- XRP continued its bearish trajectory after taking a 7.9% hit since the weekend

- Lack of strong selling volume hinted at potential for recovery if the market-wide sentiment turns around

XRP saw heightened on-chain activity in recent weeks. However, a recent report also noted that the long-term holders’ net unrealized profit/loss (NUPL) mirrored the 2021 price top. This may be worrisome news for investors.

Uncertainty around Bitcoin [BTC] and a bearish macroeconomic outlook has beset the crypto world with selling pressure. XRP’s derivatives market saw negative funding rates too, implying short sellers were dominant.

XRP bulls rebuffed from the $2.45 resistance

Source: XRP/USDT on TradingView

On the 1-day timeframe, the market structure was bearish after XRP made a new lower low. The Fibonacci retracement levels plotted based on the rejection from $3 earlier this month showed that the 50% retracement level was at $2.45.

XRP bulls were unable to push the price beyond this resistance level. At the time of writing, the price was down 7.9% from Saturday’s high at $2.47. The 20 and 50-day moving averages revealed that the momentum was bearish. Moreover, the 20 DMA has acted as dynamic resistance recently and may be expected to oppose XRP’s gains in the short term.

Despite the downtrend over the past two months, however, the CMF remained above +0.05 for the most part. It was at +0.06 at press time, signifying strong capital inflows to the market. The clue was that selling volume was weak, and a BTC recovery could see XRP jump higher and break its bearish structure.

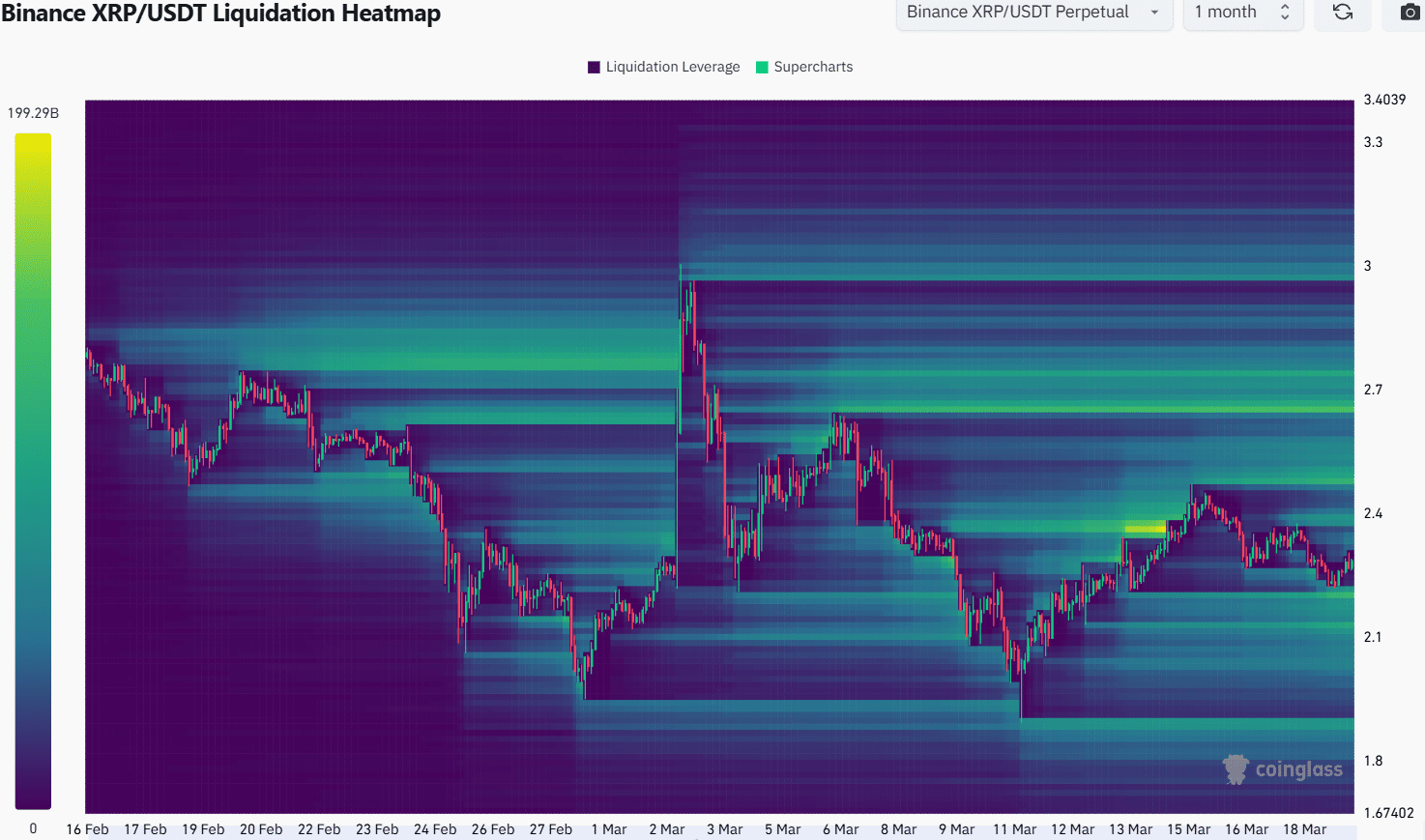

The liquidation heatmap highlighted two magnetic zones of interest at $2.2 and $2.37. Both liquidation pockets were similarly sized and had an equal chance of attracting the price to them. Considering the short-term price action, a move to $2.2 may be more likely over the next day or two.

Overall, traders and investors can expect more losses until BTC’s trajectory changes. In the short term, a drop to $2.2 could give bulls an opportunity to go long, targeting the $2.4-$2.45 resistance.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion