- DeFi dominance is under 3%, potentially signaling a buying opportunity for undervalued tokens.

- Despite challenges, innovative DeFi projects continue to attract investment and show resilience.

DeFi’s share of the market has quietly slipped to a historic low — under 3% — but that decline may be masking an opportunity.

As capital continues to concentrate in Bitcoin [BTC] and Ethereum [ETH], a growing number of investors are eyeing undervalued DeFi tokens that have been left behind in the broader downturn.

Names like Chainlink [LINK], Hedera [HBAR], Avalanche [AVAX], Uniswap [UNI], and Aave [AAVE] have maintained strong fundamentals despite fading hype.

With market attention elsewhere, this could be a pivotal accumulation phase for high-conviction plays in the DeFi ecosystem.

DeFi dominance hits historic lows, but…

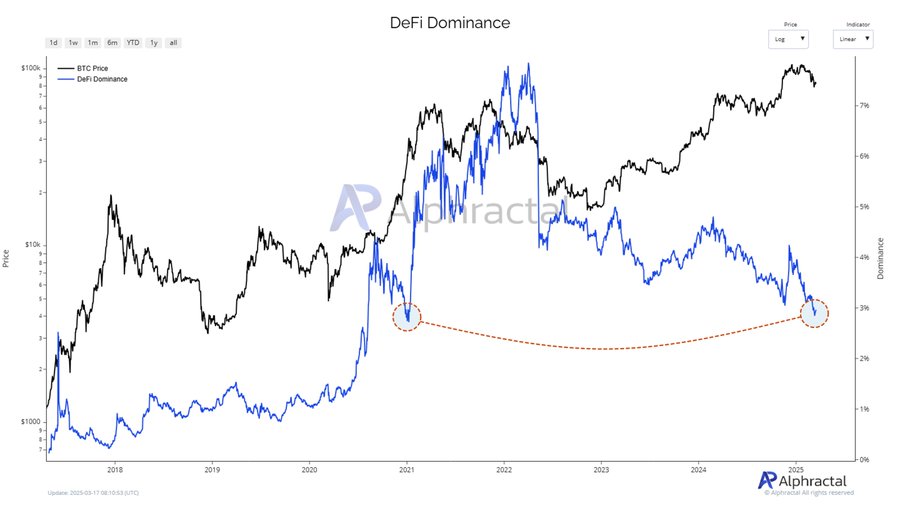

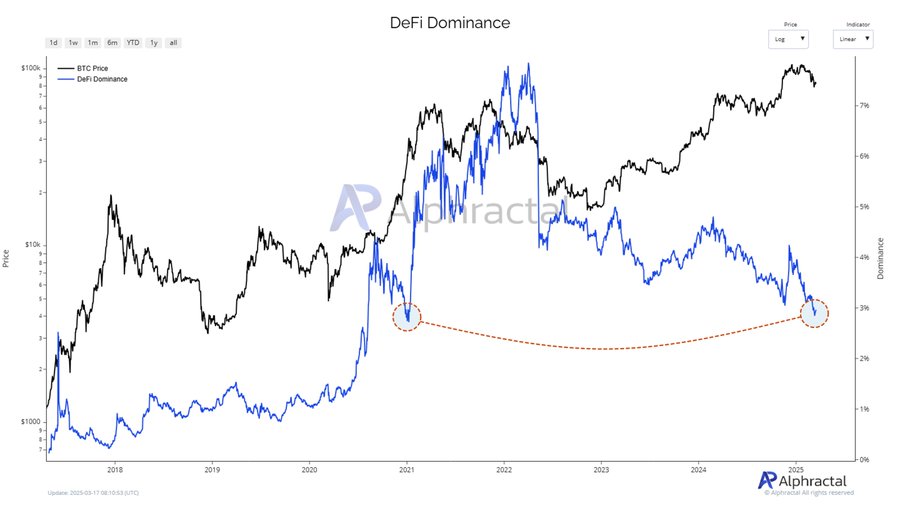

Recent data from Alphractal shows DeFi dominance falling below 3% — levels last seen during the early 2021 cycle bottom.

Notably, that previous dip marked the start of a major DeFi resurgence as capital rotated out of Bitcoin into undervalued altcoins.

The current setup mirrors that historical trend, with BTC trading near local highs while DeFi tokens lag behind.

Source: Alphractal

This sharp divergence could signal a cyclical pivot point. Investors who positioned early during the 2021 dominance trough saw outsized returns — and the same setup may be unfolding now.

As broader market sentiment remains cautious, this dip in DeFi share might just be the opportunity patient accumulators have been waiting for.

Sector shakedown or undervaluation?

With DeFi dominance falling below 3%, the sector faces a pivotal moment. Recent events have compounded uncertainty — like AAVE’s volatile price action tied to its fee switch proposal, which raised manipulation concerns.

Meanwhile, February brought regulatory clarity when the SEC dropped its appeal against a ruling that exempted DeFi platforms from securities laws.

Still, the damage from prior enforcement fears lingers. Broader market jitters — such as 17 straight days of Bitcoin ETF outflows – have also pushed investors toward safer assets.

Yet, historically, similar DeFi lows preceded major rebounds.

DeFi projects are quietly performing

Despite a decline in DeFi dominance, several projects continue to demonstrate resilience and innovation.

Hemi Labs recently launched its mainnet with a TVL of $440 million, aiming to integrate Bitcoin and Ethereum into a unified network.

Similarly, Converge, developed by Ethena and Securitize, is set to debut in Q2 as an Ethereum-compatible blockchain featuring native KYC and custody solutions, targeting institutional adoption.

In comparison to other crypto sectors, DeFi’s reduced market share contrasts with the growth observed in other areas.

For instance, World Liberty Finance, a DeFi initiative backed by former President Donald Trump, recently secured $550 million in token sales, indicating sustained investor interest.

Additionally, platforms like INFINIT are enhancing user experiences by introducing tools such as the INFINIT Terminal, which simplifies interactions with DeFi protocols through personalized, text-based agents.

While DeFi faces challenges, these developments suggest that innovative projects continue to attract attention and investment, potentially signaling a period of undervaluation rather than a sector-wide decline.