- Bitcoin’s spot demand drops sharply, making it vulnerable to further downside, with bearish sentiment rising

- The futures market showed increasing short positions, reinforcing the bearish outlook for Bitcoin amidst global uncertainties

Bitcoin [BTC] is facing renewed selling pressure as demand in the spot market shrinks at its fastest rate since July 2024.

On-chain data reveals a significant contraction in apparent demand, reducing buy-side liquidity and making the asset more vulnerable to downward price movements.

Meanwhile, in the futures market, traders are increasingly opening short positions, reinforcing a bearish outlook. With both spot demand waning and bearish sentiment dominating the derivatives market, Bitcoin’s price has struggled to find support.

Spot demand plummets

Bitcoin’s spot demand plays a crucial role in maintaining price stability by ensuring consistent buy-side pressure.

When spot demand declines, fewer buyers are willing to acquire Bitcoin, increasing the risk of downward price movements.

Source: CryptoQuant

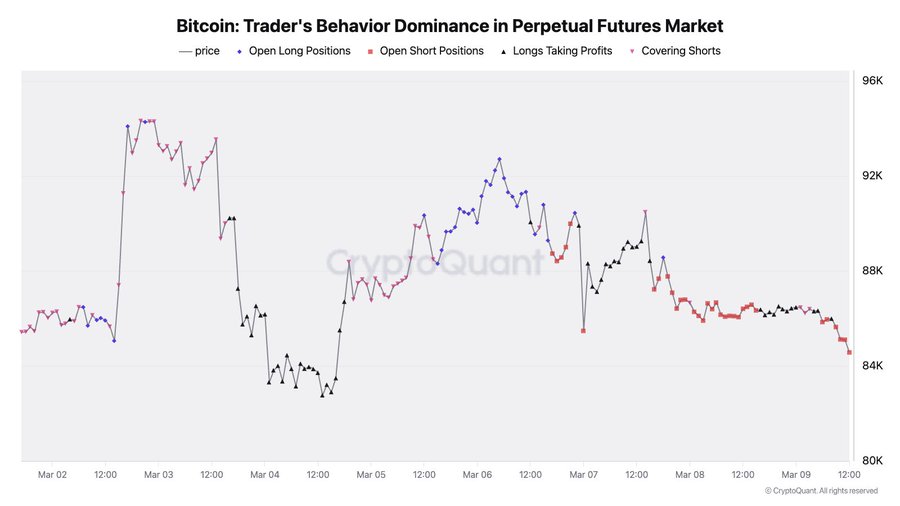

The chart shows a sharp decline in apparent demand starting in early 2025, reaching its lowest point in nearly a year. This drop resembles the pattern observed in July 2024, when a similar decrease in spot demand aligned with a price correction.

Throughout late 2024, positive demand predominantly drove Bitcoin’s rally. However, the recent negative demand reflects a decline in market confidence. If this trend persists, Bitcoin could experience additional downward pressure in the coming weeks.

Bearish bets intensify Bitcoin’s downtrend

The perpetual futures market plays a crucial role in Bitcoin’s price action, as traders use leverage to speculate on price movements.

When long positions dominate, it suggests bullish sentiment, whereas an increase in short positions signals growing bearish pressure.

Source: CryptoQuant

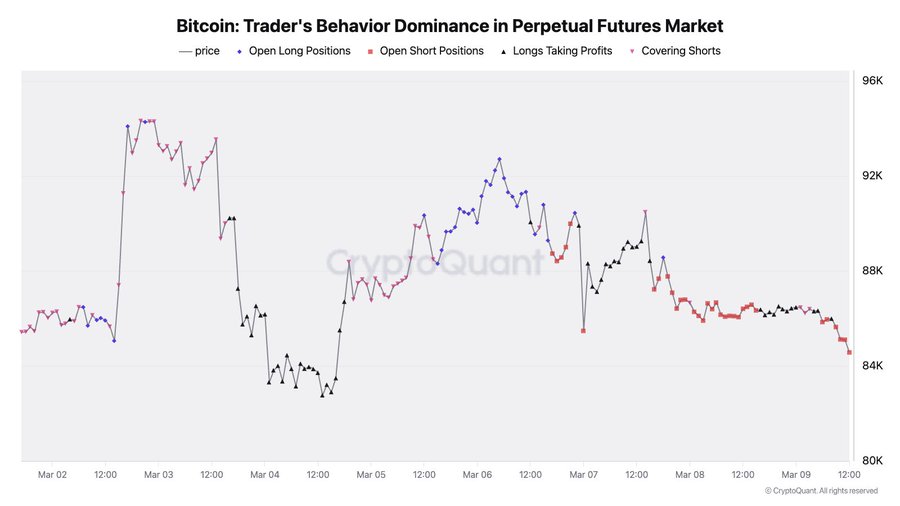

The data reveals that from the 3rd of March onward, there has been a noticeable increase in open short positions, which aligns with Bitcoin’s price drop from approximately $96K to below $84K.

This pattern reflects traders’ anticipation of further price declines, strengthening bearish sentiment. Additionally, the decision of long-position traders to take profits indicates that bullish traders are closing their positions rather than reinforcing them.

If short traders do not begin covering their positions, Bitcoin’s price may continue to experience downward pressure soon.

Broader market sentiment

Over the past week, Bitcoin’s price has dropped by approximately 10.98%, settling at $82,211 at the time of writing.

This decline aligns with increasing global economic uncertainties. Notably, President Donald Trump has acknowledged the possibility of a recession, describing the economy as undergoing a significant transition.

Furthermore, escalating trade tensions and concerns about China’s deflationary pressures have fostered a risk-averse sentiment, causing declines in both traditional and cryptocurrency markets.

These factors suggest that Bitcoin’s recent price drop may be part of a broader market trend driven by macroeconomic influences rather than an isolated incident.

If these economic uncertainties persist, Bitcoin could face ongoing bearish pressure in the weeks ahead. However, positive developments such as favorable regulatory changes or greater institutional adoption could restore market confidence and potentially reverse the downward trend.