- Ethereum users decided to lock their ETH after the Merge.

- ETH exchange supply has diminished by 16.4% over the previous seven weeks.

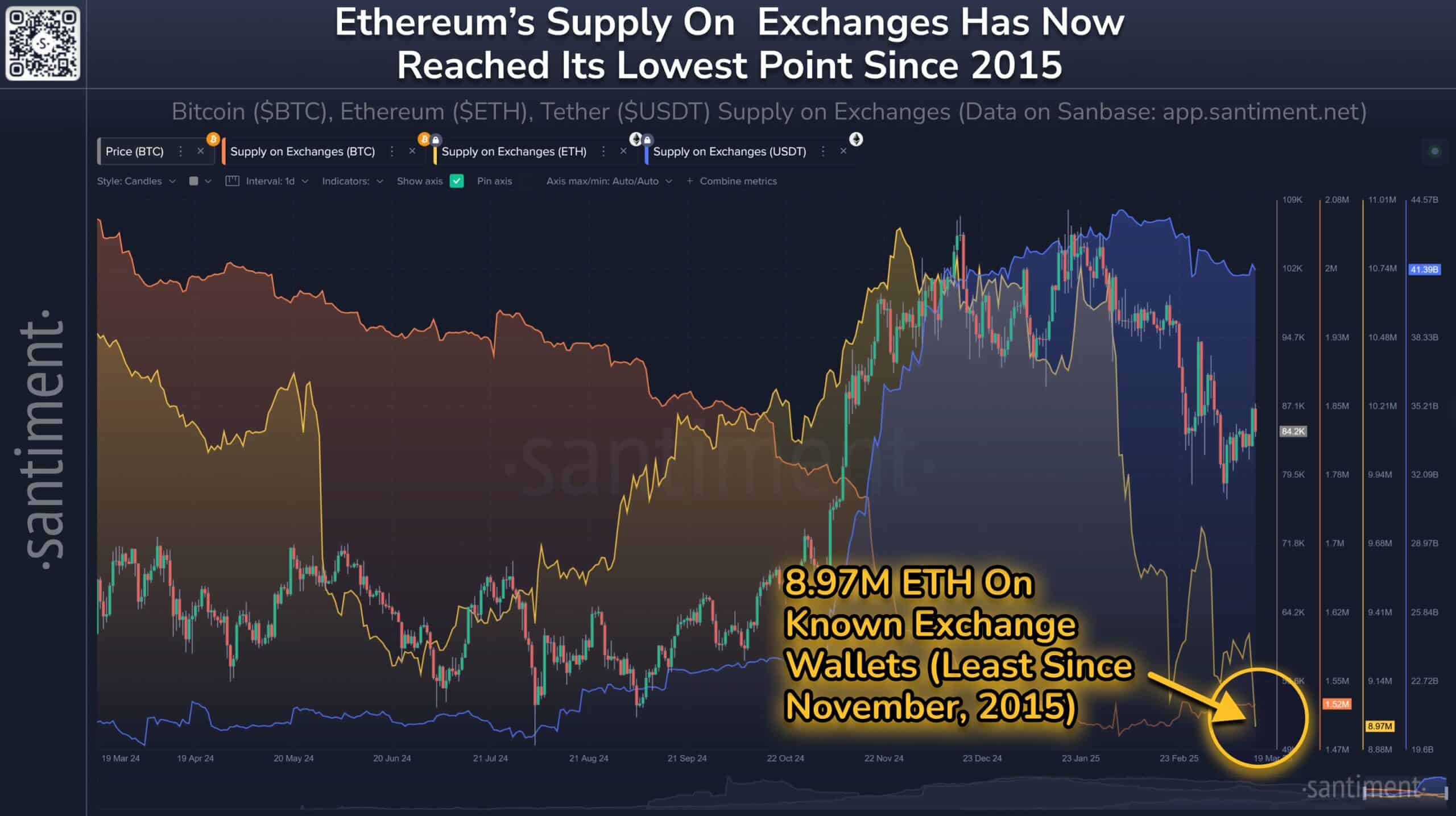

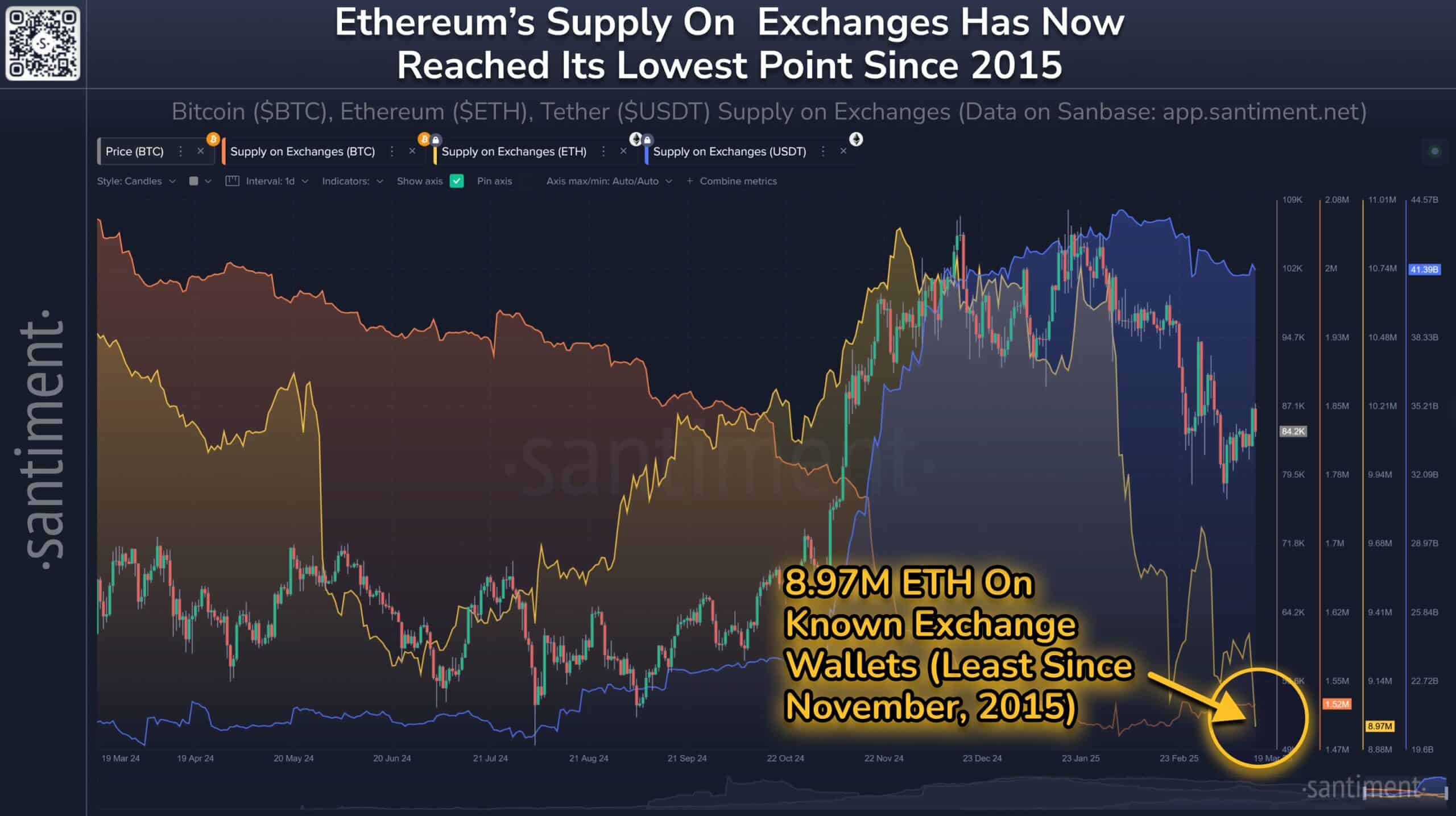

The amount of Ethereum [ETH] on centralized exchanges has dropped to 8.97 million ETH, marking its lowest supply since November 2015.

Additionally, investor behavior has shifted significantly as the immediate trading supply of ETH reaches this historical low.

Source: Santiment

Santiment data reveals a consistent decline in Ethereum supply on centralized exchanges, reflecting increased confidence in Ethereum’s long-term potential.

As a result, ETH holders are increasingly using their tokens for staking and decentralized finance (DeFi) activities, shifting away from prioritizing immediate trading.

Supply shift: Impact of DeFi and staking

The voluntary transfer of Ethereum from exchanges is primarily driven by growing interest in DeFi functions and staking rewards. After the Merge, ETH users began locking their tokens as the shift to Proof of Stake offered staking rewards along with network security benefits.

Additionally, Ethereum’s leadership in the DeFi sector has attracted diverse user groups participating in activities like lending, liquidity provision, and yield farming.

This shift in ownership reflects a preference among investors to engage actively within the ETH network rather than keeping their ETH on centralized exchanges.

The increasing interaction with the Ethereum platform supports its long-term sustainability and growth.

Ethereum’s exchange supply decline accelerates

ETH exchange supply has decreased by 16.4% over the past seven weeks, marking the largest drop since late 2024.

This sharp decline reflects growing investor confidence, as many shift their holdings toward staking and DeFi applications. Ethereum is evolving into a yield-generating asset rather than merely a trading instrument.

The ongoing outflow from exchanges suggests that holders anticipate a rise in Ethereum’s value, supporting a long-term bullish outlook.

Diminished exchange supply could significantly impact market dynamics. Limited ETH availability might drive prices higher due to scarcity at stable demand levels.

Additionally, reduced liquidity on exchanges could lead to increased volatility, amplifying price movements. The continued migration of Ethereum from centralized platforms highlights strong network confidence, reinforcing bullish sentiment.

As DeFi and staking attract more capital, Ethereum’s position as a valuable long-term asset strengthens within the evolving crypto market landscape.