- Bitcoin’s ROI has diminished over cycles, but it still outperforms traditional investments in long-term growth

- Rising leverage and shifting whale sentiment signal increased volatility, making short-term risks more likely

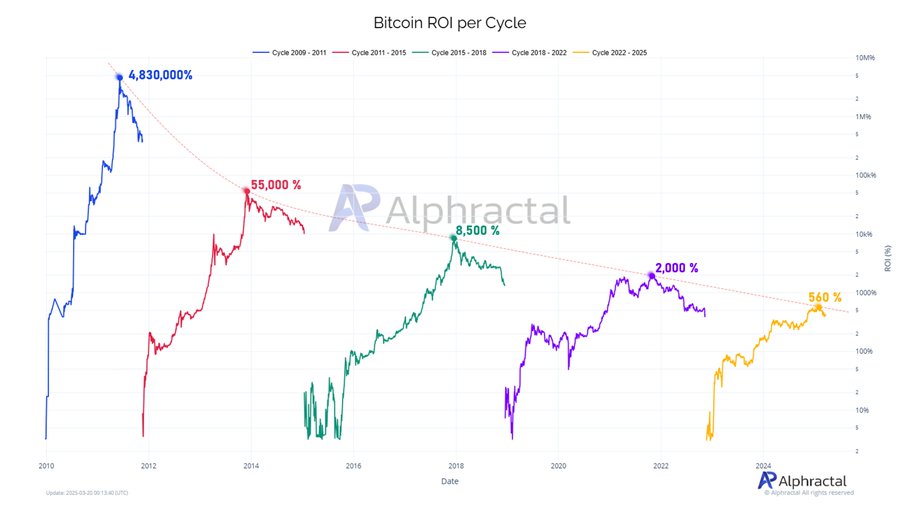

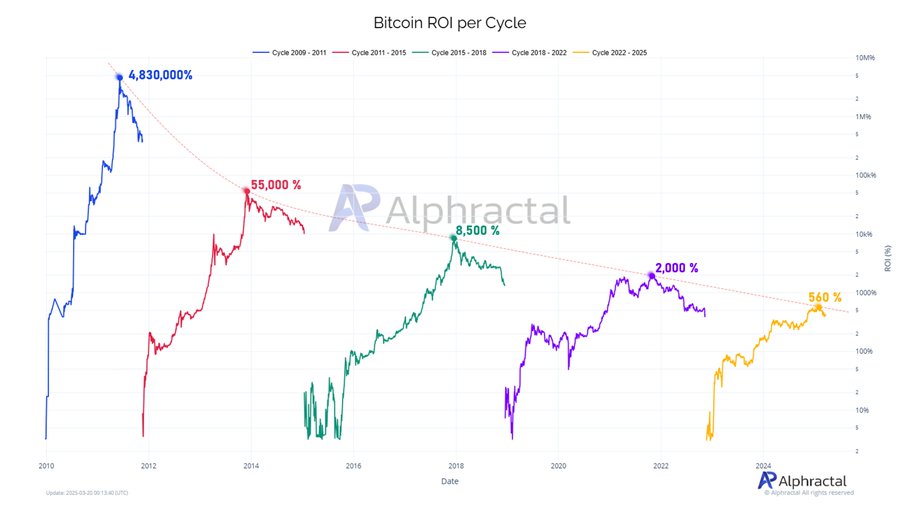

As Bitcoin [BTC] matures, its explosive returns from earlier cycles have given way to more stable, yet still impressive, growth.

With the latest cycle showing a 560% return on investment (ROI), Bitcoin continues to outpace traditional investments like stocks, making it an attractive choice for long-term investors.

However, with rising market leverage and a shift in whale sentiment towards short positions, the potential for increased volatility looms on the horizon.

Diminishing returns, growing maturity

Bitcoin’s ROI has followed a clear downtrend with each halving cycle: from a staggering 4,830,000% gain in its earliest days (2009–2011) to 55,000% in the 2011–2015 cycle, 8,500% in 2015–2018, and 2,000% during 2018–2022.

Source: Alphractal

The current cycle (2022–2025) so far shows a 560% ROI—still outperforming traditional markets but reinforcing a steady pattern of diminishing returns as Bitcoin scales and matures.

This declining ROI arc mirrors the asset’s increasing liquidity, institutional adoption, and reduced speculative blow-off tops.

Whale positioning flips bearish as short exposure grows

The latest sentiment data from large Bitcoin holders reveals a shift in positioning. The whale position sentiment index has turned lower after peaking, indicating a rising preference for short positions.

Historically, sharp downturns in this metric have preceded either short-term pullbacks or high-volatility price zones.

Source: Alphractal

The change comes at a time when BTC price action shows consolidation around $85k-$90k, suggesting whales may be hedging against downside risk.

This flip in sentiment does not always signal a trend reversal, but it highlights a cooling of confidence among influential market participants.

In a maturing market, such behavior shows the growing influence of derivative markets on price psychology and near-term volatility.

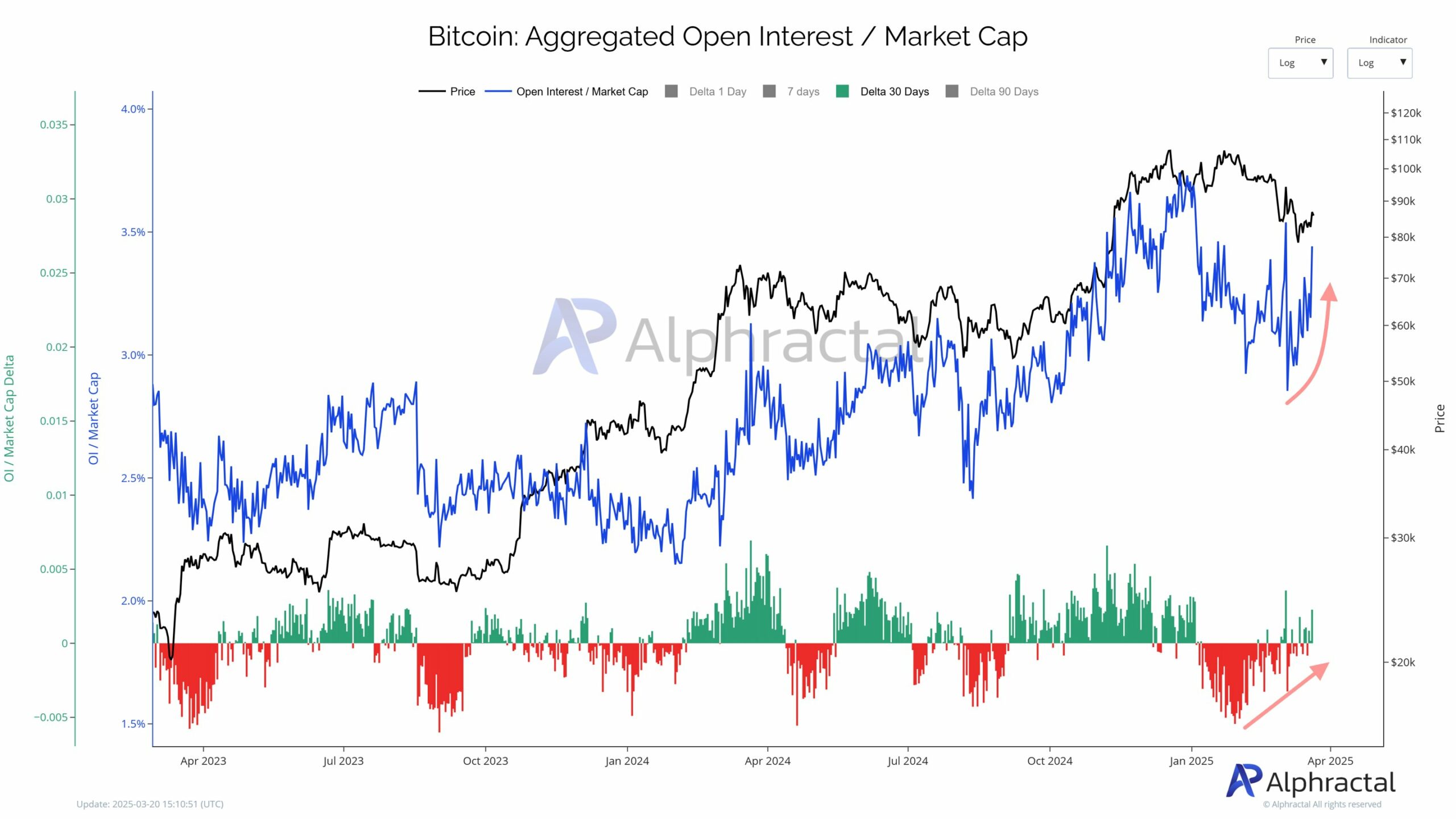

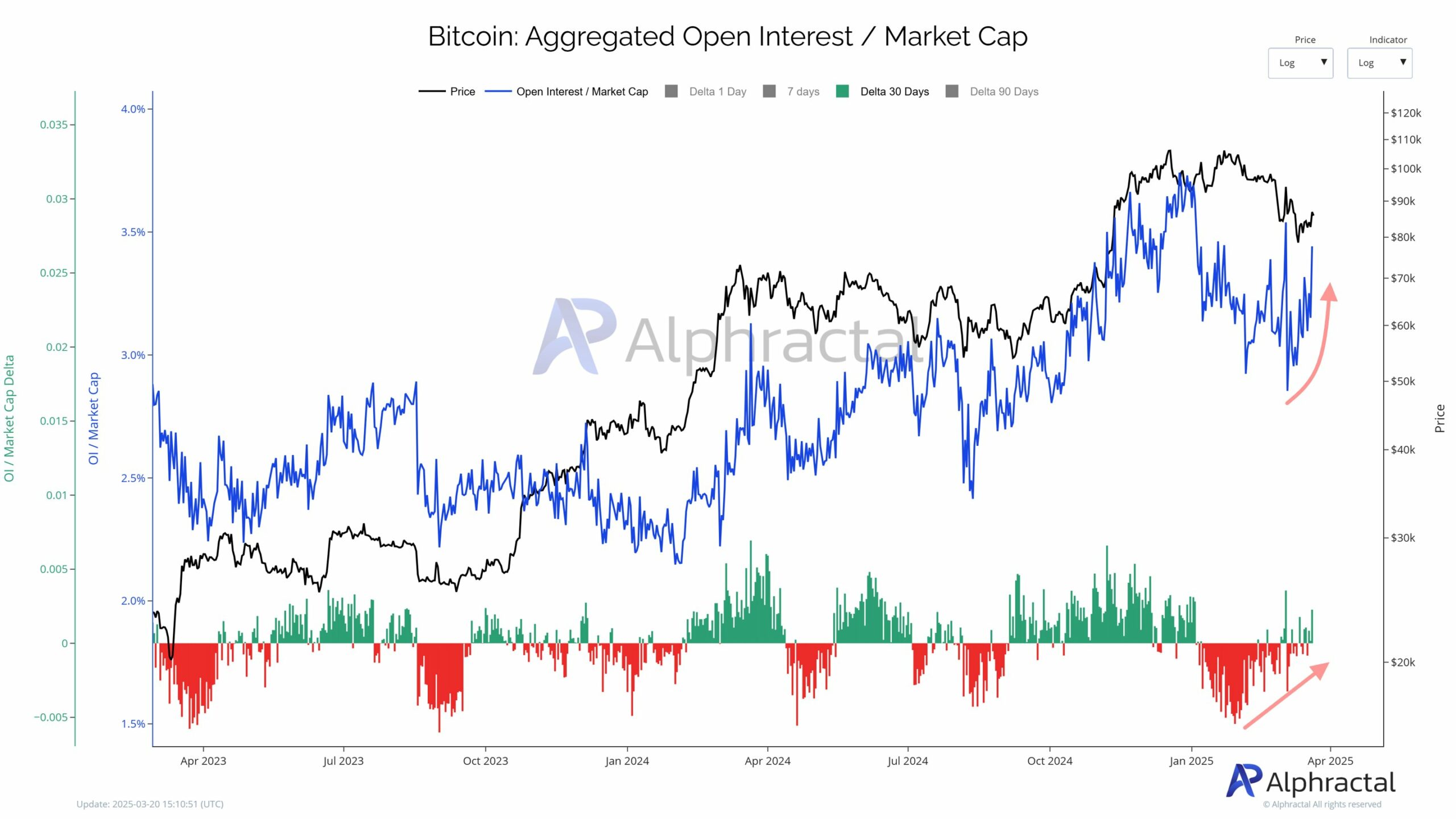

Open Interest surges relative to market cap

Bitcoin’s Aggregated Open Interest (OI) relative to Market Cap is rising sharply again, crossing the 3% threshold — a level that has historically preceded increased volatility or short-term corrections.

As the blue line trends upward, it signals a build-up in leverage across futures markets. The growing gap between price and OI/Market Cap ratio suggests speculative positioning is heating up faster than spot market demand.

Source: Alphractal

The 30-day delta has turned positive, indicating fresh capital entering the derivatives market. This trend resembles patterns observed during previous market peaks and shakeouts.

Although not inherently bearish, the data suggests that Bitcoin’s next significant move could be amplified by over-leveraged traders, making heightened volatility highly likely.

What does the future look like?

Bitcoin has matured into an institutional-grade asset, defined by resilience and long-term growth rather than exponential surges.

While its ROI no longer matches early bull runs, it consistently outperforms traditional assets like equities and gold. However, growing leverage and cautious whale sentiment present risks of short-term volatility.

Investors should anticipate sharper rallies and corrections as macroeconomic conditions and liquidity evolve. A disciplined, long-term approach is key to navigating these fluctuations.

With proper allocation and risk management, Bitcoin remains a valuable portfolio asset in the increasingly digital and decentralized financial landscape.