- VEE’s price doubled over the last seven days of trading, driven by whale activities

- However, intense profit-taking triggered a retracement on the price charts

VEE crypto, the native token of the SmartNFT analytics platform BLOCKv, soared by 100% in 7 days. In doing so, it outperformed top coins, including Bitcoin [BTC], over the same period.

However, with 2x gains in a week, speculators have begun booking profits. At press time, the altcoin had retraced by nearly 40% but appeared to stabilize above the key 50% Fibonacci retracement level. Will the uptrend continue?

VEE crypto under profit-taking

Source: VEE/USDT, TradingView

In most cases, such strong uptrends are always followed by pullbacks that typically ease and bounce back at 50% or 61.8% Fib levels. In VEE’s case, the 50% Fib level coincided with a bullish order block (support) on the 6-hour chart. As such, the area was expected to act as a strong support.

The lower candlestick wick showed that this appeared to have played out at press time. This meant there was considerable demand at the 50% Fib level. Unfortunately, capital inflows were average, as demonstrated by the CMF (Chaikin Money Flow) to neutral levels.

Additionally, the RSI was at the pivot level, and only a rebound at the neutral area could signal a likely recovery effort.

If the key technical indicators gain traction again, VEE could re-target $0.053 or a recent high of $0.067.

On the contrary, an extended pullback and profit-taking could drag VEE to $0.03 or $0.02.

Whales behind the rally

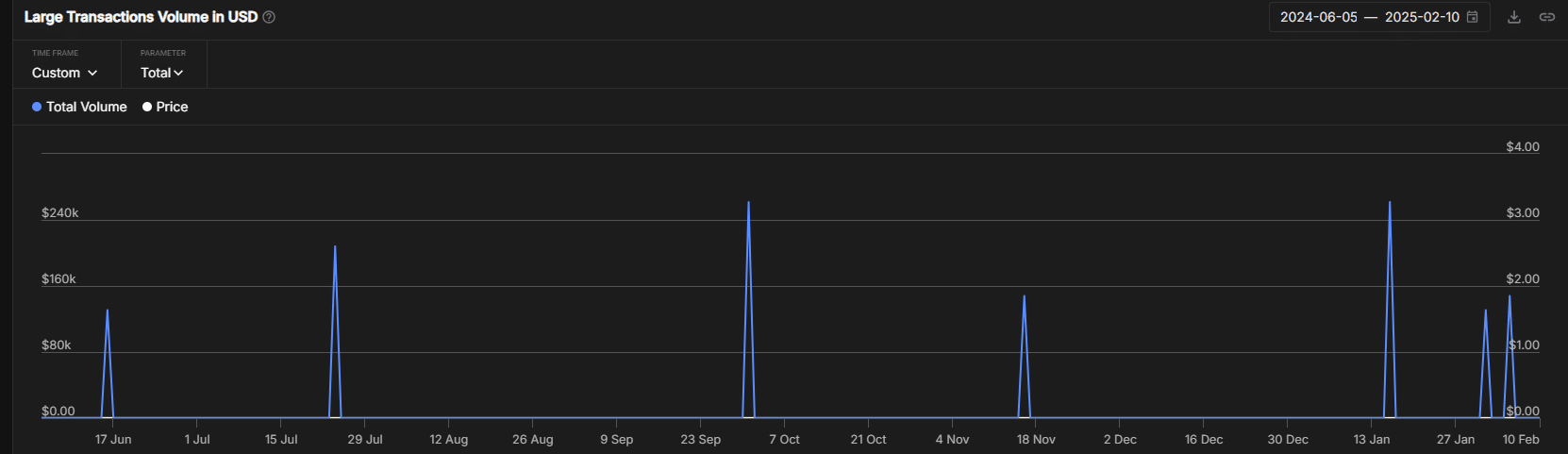

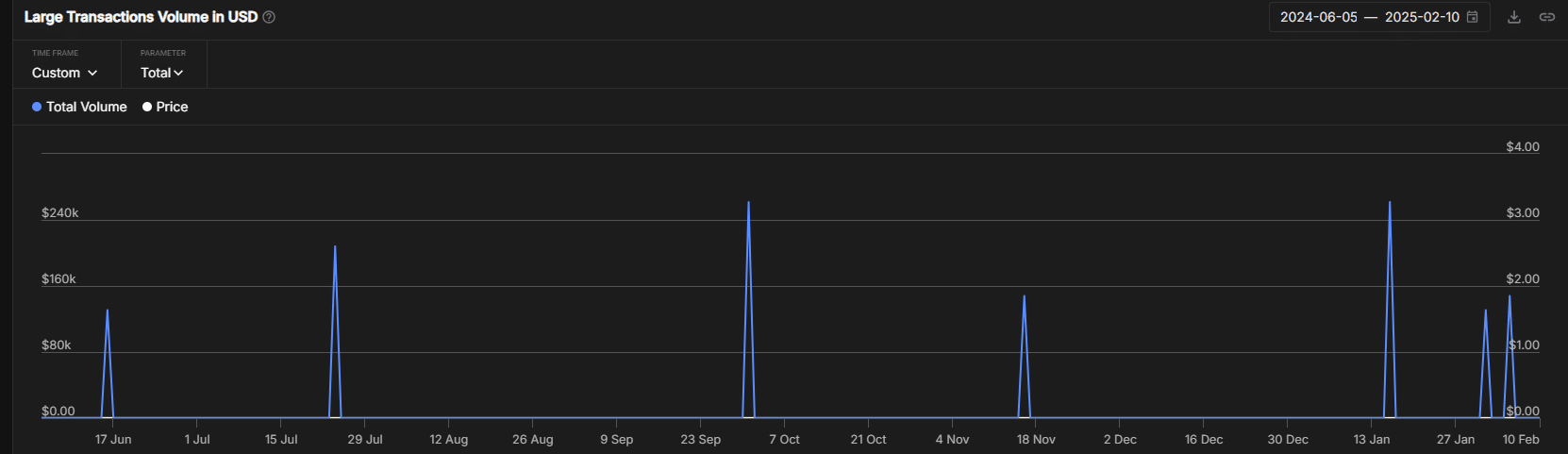

Source: IntoTheBlock

A closer look at the factors behind the latest rally revealed that whale movements triggered the wild 100% pump. Notably, on 1 February, VEE saw a large transaction worth $130k.

As highlighted by the blue spikes, another whale clip of nearly $150k was recorded on 5 February. This recent whale clip triggered the second leg of the rally. VEE pumped by 64% on the day alone and extended it to 160% by 10 February.

Read BlockV [VEE] Price Predictiion 2025-2026

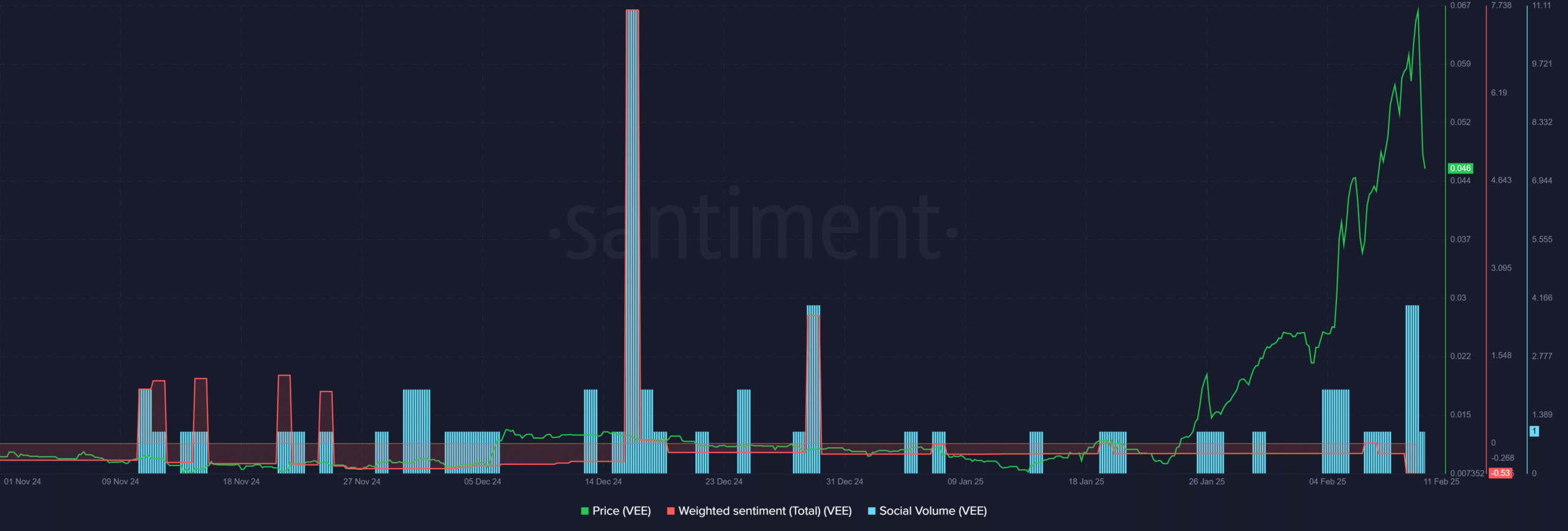

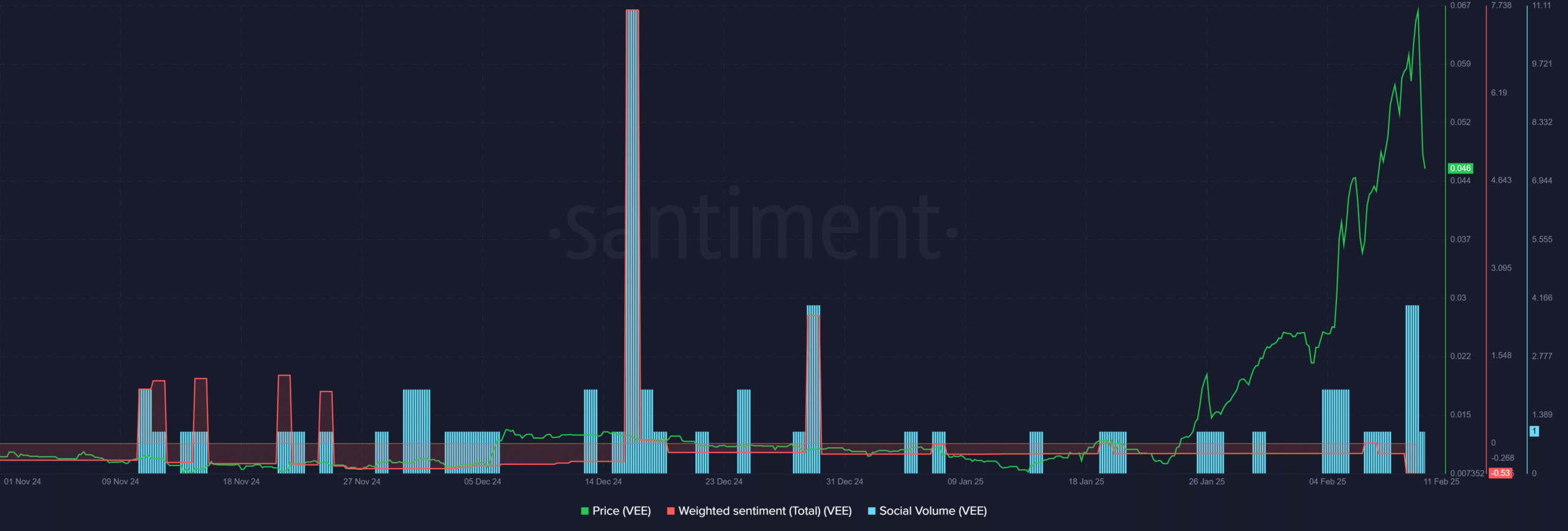

The surge in market interest during the rally offered the much-needed fuel for VEE to climb higher.

According to Santiment, social volume spiked, hinting at increased market interest across socials. However, the weighted sentiment flipped negative, which could hold back a strong rebound for VEE in the short term.

Source: Santiment

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion