- Whale activity and falling reserves hinted ar limited selling pressure and potential for a rebound

- Hike in active addresses alluded to rising demand, while long liquidations pointed to bearish pressure

Significant whale activity has stirred Uniswap’s [UNI] market lately. In fact, a certain whale purchased 290,212 UNI for 1,000 ETH ($1.97M) after being inactive for 3.5 months. Such a large-scale transaction is a sign of renewed interest in UNI and positive sentiment across the market.

At press time, UNI was trading at $6.82 following a slight 0.13% hike over the last 24 hours. Such whale movements are often signs of shifts in the market, especially as large players have the potential to influence price action.

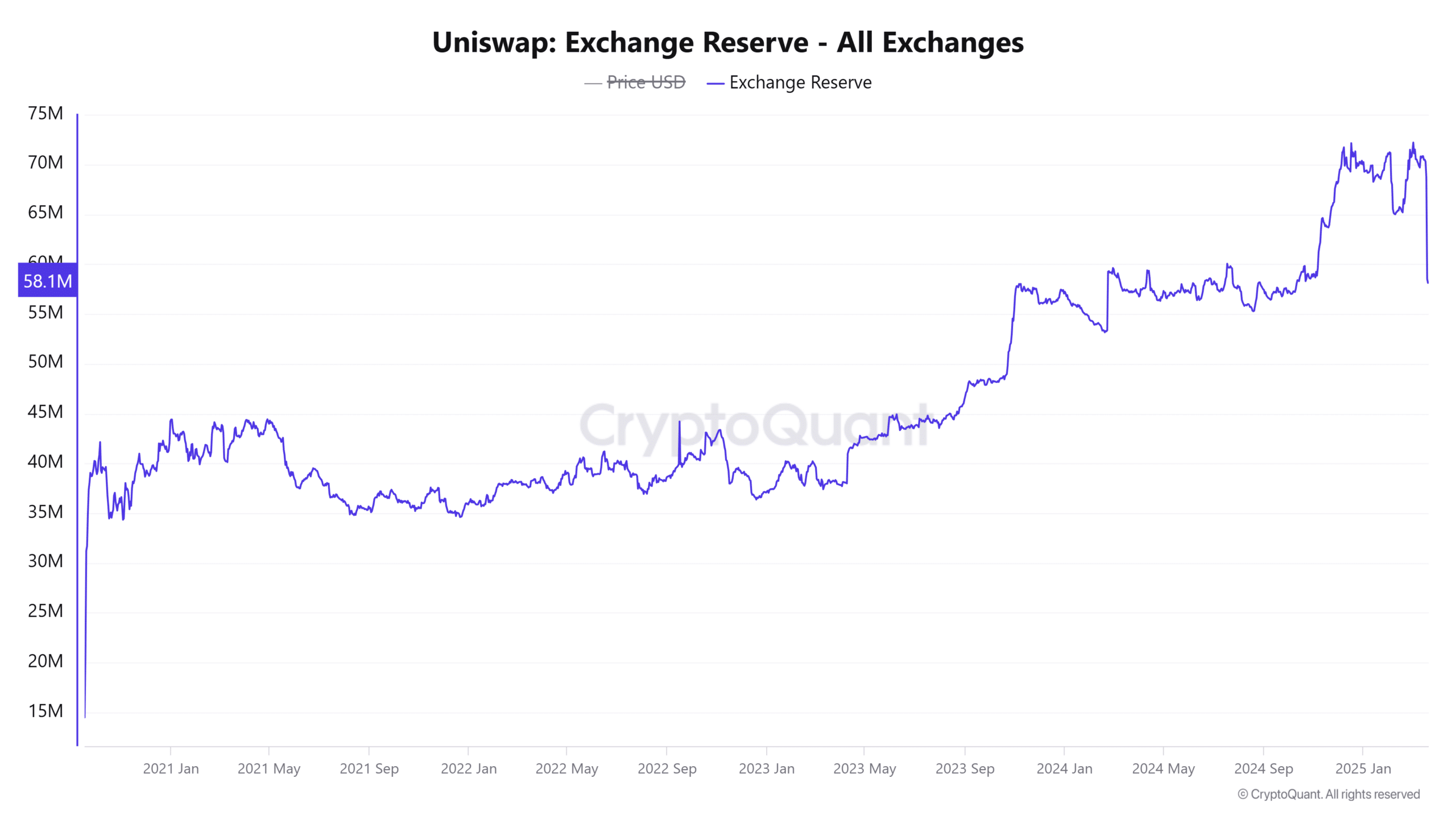

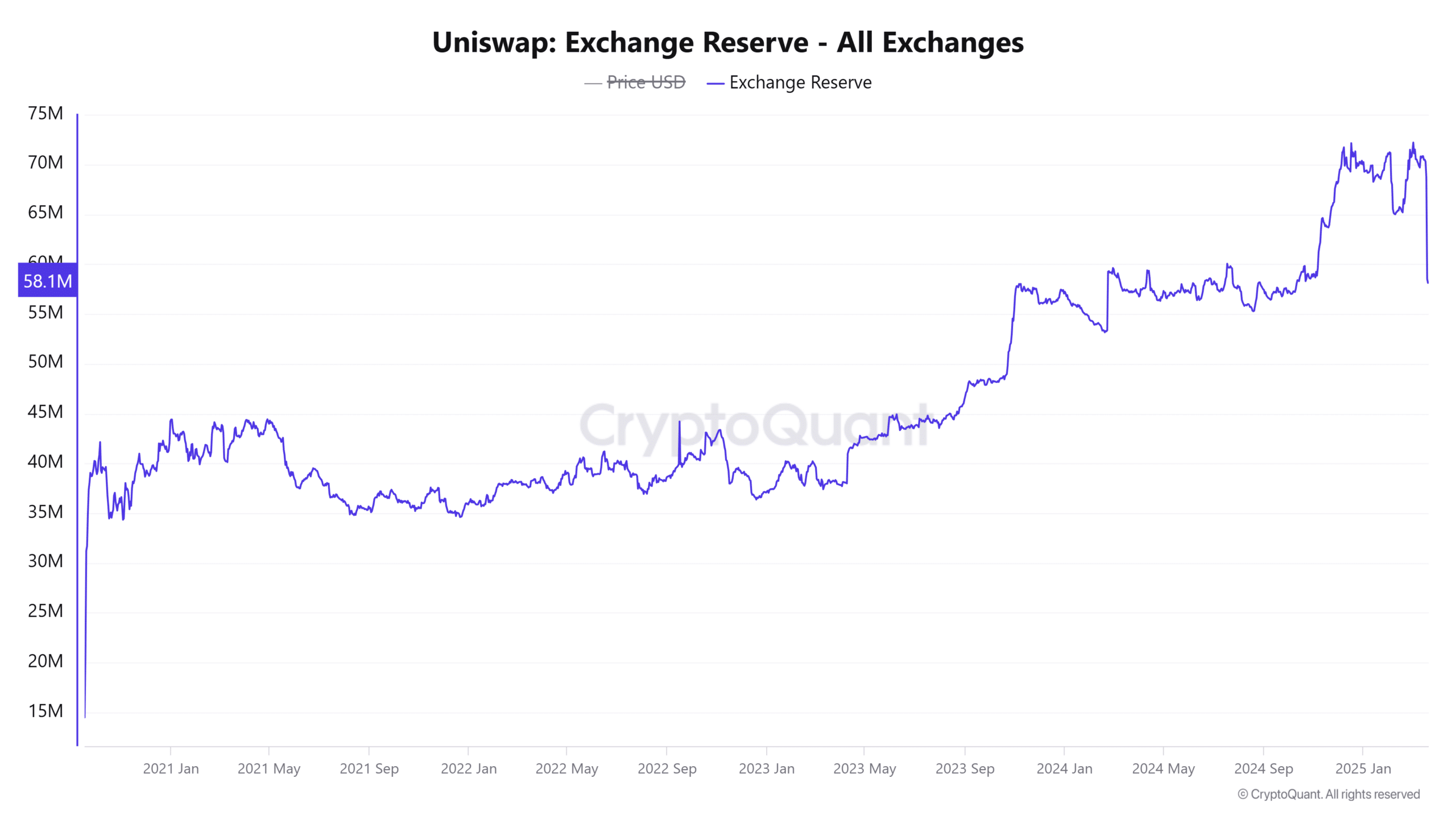

UNI’s exchange reserves decreased by 15% over the last 24 hours, hinting at a fall in selling pressure. A decline in available coins on exchanges means less liquidity, something which typically supports the price.

As fewer UNI coins are available to sell, this could help limit significant downward movement, assuming demand stays consistent. Therefore, the fall in reserves could imply some level of support for price stability or even a potential recovery. Especially if demand rises across the market.

Source: CryptoQuant

UNI’s price outlook – Is a rebound on the horizon?

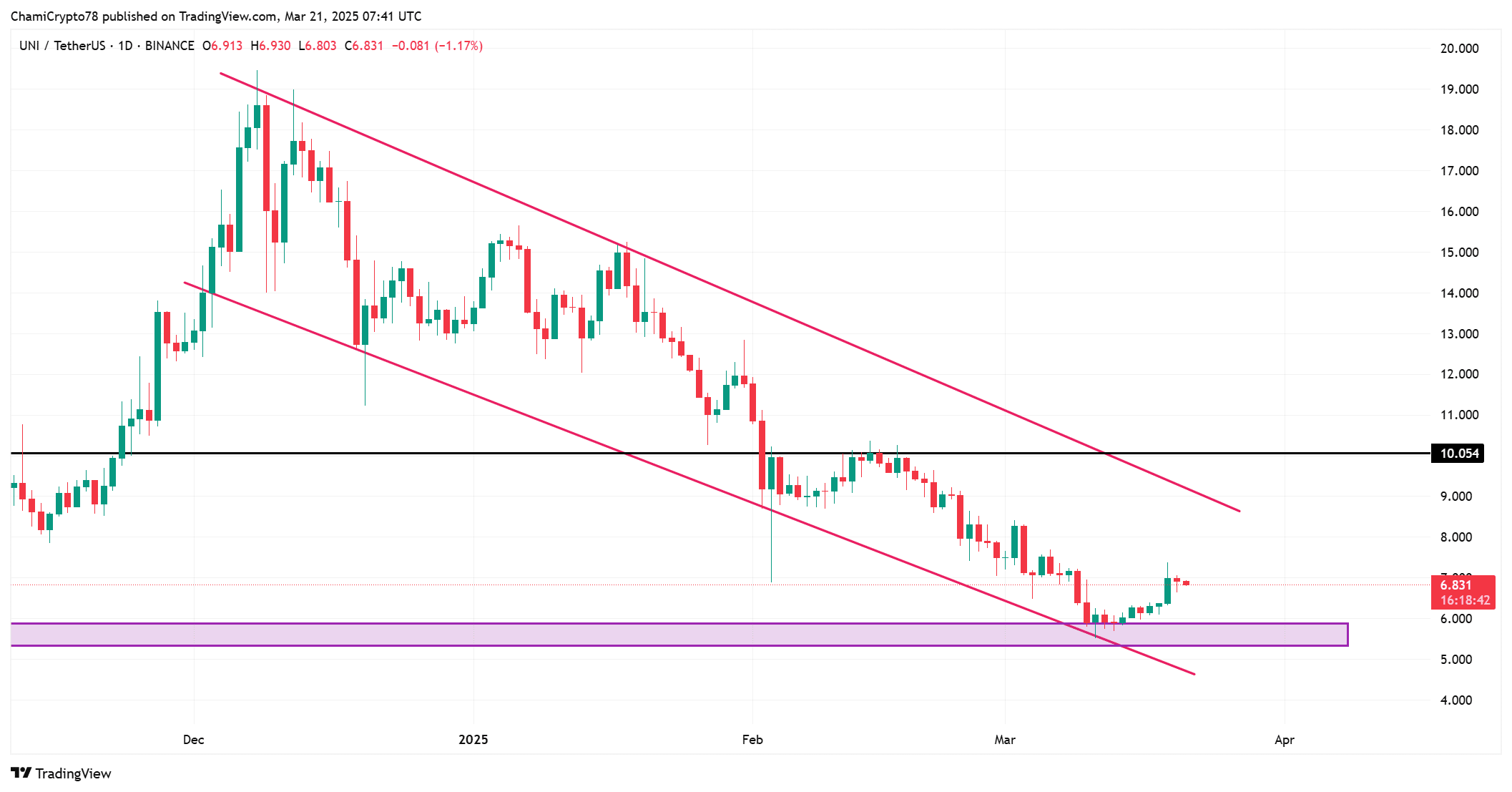

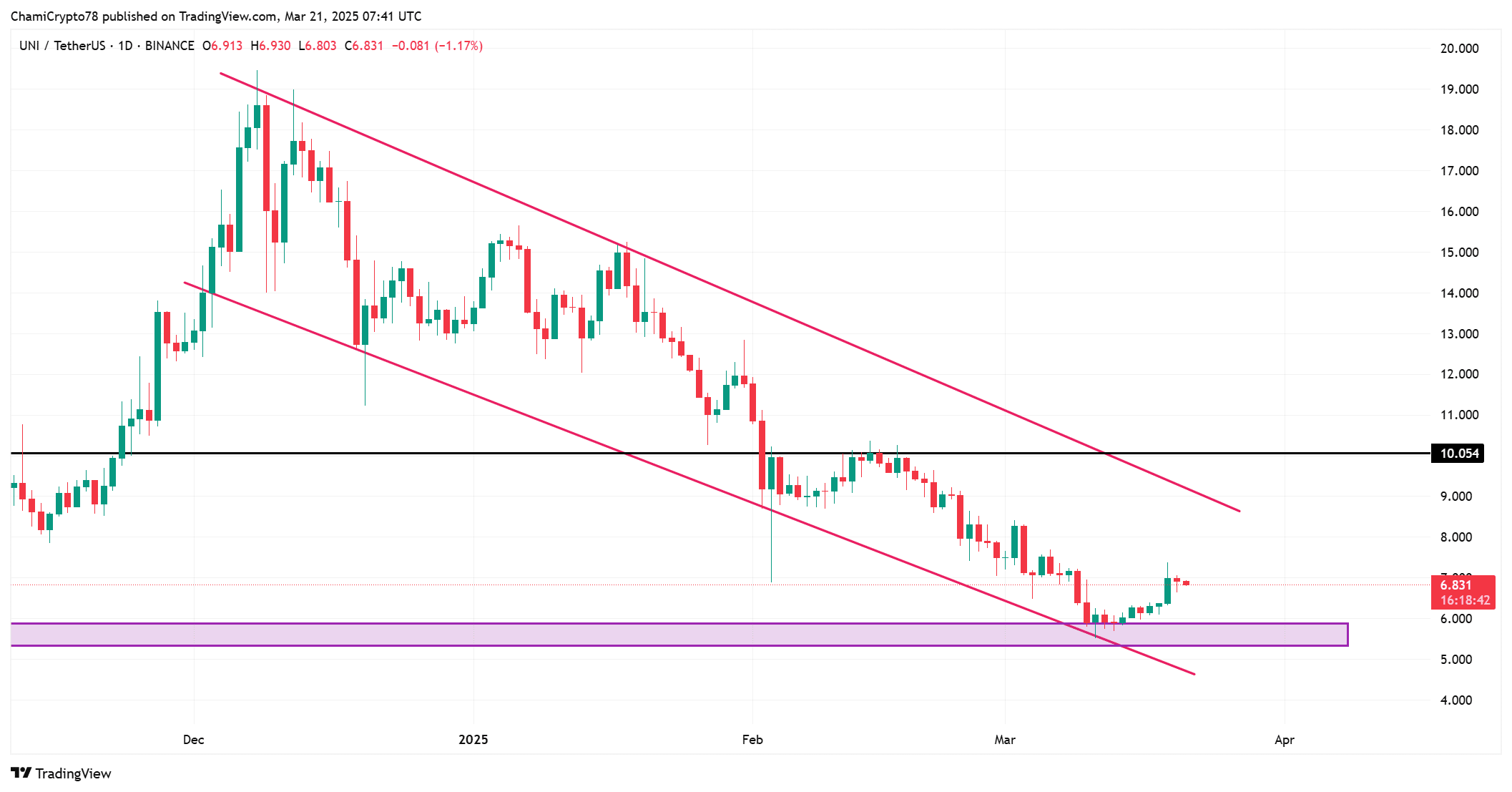

Looking at UNI’s chart, there seemed to be signs of a potential rebound. UNI’s price recently reached a crucial support level, with the price action bouncing upwards over the last few days.

If the price continues to hold above its press time support levels, a potential upward move may occur.

Furthermore, the price might test resistance near the upper boundary of its descending channel, with a break above $10.05 alluding to a stronger bullish trend. Therefore, while market conditions may be uncertain, the chart showed promising signs of a potential rebound in the near future.

Source: TradingView

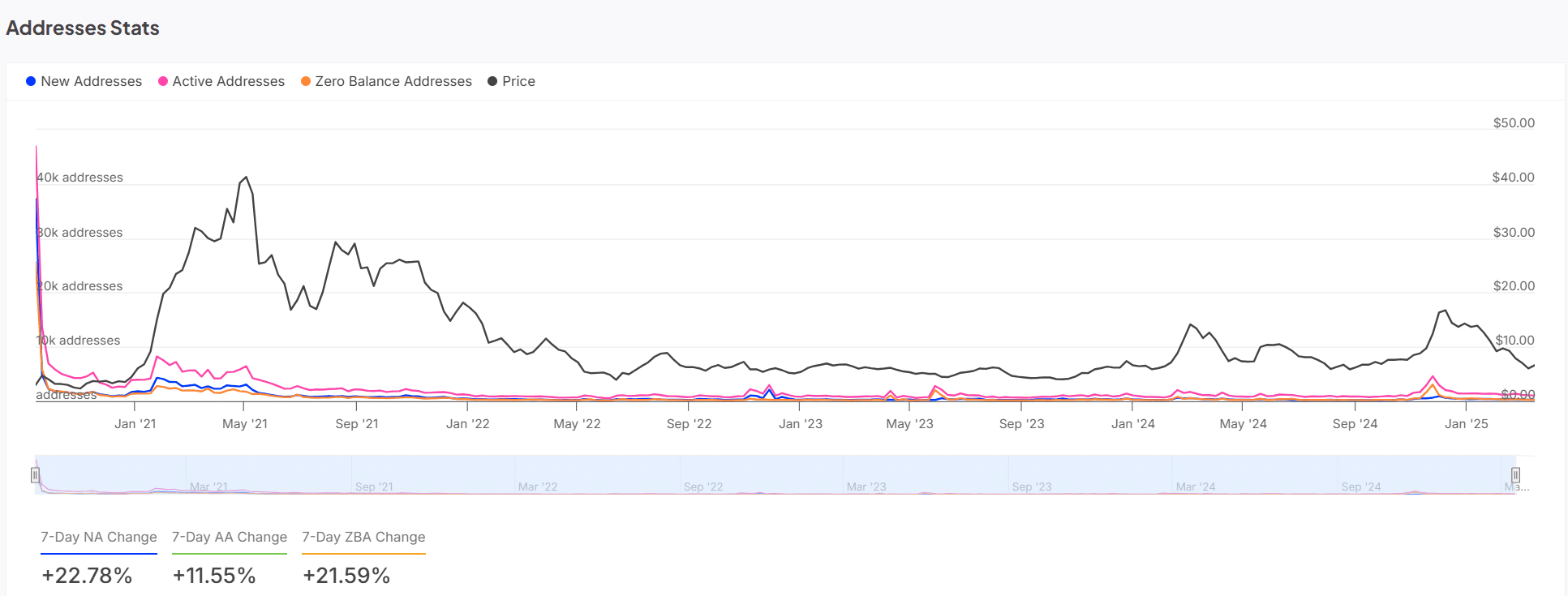

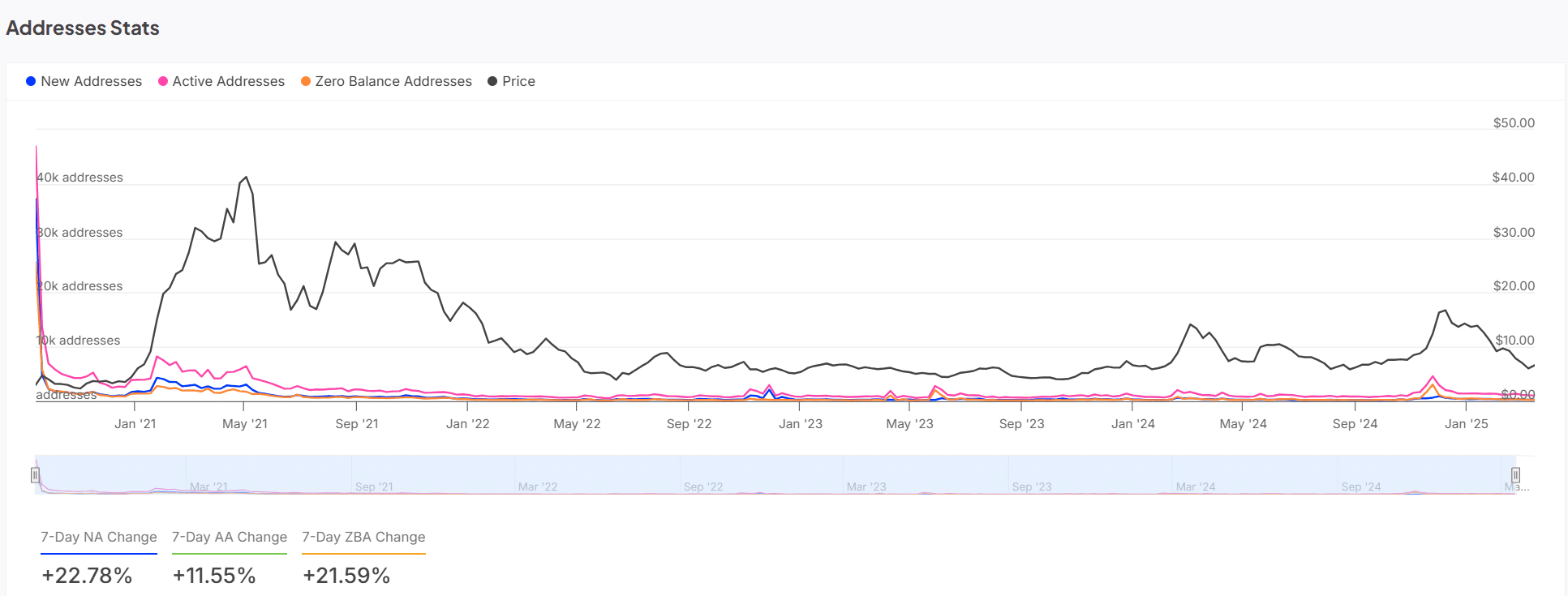

UNI’s addresses stats and analysis

UNI’s address stats further hinted at a positive trend. Over the past week, new addresses have surged by 22.78%, with active addresses climbing by 11.55%.

Such a hike in active addresses indicated that more investors are participating in UNI’s market – A sign of heightened interest. The uptick in both new and active addresses revealed that demand is likely rising. This could lend the necessary support for a price rebound on the charts.

Source: IntoTheBlock

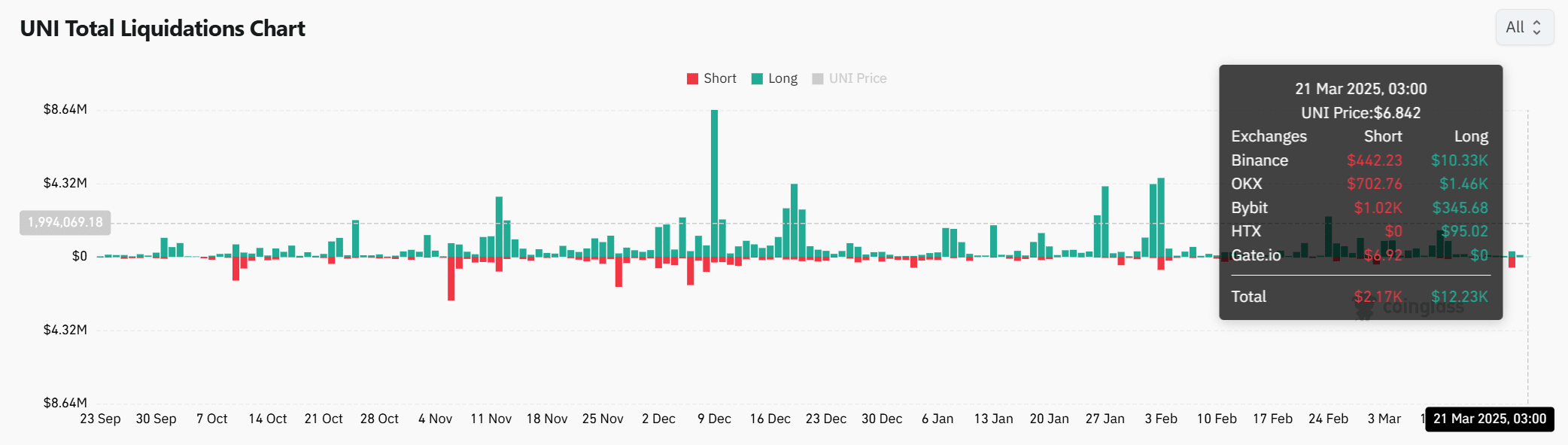

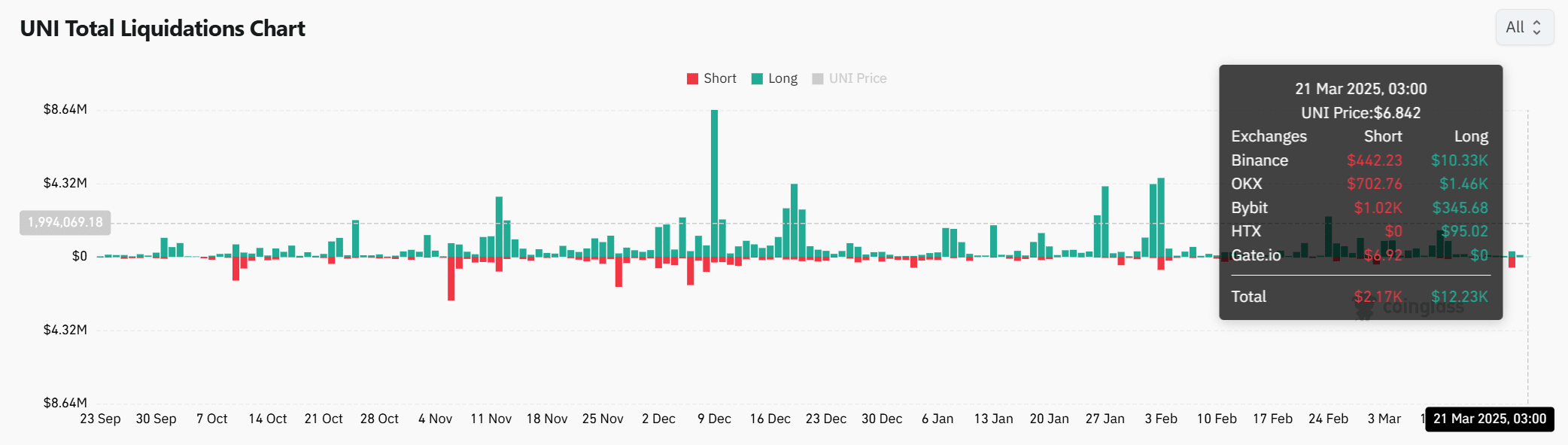

Long vs short liquidations – What does the data suggest?

Finally, liquidation data revealed that long positions are being squeezed more than short positions, with long liquidations at $12.23k compared to short liquidations at $2.17k. This indicated that the market sentiment may be skewed toward bearishness. Especially as more traders betting on price hikes are forced to liquidate.

Although long liquidations hinted at potential downside pressure, the hike in active addresses and falling reserves signaled that demand could stabilize the price or even cause a rebound.

Source: Coinglass

At the time of writing, UNI seemed to be showing promising signs of a potential rebound, despite facing liquidity challenges and selling pressure. Whale activity, hike in address stats, and liquidation data indicated that there may be renewed interest in UNI.

In light of the growing participation of investors, the support levels are likely to hold. This could lead to a price recovery in the near term. Therefore, UNI might be poised for a potential upward move in the coming days, despite the liquidity constraints.