- There has been a surge in liquidity inflows into Berachain over the past 24 hours, surpassing other chains.

- The market remains sluggish, but the pressure hints at an upside opportunity for a major boom.

In the past 24 hours, Berachain [BERA] has declined by 4.58% as market sentiment turned bearish. This continues its downward trend from the past week, during which the asset dropped by 10.65%.

This price decline comes amid massive liquidity inflows into the chain. However, other key market metrics indicate intense selling pressure from market participants.

Liquidity inflows fail to trigger a price surge

Massive liquidity inflows into Berachain have been recorded over the past 24 hours, according to Artemis.

During this period, $112.8 million worth of BERA was purchased, as indicated by chain netflows, placing it ahead of Base, Solana [SOL], and Sei Network [SEI].

Source: Artemis

Typically, a large liquidity inflow is followed by a major price surge. However, the opposite is happening with BERA, as the asset still struggles, and investors remain in a drawdown during this period.

A study of Total Value Locked (TVL) shows that investors are beginning to sell their locked or deposited BERA across protocols on Berachain.

This trend began on the 6th of March, when TVL stood at $3.495 billion. As of press time, TVL has dropped to $3.187 billion, meaning $308 million worth of BERA has flooded the market, adding to the downward pressure.

Selling pressure grows across spot and derivatives markets

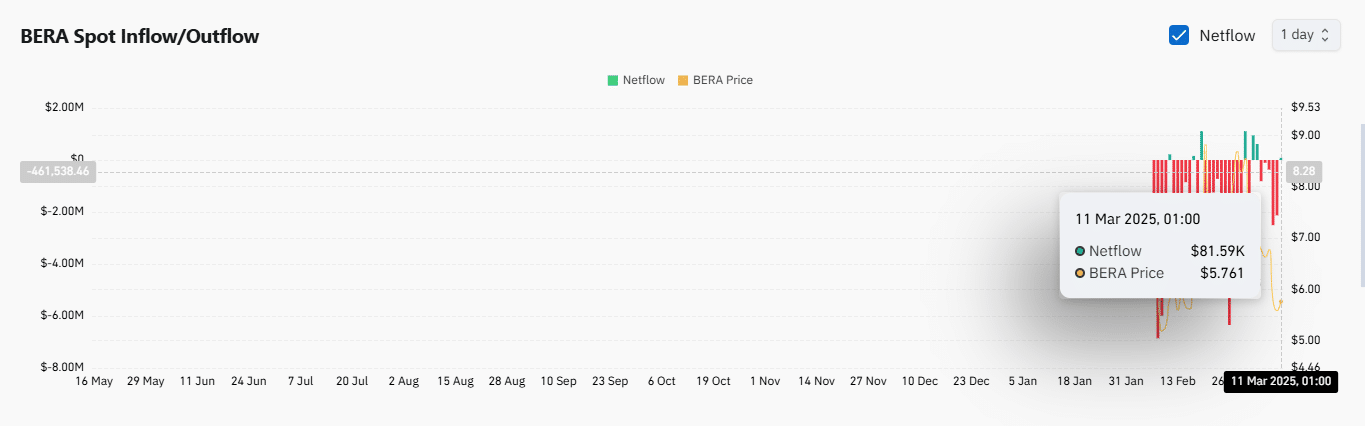

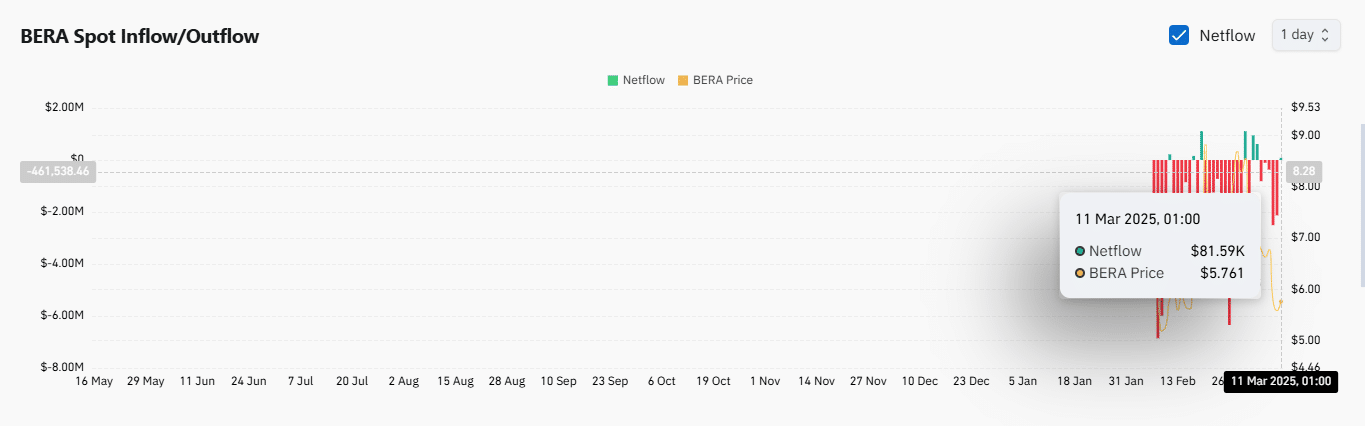

The selling pressure isn’t limited to DeFi protocols—traders are also selling in both the spot and futures markets.

Coinglass exchange netflow data shows that after five consecutive days of buying from spot traders, this cohort has begun selling BERA.

As of press time, $81,570 worth of the asset has been sold—a number likely to increase as other segments of the market follow suit.

Source: Coinglass

Derivative traders are also picking up the pace.

According to AMBCrypto’s analysis, the Funding Rate—used to determine market trends based on whether long or short traders are paying the premium—shows that short traders are dominating, with a reading of -0.0834.

In simple terms, there are likely more short contracts in the market than longs. Importantly, traders holding these short contracts are paying a periodic fee to maintain their positions.

Events like this indicate bearish sentiment, which tends to weigh on price action.

Is there still hope for a price rebound?

While the market remains broadly bearish, there are signs of potential recovery.

A closer look at BERA’s 4-hour chart showed the asset bounced perfectly from a key support level at $5.538, forming three consecutive bullish candles.

If bearish momentum slows and this support level acts as a catalyst, BERA has two potential target levels: first at $7.20, where the asset would gain 30%, and then at $8.89, representing a 60% increase.

Source: TradingView

However, this scenario depends on bullish trends emerging and bears retreating. If that happens, BERA could see a major price surge, reaching these targets.