- ETH has made moderate recovery, rising by 2.8% over the past day.

- Ethereum’s outflow hit a 23-month high, signaling growing confidence.

Ethereum [ETH] has continued to trade sideways since the market recovery, and appeared stuck within a consolidation range.

With ETH struggling to reclaim a higher resistance level, investors have taken this opportunity to accumulate.

Ethereum outflow hits 23-month high

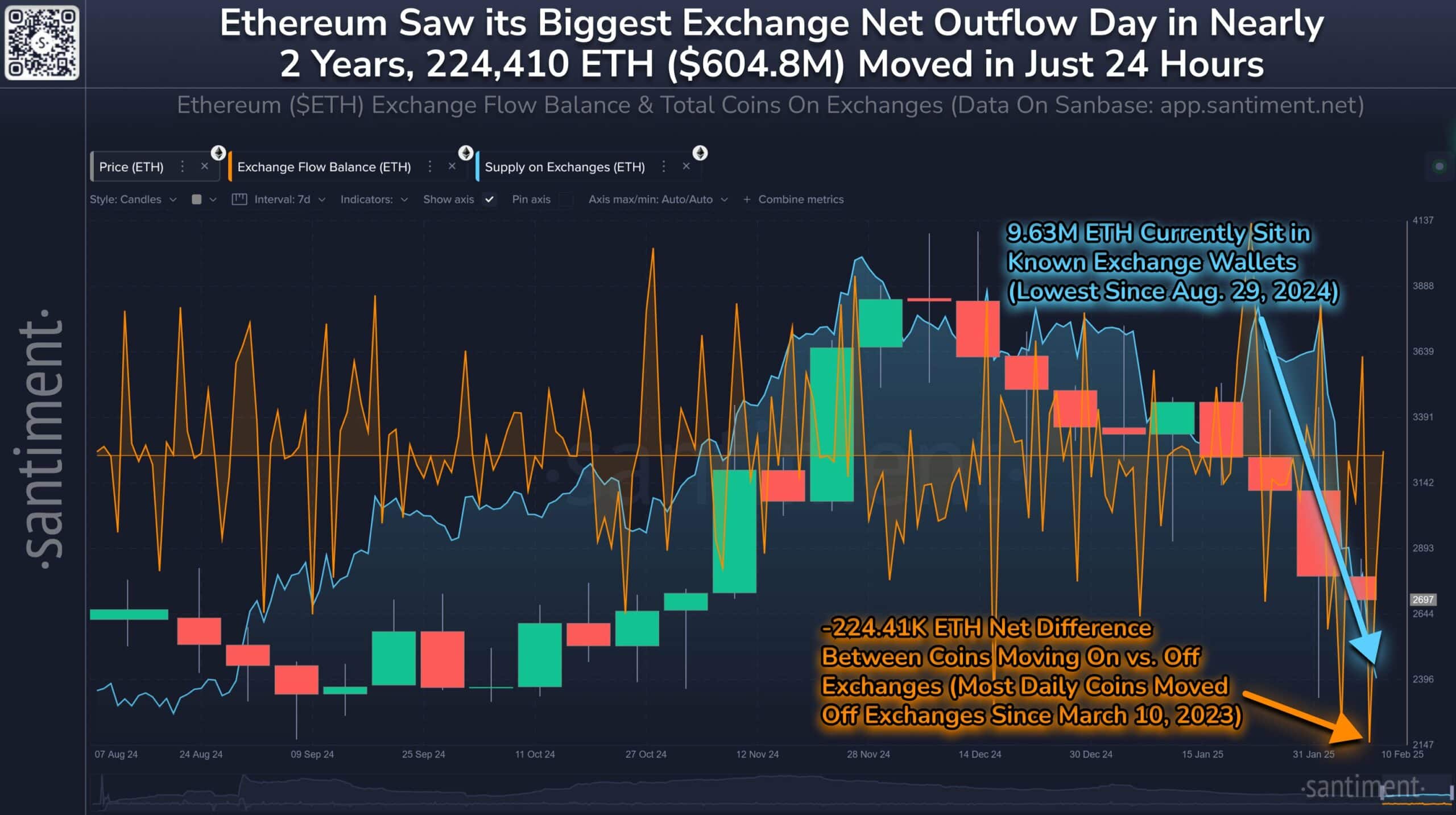

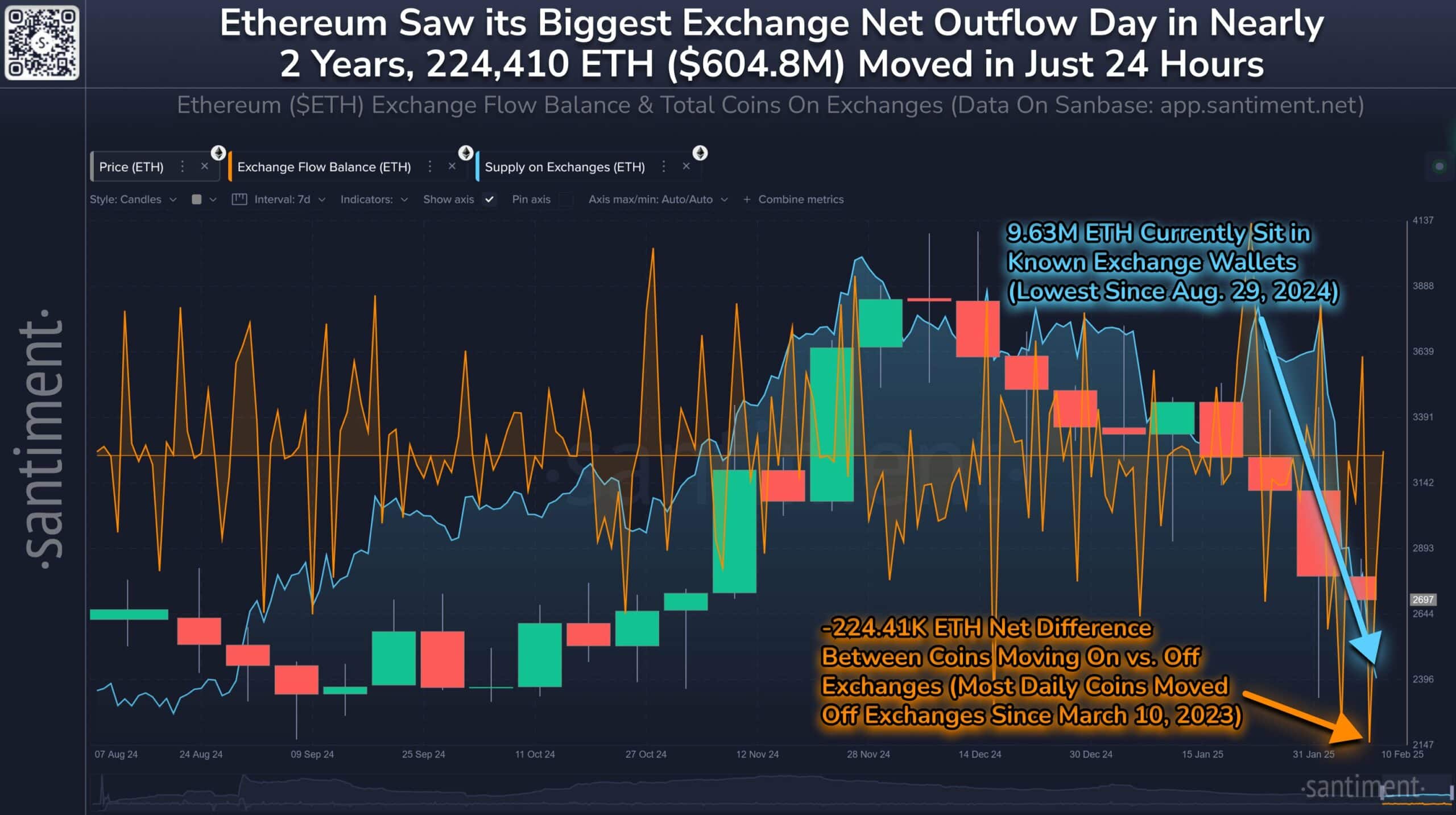

According to Santiment, Ethereum has experienced historical withdrawals from exchanges. As such, Ethereum saw 224,410 ETH tokens move off exchanges in the 24 hours between the 8th and 9th of February.

Source: Santiment

This trend extended on the 10th of February, with 768.5k in exchange outflows. This outflow was the largest amount of net coins withdrawn from exchanges in a single day over the past 23 months.

When exchange outflow surges, it implies that investors are actively buying the asset and anticipate prices to recover and make another high.

Although this is a long-term perception, it signals growing market confidence despite the price struggles.

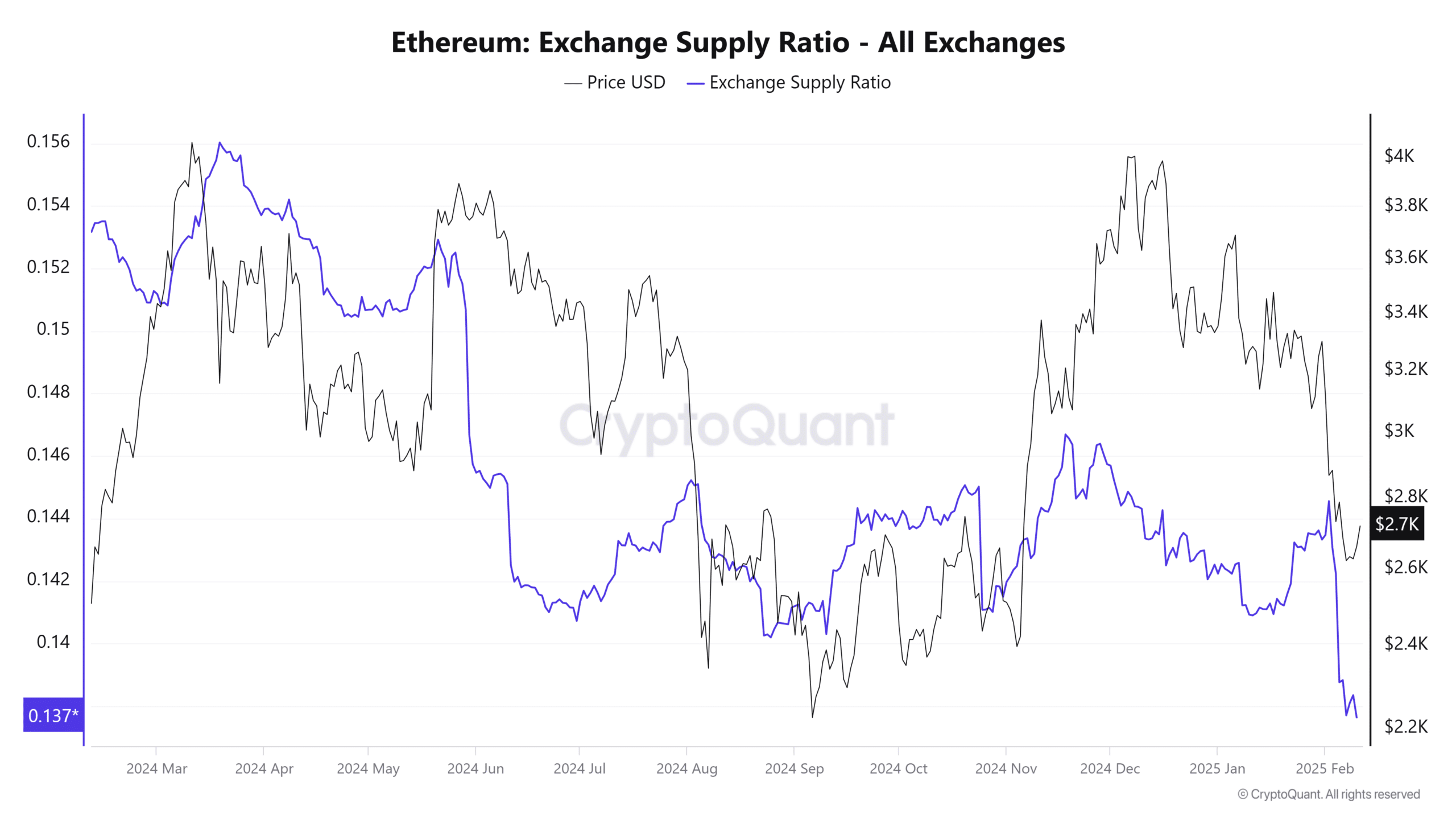

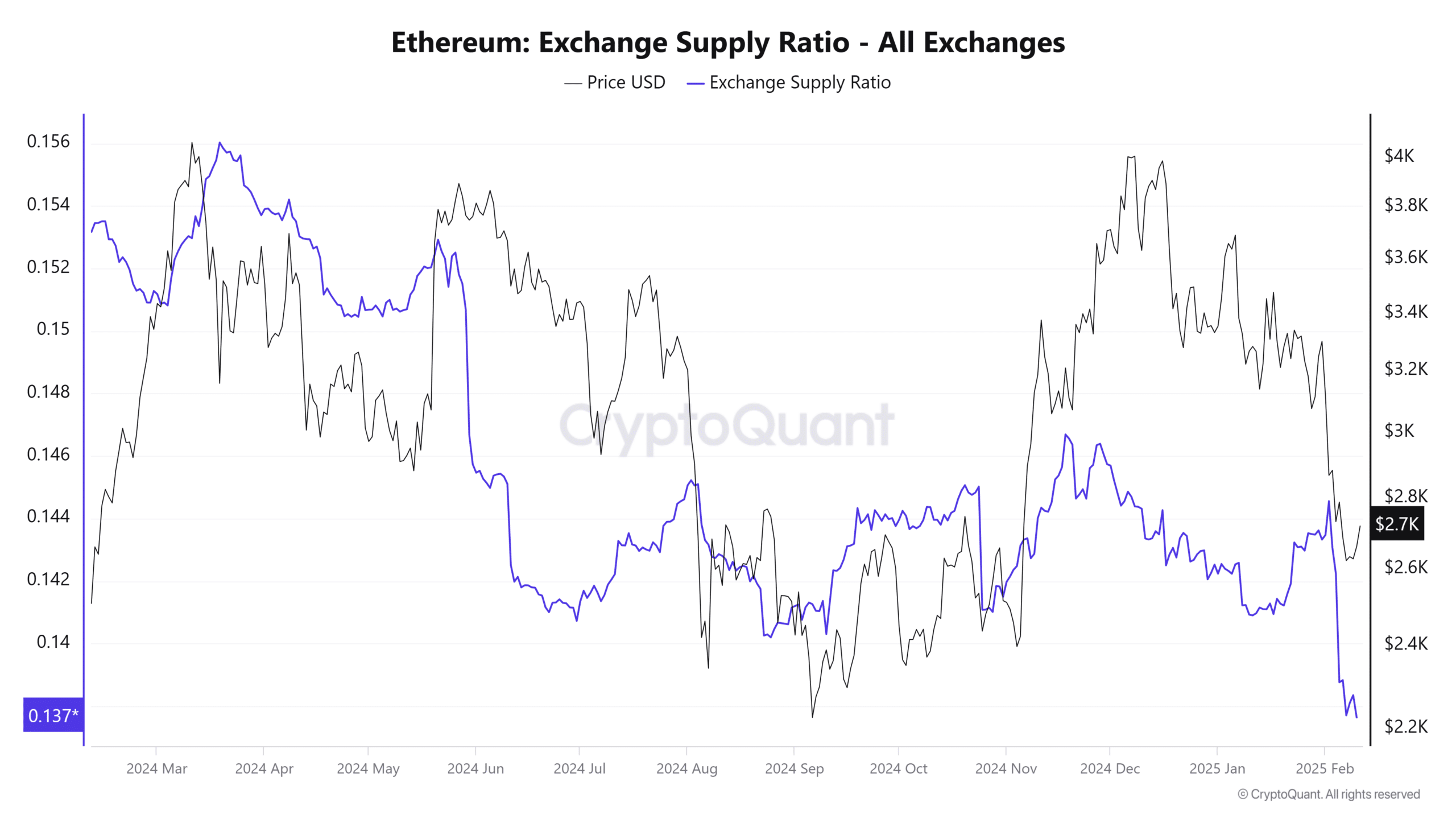

Source: CryptoQuant

This bullishness was further confirmed by the exchange supply ratio, which declined to hit a yearly low.

Therefore, ETH investors are currently content with holding for the long term and would expect prices to rise. The shrinking level of available coins to be publicly sold off also means less likelihood of future major selloffs.

Any impact on ETH?

The growing outflow has positively affected ETH prices. In fact, as of this writing, Ethereum was trading at $2716. This marked a 2.84% rise on daily charts, extending this bullish outlook by 0.84% on weekly charts.

Therefore, with Ethereum experiencing massive outflow, it suggests that most participants are currently bullish.

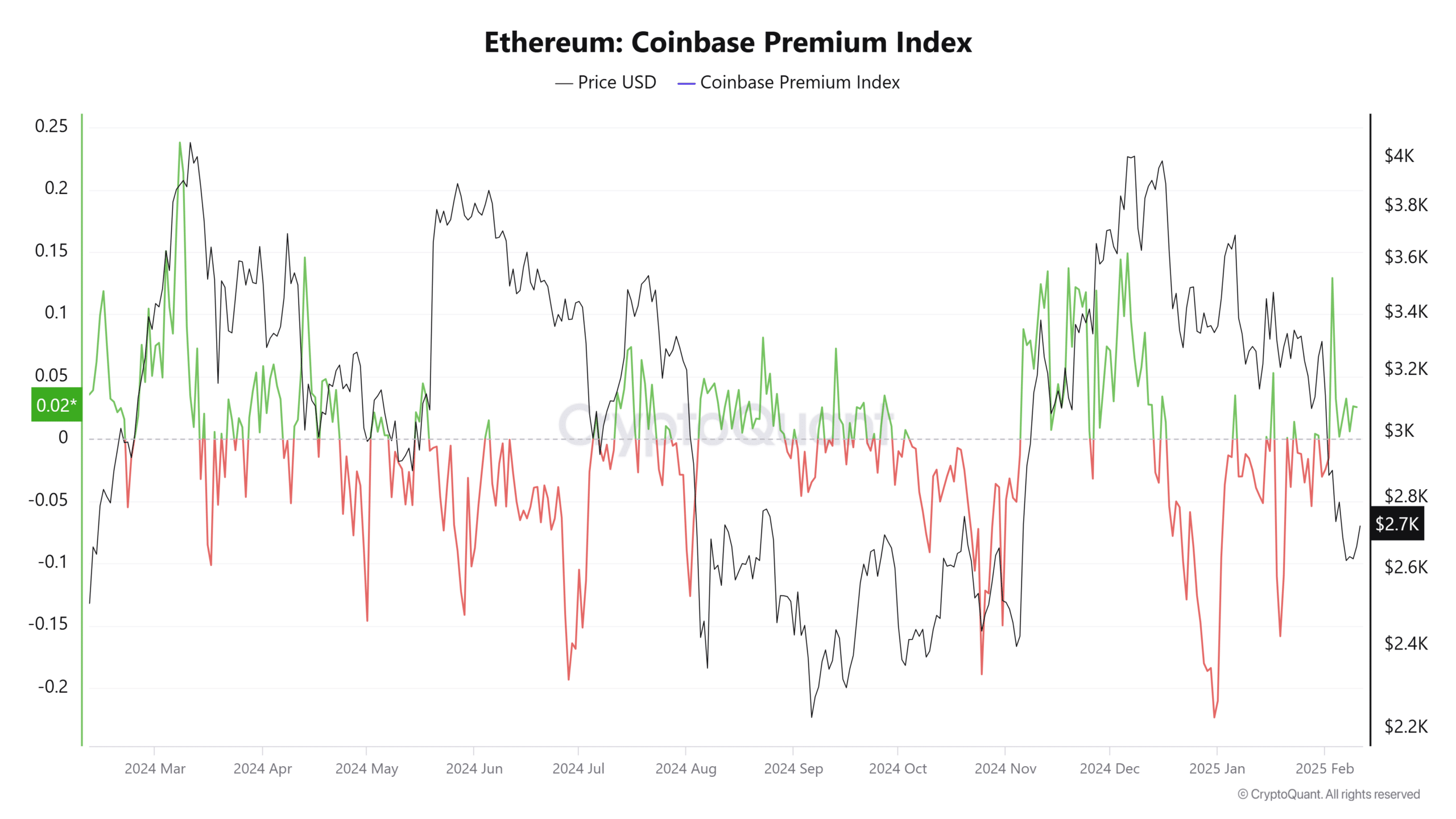

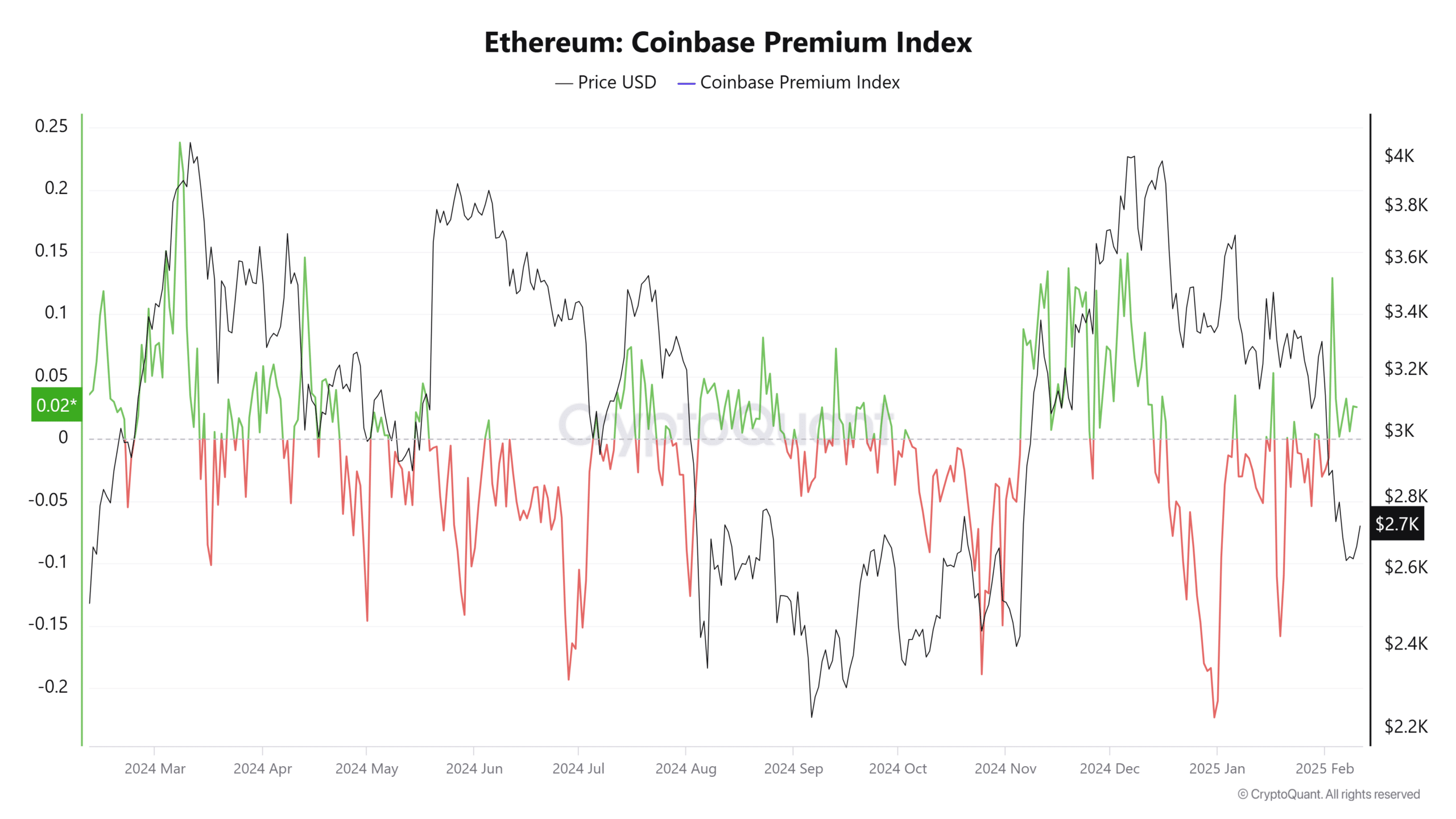

Source: CryptoQuant

This bullishness is even more prevalent among institutional investors. This is evidenced by the fact that the Coinbase premium index has remained positive throughout the week.

Thus, institutions are actively accumulating as ETH is currently in the accumulation phase, and the demand from the U.S. market and institutions could position it for further gains.

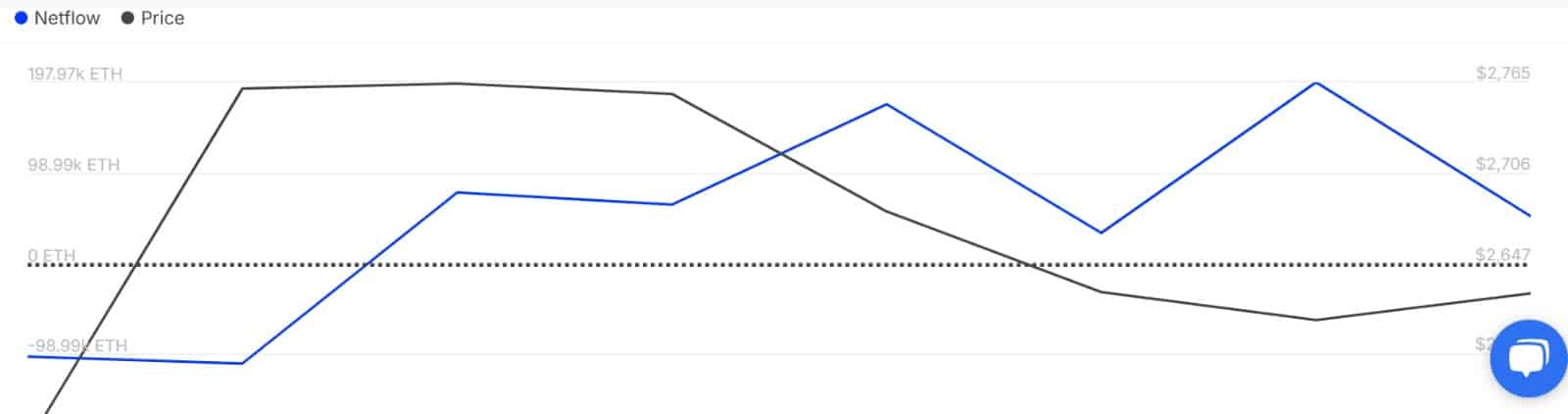

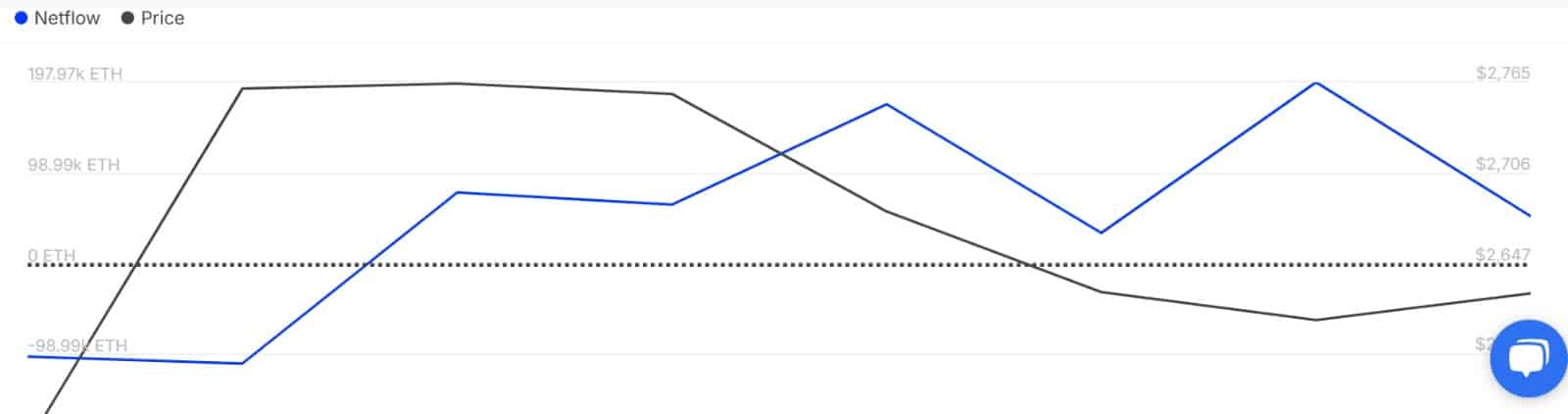

Source: IntoTheBlock

This institutional demand was further affirmed by large holders’ netflow, which spiked.

ETH’s large holders have made more capital inflow than outflow from the 5th of February, experiencing six days of positive capital inflow.

This surge suggests that whales were buying more ETH tokens than they were selling, reflecting growing market confidence.

Read Ethereum’s [ETH] Price Prediction 2025–2026

Simply put, ETH is experiencing strong bullish sentiments as investors continue to accumulate the altcoin.

If this trend continues, Ethereum could recover and reclaim $3000, where it has faced multiple rejections. However, if buyers fail to hold and sellers enter the market, ETH could drop to $2591.