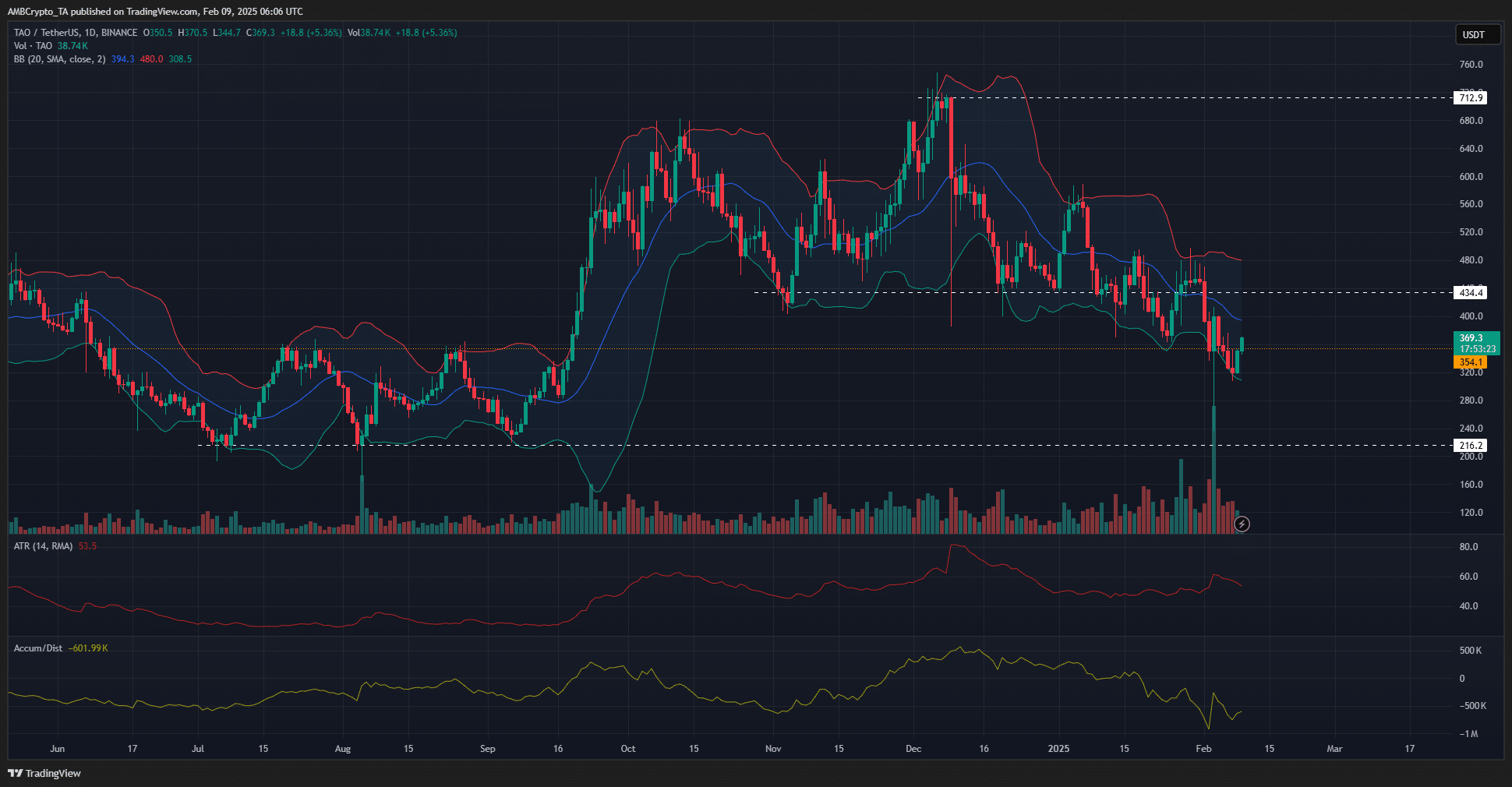

The 1-month liquidation heatmap showed a cluster of short liquidations building up around the $380-$400 region. This coincided with the local highs TAO reached during the dead cat bounce on Monday the 3rd of February.

The lack of demand and the overall bearish structure meant that a rejection from the $400 resistance zone was likely. Swing traders can wait for Bittensor’s test of that region before looking to go short.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion