- Trading volumes in the altcoin market have sharply declined, prompting leading analysts to question if the bull run has come to an end.

- With volume historically tied to price action, this shift signals a potential change in investor sentiment and market dynamics.

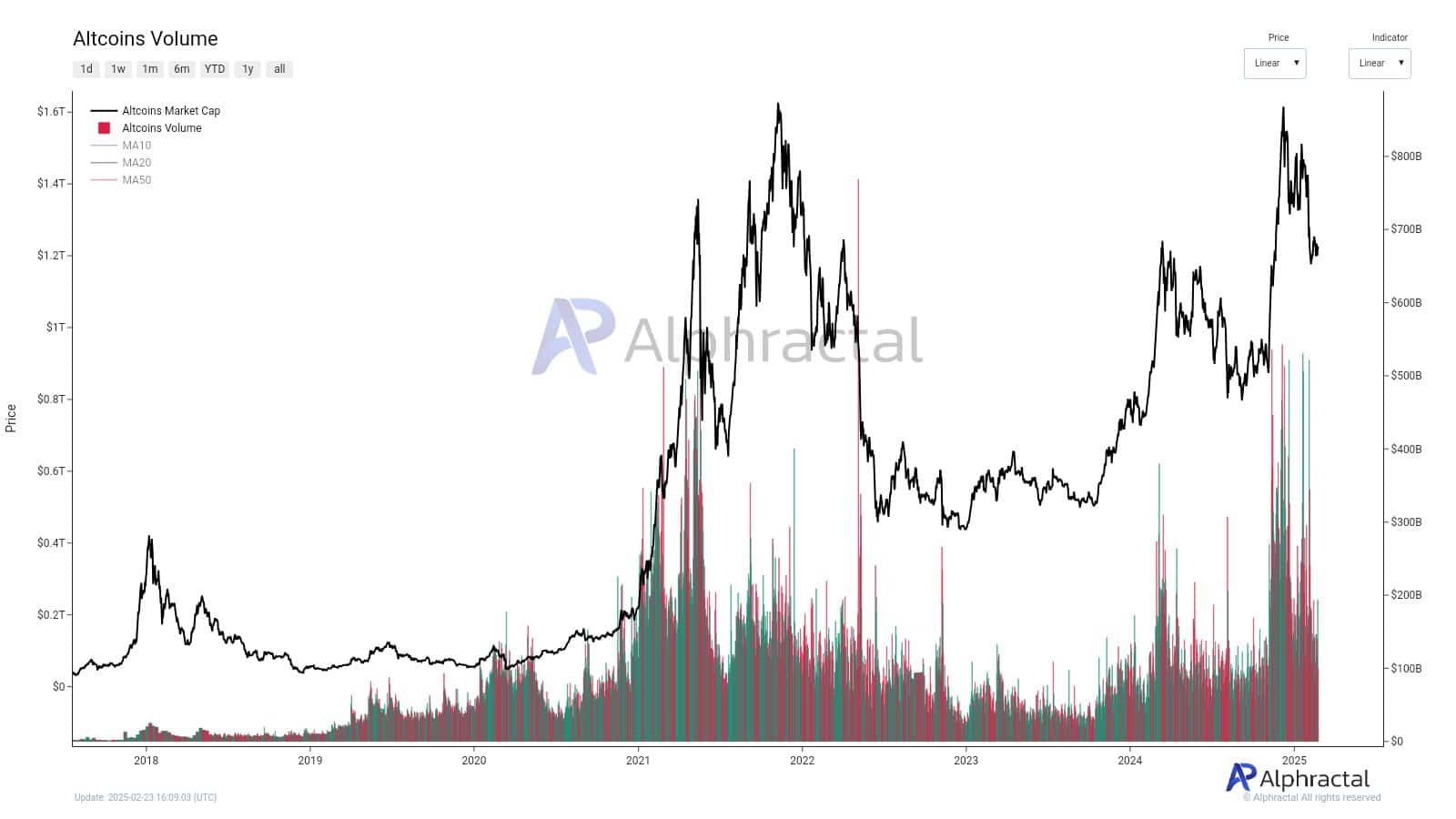

The altcoin market has reached a critical juncture, with trading volumes recently dropping to levels not seen since 2021.

This decline, often perceived as a sign of reduced market interest, is prompting analysts to question the future of altcoins.

Since trading volume typically correlates with price action, this slowdown could indicate a shift in enthusiasm from both retail and institutional investors.

As the market stands at a crossroads, the pressing question is whether we are witnessing the end of one phase and the beginning of another.

Altcoin volume and its significance

Trading volume is a crucial market indicator that reflects the level of activity and investor interest. In the context of altcoins, volume has a direct correlation with price action and often confirms bullish or bearish trends.

During periods of high volume, prices typically experience significant upward or downward movements. Conversely, low volume usually signals consolidation or market stagnation.

Observing previous altcoin cycles, volume generally peaks during bullish periods, thereby validating the strength of market rallies.

The current volume decline and its implications

Altcoin trading volume has seen a sharp drop in recent weeks, raising concerns about waning market momentum.

Source: Alphractal

The latest data indicates that trading activity has retreated from recent highs, aligning with general market hesitation.

February 2025 has experienced increased volatility, with ETF flows fluctuating, regulatory uncertainty affecting sentiment, and liquidity tightening across risk assets.

This downturn in volume suggests a potential shift in market structure, as investors reassess their positions amid evolving macroeconomic conditions.

Historically, similar declines have followed major market peaks. The post-2021 cooldown saw a steep drop in both altcoin prices and volume, leading to prolonged stagnation.

A comparable pattern emerged in 2022 when volume collapsed following a euphoric surge. The current question is whether this decline is a temporary pullback before renewed momentum or the beginning of an extended downturn for altcoins.