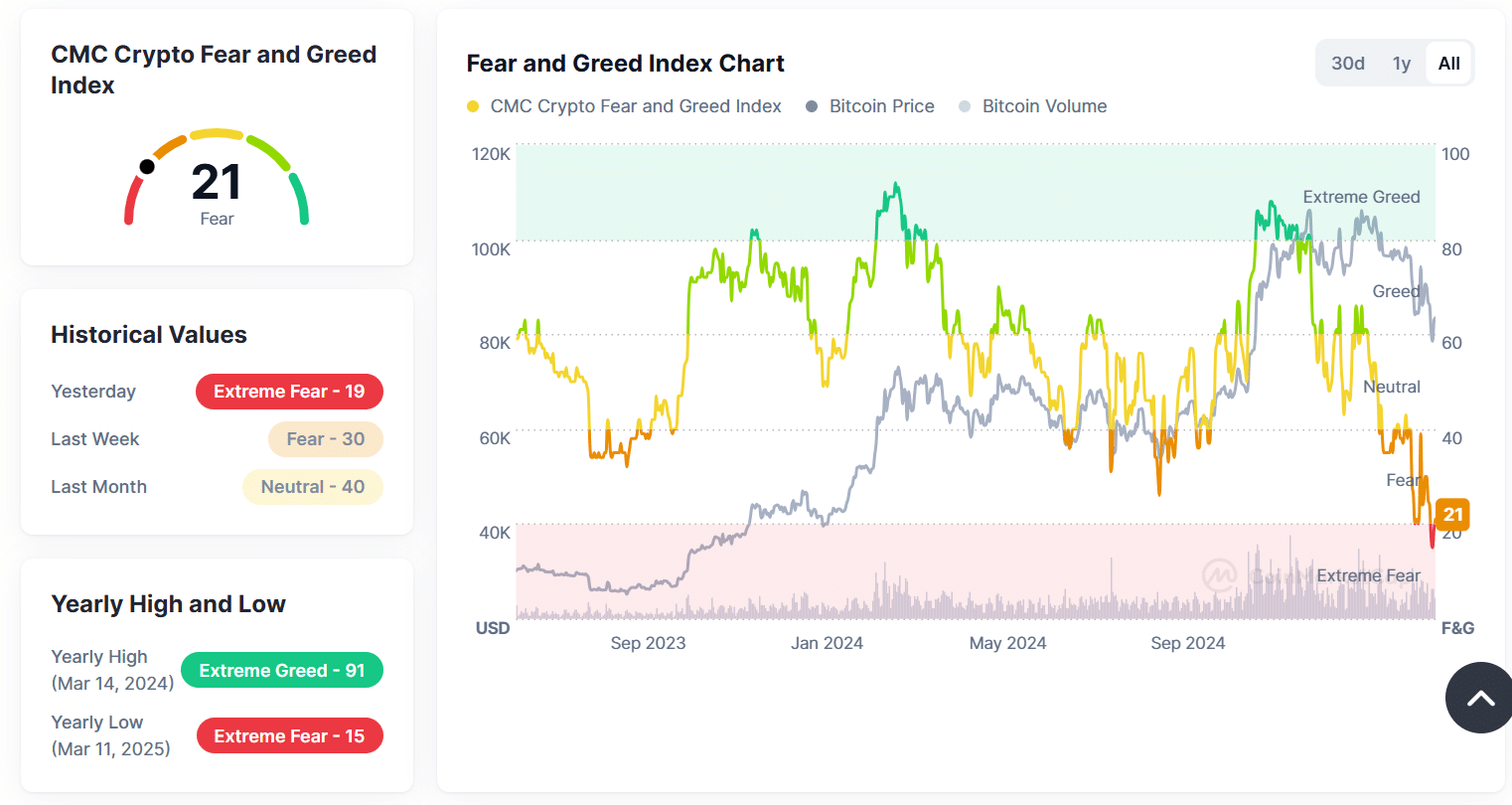

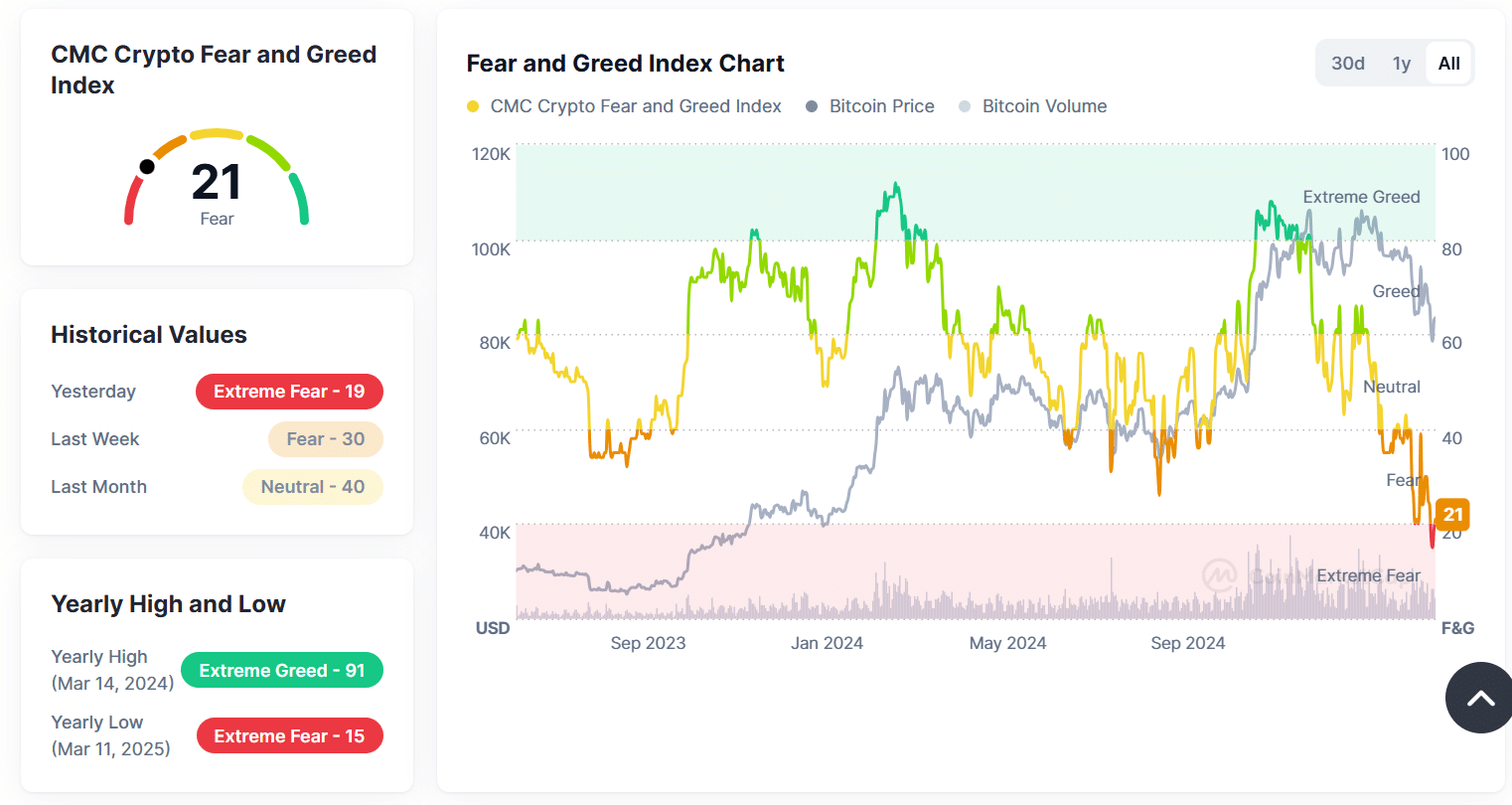

- The Fear and Greed Index has plummeted to 21, marking heightened fear in the market.

- ETF net flows show a mixed trend, with BTC seeing minor inflows while ETH struggles with continued outflows.

The cryptocurrency market is experiencing heightened fear, with the Crypto Fear and Greed Index plunging.

This sharp decline reflects growing uncertainty, driven by significant outflows from ETFs, declining market capitalization, and broader macroeconomic concerns.

Crypto Fear and Greed Index drops

The crypto market sentiment has taken a significant hit as the Fear and Greed Index plummeted to 21, indicating extreme fear among investors.

Just last month, the index stood at a neutral 40, showcasing a sharp decline in confidence as market conditions worsened.

Source: CoinMarketCap

This drop aligns with a broader market correction, reflected in the crypto market cap and ETF net flow trends over the past 30 days.

Market cap suffers major declines

The total crypto market cap now stands at approximately $3 trillion, with Bitcoin [BTC] and Ethereum [ETH] taking significant hits.

Bitcoin’s market cap was $1.65 trillion at press time, marking a 15.11% decline, while Ethereum has seen a more drastic fall, dropping 30.53% to $227.41 billion.

Meanwhile, stablecoins remained relatively stable at $216.23 billion, reflecting a shift towards risk-averse assets in a time of heightened uncertainty.

Source: CoinMarketCap

Other altcoins have also faced major sell-offs, with their collective market cap down 19.76%.

ETF netflows reflect mixed sentiment

ETF netflows provide further insight into investor behavior.

While Bitcoin saw a modest $13 million in positive inflows, Ethereum recorded $10 million in outflows, highlighting diverging investor sentiment between the two leading cryptocurrencies.

Source: CoinMarketCap

Over the past month, multiple days of negative flows have contributed to bearish sentiment, reinforcing the extreme fear reflected in the index.

The persistent outflows suggest investors are still hesitant to deploy capital, further weighing on market recovery.

Implications for crypto markets

A fear and greed index at these levels typically signals an oversold market, but it also indicates a lack of buying confidence among investors.

Historically, such extreme fear levels have preceded recovery phases as opportunistic traders seek to capitalize on lower prices.

However, with continued market cap declines and persistent ETF outflows, the road to recovery may still face resistance.

If Bitcoin fails to hold its market dominance and Ethereum’s outflows continue, the bearish trend could persist, forcing more liquidations and deepening the market correction.

On the other hand, any shift towards positive ETF inflows and market cap stabilization could mark the beginning of a sentiment reversal.

Conclusion

The current market sentiment suggests a cautious approach for traders and investors. While extreme fear may present buying opportunities, macroeconomic factors and capital outflows remain key risks.

Monitoring ETF trends, stablecoin dominance, and Bitcoin’s market strength will be critical in determining the next major move.