- ETH/BTC is a strong indicator of a trend reversal in Ethereum’s favor against Bitcoin.

- Volume indicators confirm seller exhaustion—will it translate to a price increase?

Following the recent Federal Open Market Committee (FOMC) meeting, which signaled a slowing economy, both Bitcoin [BTC] and Ethereum [ETH] have successfully reclaimed critical resistance levels.

This development raises whether ETH, currently at a five-year low against BTC in the ETH/BTC pair, could outpace Bitcoin in an impending market rebound.

Market dilemma: Execution or speculation?

Amid concerns about the economic impact of tariffs, the Federal Reserve maintained the borrowing rate at 4.25%-4.5%, unchanged since December.

However, markets surged on ‘speculation’ that the Fed might implement two rate cuts this year instead of one. With inflation showing signs of easing and labor market pressures intensifying, the central bank may be compelled to adopt a more accommodative policy.

The anticipation of increased liquidity and policy easing sparked a sharp rally in risk assets.

At the time of writing, Bitcoin climbed 5.02%, decisively breaking through the $85k resistance level, while Ethereum gained 6.45%, reclaiming the $2k mark after a prolonged period of consolidation.

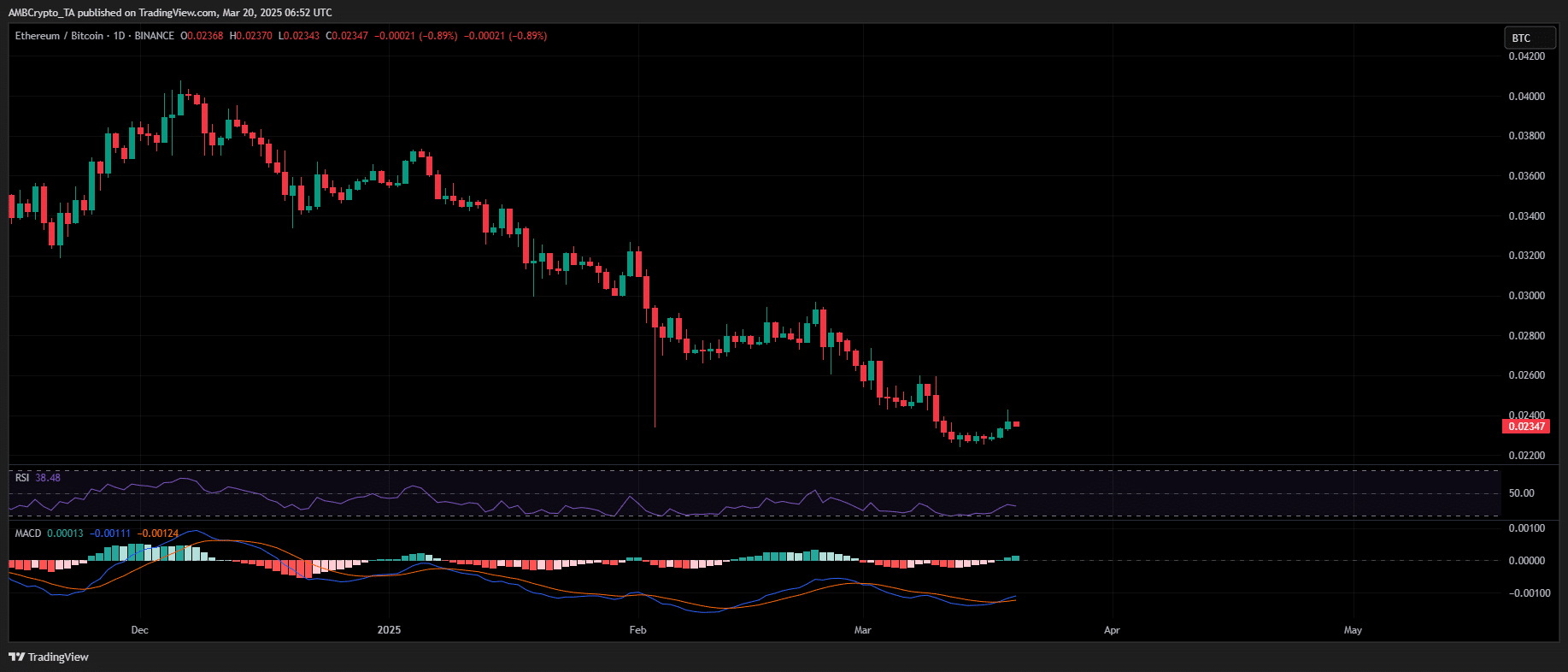

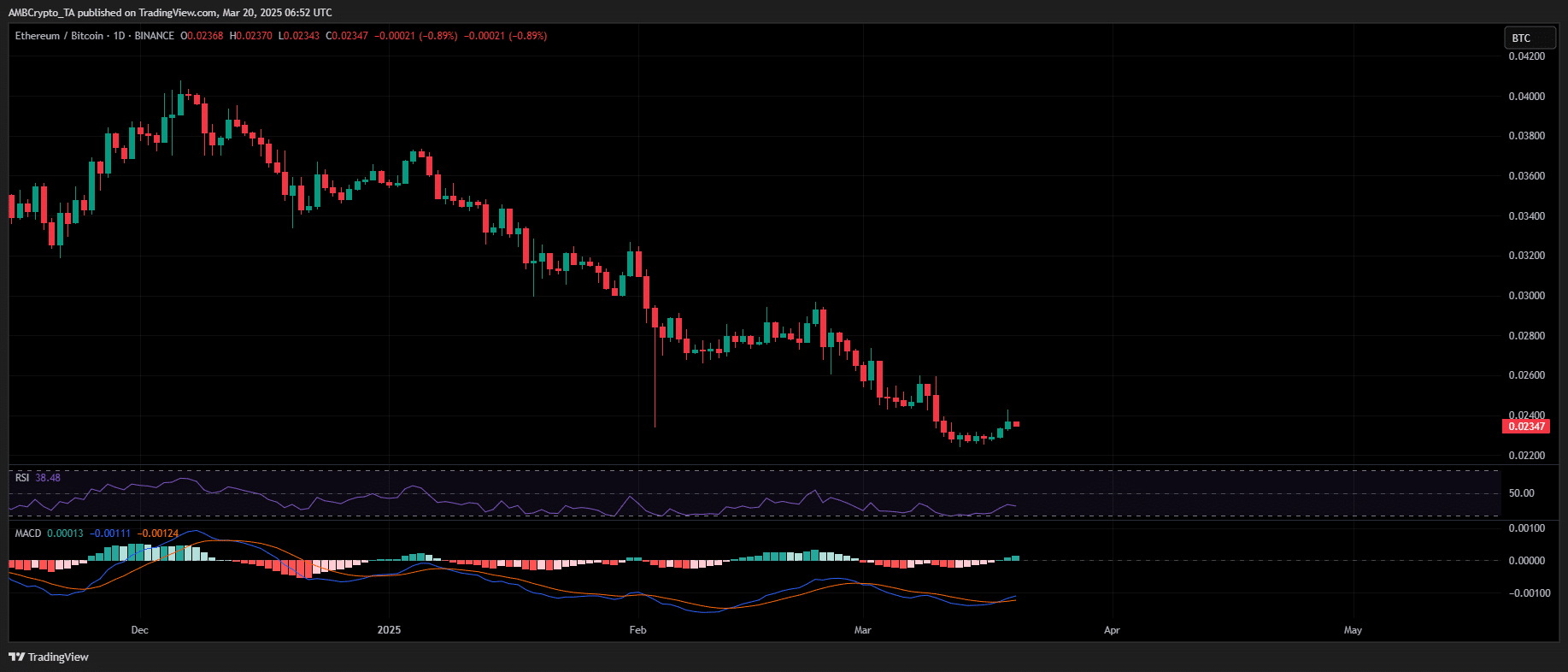

Additionally, the 1-day ETH/BTC MACD indicator turned bullish as trading volume reached a two-week-high, suggesting a potential shift in favor of Ethereum.

Source: TradingView (ETH/BTC)

However, holding this pattern remains uncertain. Without clear policy “execution”, post-FOMC volatility has surged. This makes it harder to confirm these resistance zones as strong support levels.

ETH vs. BTC: Who dominates the next market recovery?

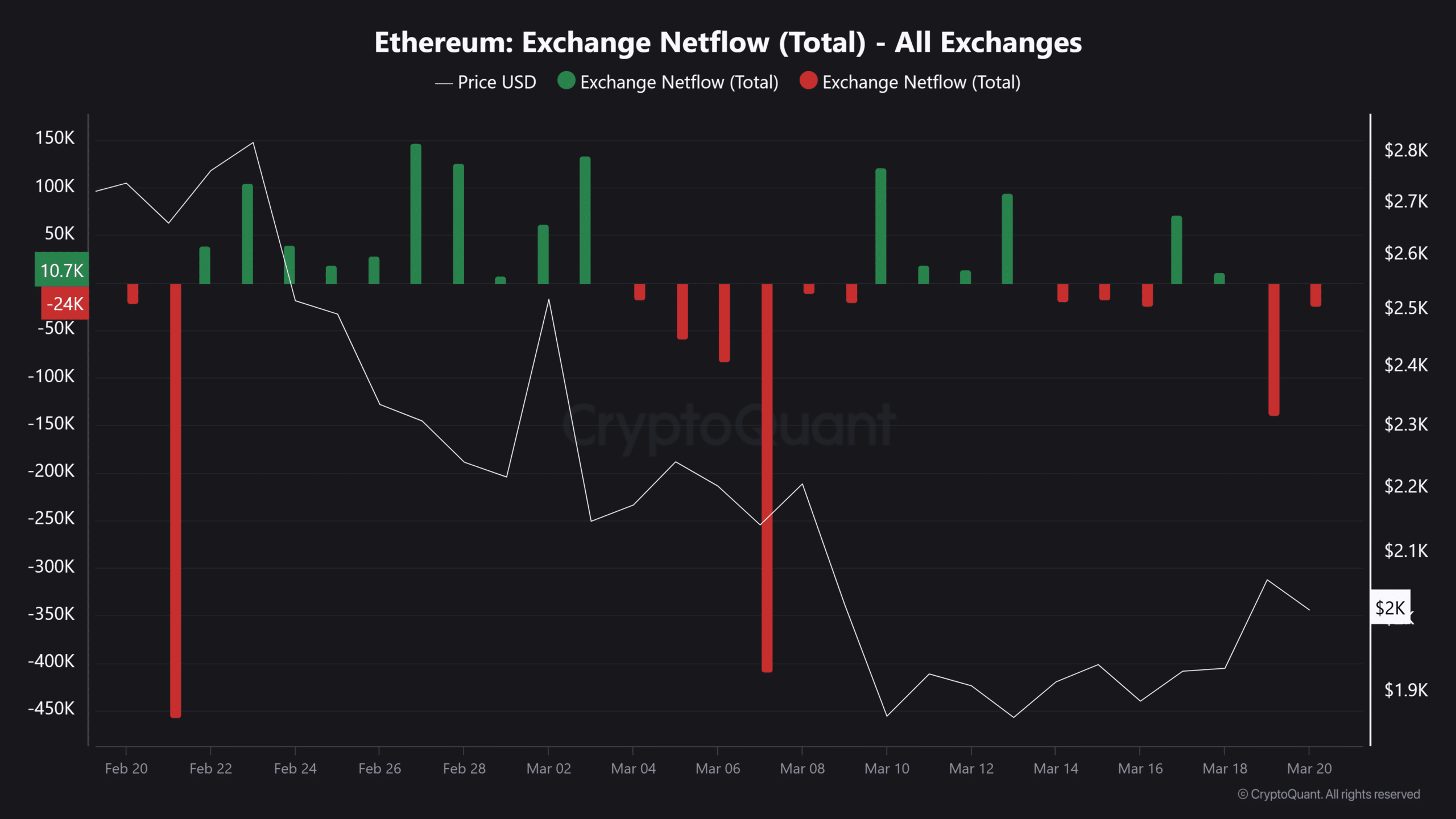

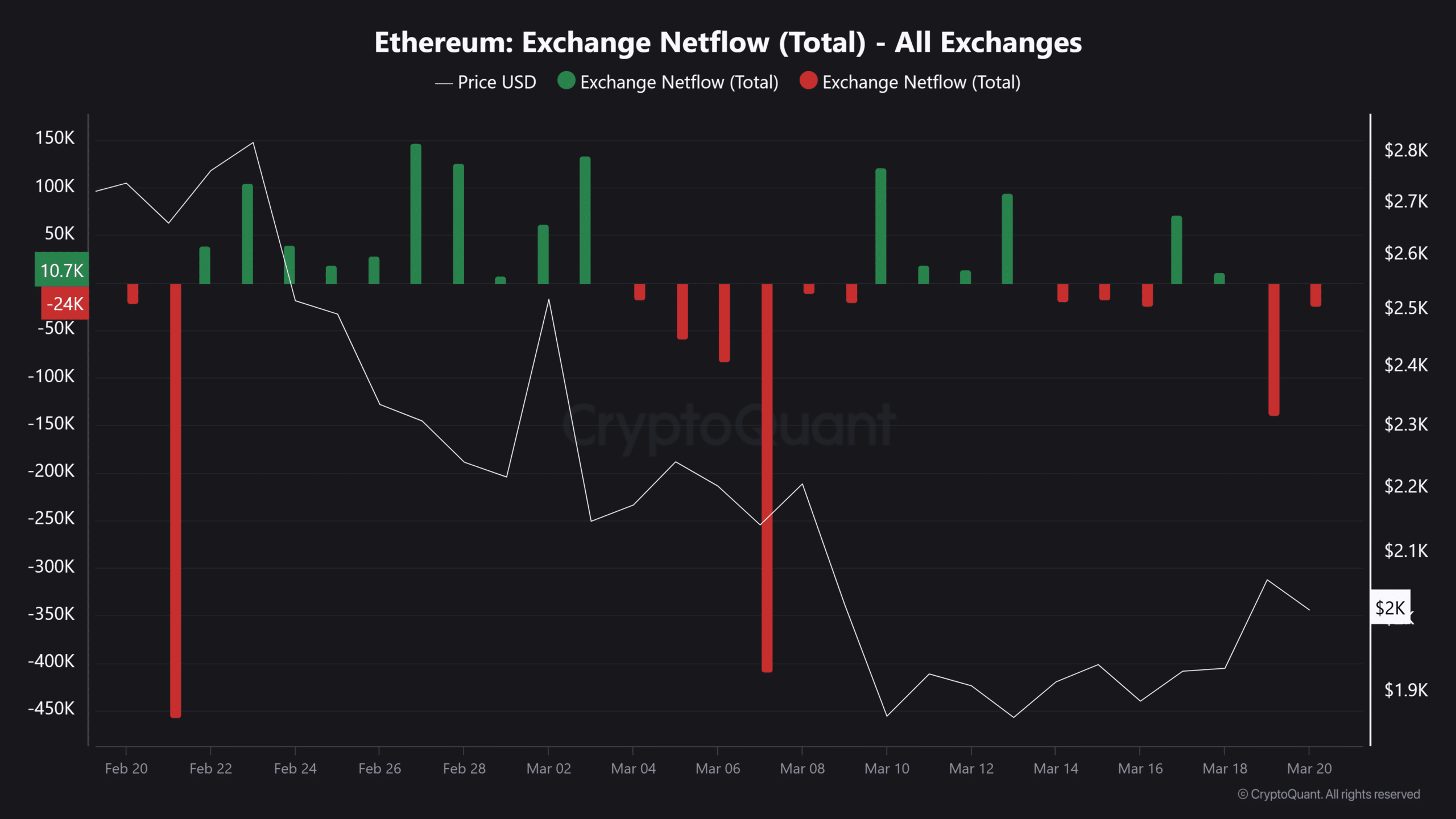

Fundamentals are key to confirming this trend. As ETH reclaimed the $2k level, large capital inflows hinted at a potential bottom formation.

On-chain data confirms that Donald Trump’s World Liberty Financial has resumed ETH accumulation. The fund moved 25 million USDC to a new multi-sig wallet and executed a 4,468 ETH ($10 million) purchase at $2,238.

Simultaneously, retail demand surged at $2,059, triggering the largest ETH exchange outflow in over two weeks – 139k ETH moving off exchanges.

Source: CryptoQuant

Meanwhile, BTC ETFs recorded four consecutive days of net inflows, reinforcing its current market price as a strong “dip-buying” zone.

However, for Ethereum to establish dominance, ETH/BTC must break key resistance at $0.025, backed by a sustained capital rotation from BTC into ETH.

Currently, Bitcoin’s strong fundamentals continue to drive long-term holding sentiment, while Ethereum’s recovery hinges on reclaiming the $2.5K resistance.

Without a confirmed breakout, speculation-driven volatility persists, leaving the broader market rebound uncertain. Failure to hold key support could see Ethereum risk losing the critical $2k support level.