- HBAR is likely to fall another 13% over the next few days.

- A short-term price bounce alongside BTC was possible in the next 24 hours.

Hedera [HBAR] has shed 7.9% in 24 hours, and its daily trading volume has increased by 20%. This showed increased selling pressure on the token as the local support level gave way.

The Long/Short Ratio by Taker Buy/Sell Volume showed that 56.5% of the taker volume was sellers’. This showed strong bearish sentiment over the past 24 hours and came alongside a retest of $0.223 as resistance.

HBAR falls below $0.223, reflects rising volatility

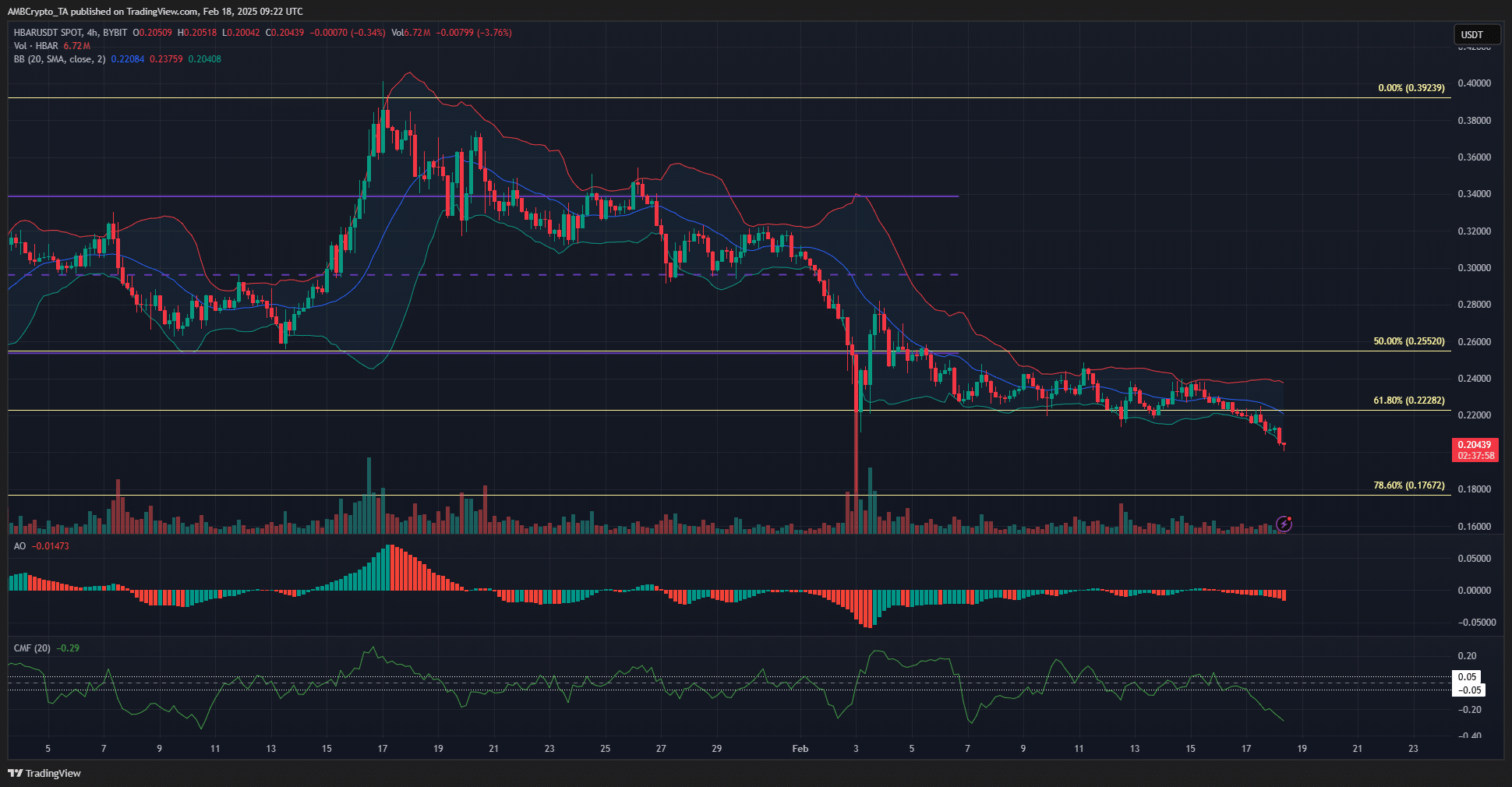

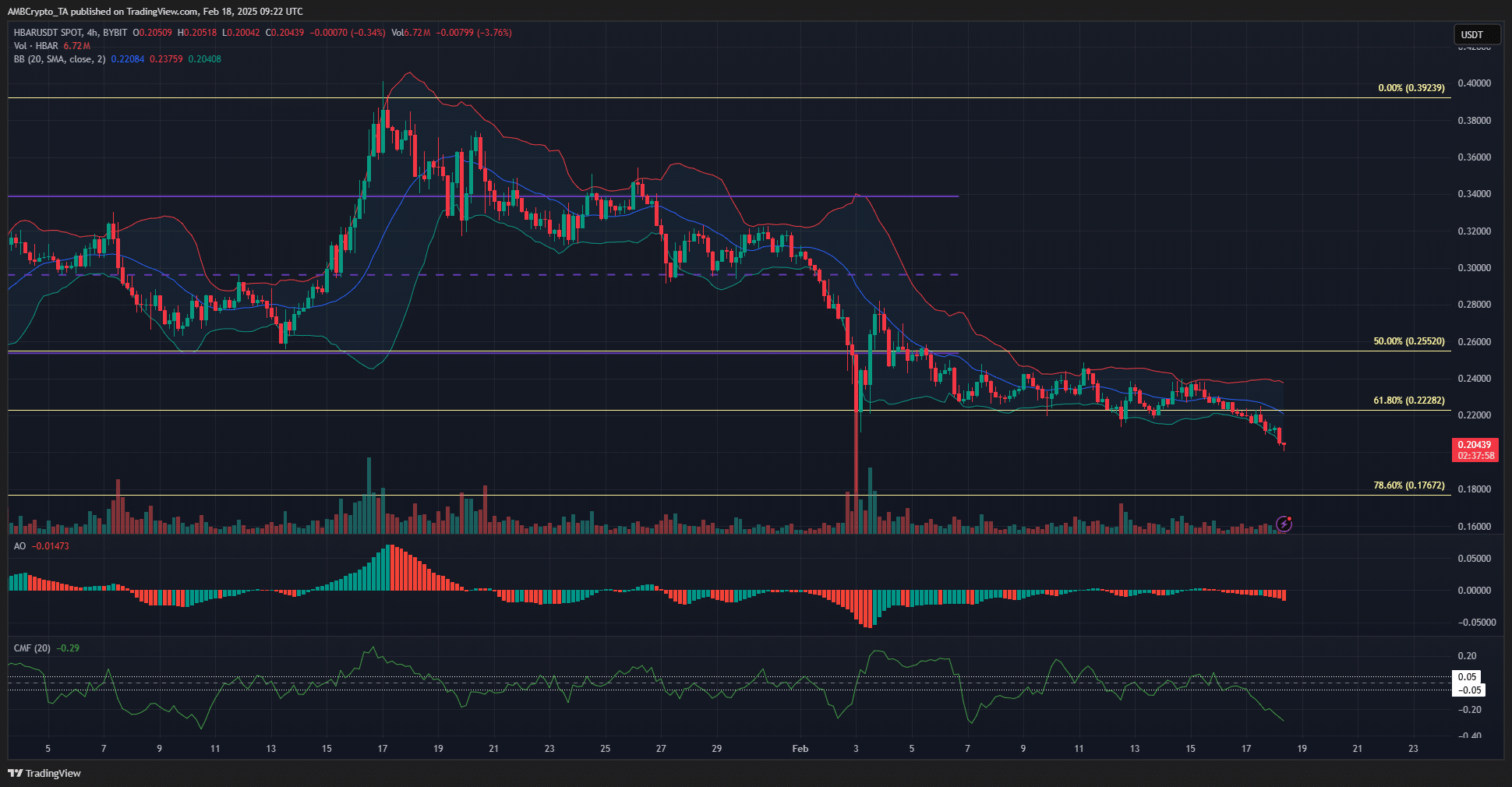

Source: HBAR/USDT on TradingView

After the substantial losses in early February, Hedera prices stabilized above the $0.223 level. This support was also the 61.8% retracement level, plotted based on the November rally.

During this consolidation phase, the trading volume shrunk, and the Bollinger bands tightened around the price.

The CMF remained in neutral territory for the most part, and Bitcoin [BTC] remained stuck within the $95.5k-$98k zone.

Over the past 48 hours, the momentum began to solidify and lean bearishly. During this time, BTC did not do much, but the rest of the altcoin market was in decline.

The HBAR Awesome Oscillator made a bearish crossover, and the CMF fell below -0.05. The Bollinger bands began to expand as the losses intensified.

Since losing the $0.223 support level, Hedera prices have been slashed by just over 8% in under two days.

This short-term downtrend is expected to continue, and HBAR would likely retest $0.176 as support over the next few days. However, with BTC approaching a support zone at $94k, HBAR might see a short-term price bounce.

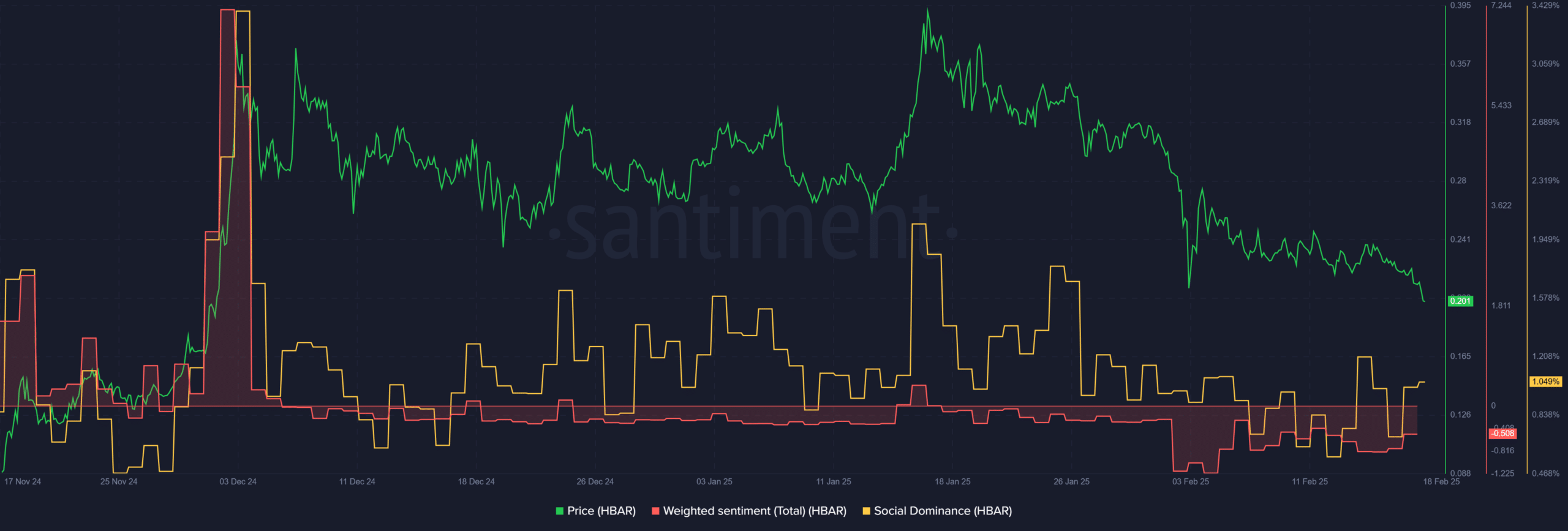

Data from Santiment showed that the social metrics were firmly bearish.

Social Dominance, which is a measure of the token’s volume as a fraction of 50+ of the most popular crypto assets mentioned on social media, has been falling since mid-January.

The Weighted Sentiment has been resolutely bearish since mid-December.

Overall, the short-term market structure meant that bulls should be cautious. Long trades would be against the trend, riskier, and favorable for scalpers.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion